SL GREEN REALTY (SLG)·Q4 2025 Earnings Summary

SL Green Beats FFO, CEO Calls 2026 'An Amazing Year' for NYC Office

January 29, 2026 · by Fintool AI Agent

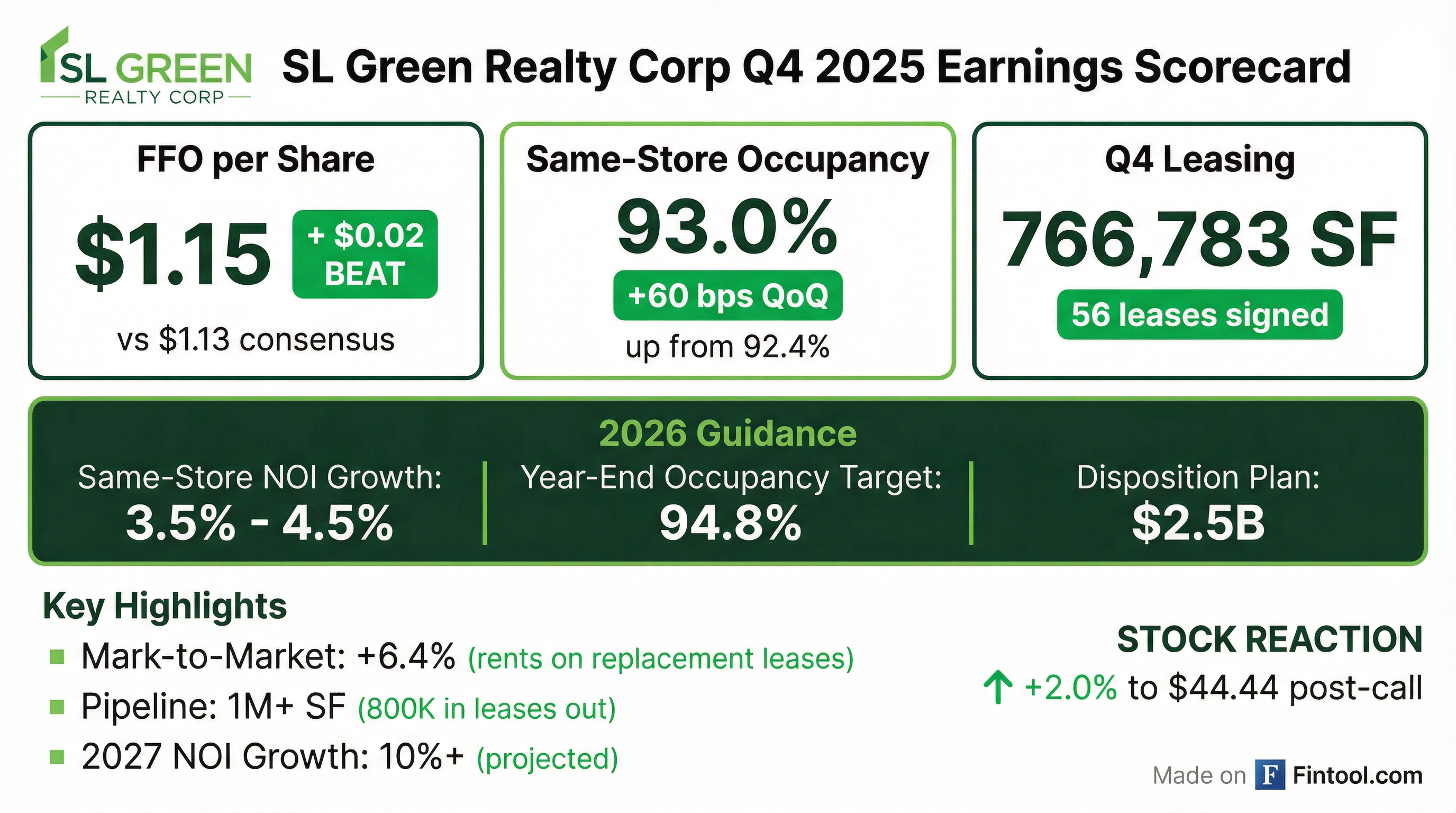

SL Green Realty Corp. (NYSE: SLG), Manhattan's largest office landlord, delivered a beat-and-raise quarter that had CEO Marc Holliday sounding his most bullish in years. FFO of $1.15 per share topped the Street's $1.13 consensus, same-store occupancy hit 93.0%, and management guided to 10%+ NOI growth in 2027. "2026 is setting up to be quite an amazing year for the commercial office sector," Holliday declared on the call. The stock rallied +2.0% to $44.44 in post-earnings trading, a notable reversal from the -3.9% decline on the initial 8-K release.

Did SL Green Beat Earnings?

Yes. FFO came in $0.02 above consensus, driven by lower expenses and stronger NOI. FAD also outperformed—beating initial 2024 guidance by $65 million for the full year, with $20 million of that coming in Q4 alone.

For full-year 2025, FFO totaled $5.72 per share. While down from $8.11 in 2024, that prior year included $0.36 of one-time gains on discounted debt extinguishments.

Key drivers of the beat:

- Lower expenses net of reimbursements

- Improved hospitality business contribution

- Lower G&A (already low relative to AUM and peers)

What Did Management Guide?

Management's 2026 and 2027 outlook was remarkably bullish, with specific targets across occupancy, NOI, and capital markets execution:

2027 Outlook: Management expects 10%+ same-store NOI growth in 2027 as the economic occupancy translates into cash flow.

"This portfolio is, without question, the best portfolio of assets with the highest earning capacity this company has ever had." — Marc Holliday, CEO

How Did the Stock React?

The stock had a volatile earnings week:

- Jan 28 (8-K release): -3.9% to $43.56

- Jan 29 (post-earnings call): +2.0% to $44.44

The rebound suggests investors responded positively to management's bullish commentary and beat details.

The stock remains 35% below its March 2025 high, reflecting broader office REIT headwinds and interest rate concerns.

