Earnings summaries and quarterly performance for SKYWEST.

Executive leadership at SKYWEST.

Russell Childs

Chief Executive Officer and President

Dale Hansen

General Counsel and Corporate Secretary

Eric Woodward

Chief Accounting Officer

Greg Wooley

Executive Vice President, Operations (SkyWest Airlines)

Robert Simmons

Chief Financial Officer

Wade Steel

Chief Commercial Officer

Board of directors at SKYWEST.

Research analysts who have asked questions during SKYWEST earnings calls.

Savanthi Syth

Raymond James

6 questions for SKYW

Catherine O'Brien

Goldman Sachs

5 questions for SKYW

Duane Pfennigwerth

Evercore ISI

4 questions for SKYW

Thomas Fitzgerald

TD Cowen

4 questions for SKYW

John Godyn

Citigroup

2 questions for SKYW

Michael Linenberg

Deutsche Bank

2 questions for SKYW

Mike Lindenberg

Deutsche Bank

2 questions for SKYW

Tom Fitzgerald

TD Cowen

2 questions for SKYW

Hillary Cacanando

Not Mentioned in Transcript

1 question for SKYW

Richa Talwar

Deutsche Bank

1 question for SKYW

Recent press releases and 8-K filings for SKYW.

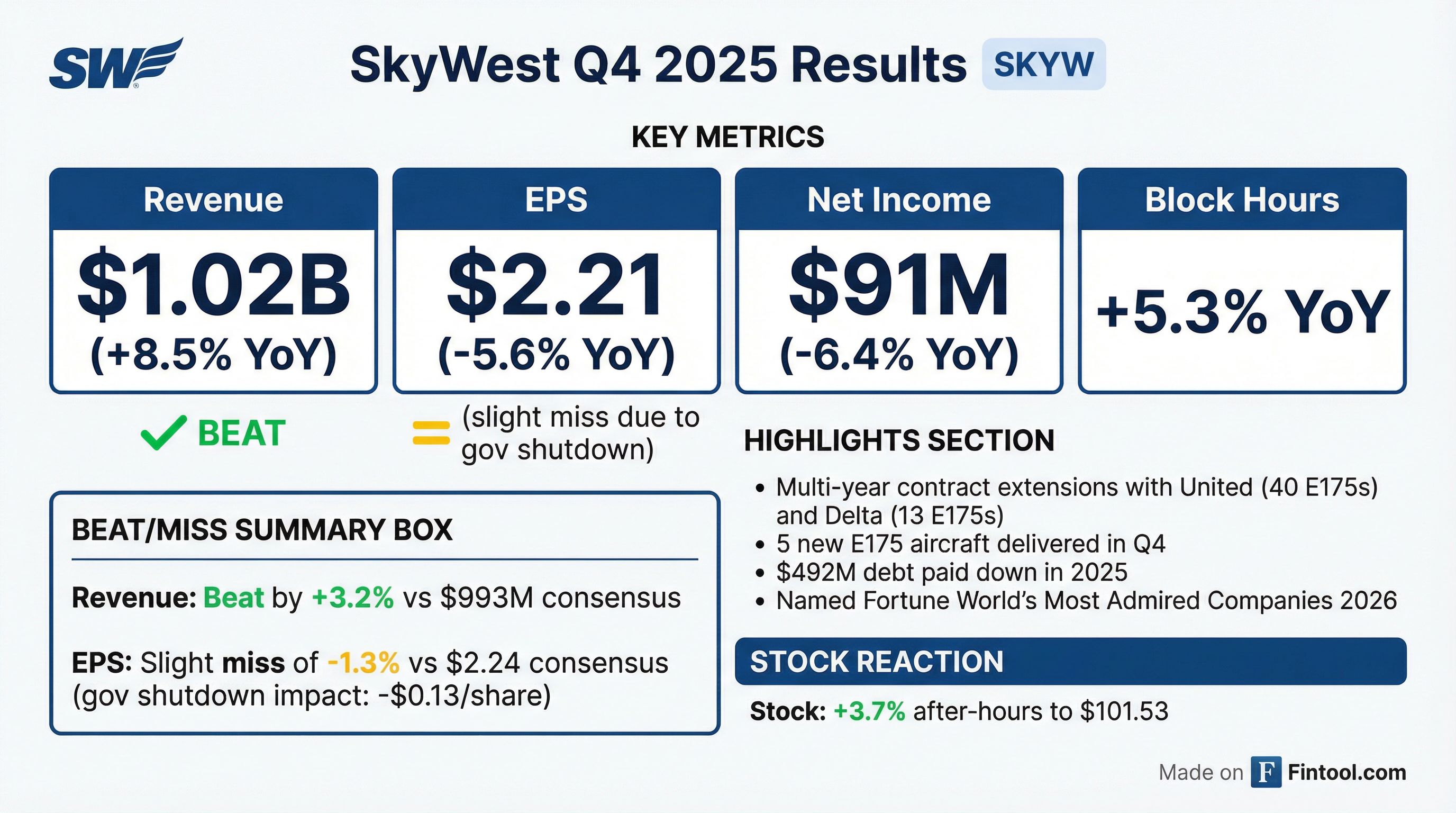

- SkyWest reported Q4 2025 GAAP net income of $91 million or $2.21 earnings per share on $1 billion in total revenue, and for the full year 2025, achieved $566 million in pre-tax income and $982 million in EBITDA.

- The company anticipates mid-single-digit percentage growth in block hours over 2025 and expects earnings per share for 2026 to be in the mid-$11 area, up modestly from previous expectations.

- SkyWest reduced its debt by $1 billion over the past three years, ending Q4 2025 with $2.4 billion in debt, and has no major E175 contract expirations until late 2028. The company also repurchased $85 million worth of shares in 2025 and plans to take delivery of 9 new E175s in 2026.

- SkyWest reported Q4 2025 net income of $91 million or $2.21 per diluted share, and full-year 2025 net income of $428 million or $10.35 per diluted share. For 2025, the company generated over $400 million in free cash flow and $982 million in EBITDA.

- The company announced extensions for 40 E175s with United and 13 E175s with Delta, ensuring no major E175 contract expirations until late 2028.

