SKYWEST (SKYW)·Q4 2025 Earnings Summary

SkyWest Q4 2025: Revenue Beats but Government Shutdown Clips EPS, Contract Extensions Boost Outlook

January 29, 2026 · by Fintool AI Agent

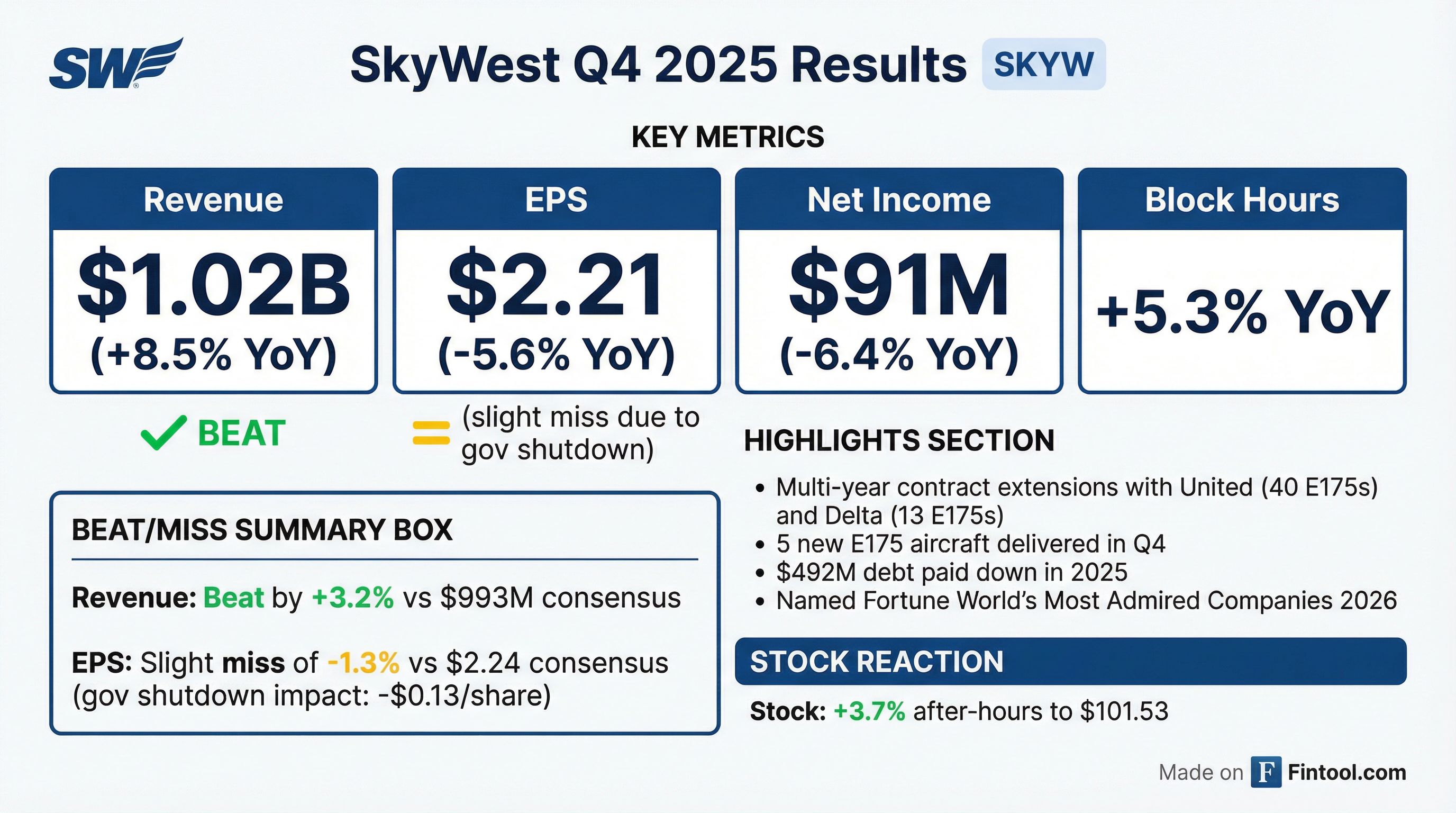

SkyWest (NASDAQ: SKYW) reported Q4 2025 results that exceeded revenue expectations by 3.2% while narrowly missing EPS estimates due to FAA-mandated flight cancellations during the U.S. government shutdown in October-November 2025. The regional airline operator announced major contract extensions with both United Airlines and Delta Air Lines, securing commitments for 53 additional E175 aircraft and extending its partnership runway significantly.

