STARBUCKS (SBUX)·Q1 2026 Earnings Summary

Starbucks Surges 8% as 'Back to Starbucks' Delivers First Transaction Growth in 8 Quarters

January 28, 2026 · by Fintool AI Agent

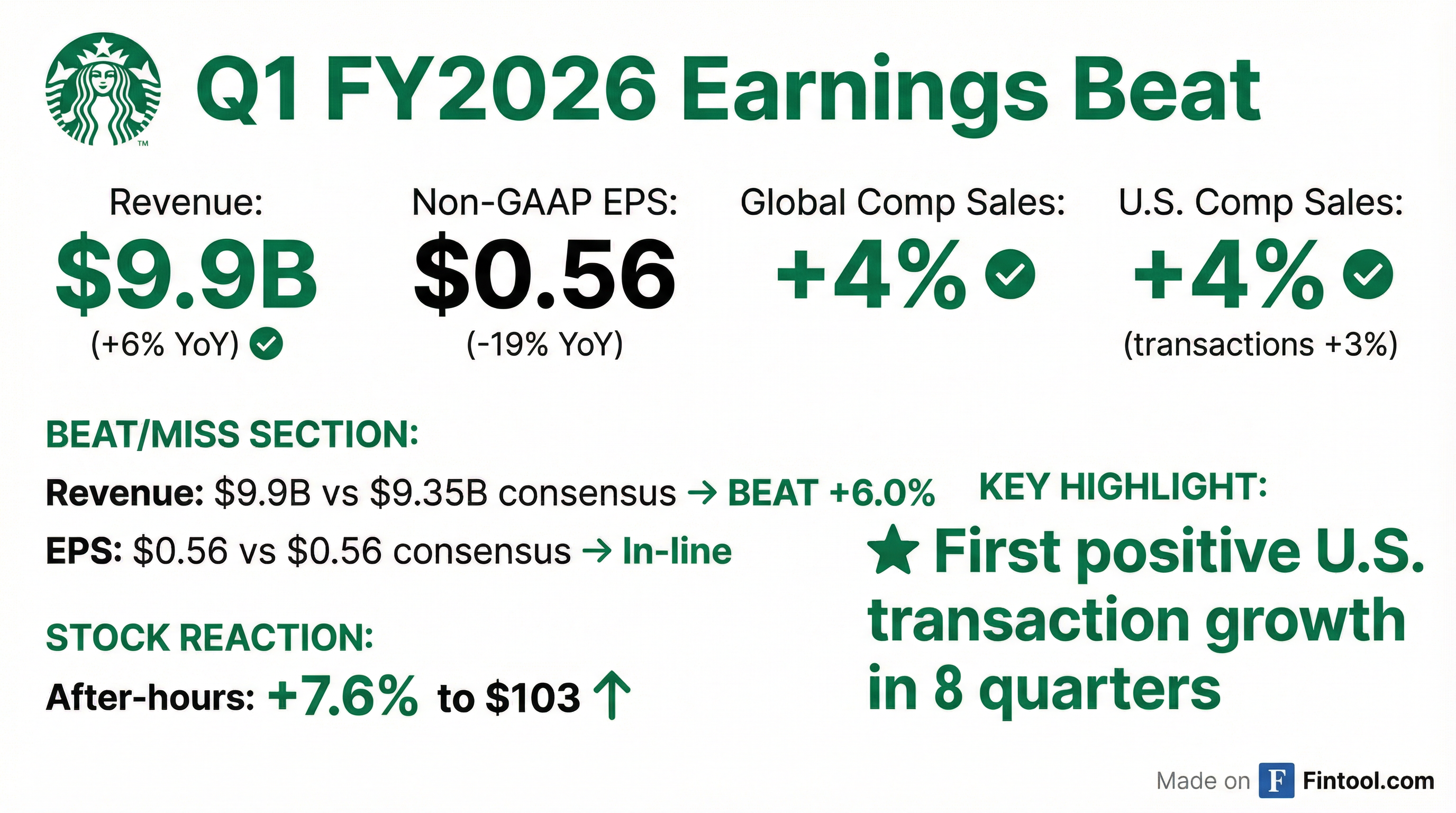

Starbucks delivered a convincing beat in Q1 FY2026, with revenue of $9.9 billion (+6% YoY) crushing consensus estimates by 6% and global comparable store sales accelerating to +4% . Most importantly, the company achieved positive U.S. transaction growth for the first time in eight quarters—a critical milestone for CEO Brian Niccol's "Back to Starbucks" turnaround. Shares surged approximately 8% in after-hours trading to $103.

Did Starbucks Beat Earnings?

Yes—convincingly on the top line, in-line on earnings.

The standout metric: U.S. comparable transactions grew 3% , marking the first positive quarter in eight quarters. This is exactly what investors have been waiting for—proof that the "Back to Starbucks" strategy is driving real customer traffic, not just ticket inflation.

Non-GAAP EPS of $0.56 declined 19% year-over-year , reflecting ongoing investments in the Green Apron Service model and labor. GAAP EPS was just $0.26, impacted by restructuring charges and a discrete tax hit from reclassifying China operations as held for sale .

How Did the Stock React?

Shares jumped approximately 8% in after-hours trading to $103, up from the $95.72 regular session close.

The magnitude of the move reflects how important transaction growth is to the investment thesis. After seven consecutive quarters of negative U.S. comps prior to Q4 FY25, two consecutive positive quarters (and now accelerating) significantly de-risks the turnaround narrative.

Key trading context:

- 52-week range: $75.50 - $117.46

- Stock had rallied ~27% since October lows on turnaround optimism

- Today's move takes shares to highest level since August 2024

What Changed From Last Quarter?

Acceleration across the board.

CEO Brian Niccol framed it succinctly: "Our Q1 results demonstrate our 'Back to Starbucks' strategy is working and we believe we're ahead of schedule" .

The Q4 FY25 call had already signaled momentum building—September had been the first month of positive transaction comps, and October continued the trend . Q1 confirmed this wasn't a one-month blip but a sustainable acceleration.

What Did Management Guide?

First formal FY2026 guidance—conservative but constructive.