- For 2026, SkyWest anticipates mid-$11 area earnings per share and mid-single-digit percentage growth in block hours over 2025, with Q1 2026 EPS expected to be flat to down from Q4 2025 GAAP EPS due to sharper seasonality.

- SkyWest ended Q4 2025 with $707 million in cash and $2.4 billion in debt, having repaid $492 million of debt in 2025 and reduced total debt by $1 billion over the past three years. The company plans approximately $600 million-$625 million in total capital expenditures for 2026, including 9 new E175 deliveries and placing 23 CRJ550s into service.

- SkyWest reported net income of $91 million, or $2.21 per diluted share for the fourth quarter of 2025, and full year net income of $428 million, or $10.35 per diluted share for 2025. The company's pre-tax income for 2025 was $566 million, marking a 31% increase from 2024, and it generated over $400 million in free cash flow.

- For 2026, SkyWest anticipates mid-single-digit % growth in block hours over 2025 and expects earnings per share to be in the mid-$11 area.

- The company announced extensions on key flying agreements, including 40 E175s with United and 13 E175s with Delta, ensuring no major E175 contract expirations until late 2028. SkyWest expects to take delivery of 9 new E175s during 2026.

- SkyWest reduced its debt by $492 million in 2025, ending Q4 2025 with $2.4 billion in debt, and utilized $85 million for share repurchases in 2025.

- SkyWest, Inc. reported net income of $91 million ($2.21 per diluted share) on $1.0 billion in revenue for Q4 2025, and net income of $428 million ($10.35 per diluted share) on $4.06 billion in revenue for the full year 2025.

- The company's full-year 2025 net income increased 33% from 2024, reflecting 15% year-over-year block hour growth, despite a $7 million reduction in Q4 2025 pre-tax income due to FAA-mandated flight cancellations.

- SkyWest reduced its total debt to $2.4 billion by December 31, 2025, from $2.7 billion at December 31, 2024, through $492 million in principal debt payments during 2025, and repurchased 268,000 shares for $27 million in Q4 2025.

- In January 2026, SkyWest reached multi-year contract extensions with United Airlines for 40 E175 aircraft and with Delta Air Lines for 13 E175 aircraft, and anticipates nearly 300 E175 aircraft in its fleet by the end of 2028.

