Earnings summaries and quarterly performance for CVS HEALTH.

Executive leadership at CVS HEALTH.

J. David Joyner

Chief Executive Officer

Amy L. Compton-Phillips

Executive Vice President and Chief Medical Officer

Brian O. Newman

Executive Vice President and Chief Financial Officer

Heidi Capozzi

Executive Vice President and Chief People Officer

Prem Shah

Group President, CVS Health

Sreekanth K. Chaguturu

Executive Vice President and President, Health Care Delivery

Steve Nelson

Executive Vice President and President, Aetna

Board of directors at CVS HEALTH.

Alecia A. DeCoudreaux

Director

Anne M. Finucane

Director

C. David Brown II

Director

Douglas H. Shulman

Director

Fernando Aguirre

Director

Guy P. Sansone

Director

J. Scott Kirby

Director

Jeffrey R. Balser, M.D., Ph.D.

Director

Larry M. Robbins

Director

Leslie V. Norwalk

Director

Michael F. Mahoney

Lead Independent Director

Roger N. Farah

Executive Chair of the Board

Research analysts who have asked questions during CVS HEALTH earnings calls.

Andrew Mok

Barclays

7 questions for CVS

Justin Lake

Wolfe Research, LLC

7 questions for CVS

Lisa Gill

JPMorgan Chase & Co.

7 questions for CVS

Elizabeth Anderson

Evercore ISI

6 questions for CVS

Michael Cherny

Leerink Partners

5 questions for CVS

Ann Hynes

Mizuho Financial Group

4 questions for CVS

Erin Wright

Morgan Stanley

4 questions for CVS

George Hill

Deutsche Bank

4 questions for CVS

Stephen Baxter

Wells Fargo & Company

3 questions for CVS

Eric Percher

Nephron Research

2 questions for CVS

John Ransom

Raymond James

2 questions for CVS

Stephen Baxter

Wells Fargo

2 questions for CVS

Brian Tanquilut

Jefferies

1 question for CVS

Charles Rhyee

TD Cowen

1 question for CVS

Elizabeth Anderson

Evercore

1 question for CVS

Joshua Raskin

Nephron Research

1 question for CVS

Kevin Caliendo

UBS

1 question for CVS

Recent press releases and 8-K filings for CVS.

- CVS Health is launching Health100, an AI-native consumer engagement platform in partnership with Google Cloud to offer a connected, proactive, personalized health care experience across channels.

- The platform leverages Google Cloud’s AI technologies—Gemini models, Cloud Healthcare API, and BigQuery—to optimize workflows, provide real-time support, and integrate biometric wearable data for proactive health management.

- Health100 will debut in 2026 with an open ecosystem approach, inviting other health innovators to build specialized applications; more details to be unveiled at Google's The Check Up event in March 2026.

- As of December 31, 2025, CVS Health operates roughly 9,000 retail pharmacies, over 1,000 walk-in clinics, and manages pharmacy benefits for approximately 87 million plan members, serving over 37 million through insurance products.

- FY 2025 revenue exceeded $400 billion, with adjusted EPS of $6.75 and operating cash flow of $10.6 billion.

- Q4 2025 revenue was $105 billion (+8% YoY), delivering adjusted operating income of $2.6 billion and adjusted EPS of $1.09.

- Aetna segment posted a YoY adjusted operating income improvement of $2.6 billion, while retail pharmacy achieved 16% same-store sales growth and completed the transition to cost-based reimbursement.

- 2026 guidance reaffirmed: revenue ≥ $400 billion, adjusted EPS of $7.00–$7.20, and operating cash flow of at least $9 billion.

- Q4 revenue totaled $105 billion, up 8% YoY, with adjusted operating income of $2.6 billion and adjusted EPS of $1.09.

- FY 2025 results: revenue exceeded $400 billion, adjusted EPS of $6.75, and operating cash flow of $10.6 billion, all surpassing initial expectations.

- Q4 segment performance: Health Services revenues grew 9% to $51 billion (AOI +9% to $1.9 billion); Pharmacy & Consumer Wellness revenues rose 12% to $38 billion, with same-store sales +16% and AOI +9% to $1.9 billion.

- 2026 guidance reaffirmed: full-year revenue of at least $400 billion, adjusted EPS of $7.00–$7.20, and operating cash flow of at least $9 billion.

