Earnings summaries and quarterly performance for SelectQuote.

Executive leadership at SelectQuote.

Timothy R. Danker

Chief Executive Officer

Daniel A. Boulware

General Counsel and Corporate Secretary

Joshua B. Matthews

President, Senior Division

Robert Grant

President

Ryan M. Clement

Chief Financial Officer

Sarah Anderson

Executive Vice President, Healthcare Pharmacy Services

Stephanie Fisher

Chief Accounting Officer

William Grant III

Chief Operating Officer

Board of directors at SelectQuote.

Research analysts who have asked questions during SelectQuote earnings calls.

George Sutton

Craig-Hallum

6 questions for SLQT

Benjamin Hendrix

RBC Capital Markets

4 questions for SLQT

Patrick McCann

Noble Capital Markets

4 questions for SLQT

Ben Hendricks

RBC Capital Markets

2 questions for SLQT

David Windley

Jefferies Financial Group Inc.

2 questions for SLQT

George Stottman

Craig-Hallum Capital Group LLC

1 question for SLQT

Matt McCann

NOBLE Capital Markets

1 question for SLQT

Michael Murray

RBC Capital Markets

1 question for SLQT

Pat McCann

Noble Capital Markets, Inc.

1 question for SLQT

Recent press releases and 8-K filings for SLQT.

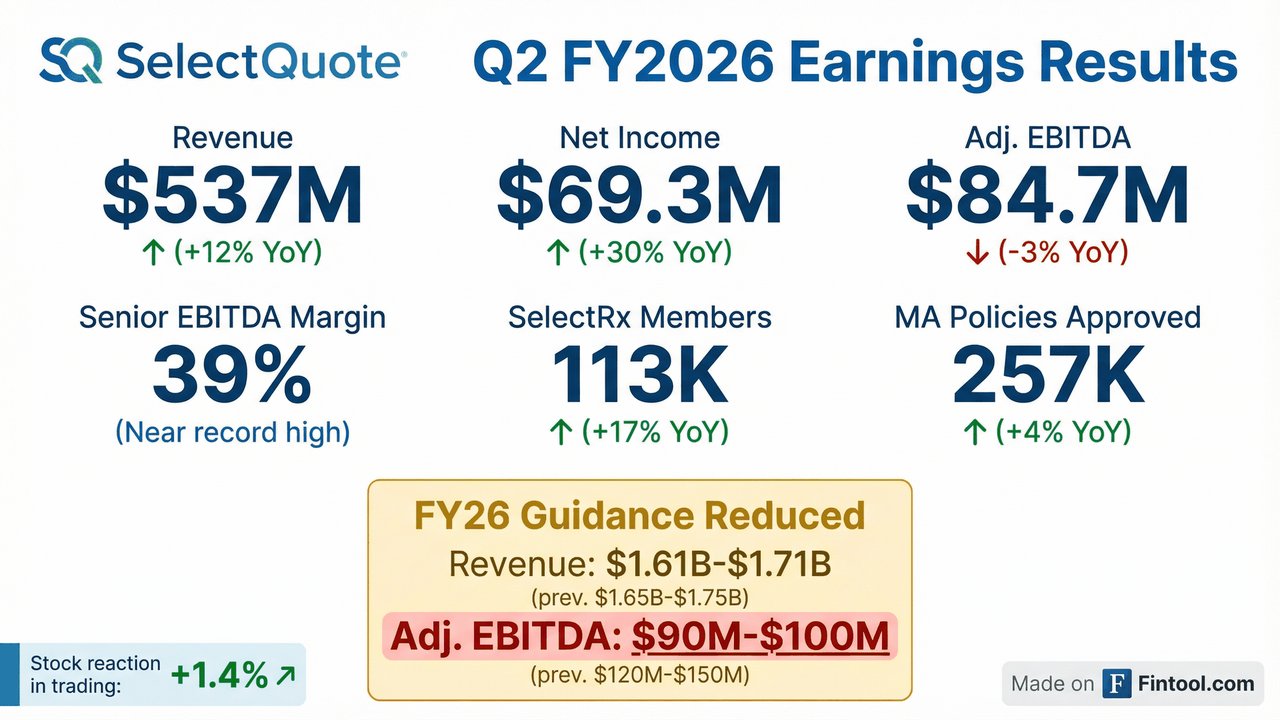

- SelectQuote (SLQT) reported Q2 FY26 revenue of $537 million, marking a 12% year-over-year increase, and an EPS beat at $0.26.

