Shell (SHEL)·Q4 2025 Earnings Summary

Shell Beats on EPS But Misses Revenue as Stock Slides 4%

February 5, 2026 · by Fintool AI Agent

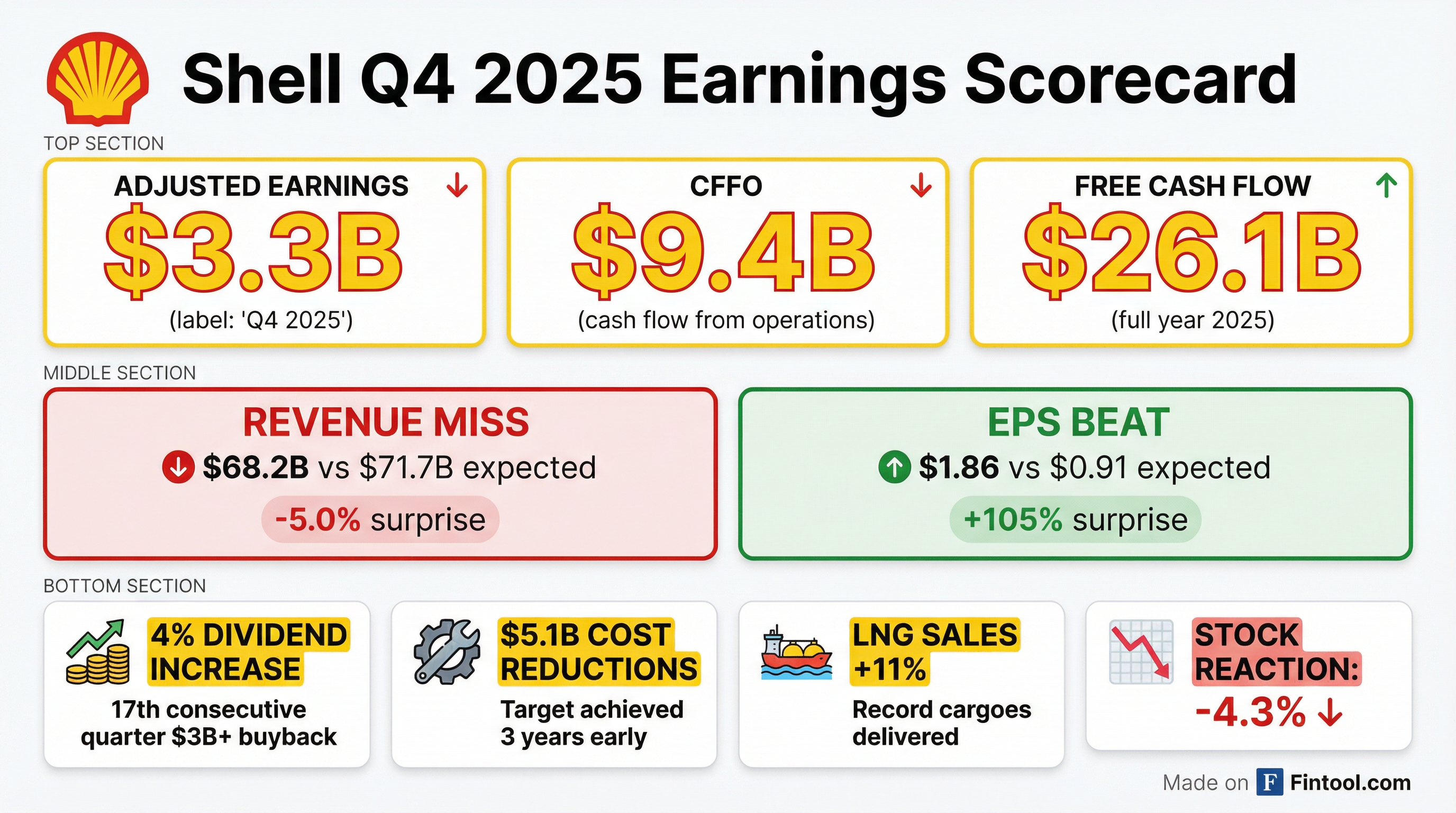

Shell delivered Q4 2025 results that beat EPS expectations by a wide margin (+105%) but missed revenue estimates by 5%, sending shares down 4.3% despite the company raising its dividend and announcing another $3.5B buyback. The quarter showcased Shell's operational discipline amid lower commodity prices, with $5.1B in structural cost reductions achieved—hitting the 2028 target three years early—but concerns about reserve life and a struggling chemicals segment weighed on sentiment.

