Earnings summaries and quarterly performance for SEACOAST BANKING CORP OF FLORIDA.

Executive leadership at SEACOAST BANKING CORP OF FLORIDA.

Board of directors at SEACOAST BANKING CORP OF FLORIDA.

Alvaro J. Monserrat

Director

Christopher E. Fogal

Lead Independent Director

Dennis J. Arczynski

Director

Dennis S. Hudson, III

Director

Eduardo J. Arriola

Director

H. Gilbert Culbreth, Jr.

Director

Jacqueline L. Bradley

Director

Joseph B. Shearouse, III

Director

Maryann Goebel

Director

Robert J. Lipstein

Director

Research analysts who have asked questions during SEACOAST BANKING CORP OF FLORIDA earnings calls.

David Bishop

Hovde Group

8 questions for SBCF

David Feaster

Raymond James

8 questions for SBCF

Russell Gunther

Stephens Inc.

8 questions for SBCF

Stephen Scouten

Piper Sandler & Co.

6 questions for SBCF

Wood Lay

Keefe, Bruyette & Woods

4 questions for SBCF

Will Jones

Keefe, Bruyette & Woods (KBW)

2 questions for SBCF

Woody Lay

Keefe, Bruyette & Woods (KBW)

2 questions for SBCF

Christopher Marinac

Janney Montgomery Scott LLC

1 question for SBCF

Recent press releases and 8-K filings for SBCF.