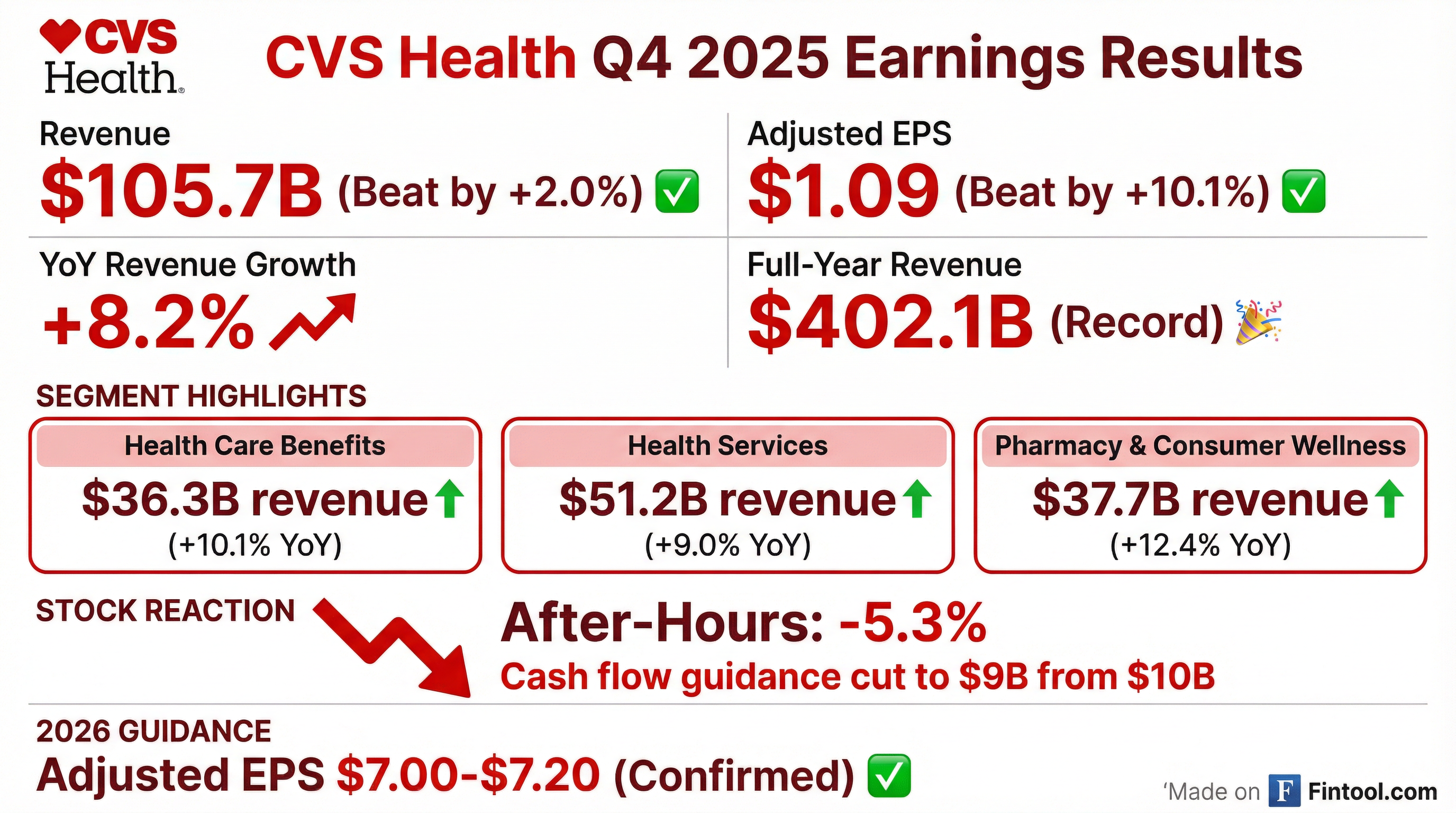

- Consolidated Q4 2025 revenue of $105.7 B (+8.2% Y/Y), GAAP EPS $2.30, adjusted EPS $1.09.

- Cash flow from operations of $3.4 B for the quarter and $10.6 B year-to-date.

- Reaffirmed FY 2026 guidance: consolidated revenue ≥ $400.0 B, adjusted EPS $7.00–$7.20, and cash flow from operations ≥ $9.0 B.

- Segment highlights: Health Services revenue of $51.2 B with AOI of $1.92 B ; Pharmacy & Consumer Wellness revenue of $37.7 B with AOI of $1.91 B.