- Despite the revenue growth, the company cut its full-year FY26 guidance, lowering revenue to $1.61–$1.71 billion and adjusted EBITDA to $90–$100 million, which led to a 6.8% premarket stock drop.

- The guidance revision was primarily attributed to a carrier marketing cut and PBM reimbursement changes, impacting adjusted EBITDA by approximately $40 million.

- SelectQuote secured a new $415 million credit facility, extending debt maturities to 2031, and signed a multiyear PBM agreement to stabilize SelectRx economics.

- Wall Street analysts noted concerns including a recent DOJ lawsuit, cash-conversion issues, and a complicated balance sheet.

- SelectQuote reported a strong Q2 2026 with 12% year-over-year revenue growth to $537 million, driven by both Senior and Healthcare Services segments, and achieved near record Senior EBITDA margins of 39%.

- The company revised its fiscal 2026 guidance, lowering consolidated revenue to $1.61 billion-$1.71 billion and Adjusted EBITDA to $90 million-$100 million, primarily due to a $20 million impact from a national carrier partner cutting strategic marketing budgets and a $20 million PBM reimbursement headwind.

- SelectQuote secured a new $415 million credit facility in January, extending debt maturities to 2031 and enhancing capital flexibility for strategic investments.

- Despite the revised EBITDA forecast, the company projects fiscal 2026 operating cash flow to be $25 million-$35 million, representing a significant increase of over $40 million at the midpoint compared to the previous year, driven by cash efficiency gains in both Senior and Healthcare Services divisions.

- SelectQuote reported Q2 2026 revenue of $537 million, a 12% year-over-year increase, with Senior revenue growing 2% to $262 million and Healthcare Services revenue increasing 26% to $231 million.

- The company updated its fiscal 2026 consolidated revenue guidance to $1.61 billion-$1.71 billion and Adjusted EBITDA guidance to $90 million-$100 million, reflecting a $40 million aggregate impact from a PBM reimbursement headwind and a national carrier's marketing budget cuts.

- Despite the revised EBITDA guidance, SelectQuote forecasts fiscal 2026 operating cash flow of $25 million-$35 million, a significant increase from the prior year, driven by operational efficiency.

- SelectQuote secured a new $415 million credit facility, extending debt maturities to 2031 and enhancing capital flexibility, alongside a multi-year PBM agreement for SelectRx to improve profitability visibility.

- SelectQuote reported Q2 2026 consolidated revenue of $537 million, a 12% year-over-year increase, driven by strong performance in both the Senior and Healthcare Services segments.

- The company revised its fiscal 2026 consolidated revenue guidance to $1.61 billion-$1.71 billion and Adjusted EBITDA guidance to $90-$100 million, reflecting a $40 million aggregate impact from a PBM reimbursement headwind and a national carrier partner's marketing budget cut.

- SelectQuote announced a new $415 million credit facility in January, which significantly extends debt maturities to 2031 and enhances capital flexibility.

- The Healthcare Services segment saw revenue grow 26% year-over-year to $231 million and secured a multi-year PBM agreement for SelectRx, improving visibility into drug reimbursement pricing and expanding profitability.

- The Senior segment achieved near record EBITDA margins of 39% in Q2 2026, with revenue of $262 million.

- SelectQuote (SLQT) reported consolidated revenue of $537 million for Q2 2026, marking a 12% year-over-year increase, while Adjusted EBITDA was $85 million, a slight decrease from the prior year.