- SkyWest, Inc. reported Q4 2025 net income of $91 million ($2.21 per diluted share) and full-year 2025 net income of $428 million ($10.35 per diluted share), with full-year net income increasing 33% from 2024.

- Revenue for Q4 2025 was $1.0 billion, an 8% increase from Q4 2024, driven by a 5% increase in block hour production.

- The company repurchased 268,000 shares for $27 million during Q4 2025 and had $213 million of remaining availability under its share repurchase program as of December 31, 2025.

- SkyWest secured multi-year contract extensions with United Airlines for 40 E175 aircraft and Delta Air Lines for 13 E175 aircraft in January 2026.

- Total debt decreased to $2.4 billion at December 31, 2025, from $2.7 billion at December 31, 2024, reflecting $492 million in principal debt payments during 2025.

- SkyWest Inc. reported net income of $116 million and diluted earnings per share of $2.81 for the third quarter of 2025. Total Q3 revenue was $1.1 billion, an increase from $913 million in Q3 2024.

- The company provided updated guidance, anticipating 2025 GAAP EPS in the mid-$10 per share area (implying Q4 EPS of approximately $2.30) and 2026 EPS in the area of $11, representing mid to high single-digit percentage growth.

- SkyWest announced an agreement with United to extend up to 40 CRJ-200s into the 2030s and has 74 E175s on firm order with Embraer, with deliveries of 3 E175s expected in Q4 2025 and 11 in 2026.

- The company repurchased 244,000 shares for $27 million in Q3 2025, with $240 million remaining under its share repurchase authorization as of September 30.

- SkyWest, Inc. reported net income of $116 million and diluted EPS of $2.81 for Q3 2025, an increase from $90 million and $2.16, respectively, in Q3 2024.

- Revenue grew 15% to $1.1 billion in Q3 2025, up from $913 million in Q3 2024, reflecting a 15% increase in block hour production.

- The company secured a multi-year contract extension with United Airlines for up to 40 CRJ200 aircraft.

- SkyWest repurchased 244,000 shares for $26.6 million during Q3 2025, with $240 million of availability remaining under its share repurchase program.

- Total debt decreased to $2.4 billion as of September 30, 2025, down from $2.7 billion at December 31, 2024.

- SkyWest, Inc. reported net income of $116 million, or $2.81 per diluted share, for Q3 2025, an increase from $90 million, or $2.16 per diluted share, in Q3 2024.

- Revenue for Q3 2025 reached $1.1 billion, a 15% increase from $913 million in Q3 2024, with operating income up 33% to $174 million.

- The company maintained strong liquidity with $753 million in cash and marketable securities and reduced total debt to $2.4 billion as of September 30, 2025.

- SkyWest repurchased 244,000 shares for $26.6 million during Q3 2025 and secured a multi-year contract extension with United Airlines for up to 40 CRJ200 aircraft.

- AM Best has affirmed the Financial Strength Rating of A (Excellent) and Long-Term Issuer Credit Ratings (Long-Term ICRs) of "a" (Excellent) for Skyward Specialty Insurance Group's members.

- The Long-Term ICR of "bbb" (Good) for Skyward Group and the Long-Term Issue Credit Rating of "bbb-" (Good) for its $20 million, 7.25% subordinated notes, due 2039, were also affirmed.

- The outlook for all these Credit Ratings is stable.

- The ratings reflect Skyward's very strong balance sheet strength, adequate operating performance, neutral business profile, and appropriate enterprise risk management.

- The group's operating performance is characterized by a continuing trend of improving underwriting profitability and consistent investment income.

- SkyWest Inc. reported net income of $120 million and $2.91 diluted EPS for the second quarter of 2025.

- The company anticipates 2025 GAAP EPS to be in the $10 per share area, with block hours expected to be up approximately 14% over 2024.

- SkyWest announced an agreement to purchase and operate 16 new E175s under a multiyear contract with Delta, with deliveries expected to begin in 2027, and secured firm delivery positions for 44 more E175s from 2028 to 2032.

- The company is not willing to pay a 50% tariff on new aircraft deliveries from Brazil, and anticipates remaining 2025 Embraer deliveries will be delayed into the fourth quarter or early 2026.

- SkyWest repurchased 195,000 shares for $17.3 million in Q2 2025, with $267 million remaining under its current share repurchase authorization as of June 30.

Quarterly earnings call transcripts for SKYWEST.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more