- Revenue of $105 billion+ in Q4 2025 (+8% YoY) ; adjusted operating income $2.6 billion and adjusted EPS $1.09

- Full-year 2025: revenue >$400 billion, adjusted EPS $6.75 (15% above initial expectations), operating cash flow $10.6 billion

- Reaffirmed 2026 guidance: revenue ≥$400 billion, adjusted EPS $7.00–$7.20, operating cash flow ≥$9 billion, with a 55/45 H1/H2 earnings split

- Aetna segment delivered a year-over-year adjusted operating income improvement of >$2.6 billion, driven by enhanced pricing and leadership refresh

- Disappointed by preliminary 2027 Medicare Advantage Advanced Rate Notice but commitment to MA margin recovery and long-term targets remains unchanged

- Q4 revenue of $105.7 billion (+8.2% year-over-year) and full-year revenue of $402.1 billion (+7.8% year-over-year) were driven by growth across all segments.

- Q4 GAAP diluted EPS of $2.30 and Adjusted EPS of $1.09; FY GAAP diluted EPS of $1.39 and Adjusted EPS of $6.75.

- Generated $10.6 billion of cash flow from operations in 2025, marking a record full-year total.

- Provided 2026 guidance: GAAP diluted EPS of $5.94–$6.14, Adjusted EPS of $7.00–$7.20, and updated cash flow from operations guidance to at least $9.0 billion.

- CVS Health posted Q4 revenues of $105.7 billion (up 8.2% year-over-year) and full-year revenues of $402.1 billion (up 7.8%).

- GAAP diluted EPS was $2.30 in Q4 (vs $1.30 prior) and $1.39 for FY 2025 (vs $3.66), while adjusted EPS was $1.09 in Q4 (vs $1.19) and $6.75 for the year (vs $5.42).

- Generated $10.6 billion of operating cash flow in 2025.

- Provided 2026 guidance for GAAP diluted EPS of $5.94–$6.14, adjusted EPS of $7.00–$7.20, and updated operating cash flow guidance to at least $9.0 billion.

- CVS Caremark will include biosimilars Ospomyv and Stoboclo and generics Bonsity and Tymlos on its national commercial formularies effective April 1, 2026, replacing Prolia and Forteo and offering over 50% lower cost per prescription.

- The formulary strategy has delivered $1.5 billion in gross savings and supported a 96% transition of Humira patients to biosimilars.

- Ospomyv and Stoboclo are FDA-approved for treating osteoporosis in high-risk patients and increasing bone density in cancer patients.

- CVS Specialty streamlines the transition for providers and patients through EHR integration and proactive communication.

- Aetna now has about half as many medical services requiring prior authorization as its nearest competitor, approving 95% of eligible requests within 24 hours and 77% of electronic authorizations in real time, with a goal of exceeding 80% by year-end.

- New bundled prior authorization programs cover full care pathways for lung, breast, and prostate cancer, select musculoskeletal procedures, and IVF, and embedding nurses in 17 health systems to cut 30-day readmissions and hospital stays by 5% year-over-year.

- Driving drug cost reductions via biosimilars, with a Humira alternative delivering $1.3 billion in client savings and a Stelara biosimilar priced 86% below brand list price; 25 million members now benefit from point-of-sale rebate sharing through CVS Caremark.

- In 2024, CVS Health contributed $474 billion to the U.S. economy, operates 9,000 community pharmacies within 10 miles of over 85% of Americans, and serves 87 million pharmacy benefit members and 37 million health insurance enrollees.

- A House Judiciary Committee interim report titled “When CVS Writes the Rules: How CVS Protects Itself From Innovation and Competition” alleges CVS Health may have violated federal antitrust laws by using its PBM and insurer clout to stifle digital pharmacy rivals through surveillance, audits, provider-manual changes, and cease-and-desist letters.

- The report states CVS began its push into digital pharmacy in 2019 amid competition from PillPack, Phil, and Blink, and relied on unproven fraud allegations as a pretext for its conduct.

- CVS described the findings as misguided, is reviewing the report, and noted it updated its provider manual in May 2025 to make hub-service use easier for network pharmacies.

- The probe has attracted bipartisan attention and presidential criticism, with CVS and other insurer CEOs set to testify before Congress.

Fintool News

In-depth analysis and coverage of CVS HEALTH.

Quarterly earnings call transcripts for CVS HEALTH.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more