Earnings summaries and quarterly performance for Shell.

Research analysts who have asked questions during Shell earnings calls.

Biraj Borkhataria

Royal Bank of Canada

9 questions for SHEL

Christopher Kuplent

Bank of America

9 questions for SHEL

Lydia Rainforth

UBS

8 questions for SHEL

Martijn Rats

Morgan Stanley

8 questions for SHEL

Michele Della Vigna

Goldman Sachs

8 questions for SHEL

Lucas Herrmann

BNP Paribas

7 questions for SHEL

Ryan Todd

Simmons Energy

7 questions for SHEL

Alastair Syme

Citigroup

6 questions for SHEL

Doug Leggate

Wolfe Research

6 questions for SHEL

Irene Himona

Sanford C. Bernstein

6 questions for SHEL

Paul Cheng

Scotiabank

6 questions for SHEL

Peter Low

Redburn Atlantic

6 questions for SHEL

Kim Fustier

HSBC

5 questions for SHEL

Joshua Eliot Stone

UBS

4 questions for SHEL

Giacomo Romeo

Jefferies

3 questions for SHEL

Henry Tarr

Berenberg

3 questions for SHEL

Josh Stone

UBS

3 questions for SHEL

Matthew Lofting

JPMorgan

3 questions for SHEL

Matt Lofting

JPMorgan Chase & Co.

3 questions for SHEL

Douglas George Blyth Leggate

Wolfe Research

2 questions for SHEL

Jason Gabelman

TD Cowen

2 questions for SHEL

Joshua Stone

UBS Group AG

2 questions for SHEL

Mark Wilson

Jefferies

2 questions for SHEL

Roger Read

Wells Fargo & Company

2 questions for SHEL

Alastair Roderick Syme

Citi

1 question for SHEL

Lydia Rose Emma Rainforth

Barclays

1 question for SHEL

Matthew Peter Charles Lofting

JPMorgan Chase & Co.

1 question for SHEL

Recent press releases and 8-K filings for SHEL.

- Shell plc purchased shares for cancellation on multiple dates in February 2026 as part of its existing share buy-back programme.

- From February 5, 2026, to February 24, 2026, Shell plc purchased a total of 16,896,199 shares for cancellation across various venues.

- Morgan Stanley & Co. International Plc is independently managing the trading decisions for this buy-back programme from February 5, 2026, through May 1, 2026.

- Shell has pledged approximately 3.5 billion reais (around $666–677 million) to shore up its troubled Brazilian sugar and ethanol joint venture, Raízen, which is facing mounting losses and heavy debt.

- Shell's Brazil chief, Cristiano Pinto da Costa, indicated that Shell prefers to keep Raízen operating as a single entity and expects another investor, specifically Cosan, to match Shell's capital contribution.

- Creditors have objected to a BTG Pactual restructuring proposal that would separate Raízen’s fuel distribution from its other divisions, with Shell stating that any breakup should only be considered after recapitalization.

- Cosan founder Rubens Ometto intends to commit about 500 million reais via his family investment vehicle, Aguassanta, although Cosan itself does not plan to invest directly.

- For the fourth quarter of 2025, Kosmos Energy reported a net loss of $377 million and an adjusted net loss of $78 million, with revenues of $295 million.

- Net production in Q4 2025 averaged approximately 67,900 boepd, an increase of ~4% versus Q3 2025, and year-end 2025 1P reserves stood at approximately 250 mmboe.

- Capital expenditures for Q4 2025 were $53 million, bringing the full-year 2025 total to $292 million.

- The company projects 2026 production growth of around 15% year-on-year, with expected FY26 capital expenditures of approximately $350 million, and aims for at least 10% debt reduction by year-end 2026.

- Strategic actions include a $350 million senior secured bond offering in January 2026 and the announced sale of its Equatorial Guinea assets for up to $220 million in February 2026, both aimed at debt reduction.

- Shell, along with other international oil majors, has initiated international arbitration to contest a $5 billion environmental fine imposed by Kazakhstan for alleged breaches of sulfur storage limits at the Kashagan field.

- Shell CEO Wael Sawan stated that this dispute has reduced the company's appetite for further investment in Kazakhstan.

- Shell holds a 16.81% ownership stake in the Kashagan consortium.

