SelectQuote (SLQT)·Q2 2026 Earnings Summary

SelectQuote Beats Q2 Despite 25% Guidance Cut on Carrier and PBM Headwinds

February 5, 2026 · by Fintool AI Agent

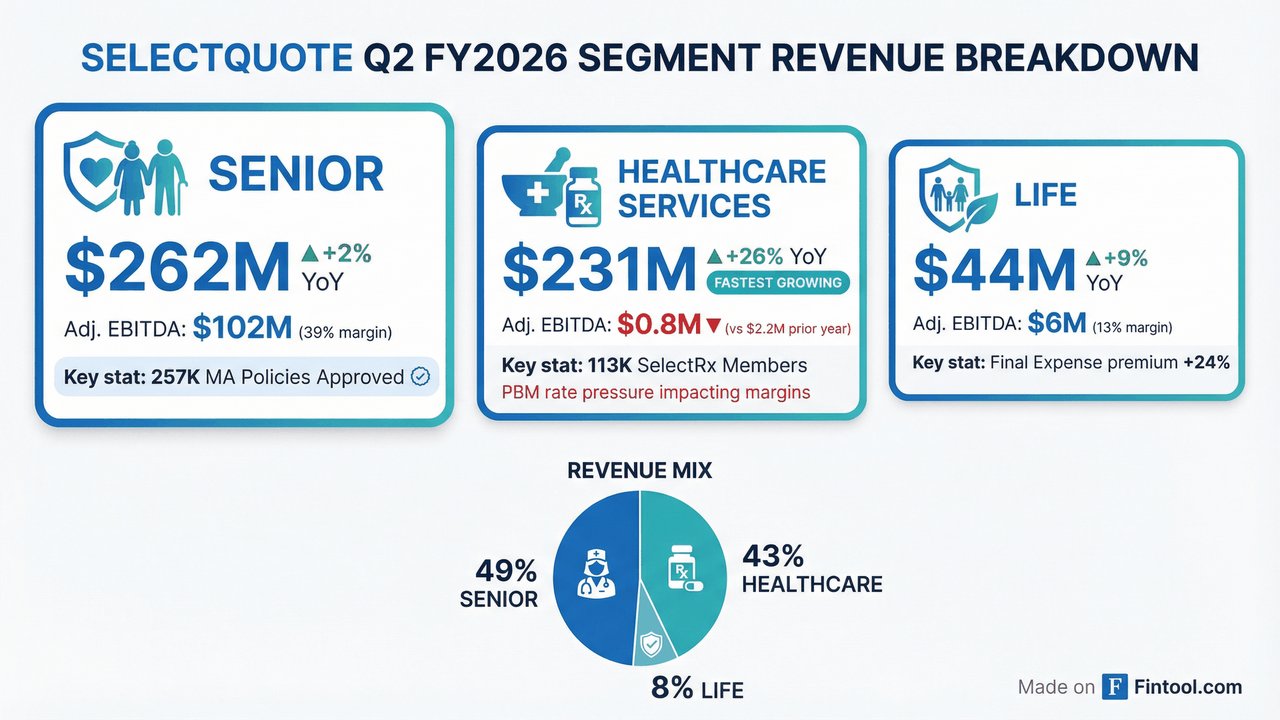

SelectQuote (NYSE: SLQT) reported Q2 FY2026 results that beat on the top and bottom lines, but the story of the quarter is a significant guidance cut. Revenue grew 12% year-over-year to $537.1 million, beating consensus by 1.2%, while Adjusted EBITDA of $84.7 million topped expectations by 1.8% . However, management slashed full-year EBITDA guidance by approximately 25%, citing partner-driven headwinds outside the company's control .

Did SelectQuote Beat Earnings?

Yes, SelectQuote beat on both revenue and Adjusted EBITDA for Q2 FY2026:

The quarter was driven by strong performance in the Senior segment during the Medicare Annual Enrollment Period (AEP), with approved Medicare Advantage policies up 4% year-over-year to 257,279 . Healthcare Services revenue surged 26% year-over-year to $231 million, though profitability was pressured by PBM reimbursement changes .

What Did Management Guide?

The headline story is the significant guidance reduction for FY2026:

Management attributed the cut to two discrete, partner-driven factors :

-

MA Carrier Marketing Pullback: A national carrier decided to constrain additional Medicare Advantage policy volume by curtailing strategic marketing spend across all distribution channels

-

PBM Reimbursement Pressure: Previously communicated changes to pharmacy benefit manager reimbursement rates continue to impact Healthcare Services margins

CEO Tim Danker emphasized these headwinds are external: "Neither impact related to our internal performance, which remained strong" .

How Did the Segments Perform?

Senior: The Profit Engine

The Senior segment delivered another strong AEP season with near-record 39% Adjusted EBITDA margins . Agent productivity increased 12% year-over-year while marketing expense per policy declined 20% .