The guidance assumes China retail operations remain company-operated in H2 . The pending Boyu Capital joint venture (more below) would change this assumption.

At the midpoint, EPS guidance of ~$2.28 implies ~10% growth from the FY25 implied run rate, though still well below the $3.50+ levels from FY22-23 peak. Management is clearly prioritizing stabilizing the business over promising aggressive EPS recovery.

Segment Deep Dive

North America: The Turnaround Is Working

The 1,100 basis point improvement in transaction comps is remarkable. Operating margin contracted due to labor investments in Green Apron Service and inflation (coffee pricing, tariffs) —this was expected and communicated last quarter.

Store count declined 1% as 165 underperforming locations were closed under the "Back to Starbucks" restructuring .

International: China Powers Ahead

China specifically:

- Comp sales: +7% (transactions +5%, ticket +2%)

- Store count: 8,011 (+4% YoY)

- 83 stores closed as part of restructuring

International margin expanded 100 bps partly due to ceasing depreciation/amortization on China assets after classifying them as held for sale .

Channel Development: Strong Momentum

The 19% revenue growth was driven by the Global Coffee Alliance and ready-to-drink business . A standout: the new multi-serve Refreshers concentrate launched in North America was met with "incredible demand" .

International Expansion Milestones

Beyond China, several markets hit notable milestones in Q1 :

- India crossed 500 coffeehouses

- Mexico on track to surpass 1,000 coffeehouses this year

- Expansion announced to 6 new cities in Latin America and Caribbean markets

- Comps grew in 9 of 10 largest international markets

The China Joint Venture: A Strategic Pivot

In November, Starbucks announced a joint venture with Boyu Capital to operate Starbucks retail in China :

- Boyu Capital acquires up to 60% of China retail operations

- Starbucks retains 40% and continues to own the brand/IP

- Expected to close Spring 2026, subject to regulatory approval

- China operations classified as held for sale on the balance sheet

This is a significant strategic shift. Starbucks is effectively de-consolidating its second-largest market while retaining brand ownership and royalty economics. The transaction triggered a $270M+ tax hit in Q1 from changing indefinite reinvestment assertions .

