Earnings summaries and quarterly performance for SL GREEN REALTY.

Executive leadership at SL GREEN REALTY.

Board of directors at SL GREEN REALTY.

Research analysts who have asked questions during SL GREEN REALTY earnings calls.

Alexander Goldfarb

Piper Sandler

7 questions for SLG

John Kim

BMO Capital Markets

7 questions for SLG

Ronald Kamdem

Morgan Stanley

7 questions for SLG

Caitlin Burrows

Goldman Sachs

6 questions for SLG

Nicholas Yulico

Scotiabank

6 questions for SLG

Peter Abramowitz

Jefferies

5 questions for SLG

Seth Bergey

Citi

5 questions for SLG

Steve Sakwa

Evercore ISI

5 questions for SLG

Vikram Malhotra

Mizuho Financial Group, Inc.

5 questions for SLG

Anthony Paolone

JPMorgan Chase & Co.

4 questions for SLG

Blaine Heck

Wells Fargo Securities

4 questions for SLG

Brendan Lynch

Barclays

4 questions for SLG

Michael Lewis

Truist Securities, Inc.

4 questions for SLG

Omotayo Okusanya

Deutsche Bank AG

3 questions for SLG

Blaine M. Heck

Wells Fargo

2 questions for SLG

Jeffrey Spector

BofA Securities

2 questions for SLG

Michael Griffin

Citigroup Inc.

2 questions for SLG

Jana Galan

Bank of America

1 question for SLG

Manush Abek

Evercore ISI

1 question for SLG

Mike Lewis

Truist Securities

1 question for SLG

Viktor Fediv

Scotiabank

1 question for SLG

Recent press releases and 8-K filings for SLG.

- SL Green's CEO Marc Holliday reported 2025 as one of the best office and leasing markets he has seen, with 27 million sq ft of leasing and 1 million sq ft of absorption in New York City. In the first 60 days of 2026, the company signed nearly 500,000 sq ft of leases and expects over 600,000 sq ft in Q1 2026.

- The company projects two-thirds of its portfolio (approximately 20 million sq ft) to achieve 98% weighted average occupancy by year-end. CFO Matthew DiLiberto anticipates 10% same store Net Operating Income (NOI) growth in 2027, and CEO Marc Holliday expects 10% net effective rent growth for New York City in 2027.

- SL Green is actively pursuing a $2.5 billion disposition plan, having completed the sale of 690 Madison Avenue for $54.5 million (realizing a 40% IRR) and having 5 additional transactions in pipeline or deep negotiations. The company is also on track to complete $4.5 billion of its $7 billion financing plan in Q1 2026.

- The company is planning a new development at 346 Madison Avenue, which is expected to be completed by the end of 2030. Additionally, Harrison Sitomer has been promoted to President and Chief Investment Officer, and the terms for CFO Matthew DiLiberto and Edward Piccinich have been re-upped for three years.

- Midtown Manhattan's leasing market demonstrated significant strength in 2025, with 27.3 million square feet leased, marking the highest activity since 2018, and total available space declining for six consecutive quarters to 38.3 million square feet.

- SL Green Realty reported a robust leasing update, with Manhattan office leases signed year-to-date totaling 491,098 square feet and a pipeline of 1,073,652 square feet as of February 27, 2026.

- The company's total leased occupancy stood at 95.5% at year-end 2025, with a projection to increase to 98.0% by year-end 2026.

- Tech/Media leasing activity in Manhattan reached 2.8 million square feet in 4Q25, the highest since 4Q19, while AI leasing activity exceeded 1.5 million square feet in 2025, indicating a growing demand from these sectors.

- Midtown East Manhattan is experiencing a lack of new office supply, with a projected net decrease in office inventory of 821,982 square feet between 2025 and 2030, driven by office-to-residential conversions and limited new deliveries.

- SL Green's CEO Marc Holliday described the current office market as "one of the best office markets and leasing markets that I've ever seen" , with nearly 500,000 sq ft of leases signed in the first 60 days of 2026 and expectations for over 600,000 sq ft in Q1. The company projects 98% weighted average occupancy by year-end for two-thirds of its portfolio.

- The company is executing a $2.5 billion disposition plan, having completed the sale of 690 Madison Avenue for $54.5 million with a 40% IRR. A $7 billion financing plan is also underway, with $4.5 billion expected to be completed in Q1 2026.

- SL Green anticipates 10% same-store Net Operating Income (NOI) growth in 2027 and projects net effective rent growth for New York City to be in the 10% range in 2027.

- Leadership changes include the promotion of Harrison Sitomer to President and CIO and the re-upping of CFO Matthew DiLiberto for three years.