Did SkyWest Beat Earnings?

Revenue: Beat by 3.2% — SkyWest posted Q4 2025 revenue of $1.024 billion, exceeding the Street's $993 million consensus by $31 million. Revenue increased 8.5% year-over-year from $944 million in Q4 2024, driven by higher fleet utilization and strong demand.

EPS: Miss by 1.3% — Diluted EPS of $2.21 came in slightly below the $2.24 consensus estimate. The government shutdown's FAA-mandated flight cancellations reduced pre-tax income by $7 million, or $0.13 per share. Adjusting for this one-time impact, EPS would have been approximately $2.34, representing a beat.

This marks SkyWest's first EPS miss after 8 consecutive quarterly beats, though the underlying business momentum remains intact.

What Changed From Last Quarter?

Government Shutdown Impact — The Q4 was "unusually challenging, starting out with the government shutdown and mandatory flight reductions and leading right into the peak holiday season travel." SkyWest was "disproportionately affected, with more canceled flights than our major partners during the mandatory flight reductions" — approximately 2,000 canceled flights and 3,000 block hours.

Operating Costs Stepped Up — Total operating expenses increased 11% YoY to $890 million, outpacing revenue growth of 8.5%. Key drivers:

- Aircraft maintenance surged 22% to $248M as SkyWest invested in returning parked aircraft to service

- Airport-related expenses jumped 40% to $35M

- Aircraft fuel increased 54% to $34M

Deferred Revenue Dynamics — The company recognized $5M of previously deferred revenue in Q4, down from $17M in Q3 2025 and $20M in Q4 2024. The contract extensions with United and Delta "push out the timing of the recognition" of the $265M deferred revenue balance.

Block Hours Grew 5% — Production increased to 369,052 block hours in Q4 2025 vs. 350,318 in Q4 2024, reflecting higher fleet utilization despite the government shutdown disruptions.

CRJ200 Fleet Winding Down — CRJ200 aircraft in service dropped to 58 from 75 a year ago, while E175 count grew to 270 from 262. This transition away from older 50-seat jets to larger 76-seat E175s continues to improve unit economics.

Full Year 2025 Performance

SkyWest delivered exceptional full-year results despite the Q4 headwinds:

The 15% block hour growth drove the outperformance, with SkyWest benefiting from strong demand from its major airline partners and successful fleet transitions.

Contract Extensions: The Headline Story

The real story for investors isn't the slight Q4 miss — it's the major contract extensions announced in January 2026:

United Airlines Extension — Multi-year extension for 40 E175 aircraft

Delta Air Lines Extension — Multi-year extension for 13 E175 aircraft

These extensions build on SkyWest's existing delivery pipeline:

By end of 2028, SkyWest anticipates having nearly 300 E175 aircraft in its fleet. The company also secured purchase rights on 50 additional E175s from Embraer for future opportunities.

Capital Allocation & Balance Sheet

SkyWest continues to strengthen its balance sheet while returning capital to shareholders:

Debt Reduction — Paid down $492 million in principal debt during 2025, reducing total debt to $2.4B from $2.7B at year-end 2024.

Share Repurchases — Repurchased 268,000 shares for $27 million at an average price of $100.43 in Q4 2025, up 10% from Q3's pace. $213 million remains available under the current program.

Liquidity — Cash and marketable securities of $707M, down from $802M a year ago, reflecting capital deployment into new aircraft and debt paydown.

Capital Expenditures — Q4 2025 capex of $214 million for five new E175 aircraft, spare engines, and other fixed assets.

Management Commentary

CEO Chip Childs highlighted the Fortune recognition and operational excellence:

"I'm humbled and honored that SkyWest was named a Fortune World's Most Admired Companies for 2026... SkyWest was named in the top 10 and the only regional airline on the list."

On operational performance, Childs noted the team achieved over 250 days of 100% controllable completion in 2025 while regularly reaching over 2,500 daily scheduled departures — a remarkable accomplishment given they serve four different major airline partners.

On long-term strategy and contract extensions:

"We spent years strengthening our balance sheet and fleet flexibility, as well as reinvesting in our future growth. We continue to play the long game and invest in our fleet and our future to ensure we're in the best possible position to respond to market demands in a way that no one else can."