- This arbitration is part of a broader set of disputes with Kazakh authorities, with total claims potentially reaching $166 billion.

- Shell has paused further investment in Kazakhstan due to government legal claims that could cost oil majors billions.

- The disputes include a lost Karachaganak arbitration that could expose Shell and partners to as much as $4 billion, alongside larger claims tied to the Kashagan project, estimated at roughly $13 billion or $13.5 billion.

- Shell's CEO, Wael Sawan, stated the company will "hold until we have a better line of sight" regarding future investments in the country.

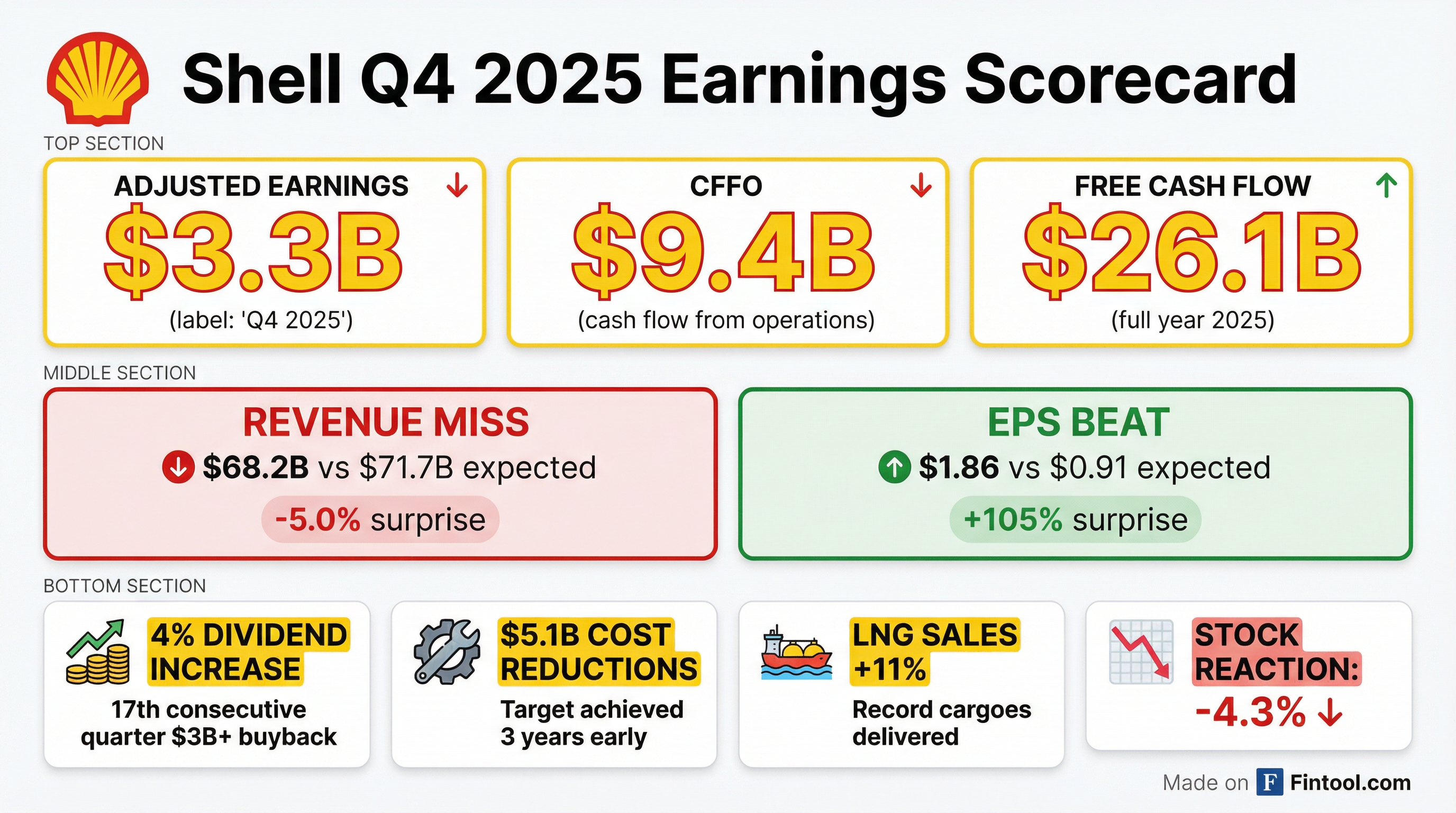

- Shell reported adjusted earnings of $3.3 billion for Q4 2025 and $18.5 billion for the full year 2025, with cash flow from operations (CFFO) of nearly $43 billion and free cash flow of over $26 billion for the full year.