What Changed From Last Quarter?

Improving: Occupancy and Leasing

Manhattan same-store office occupancy climbed to 93.0% (including signed leases not yet commenced), up from 92.4% in Q3—a 400 bps increase from the lows at end of Q1 2024.

The leasing machine continues to deliver:

- Q4 2025: 766,783 sq ft across 56 leases

- Full Year 2025: 2.6 million sq ft

- 3-Year Total: ~8 million sq ft

Critical detail: Of the 1M+ sq ft pipeline, 800,000 sq ft are leases that are out (in negotiation, many close to execution). This is not speculative demand—it's converting.

What Did Management Say About AI?

A standout Q&A exchange addressed whether AI is causing tenant downsizing. The answer: emphatically no.

"I've not heard of a single instance of the deals that we've done where tenants have downsized as a result of AI, just the opposite." — Steve Durels, EVP Leasing

AI demand metrics:

- AI tenants leased 1 million sq ft in 2025

- Currently 80 tech tenants in market with active searches for 8 million sq ft

- 13 known AI requirements for over 1.2 million sq ft

Management's view: If AI is creating any efficiency gains elsewhere, it's being more than offset by AI companies' explosive space demands.

What Did the Asia Trip Reveal?

CEO Holliday returned from a 10-day Asia swing with two dozen meetings, reporting "appetite to invest in New York was as strong as I have ever seen."

Key takeaways from global capital sources:

- Institutions are overweight in home markets and need to diversify

- NYC is viewed as "the real estate equivalent of US Treasuries" for risk-adjusted returns

- Interest in debt and equity, development and core assets

- Dollar depreciation making US assets relatively cheaper

- Some interest in Summit platform expansion

"I haven't seen this widespread of demand since pre-2020, and New York is clearly defining itself as far and away the city to invest capital in today." — Harrison Sitomer, CIO

This global appetite underpins management's confidence in executing the $7B refinance and $2.5B disposition plans.

What About the Dividend?

The dividend question came up multiple times. Management's response: wait until March.