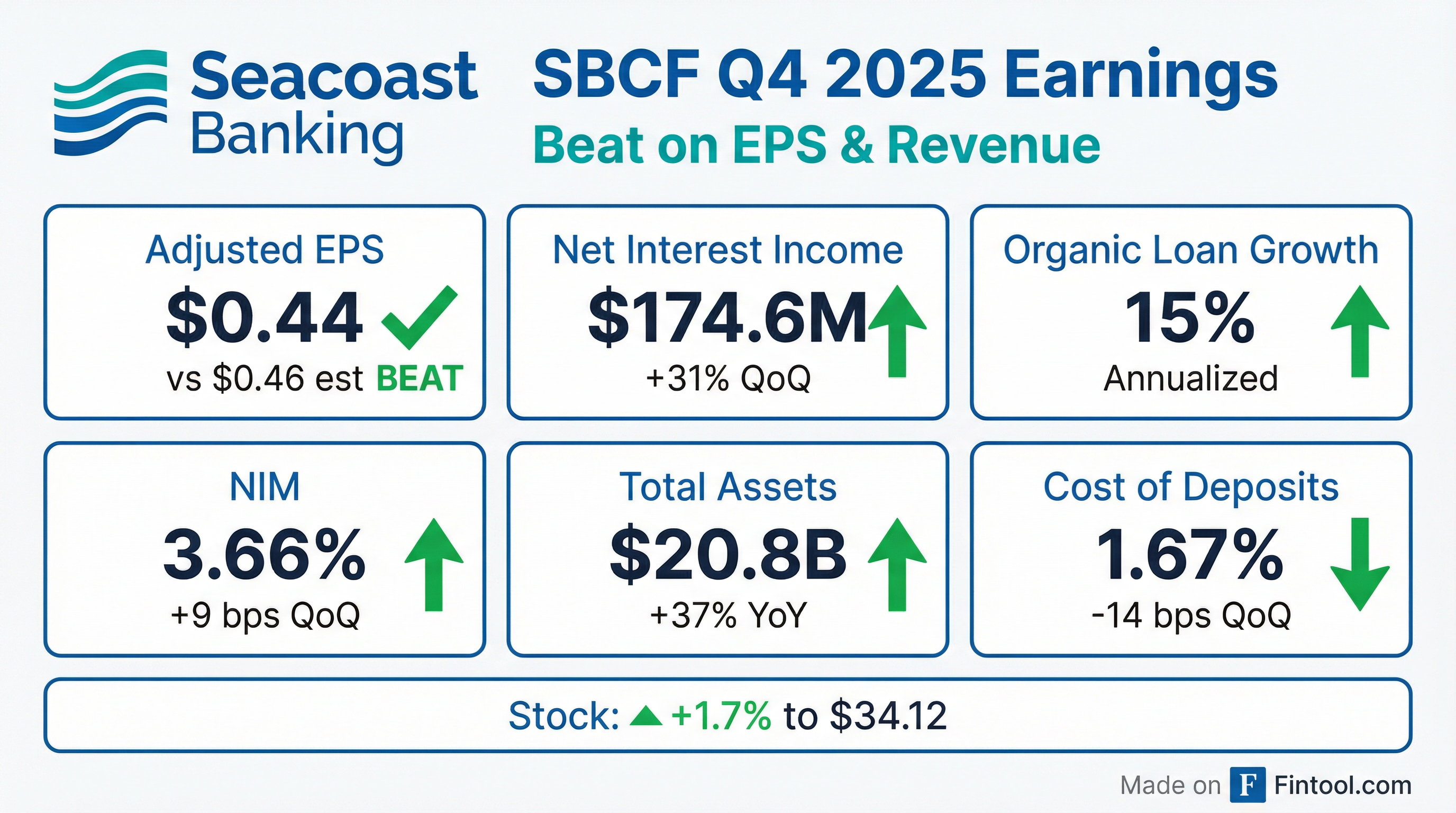

- For Q4 2025, Seacoast Banking Corporation of Florida reported net income of $34.3 million, or $0.31 per diluted share, and adjusted net income of $47.7 million, or $0.44 per diluted share, which includes $23.4 million in day-one credit provisions from the Villages Bancorporation, Inc. (VBI) acquisition.

- Net interest income increased by $41.2 million, or 31%, from the prior quarter to $174.6 million, with the net interest margin (excluding accretion on acquired loans) expanding 12 basis points to 3.44%.

- The company completed the acquisition of VBI, adding approximately $4.4 billion in assets, $1.2 billion in loans, and $3.5 billion in deposits. This acquisition is expected to result in ~24% earnings accretion.

- Total loans increased by $1.7 billion from the prior quarter, including $1.2 billion from the VBI acquisition, with organic loan growth at 15% annualized. Deposits increased $3.2 billion during the fourth quarter, including $3.5 billion from the VBI acquisition.

- For 2026, the company projects adjusted revenue growth of 29% - 31%, an adjusted efficiency ratio of 53% - 55%, and adjusted diluted earnings per share between $2.48 - $2.52.

- Seacoast Banking Corporation (SBCF) reported strong Q4 2025 adjusted net income of $47.7 million, an 18% increase year-over-year, with adjusted pre-tax, pre-provision earnings rising 39% from Q3 and 65% from the prior year quarter.

- The company achieved 15% annualized loan growth in Q4 2025 and saw net interest income increase 31% from the prior quarter to $174.6 million, with the net interest margin (excluding accretion) expanding 12 basis points to 3.44%.

- The Villages acquisition, completed on October 1, 2025, significantly increased deposits to $16.3 billion and contributed to a decline in the cost of deposits to 1.67%. The technology conversion for this acquisition is scheduled for July 2026.

- For the full year 2026, SBCF expects earnings per share in the range of $2.48-$2.52, anticipating an exit ROA above 1.30% and a return on tangible equity of approximately 16% by Q4 2026. The company also projects high single-digit loan growth and low- to mid-single-digit deposit growth.

- Seacoast Banking Corporation reported strong Q4 2025 performance, with adjusted net income increasing 18% year-over-year to $47.7 million and pre-tax, pre-provision earnings rising 65% from the prior year quarter to $93.2 million.

- Loan outstandings grew at an annualized rate of 15% in Q4 2025, contributing to a 12 basis point expansion in the net interest margin (excluding accretion) to 3.44%.

- The company issued 2026 full-year earnings per share guidance of $2.48-$2.52, projecting an exit Q4 2026 ROA above 1.30% and return on tangible equity of approximately 16%.

- For 2026, adjusted revenue growth is anticipated to be 29%-31% compared to 2025, with an adjusted efficiency ratio expected between 53%-55%, partly driven by a planned 15% increase in banker count.

- Following the Villages acquisition, the company executed a securities portfolio repositioning, selling $317 million in available-for-sale securities and reinvesting the $277 million proceeds at a significantly higher yield.

- Seacoast Banking Corporation (SBCF) reported strong Q4 2025 results, with adjusted net income increasing 18% year-over-year to $47.7 million and pre-tax, pre-provision earnings rising 39% from the prior quarter to $93.2 million.

- The company achieved 15% annualized loan growth and expanded its net interest margin (excluding accretion) by 12 basis points to 3.44% in Q4 2025.

- For 2026, SBCF projects full-year earnings per share in the range of $2.48-$2.52 and anticipates exiting Q4 2026 with an ROA above 1.30% and a return on tangible equity of approximately 16%.

- The acquisition of The Villages Bancorporation closed on October 1, 2025, contributing to higher tangible equity, which was partially deployed in a securities portfolio repositioning.