Did Shell Beat Earnings?

Shell reported adjusted earnings of $3.3B for Q4 2025, with EPS of $1.86 significantly exceeding the $0.91 consensus estimate (+105% beat). However, revenue of $68.2B missed the $71.7B estimate by 5%, reflecting lower oil prices (Brent averaged ~$10/barrel lower than the prior year) partially offset by stronger operational performance.

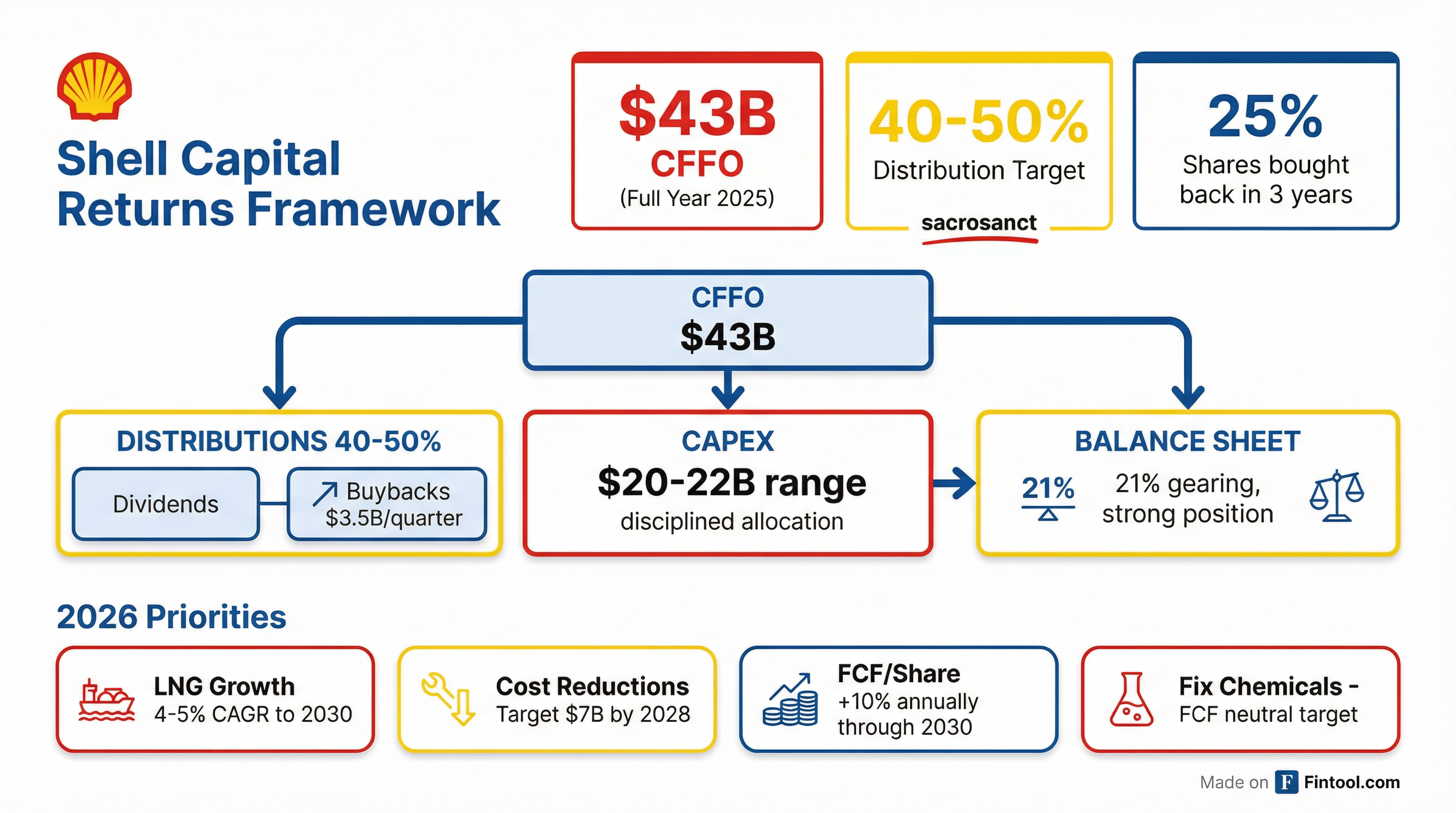

Full year 2025 adjusted earnings totaled $18.5B, with CFFO of ~$43B and free cash flow of ~$26B—solid results despite the challenging macro backdrop.

