Earnings summaries and quarterly performance for Shoals Technologies Group.

Executive leadership at Shoals Technologies Group.

Board of directors at Shoals Technologies Group.

Research analysts who have asked questions during Shoals Technologies Group earnings calls.

Brian Lee

Goldman Sachs Group, Inc.

6 questions for SHLS

Colin Rusch

Oppenheimer & Co. Inc.

6 questions for SHLS

Philip Shen

ROTH MKM

6 questions for SHLS

Praneeth Satish

Wells Fargo

5 questions for SHLS

Julien Dumoulin-Smith

Jefferies

4 questions for SHLS

Mark W. Strouse

J.P. Morgan Chase & Co.

4 questions for SHLS

Kashy Harrison

Piper Sandler

3 questions for SHLS

Andrew Percoco

Morgan Stanley

2 questions for SHLS

Chris Dendrinos

RBC Capital Markets

2 questions for SHLS

David Arcaro

Morgan Stanley

2 questions for SHLS

Dimple Gosai

Bank of America

2 questions for SHLS

Maheep Mandloi

Mizuho Financial Group

2 questions for SHLS

Christine Cho

Goldman Sachs Group

1 question for SHLS

Derek Soderberg

Cantor Fitzgerald

1 question for SHLS

Dylan Nassano

Wolfe Research

1 question for SHLS

Jon Windham

UBS Group AG

1 question for SHLS

Jordan Levy

Truist Securities

1 question for SHLS

Joseph Osha

Guggenheim Partners

1 question for SHLS

Michael Fairbanks

J.P. Morgan Chase & Co.

1 question for SHLS

Mo Chen

Truist Securities

1 question for SHLS

Recent press releases and 8-K filings for SHLS.