- SL Green's CEO, Marc Holliday, reported a strong New York City office market with 27 million sq ft of leasing and over 1 million sq ft of absorption in 2025, and nearly 500,000 sq ft of leases signed in the first 60 days of 2026.

- The company expects two-thirds of its portfolio (20 million sq ft) to reach 98% weighted average occupancy by year-end, with over 600,000 sq ft of leases projected for Q1 2026.

- SL Green is progressing with its $2.5 billion disposition plan, having sold 690 Madison Avenue for $54.5 million at a 40% IRR, and has five more transactions in pipeline. A $7 billion financing plan is also underway, with $4.5 billion anticipated in Q1 2026.

- The company projects 10% same-store Net Operating Income (NOI) growth for 2027 and anticipates 10% net effective rent growth for New York City in 2027 for better properties.

- Harrison Sitomer was promoted to President and CIO , and management stated that AI/tech/software companies constitute less than 1% of their portfolio, with no observed tenant space reductions due to AI.

- SL Green Realty Corp. promoted Harrison Sitomer to President and Chief Investment Officer on March 02, 2026.

- Sitomer, who previously served as Chief Investment Officer since January 2022, has been instrumental in strengthening the company's capital platform and launching its $1.3 billion debt fund.

- The company also extended the contracts of Chief Financial Officer Matthew DiLiberto and Chief Operating Officer Edward Piccinich through the end of 2028.

- SL Green Realty Corp. signed 32 Manhattan office leases totaling 491,098 square feet during the first two months of 2026.

- The company maintains a current pipeline of more than 1.0 million square feet.

- Notable leases include a 10-year lease for 150,036 square feet at 245 Park Avenue by a large global investment firm and a 10-year expansion lease for 51,081 square feet at 125 Park Avenue by TD Securities.

- Steven Durels, SL Green’s Executive Vice President, Director of Leasing and Real Property, stated that tenant demand remains strong, rents are rising, and concessions are tightening across Midtown Manhattan.

- SL Green Realty Corp. and its joint venture partner, Jeff Sutton's Wharton Properties, closed the sale of 690 Madison Avenue for $54.5 million on March 2, 2026.

- The property sold is a five-story, 7,850-square-foot commercial building located on Madison Avenue, which is fully leased to Richemont's Van Cleef & Arpels.

- Harrison Sitomer, Chief Investment Officer at SL Green, stated that the sale highlights the continued demand for flagship retail locations in Manhattan.

- As of December 31, 2025, SL Green held interests in 56 buildings totaling 31.4 million square feet.