How Did the Stock React?

Shell shares fell 4.3% following the earnings release, dropping from $78.79 to $75.42. The stock had run up to 52-week highs near $79.30 heading into the print, and the revenue miss plus concerns about reserve depletion triggered profit-taking.

Despite the post-earnings decline, Shell shares remain up ~29% over the trailing twelve months, trading near the top of their 52-week range ($58.55–$79.30).

What Did Management Guide?

Shell maintained its key financial targets from CMD25:

CFO Sinead Gorman emphasized that the distribution policy remains "sacrosanct," and the company announced a 4% dividend increase alongside a $3.5B buyback to be completed by the Q1 2026 results announcement in May—the 17th consecutive quarter of $3B+ buybacks.

CEO Wael Sawan noted: "We've bought back roughly 25% of our shares over the last three years... at some 20% below where our share price is today. You can see the allocation around that, the thoughtfulness is there."

What Changed From Last Quarter?

Positive developments:

- Cost reductions accelerated: Achieved $5.1B of structural cost savings, up from $4B at Q3, now targeting the higher end of the $5-7B range

- LNG sales surged 11%: Well above the 4-5% annual growth target, driven by LNG Canada startup and Pavilion Energy acquisition

- Deepwater bolt-ons: $2B of acquisitions in Gulf of Mexico, Brazil, and Nigeria largely closed the 100K bbl/day gap to 2030 production targets

- Process safety improved: 30% fewer incidents in 2025 vs. prior year, though tragically four colleagues lost their lives

Challenges and concerns:

- Reserve life fell to 7.8 years: Down from ~9 years, driven by SPDC Nigeria divestment and oil sands exits; management says this was a conscious value-over-volume decision

- Chemicals bleeding continues: Management committed to "several hundred million" in cost and CapEx cuts to achieve free cash flow neutrality; no asset shutdowns announced but "nothing is off the table"

- Kazakhstan tensions: Compensation claims from the government are impacting Shell's "appetite to invest further" in the country

Segment Performance

Upstream: Strong quarter in the current price environment, with increased contributions from higher-margin Gulf of Mexico and Brazil volumes.

Integrated Gas: Results returned to "more normal pre-COVID levels" as expected. LNG Canada continues to ramp up to full capacity. Record cargoes delivered in 2025.

Marketing: Seasonally lower but mobility hit 15%+ ROACE (up from 12%) and lubricants reached 21% ROACE (up from 19%)—both all-time highs.

Chemicals & Products: Mixed results. Refining margins helped, but chemicals face "continued low margins and lower operational performance." Q4 hurt by planned Monaca downturn.

Renewables & Energy Solutions: ROACE improved 4 percentage points YoY but still "nowhere close to where we need it to be." Management divesting underperforming projects (Atlantic Shores, ScotWind) while pivoting to flexible generation and trading.

Q&A Highlights

On reserve depletion (Alastair Syme, Citi): "Reserve life has fallen 15%. How do we frame the timeline around hurry?"

Sawan responded that Shell has de-risked the 2030 outlook with deepwater bolt-ons and improved reservoir recovery. The company has "a few years" to fill the gap to 2035 but won't rush into deals just to add resource: "We're only going to go after accretive barrels."

On buyback valuation (Josh Stone, UBS): Management confirmed buybacks are "very much value-led" at current prices, with shares still below the average buyback price over the past three years.

On M&A appetite (Biraj Borkhataria, RBC): Sawan noted more opportunities are screening now than a year ago, but the company will only pursue deals where it has "synergies with existing assets" in deepwater basins like Brazil, Nigeria, and the Gulf of Mexico.

On agentic AI (Lydia Rainforth, Barclays): Shell is deploying agentic AI across subsurface interpretation, proactive maintenance, and functional workflows, but Sawan cautioned: "We are not yet banking all sorts of cost reductions coming out of agentic AI, because we're still learning."

Looking Ahead: Key Catalysts

Management sees further upside from:

- LNG Canada ramp-up to full capacity

- New upstream opportunities in Kuwait, Libya, Venezuela gas

- Capital reallocation from low-returning assets (15% of $225B capital employed identified for redeployment)

- Nigeria Train 7 LNG in development

Sawan concluded: "You can trust us to stay value-focused and disciplined. We have entered 2026 as a more resilient organization."

Data sources: Shell Q4 2025 earnings call transcript, S&P Global estimates. Stock prices as of February 5, 2026.