On competitive positioning:

"I don't know of anybody in the industry that can evolve as well as we can."

How Did the Stock React?

SKYW rose 3.7% to $101.53 on the earnings release, as investors looked past the slight EPS miss to focus on the contract extensions and strong revenue performance.

The stock is trading at a significant discount to its 52-week high of $135.57, despite the strong full-year performance and contract visibility.

What Did Management Guide?

SkyWest provided detailed 2026 guidance on the earnings call:

Key guidance details:

- Quarterly seasonality returning to pre-COVID patterns — Q1 2026 EPS expected flat to down from Q4 2025 GAAP EPS, with Q2/Q3 being the strongest quarters

- 9 new E175 deliveries expected in 2026

- 23 CRJ550s entering service to complete the 50-aircraft United commitment

- Deferred revenue recognition of $20-25M per quarter expected in 2026 (from $265M cumulative balance)

Management noted this guidance is modestly higher than what they provided last quarter, driven by better-than-expected utilization trends.

Q&A Highlights

On Contract Extension Economics — Analyst Katie O'Brien (Goldman Sachs) asked whether paid-off aircraft affected renewal rates. CEO Chip Childs responded that "rate economics are very consistent with where they were before, so we will see a very consistent level of revenue continuing on with these airplanes."

On Utilization Trends — CFO Wade Steel confirmed "positive trends in aircraft utilization" with spring/summer 2026 schedules looking "extremely positive." This is one reason block hour guidance was increased from last quarter.

On Balance Sheet Flexibility — CFO Rob Simmons stated the company is "in an all of the above position" for capital allocation — able to invest in fleet, continue delevering, and execute buybacks simultaneously. Unencumbered assets total $1.5 billion.

On E175 Order Book — Of the 69 aircraft on order with Embraer, 25 are allocated to partners (16 Delta, 8 United, 1 Alaska) and 44 remain unassigned. 2027 deliveries are "all spoken for" with majority of 2028 also committed.

On Seasonal Model — The return of prorate business is creating "increasingly seasonal" results consistent with typical industry patterns.

Growth Initiatives

New American Airlines Prorate Agreement — SkyWest began a prorate agreement with American Airlines, currently operating 4 aircraft with expansion to 9 aircraft by mid-2026. This diversifies SkyWest's partner base beyond its traditional United, Delta, and Alaska relationships.

CRJ Fleet Redeployment — The company has 20 parked dual-class CRJ aircraft in heavy maintenance that will return to service on signed contracts in 2026. An additional 40 CRJ200s remain parked with "very good opportunities" in the marketplace.

SkyWest Charter — The charter business is currently "on the back burner" due to overwhelming demand for core airline operations. CEO Childs noted they're seeing "demand we can't meet" from sports teams and other charter customers. Management expects this could become a bigger opportunity in 2027-2028 once MRO capacity allows.

Underserved Communities — Management highlighted growth in service to underserved communities as a 2026 focus area, working with airports to expand prorate service.

Forward Catalysts & Risks

Catalysts:

- Continued E175 deliveries (9 aircraft expected in 2026)

- Potential assignment of 44 unassigned E175 delivery positions to new partner contracts

- Ongoing fleet utilization improvements as industry pilot supply normalizes

- Further debt reduction freeing up cash flow for shareholder returns

- New American Airlines prorate expansion to 9 aircraft

- Chicago hub build-out creating regional flying opportunities

Risks:

- Dependence on major airline partner health and contract renewals

- Pilot attraction and retention in competitive labor market

- Government policy risk (another shutdown would impact operations)

- Third-party MRO network challenges including labor and parts availability

- Aircraft maintenance cost inflation as CRJ fleet ages

The Bottom Line

SkyWest's Q4 2025 results tell a story of operational resilience despite external headwinds. The government shutdown cost shareholders $0.13/share, turning what would have been another EPS beat into a slight miss. But the fundamentals remain strong: 15% full-year revenue growth, 33% EPS growth, accelerating fleet investments, and — most importantly — multi-year contract extensions with two of its biggest partners.

At 9.7x trailing earnings with $10+ EPS power demonstrated, SkyWest offers compelling value for investors who believe regional airline demand will remain robust as major carriers continue outsourcing smaller routes to specialized operators.

Updated January 29, 2026 with Q&A highlights and 2026 guidance from earnings call. View full transcript