- The company achieved $5.1 billion in structural cost reductions by the end of 2025, reaching its $5-$7 billion target three years early, and ended 2025 within its $20-$22 billion cash CapEx range.

- Shell announced a 4% increase in its dividend and a $3.5 billion share buyback program for Q1 2026, marking the 17th consecutive quarter of buybacks of $3 billion or more, and delivered shareholder distributions at the top end of its 40%-50% of CFFO target in 2025.

- LNG sales grew by 11% in 2025, exceeding the 4%-5% per annum target through 2030, and the company started up over a quarter of its new oil and gas production target of 1 million barrels of oil equivalent per day by 2030.

- The chemicals business continues to face challenges due to low margins, with management prioritizing its repositioning and identifying hundreds of millions in cost and CapEx reductions for 2026.

- Shell reported full year 2025 adjusted earnings of $18.5 billion and cash flow from operations of close to $43 billion, with free cash flow just over $26 billion.

- The company achieved $5.1 billion in structural cost reductions by the end of 2025, reaching the lower end of its $5 billion-$7 billion target by 2028 three years early.

- Shell announced a 4% increase in its dividend and a $3.5 billion share buyback program for Q1 2026, marking the 17th consecutive quarter of $3 billion or more in buybacks.

- LNG sales grew by 11% in 2025, exceeding the target of 4%-5% per annum through 2030, supported by the startup of LNG Canada and the acquisition of Pavilion Energy.

- The company maintained a strong balance sheet with gearing at 21% (or 9% excluding leases) and ended 2025 within its disciplined cash CapEx range of $20 billion-$22 billion.

- Shell reported Q4 2025 adjusted earnings of $3.3 billion and full-year 2025 adjusted earnings of $18.5 billion, generating close to $43 billion in cash flow from operations and over $26 billion in free cash flow.

- The company achieved $5.1 billion in structural cost reductions by the end of 2025, nearing its $5-$7 billion target by 2028 three years early. Cash CapEx for 2025 was within the $20-$22 billion range, which is maintained for 2026.

- Shareholder distributions in 2025 were at the top end of the 40%-50% of CFFO range, supported by a 4% dividend increase and a new $3.5 billion share buyback program.

- Key strategic moves in 2025 included the divestment of SPDC in Nigeria and a loss-making chemicals asset in Singapore, the acquisition of Pavilion Energy, and the startup of over a quarter of new oil and gas production targeting 1 million barrels of oil equivalent per day by 2030.

- Shell plc declared a Q4 2025 interim dividend of US$0.372 per ordinary share and US$0.744 per ADS.

- The ex-dividend date for ordinary shares is February 19, 2026, the record date is February 20, 2026, and the payment date is March 30, 2026.

- The company also commenced a $3.5 billion share buyback programme, with an aggregate term of approximately three months, intended to reduce the issued share capital and be completed before the Q1 2026 results announcement.

- Shell plc reported Income attributable to Shell plc shareholders of $4,134 million for Q4 2025 and $17,838 million for the full year 2025, an 11% increase compared to full year 2024. However, Adjusted Earnings for the full year 2025 decreased by 22% to $18,529 million.

- Cash flow from operating activities for the full year 2025 was $42,863 million, a 22% decrease from 2024, with free cash flow at $26,052 million.

- The company declared a dividend per share of $0.372 for Q4 2025 and completed $3.4 billion in share buybacks during the quarter, announcing a new $3.5 billion buyback program expected to be completed by the first quarter 2026 results announcement.

- Net debt at the end of Q4 2025 increased to $45,687 million from $38,809 million at the end of 2024, resulting in a gearing of 20.7%.

Fintool News

In-depth analysis and coverage of Shell.

Quarterly earnings call transcripts for Shell.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more