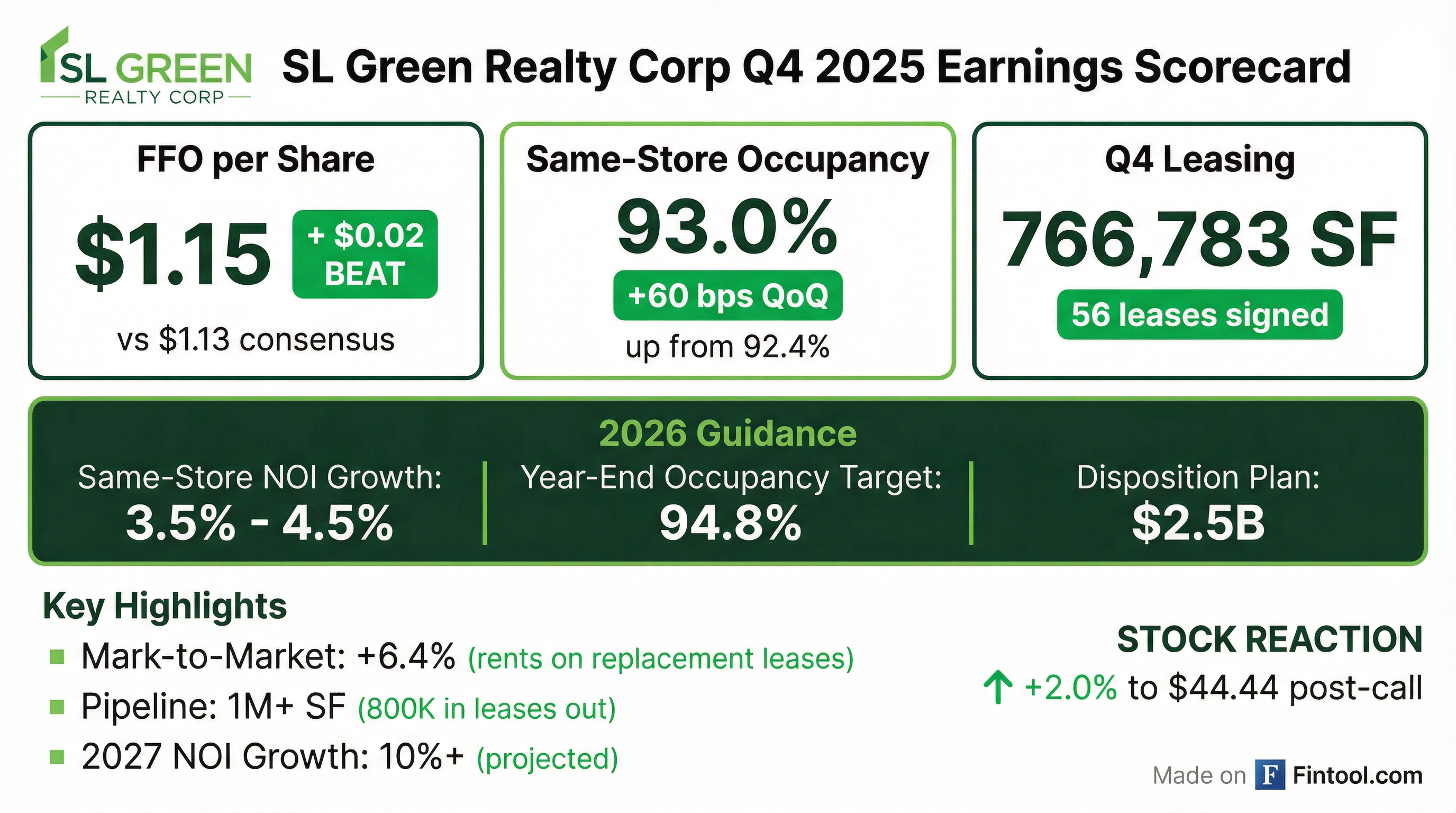

- SL Green Realty Corp. reported a net loss attributable to common stockholders of $104.6 million, or $1.49 per share, for the fourth quarter ended December 31, 2025, compared to a net income of $9.4 million, or $0.13 per share, for the same period in 2024.

- Funds from Operations (FFO) for Q4 2025 were $86.2 million, or $1.13 per share, down from $131.9 million, or $1.81 per share, in Q4 2024. For the full year 2025, FFO was $437.7 million, or $5.72 per share, compared to $569.8 million, or $8.11 per share, in 2024.

- In investment activity, the company closed on the purchase of Park Avenue Tower for $730.0 million in January 2026 and sold a 49.0% joint venture interest in 100 Park Avenue for a gross asset valuation of $425.0 million in December 2025, generating $34.9 million in cash proceeds.

- The company declared two monthly ordinary dividends of $0.2575 per share in Q4 2025 and announced a modification to its dividend policy, shifting to quarterly payments beginning in fiscal year 2026.

- SL Green reported a Q4 2025 FFO beat of $0.02 per share and a full-year FAD beat of $65 million, with $20 million occurring in Q4.

- The company achieved almost 800,000 sq ft of Manhattan office leasing in Q4 2025, contributing to an annual total of 2.6 million sq ft. Same-store lease occupancy ended 2025 at 93%, with a 2026 objective of 94.8% by year-end.

- SL Green is progressing with its $7 billion refinance plan and $2.5 billion disposition plan for 2026, expecting transaction volume in 2026 to exceed $23 billion from the previous year.

- The company projects generating over $100 million in fee revenue from institutional investors and plans to launch a new fund for senior credit lending in 2026, with current debt fund deployment tracking at $150 million-$175 million per quarter.

- SL Green Realty Corp. reported a $0.02 per share FFO beat for Q4 2025, driven by higher net operating income (NOI), improved hospitality business contribution, and lower general and administrative (G&A) expenses. The company also exceeded its initial FAD guidance for 2025 by $65 million, with nearly $20 million of that outperformance occurring in Q4 2025.

- The company achieved 93% same-store lease occupancy by the end of 2025, an increase of almost 400 basis points from Q1 2024 lows, and aims for 94.8% by the end of 2026. Q4 2025 saw almost 800,000 sq ft of Manhattan office leasing, contributing to an annual total of 2.6 million sq ft.

- Management anticipates 2026 to be a strong year for the commercial office sector, supported by plans to execute a $7 billion refinancing strategy and a $2.5 billion disposition plan. There is strong global investor appetite for New York City assets, with 2026 transaction volume projected to exceed $23 billion.

Quarterly earnings call transcripts for SL GREEN REALTY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more