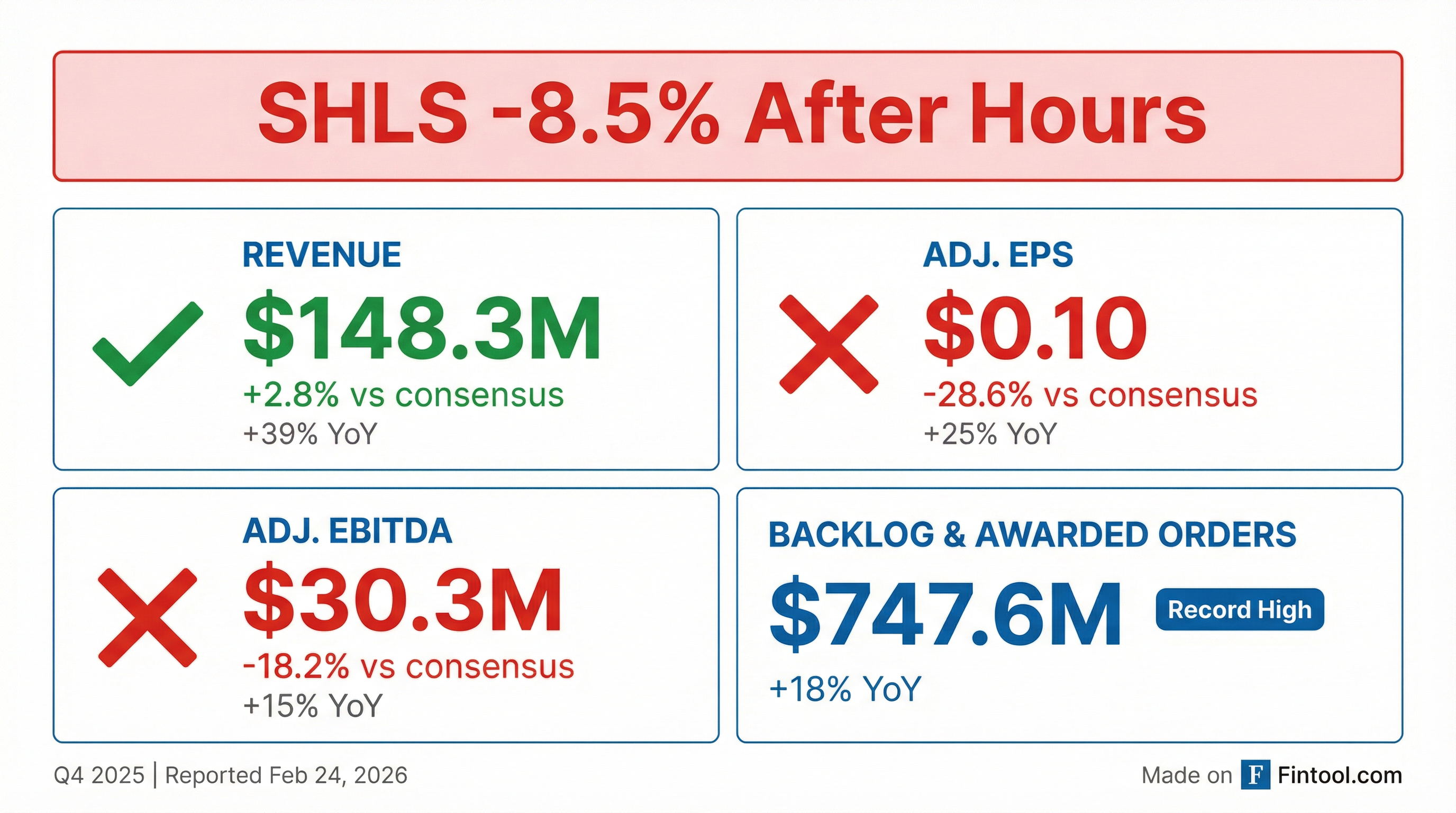

- Shoals Technologies Group (SHLS) reported record quarterly revenue of $148.3 million for the fourth quarter ended December 31, 2025, marking a 39% increase from the prior-year period, and achieved a record backlog and awarded orders of $747.6 million.

- For the full year 2025, the company's revenue increased 19% to $475.3 million, with net income reaching $33.6 million and Adjusted EBITDA at $99.5 million.

- The company provided a First Quarter 2026 outlook, projecting revenue in the range of $125 million to $135 million and Adjusted EBITDA between $16 million and $21 million.

- An explanatory note clarified that previous language regarding changes in customer order patterns and an intention to suspend quarterly guidance was included in error; the company confirms no material changes in customer order patterns and will continue providing quarterly guidance.

- Shoals Technologies Group reported Q4 2025 revenue of approximately $148 million, a 38.6% year-over-year increase, contributing to full-year 2025 revenue growth of 19%.

- Adjusted EBITDA for Q4 2025 was $30.3 million, up 14.7% year-over-year, though profitability was softer than anticipated due to factors like higher legal expenses, tariffs, and product mix.

- The company achieved a record backlog and awarded orders (BLAO) of approximately $748 million by year-end 2025, with $603 million scheduled for shipment in 2026.

- Guidance for full-year 2026 projects revenue between $560 million-$600 million and Adjusted EBITDA between $110 million-$130 million, with gross margin percentages expected in the low to mid-30s for the foreseeable future due to ongoing tariff impacts, new facility transition, and product mix.

- Shoals Technologies Group reported Q4 2025 revenue of $148 million, an increase of 38.6% over the prior year period, and adjusted EBITDA of $30 million, growing 15% year-over-year.

- The company ended Q4 2025 with a record backlog and awarded orders (BLAO) of $748 million, an 18% year-over-year increase, with approximately $603 million of this BLAO having shipment dates in 2026.

- For full year 2026, Shoals expects revenue between $560 million and $600 million and adjusted EBITDA between $110 million and $130 million, representing year-over-year growth of 22% and 21% at the midpoint, respectively.

- Profitability in Q4 2025 was softer than anticipated, with a gross profit percentage of 31.6%, impacted by higher legal expenses, tariffs, product mix, and increased labor and shipping costs. The company anticipates gross margins in the low to mid-30s for the foreseeable future, with improvements expected in the latter half of 2026 as it moves into a new manufacturing facility.

- Shoals Technologies Group reported Q4 2025 revenue of $148.3 million and Adjusted EBITDA of $30.3 million, which was below guidance due to higher legal spend, tariffs, product mix, and increased labor and shipping costs.

- For the full year 2025, the company achieved revenue of $475.3 million, marking approximately 19% topline growth, and Adjusted EBITDA of $99.5 million.

- The company ended Q4 2025 with a strong Backlog & Awarded Orders (BLAO) of $748 million and a Book-to-Bill ratio of 1.2.

- International revenue significantly increased to $13 million in 2025 from less than $1 million in 2024, and the new BESS offering secured $67 million in BLAO.