Key points on dividend philosophy:

- Board takes a "holistic look" at cash flow—not just operating income

- SL Green is an active buyer/seller; gains from sales are core to the model

- Fee income from asset management ($100M+) replaces what used to be DPE income

- Taxable income is the real governor, not FFO or FAD

"This is not a company that feels like it's in a moment of decline. I think we're in a moment of expansion on all levels." — Marc Holliday

Current dividend metrics:

- Annual dividend: $3.09/share

- Current yield: ~7.0%

- FFO payout: ~54%

- FAD payout: ~100%

The FAD payout near 100% is the concern, but management pointed to improving FAD trajectory in 2027 as capital spending moderates.

What's the Capital Markets Update?

The financing environment is improving materially:

Park Avenue Tower financing (January 2026):

- Spread: 1.58% at full proceeds

- AAA bonds: Sold at 112 bps over Treasury (50%+ of deal)

- Historical context: In 2018-2019, AAAs traded at 60 bps over Treasury

2026 refinancing pipeline ($7B):

- One Madison Avenue

- 245 Park Avenue

- Corporate credit facility

- These three total ~$5B of the $7B plan

Disposition progress ($2.5B plan):

- 4 transactions already in term sheet/contract negotiations

- Mix includes: stabilized office, development sites, residential, retail

New fund launch: Management will launch fundraising for a new senior credit lending fund in 2026—expanding beyond the current subordinate credit focus.

What's the Leasing Pipeline Detail?

The pipeline of 1M+ sq ft breaks down impressively:

Sixth Avenue update: "Sixth Avenue is the new Park Avenue." The submarket is tightening rapidly. At 1185 Avenue of the Americas, SL Green had 700,000 sq ft of rollover across 25 floors—they've addressed all but 24,000 sq ft through leasing and pending deals.

Large tenant demand:

- 250 tenants being tracked with 26 million sq ft of requirements

- 32 tenants with requirements over 250,000 sq ft

- 37 tenants with requirements between 100,000-250,000 sq ft

- Best-of-best market: 3.7% availability, no 100,000 sq ft blocks available

What Are the Risks to Monitor?

-

Same-Store NOI Still Negative: -3.4% Q4 YoY, -2.0% for full year—but management guides to positive inflection in 2026

-

Interest Rate Sensitivity: $7B refinancing plan success depends on continued spread tightening

-

FAD Payout Near 100%: Limited dividend cushion until 2027 when capital spending moderates

-

Execution Risk: $2.5B disposition and $7B refinance are ambitious targets

-

Economic Occupancy Gap: 93% lease occupancy vs 86.7% economic occupancy means significant revenue hasn't yet converted to cash

What Should Investors Watch Next?

Near-term catalysts:

- March 2026: Dividend decision

- Q1/Q2 2026: Disposition announcements (4 deals in negotiation)

- 2026: One Madison and 245 Park refinancings

Longer-term:

- 2027 NOI inflection (10%+ growth target)

- FAD improvement as capital spending normalizes

- 346 Madison Avenue development progress

Key KPIs:

- Same-store occupancy trajectory toward 94.8%

- Economic occupancy conversion to cash NOI

- Mark-to-market rent spreads

- Refinancing spreads vs guidance

What's the Bottom Line?

SL Green delivered a beat quarter with management striking their most bullish tone in years. The fundamentals are improving—93% occupancy, positive mark-to-market rents, a 1M+ sq ft pipeline with 800K in leases out, and AI driving expansion rather than contraction. The 2027 outlook of 10%+ NOI growth suggests the inflection is coming.

The ~7% dividend yield reflects skepticism about execution and the 2026 earnings dip. But if management delivers on the $7B refinance, $2.5B disposition, and 94.8% occupancy targets, the stock looks mispriced relative to the trajectory.

Marc Holliday's takeaway: "The disconnect now is simply too big to ignore between the value of our premier assets in this company and our share price."

Links: SL Green Company Page | Q4 2025 Transcript | Q3 2025 Earnings