CFO Cathy Smith noted the three sources of value: (1) upfront investment by Boyu, (2) retained stake, and (3) future royalty payments .

Margin Bridge: Investments vs. Inflation

Non-GAAP operating margin of 10.1% contracted 180 bps year-over-year . Key drivers:

Headwinds:

- Labor investments for Green Apron Service (~annualize by Q4)

- Elevated coffee prices and tariffs (expect peak in Q2, relief in H2)

- About one-third of North America's 420 bps margin contraction driven by product/distribution cost inflation

Offsets:

- Sales leverage from higher traffic

- $39 million monthly reduction in D&A from China held-for-sale classification

- G&A decreased 7% YoY from FY25 restructuring

$2 Billion Cost Savings Program: Management announced a comprehensive cost reduction initiative targeting $2 billion over the next 2-3 years . Areas include:

- G&A optimization (already in progress)

- Procurement efficiencies

- Technology-driven automation

- Supply chain improvements

Management expects margin to improve slightly for the full year, weighted to H2 as:

- Green Apron investments anniversary in Q4

- Coffee/tariff pressures abate in Q3-Q4

- Savings initiatives come to fruition

- Sales leverage continues building

What the 'Back to Starbucks' Playbook Looks Like

CEO Niccol outlined the key pillars driving the turnaround and added new operational details in Q1:

1. Green Apron Service Standard

- Full U.S. rollout delivered first transaction growth in 8 quarters

- Better staffing at peak hours with new leadership expectations (3-year minimum tenure for coffeehouse leaders)

- Smart Queue algorithm delivering <4 min service times at peak

- GROW program launched—simplified reporting measuring 5 key metrics within leaders' control

- Green Dot Assist AI-powered knowledge tool fully scaled across North America in November

2. Coffee House Experience

- ~200 uplifts completed (primarily Southern California and NYC)

- On track for 1,000+ by end of FY26

- New Ristretto format in development (tall, grande, pico versions for build cost flexibility)

- Seats returned to cafes—Niccol: "Every cafe I walk into, people are sitting in those seats, enjoying a cup of coffee... and dwelling"

3. Marketing & Menu Innovation

- Menu reduced ~25-30% since Niccol arrived

- New platforms in development: health/wellness, afternoon energy (still/sparkling/blended), artisanal bakery

- Protein platform seeing strong trial-to-repeat conversion; incremental to existing business

- Holiday launch week was record revenue week for U.S. company-operated business

- Barista Mug created significant buzz and drove traffic

4. Technology & Leadership

- New CTO: Anand Varadarajan joined from Amazon, where he was President of Worldwide Grocery Technology

- Digital menu boards rolling out system-wide to enable menu dayparting

- Green Dot Assist provides foundation for future AI solutions

The 650 pilot stores that launched Green Apron Service earliest continue to outperform the fleet by ~200 bps —suggesting the full rollout has further runway.

Q&A Highlights

On pilot store performance and transfer impact: The 650 pilot stores that launched Green Apron Service earliest continue to outperform the fleet by approximately 200 basis points in comparable sales, driven almost entirely by transactions . About 0.5 percentage points of the North America comp was driven by sales transfer from the ~165 stores closed under restructuring .

On cost savings: Niccol revealed a $2 billion cost reduction program over the next 2-3 years, spanning the entire P&L: "We've got a list of projects with people's names next to it, clear deliverables... when one idea doesn't work, we get another idea that's up" . Savings will come from G&A, procurement, technology-driven efficiency, and supply chain optimization.