- Management expects the adjusted efficiency ratio to be in the 53%-55% range for 2026 and plans to increase its banker count by approximately 15%.

- Seacoast Banking Corporation of Florida (SBCF) reported net income of $34.3 million and adjusted net income of $47.7 million, or $0.44 per diluted share, for the fourth quarter of 2025.

- Net Interest Income for Q4 2025 totaled $174.6 million, an increase of 31% from the prior quarter, with the Net Interest Margin expanding to 3.66%.

- The company completed the acquisition of Villages Bancorporation, Inc. (VBI) on October 1, 2025, adding approximately $4.4 billion in assets, $1.2 billion in loans, and $3.5 billion in deposits.

- SBCF achieved 15% annualized organic loan growth in Q4 2025, excluding the VBI acquisition, bringing total loans to $12.6 billion as of December 31, 2025.

- In January 2026, the company repositioned its available-for-sale securities portfolio, incurring a pre-tax loss of approximately $39.5 million but reinvesting proceeds at a higher average taxable equivalent book yield of 4.8%.

- Seacoast reported net income of $34.3 million for the fourth quarter of 2025, which included $18.1 million in merger and integration costs and $23.4 million in day-one credit provisions from the Villages Bancorporation, Inc. (VBI) acquisition.

- Adjusted pre-tax pre-provision earnings for Q4 2025 were $93.2 million, increasing 39% from the prior quarter and 65% from the prior year quarter.

- The company achieved 15% annualized organic loan growth in the fourth quarter of 2025.

- Net Interest Income for Q4 2025 totaled $174.6 million, an increase of 31% from the prior quarter and 28% from the prior year quarter.

- Seacoast completed the acquisition of Villages Bancorporation, Inc. (VBI) on October 1, 2025, adding approximately $1.2 billion in loans and $3.5 billion in deposits.

- Seacoast Banking Corporation of Florida (SBCF) announced on December 19, 2025, the renewal of its share repurchase program, extending it until December 31, 2026.

- The renewed program authorizes the company to repurchase up to $150 million of its common stock, an increase over the previous program.

- This authorized amount represents approximately 5% of the Company’s outstanding common stock.

- Seacoast Banking Corp of Florida reported net income of $36.5 million, or $0.42 per share, for Q3 2025, with adjusted net income increasing 48% year over year.

- The company completed the acquisition of Villages Bancorporation, Inc. on October 1, 2025, adding approximately $4 billion in assets, $1.3 billion in loans, and $3.5 billion in low-cost deposits.

- This acquisition is projected to deliver ~24% EPS accretion in 2026E, with a tangible book value earnback period of approximately 2.8 years.

- For Q3 2025, the company achieved 7% annualized organic deposit growth and 8% annualized organic loan growth, alongside a 5% increase in net interest income to $133.9 million from the prior quarter.

- Adjusted net income for Q3 2025 increased 48% year over year to $45.2 million, or $0.52 per share.

- The company reported strong organic growth with deposits increasing 7% annualized ($212 million) and loan balances growing 8% on an annualized basis.

- Net interest income was $133.5 million, a 5% increase from the prior quarter, and the net interest margin (excluding accretion on acquired loans) expanded 3 basis points to 3.32%. The company expects to exit the year with a core net interest margin of approximately 3.45%.

- Asset quality remains sound, with non-performing loans declining by $3.6 million to 0.55% of total loans, and net charge-offs at $3.2 million or 12 basis points annualized.

- Seacoast completed the acquisition of Heartland Bank on July 11, adding approximately $824 million in assets, and finalized the acquisition of The Villages Bank Corporation on October 1, adding over $4 billion in assets.

- Seacoast Banking Corporation reported strong Q3 2025 results, with adjusted net income increasing 48% year-over-year to $45.2 million or $0.52 per share.

- The company achieved 8% annualized organic loan growth and 7% annualized organic deposit growth (excluding brokered and acquired deposits).

- The acquisition of Heartland Bank was completed and converted in Q3, and The Villages Bancorporation acquisition was finalized on October 1, with its full technology conversion anticipated in early Q3 2026.

- Management expects the core net interest margin to reach approximately 3.45% by year-end 2025 and anticipates continued high single-digit loan growth.

- Tangible book value per share increased 9% year over year to $17.61, supported by a strong capital position including a 14.5% tier-one capital ratio.

Quarterly earnings call transcripts for SEACOAST BANKING CORP OF FLORIDA.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more