- The Senior segment achieved $262 million in revenue, a 2% year-over-year increase, with Adjusted EBITDA rising to $102 million, driven by 4% higher MA approved policies and 39% Adjusted EBITDA margins. Healthcare Services revenue grew 26% year-over-year to $231 million, though Adjusted EBITDA was $846 thousand, reflecting PBM reimbursement rate pressure.

- The company revised its FY26 financial guidance, with revenue now expected between $1.61 billion and $1.71 billion (down from $1.65 billion to $1.75 billion) and Adjusted EBITDA projected between $90 million and $100 million (down from $120 million to $150 million).

- SLQT secured a new $415 million credit facility in January 2026, extending debt maturities to January 2031 and enhancing operational flexibility.

- SelectQuote, Inc. reported Q2 FY2026 consolidated revenue of $537.1 million, net income of $69.3 million, and Adjusted EBITDA of $84.7 million.

- The company revised its fiscal year 2026 guidance, now expecting revenue between $1.61 billion and $1.71 billion and Adjusted EBITDA between $90 million and $100 million, attributing the change to partner-driven headwinds.

- For Q2 FY2026, the Senior segment generated $261.5 million in revenue and $102.5 million in Adjusted EBITDA, while the Healthcare Services segment reported $230.7 million in revenue and $0.8 million in Adjusted EBITDA.

- In January 2026, SelectQuote secured a new $415 million credit facility, extending its debt maturity to January 2031 and enhancing operational flexibility.

- SelectQuote, Inc. reported consolidated revenue of $537.1 million, net income of $69.3 million, and Adjusted EBITDA of $84.7 million for the second quarter of fiscal year 2026. This compares to consolidated revenue of $481.1 million, net income of $53.2 million, and Adjusted EBITDA of $87.5 million for the second quarter of fiscal year 2025.

- The company updated its fiscal year 2026 guidance, now expecting revenue in a range of $1.61 billion to $1.71 billion and Adjusted EBITDA in a range of $90 million to $100 million. This revised guidance reflects "two discrete, partner-driven headwinds".

- For the second quarter of fiscal year 2026, the Senior segment generated $261.5 million in revenue and $102.5 million in Adjusted EBITDA, while the Healthcare Services segment reported $230.7 million in revenue and $0.8 million in Adjusted EBITDA.

- SelectQuote's SelectRx pharmacy has secured a new multiyear agreement with a significant PBM partner, which became effective on January 1, 2026.

- This agreement is anticipated to provide enhanced reimbursement rate predictability and stability, offering more predictable economics for SelectRx.

- CEO Tim Danker stated that the new contract offers increased visibility to reimbursement rates, supporting continued investment and growth for the SelectRx pharmacy.

- Pathlight Capital is serving as the Administrative Agent on a $415 million senior secured credit facility for SelectQuote, Inc., which includes a $325 million term loan provided by Pathlight.

- The proceeds from this facility are designated for refinancing existing debt and supporting ongoing working capital needs.

- SelectQuote's CEO, Tim Danker, stated that this financing will lower the company's cost of capital, improve liquidity, and provide capital flexibility for investing in the growth of its senior health insurance and healthcare services businesses.

- SelectQuote, Inc. (SLQT) announced on January 12, 2026, the successful completion of a new $415 million credit facility.

- This facility is comprised of a $325 million term loan with Pathlight Capital LP and an enhanced $90 million revolving credit facility with UMB Bank.

- The new agreement significantly extends the term debt maturity to 2031 and was used to fully repay all existing term debt previously due in June 2026 and September 2027.

- It also enhances liquidity by increasing the revolving credit facility limit to $90 million available during the peak season (up from $72 million) and provides a slightly improved cost of capital.

- The term loan bears interest at SOFR (subject to a floor of 3.00%) plus 6.50% or a base rate plus 5.50%, with quarterly amortization starting at 0.625% of the initial principal.

Quarterly earnings call transcripts for SelectQuote.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more