On rewards vs. non-rewards customers: Non-rewards customer transaction growth outpaced rewards growth, marking the first quarter since Q2 FY2022 that both groups grew simultaneously . The 90-day active rewards base hit a record 35.5 million members (+3% YoY) . Niccol emphasized engagement over discounting: "It's through better engagement that we're getting people to be active. Not through discounting and couponing, but rather giving people the Starbucks experience" .

On afternoon daypart opportunity: Niccol outlined a major growth vector: "The afternoon is a reset... you sometimes want a blended drink, energy drink, sparkling drink... and you sometimes want protein" . Digital menu boards, now rolling out system-wide, will enable dayparting the menu. Expect customized/personalized energy, sparkling energy, and protein-forward snacking to drive afternoon growth.

On protein platform traction: The protein platform (launched early Q1) saw strong repeat in January as customers re-engaged post-holidays. Key insight: Protein Cold Foam has become a traffic driver—customers come specifically for protein, and it works on almost any drink . Awareness remains low, suggesting substantial upside.

On new store growth: Niccol confirmed thousands of identified sites in the U.S. alone, with no barrier to unit growth . The bottleneck was ensuring the right build and people capability. New initiatives include:

- Coffeehouse coaches (assistant store managers) to create a pipeline for new store openings

- Ristretto format in tall, grande, and pico sizes for build cost flexibility

- All access modes (café, drive-through, mobile order pickup) in single ecosystem

On throughput: Average café and drive-through service times are now below the 4-minute target at peak . However, Niccol acknowledged opportunity remains on the "tails"—not every transaction hits the target yet .

Key Quotes From Management

"Turn around the top line, and then earnings growth will follow. And I am delighted to say we are now achieving top-line growth driven by transactions." — Brian Niccol, Chairman and CEO

"We've got a clear plan in place to basically track down about $2 billion of costs... over the next two years in front of us." — Brian Niccol

"The shine is back on our brand, both in the U.S. and around the world." — Brian Niccol

"Every age cohort has increased their visitation with Starbucks over the last couple of months." — Brian Niccol

"We have always said that we expect the top line to come first, and then earnings will follow." — Cathy Smith, CFO

Risks and Concerns

Near-term headwinds:

- Coffee prices and tariffs expected to peak in Q2 before relief in H2

- Q2 seasonally weakest margin quarter

- GAAP earnings distorted by China transaction tax effects

- Operating margins still well below historical mid-teens levels

Execution risk:

- Niccol explicitly cautioned: "The path forward won't be linear"

- Supply chain challenges surfaced as transactions grew—product availability needs strengthening

- ~0.5pt of comp came from closed store transfers—underlying comp closer to 3.5%

- China JV regulatory approval timeline uncertain

Structural questions:

- Can $2B cost program restore margins without sacrificing brand investments?

- Competitive pressure from drive-through/takeout focused chains accelerating

- U.S. licensed store revenue declined due to grocery/retail channel weakness

Forward Catalysts

The Bottom Line

Q1 FY2026 is a pivotal quarter for Starbucks. The company delivered on the most important metric—positive U.S. transaction growth for the first time in eight quarters—validating CEO Brian Niccol's "Back to Starbucks" turnaround strategy. Revenue beat by 6%, global comps accelerated to +4%, and China surged +7%.

The 8% after-hours move reflects relief that the turnaround is gaining traction, not just a cost-cutting exercise. With Investor Day tomorrow (January 29) expected to provide a more complete long-term financial roadmap, the stock's re-rating may just be beginning.

Key questions for Investor Day:

- What is the margin recovery trajectory?

- What are the economics of the China JV?

- How sustainable is +3-4% comp growth?

- What's the long-term EPS algorithm?

For now, the coffee giant appears to be brewing a genuine turnaround.

Data sourced from Starbucks Q1 FY2026 8-K filing, Q1 FY2026 earnings call transcript, and Q4 FY2025 earnings call transcript. Stock prices from market data as of January 28, 2026.