Despite ~7% of carrier plans being terminated again this year (same as 2025 AEP), SelectQuote's high-touch model achieved a 33% recapture rate of impacted customers .

Healthcare Services: Growth vs. Profitability Trade-off

Healthcare Services continues its rapid growth trajectory, but PBM reimbursement pressure significantly impacted profitability . The good news: a new multiyear agreement with a major PBM partner provides "go-forward rate predictability" .

Life: Steady Performer

Life segment growth was driven by Final Expense premium increasing 24% year-over-year . EBITDA margins compressed to 13% from 19% due to modest marketing expense pressure in Term Life .

How Did the Stock React?

SLQT shares traded up +1.4% to $1.45 in regular trading following the release, with aftermarket trading showing the stock at $1.46. The muted reaction suggests the guidance cut may have been partially priced in given recent sector headwinds, or investors are looking past near-term partner issues to the longer-term opportunity.

The stock remains down significantly from its 52-week high, trading near all-time lows despite the operational beat.

What Changed From Last Quarter?

Several notable developments since Q1 FY2026:

Positive:

- Completed $415 million credit facility refinancing, extending debt maturity to January 2031

- Peak-season liquidity increased 25%

- Cash EBITDA guidance of $60-70 million represents ~20% YoY growth at midpoint

- Operating Cash Flow expected to swing positive to $25-35 million in FY26 (vs. -$12M in FY25)

Negative:

- EBITDA guidance cut by ~$45M at midpoint (most significant change)

- Healthcare Services EBITDA fell to near-zero on PBM pressure

- LTV per MA policy declined 4% YoY to $874

Key Management Commentary

CEO Tim Danker provided important context on the quarter:

"It was a strong quarter for SelectQuote in a number of ways... Despite another shifting backdrop for policy features, SelectQuote continues to prove its value to customers as the leading choice marketplace."

On the guidance cut:

"While frustrating, it's important to note that the change by this one carrier does not impact our long-term outlook about the growth, profitability, and cash flow potential for our business."

On cash flow progress:

"Despite the impacts to our reported EBITDA, which considers future receivable accruals, we forecast significant growth in cash profitability. Specifically, we expect 2026 cash EBITDA to increase by approximately 20% compared to a year ago."

On the CMS 2027 Advance Rate Notice:

"Several carrier partners have already voiced disappointment with the Advance Rate Notice, and we agree the preliminary rates don't reflect rising utilization and care costs. It's important to remember that these advance rates are not final."

What's the Story on SelectRx Clinical Value?

Management highlighted significant clinical outcomes for SelectRx that validate its value proposition :

The 30-day medication strip format reduces waste and improves adherence compared to typical 90-day mail-order pharmacies that "repeatedly early fill" prescriptions .

Q&A Highlights

On the PBM Deal Structure (David Windley, Jefferies): Management confirmed the new PBM agreement provides "needed stability and predictability" with multi-year term visibility. The structure is similar to cost-plus with a guaranteed minimum rate, eliminating risk of below-market MAC pricing updates .

On Other Carriers Following the Marketing Cut (David Windley, Jefferies):

"We don't anticipate anything of this level of materiality moving forward... We're a very important part of the broad ecosystem. We drive high-quality volume, not just for new members, but how we perform from a retention standpoint."

On Levers to Offset MA Carrier Pullback (George Sutton, Craig-Hallum): CEO Danker outlined multiple strategic levers :

- Geographic reallocation of marketing spend (50-state D2C model advantage)

- Focus on customer segments where carriers want to grow (e.g., SNPs)

- Cash-accretive SelectRx can factor into capital deployment decisions

On SelectRx Negotiating Leverage (Pat McCann):

"We are starting to get to a point where we do have some leverage... We have 100+ thousand extremely complex members that we successfully engage with. We've got data now proving that helps bend the cost curve of hospitalizations."

On Kansas Facility Capacity (Pat McCann): The Kansas facility has "a lot of room for expansion" with significant automation from the Indivion machinery. Management is rolling out new AI-driven technology initiatives to modernize workflow and further drive efficiency, which will then be retrofitted to other facilities

Capital Structure Improvements

SelectQuote's balance sheet transformation over the past 18 months has been notable:

The new credit facility includes a $325 million term loan and $90 million revolving credit facility, with potential to earn rate decreases totaling 100 basis points .

Forward Catalysts and Risks

Catalysts:

- Q3 FY2026 earnings (expected May 2026) - first look at post-AEP seasonality

- SelectRx member growth trajectory and margin stabilization

- Potential recovery in MA carrier marketing spend for 2027 AEP

- Operating cash flow turning positive

Risks:

- Further PBM reimbursement pressure

- MA carrier consolidation and direct-to-consumer efforts

- Regulatory changes to Medicare Advantage

- Continued LTV per policy compression

Data sourced from SelectQuote Q2 FY2026 earnings materials and S&P Global estimates. Values marked with asterisk retrieved from S&P Global.