- Shoals provided a Q1 2026 revenue outlook of $125 million to $135 million and an Adjusted EBITDA outlook of $16 million to $21 million, alongside full-year 2026 guidance for revenue of $560 million to $600 million and Adjusted EBITDA of $110 million to $130 million.

- Shoals Technologies Group reported Q4 2025 revenue of $148 million, a 38.6% year-over-year increase, contributing to $475 million in revenue for the full year 2025.

- The company provided full year 2026 guidance of $560 million-$600 million in revenue and $110 million-$130 million in adjusted EBITDA, representing 22% and 21% year-over-year growth at the midpoint, respectively.

- A record backlog and awarded orders (BLAO) of approximately $748 million was reported at year-end 2025, with $603 million scheduled for shipment in 2026, supporting the growth outlook.

- Gross profit percentage in Q4 2025 was 31.6%, lower than anticipated due to factors like tariffs, product mix, and increased costs. The company anticipates gross margins in the low to mid-30s for the foreseeable future, with potential for improvement beyond 2026.

- Strategic growth initiatives include international expansion, with revenue reaching $13 million in 2025, and the BESS business poised for rapid growth in 2026, supported by a new production facility expected to be fully operational by mid-2026.

- Shoals Technologies Group, Inc. reported record quarterly revenue of $148.3 million for Q4 2025, marking a 39% increase from the prior year, with net income of $8.1 million and Adjusted EBITDA of $30.3 million.

- For the full year 2025, revenue increased 19% to $475.3 million, and net income was $33.6 million, with Adjusted EBITDA reaching $99.5 million.

- The company achieved record backlog and awarded orders of $747.6 million as of December 31, 2025, an 18% increase from year-end 2024.

- For Q1 2026, Shoals expects revenue to be in the range of $125 million to $135 million and Adjusted EBITDA between $16 million and $21 million.

- The full year 2026 outlook projects revenue between $560 million and $600 million and Adjusted EBITDA in the range of $110 million to $130 million.

- Shoals Technologies Group reported record quarterly revenue of $148.3 million for Q4 2025, marking a 39% increase year-over-year, contributing to full-year 2025 revenue of $475.3 million.

- Adjusted EBITDA reached $30.3 million in Q4 2025 and $99.5 million for the full year 2025.

- The company achieved a record backlog and awarded orders of $747.6 million as of December 31, 2025, representing an 18% increase from year-end 2024.

- Shoals provided a Q1 2026 revenue outlook of $125 million to $135 million and a full-year 2026 revenue outlook of $560 million to $600 million.

- Shoals Technologies Group and ON.energy have announced an agreement to deploy multiple gigawatts of critical power systems into the AI data center market.

- The partnership combines ON.energy's medium-voltage AI UPS™ platform with Shoals' DC Recombiner to deliver a scalable path to resilient backup power for data centers.

- Shoals is scaling its production capacity at its ~638,000 square foot manufacturing campus in Portland, TN, to support the growth in energy demand driven by AI and cloud computing.

- Shoals Technologies Group (SHLS) announced a favorable initial determination from the U.S. International Trade Commission (ITC) on February 6, 2026, in its patent infringement complaint against Voltage, LLC.

- The ITC found that Voltage violated Section 337 of the Tariff Act of 1930 by importing LYNX trunk bus products into the United States, infringing on Shoals' patented Big Lead Assembly (BLA) solutions.

- The ITC's final determination is expected by June 2026, which, if upheld, would prevent the unlawful importation of infringing trunk bus solutions.

- Shoals also has an ongoing appeal with the U.S. Court of Appeals regarding an earlier ITC decision related to another of its patents.

- Shoals delivered record revenue of $135.8 million in Q3 2025, marking a 32.9% increase year-over-year and 22.5% sequential growth over Q2 results.

- The company achieved a record backlog and awarded orders (BLAO) of $720.9 million as of September 30, 2025, representing a 21% year-over-year increase.

- Adjusted gross profit percentage for the quarter was 37%, and adjusted EBITDA was $32.0 million, or 23.5% of revenue.

- Shoals increased its anticipated revenue range for the full year 2025 to between $467 million and $477 million, and adjusted EBITDA to between $105 million and $110 million.

- The company is actively pursuing new growth opportunities, including international markets and Battery Energy Storage Solutions (BESS), having signed two MSAs to deliver products in emerging BESS markets with $18 million of BESS in backlog at the end of Q3.

Quarterly earnings call transcripts for Shoals Technologies Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more