Earnings summaries and quarterly performance for AMAZON COM.

Executive leadership at AMAZON COM.

Andrew Jassy

Chief Executive Officer

Brian Olsavsky

Senior Vice President and Chief Financial Officer

David Zapolsky

Senior Vice President, Chief Global Affairs & Legal Officer

Douglas Herrington

Chief Executive Officer, Worldwide Amazon Stores

Jeff Bezos

Executive Chair

Matthew Garman

Chief Executive Officer, Amazon Web Services

Board of directors at AMAZON COM.

Andrew Ng

Director

Brad Smith

Director

Daniel Huttenlocher

Director

Edith Cooper

Director

Indra Nooyi

Director

Jamie Gorelick

Lead Independent Director

Jonathan Rubinstein

Director

Keith Alexander

Director

Patricia Stonesifer

Director

Wendell Weeks

Director

Research analysts who have asked questions during AMAZON COM earnings calls.

Brian Nowak

Morgan Stanley

9 questions for AMZN

Douglas Anmuth

JPMorgan Chase & Co.

7 questions for AMZN

Eric Sheridan

Goldman Sachs

7 questions for AMZN

Mark Mahaney

Evercore ISI

7 questions for AMZN

Justin Post

Bank of America Corporation

6 questions for AMZN

Colin Sebastian

Baird

5 questions for AMZN

John Blackledge

TD Cowen

3 questions for AMZN

Michael Morton

MoffettNathanson

3 questions for AMZN

Ross Sandler

Barclays

3 questions for AMZN

Doug Anmuth

J.P. Morgan

2 questions for AMZN

Ronald Josey

Citigroup Inc.

2 questions for AMZN

Brent Thill

Jefferies

1 question for AMZN

Recent press releases and 8-K filings for AMZN.

- Amazon Pharmacy now offers Eli Lilly’s Zepbound KwikPen for weight management with transparent cash-pay pricing starting at $299 per month for the 2.5 mg starter dose and fast home delivery to over half of U.S. households.

- With a valid prescription, customers can order the multi-dose injectable device online, view upfront pricing before checkout, and benefit from caregiver support for managing loved ones’ prescriptions.

- Amazon Pharmacy provides 24/7 licensed pharmacist access and automatically applies manufacturer-sponsored coupons, saving customers over $200 million to date—GLP-1 medications being the largest savings category.

- The service collaborates with healthcare providers and digital health partners like LillyDirect, WeightWatchers, and Noom to broaden access to weight management treatments.

- AWS launched Amazon Connect Health, an agentic AI platform on Amazon Connect to automate high-volume administrative tasks such as patient verification, appointment scheduling, clinical documentation, and medical coding, with HIPAA eligibility and EHR integration.

- The platform is priced at $99 per user per month for up to 600 encounters, marking AWS’s first major AI-agent product for healthcare.

- Early customer results include UC San Diego Health saving about 1 minute per call, redirecting 630 hours per week from verification to patient assistance, and reducing call abandonment by up to 60%, while Amazon One Medical used ambient documentation in over 1 million visits.

- AWS positions Connect Health against competitors like OpenAI’s ChatGPT Health and Anthropic’s Claude for Healthcare in the expanding healthcare AI landscape.

- Global integration of Smartly with Amazon DSP enables advertisers to extend AI-powered Smartly video campaigns to Amazon’s premium CTV inventory (Prime Video, Fire TV) and third-party publisher inventory

- Integration unifies workflows across social and streaming, offering real-time performance visibility, creative optimization, and full-funnel measurement for incremental reach and dynamic budget reallocation

- Responds to growing demand—with approximately 70% of marketers planning to increase streaming budgets—and additional features to be deployed throughout 2026

- Amazon will invest an additional €18 billion in Spain to expand AWS data centers and AI infrastructure, bringing its total commitment to €33.7 billion.

- The expansion centers on AWS network infrastructure in Aragón—including Zaragoza, Huesca and Teruel—and builds on the region launched in 2022.

- The programme is projected to contribute roughly €31.7 billion to Spain’s GDP by 2035 and support 29,900–30,000 full-time equivalent jobs annually, including about 6,700 direct roles.

- Planned additions cover new data centers, server manufacturing and testing plants, a dedicated AI/ML server repair facility, and related fulfillment infrastructure.

- Amazon will invest $50 billion in OpenAI, with an initial $15 billion and a further $35 billion purchase commitment contingent on specified milestones or a public listing.

- AWS will be the exclusive third-party cloud distribution provider for OpenAI Frontier, expanding enterprise access to AI agents and governance tools.

- OpenAI will consume 2 gigawatts of AWS Trainium capacity and expand its existing $38 billion AWS compute agreement by an additional $100 billion over eight years.

- Amazon Web Services and OpenAI will co-develop a Stateful Runtime Environment on Amazon Bedrock to enable context-aware generative AI applications at production scale.

- Amazon will invest $50 billion in OpenAI, beginning with $15 billion upfront and $35 billion in subsequent funding upon meeting certain conditions.

- AWS and OpenAI will co-create a Stateful Runtime Environment on Amazon Bedrock, enabling developers to build generative AI applications and agents at production scale.

- AWS will serve as the exclusive third-party cloud distributor for OpenAI Frontier, expanding access to OpenAI’s enterprise AI platform.

- OpenAI commits to consume 2 gigawatts of AWS Trainium capacity to support demand for the new runtime environment, Frontier, and other advanced workloads.

- Amazon and STACK Infrastructure will develop multi-campus data centers in Caddo and Bossier Parishes with a $12 billion capital investment.

- The project is designed to expand digital infrastructure capacity for AI and cloud computing, delivering next-generation data center campuses.

- Construction is expected to create over 1,500 jobs, while operations will support more than 540 permanent, full-time positions.

- STACK will fully fund water, wastewater, electrical, and related infrastructure upgrades, enhancing utility capacity, reliability, and resilience.

- State and local leaders highlight the initiative’s role in driving regional economic growth and boosting tax revenues for public services.

- Amazon is investing $12 billion to build its first interconnected AI and cloud computing data center campuses in Caddo and Bossier parishes, Louisiana.

- The project aligns with Amazon’s increased 2026 capex guidance to $200 billion, up from roughly $130 billion in 2025.

- The development is expected to create 540 direct full-time jobs, about 1,700 indirect jobs, and employ up to 1,500 construction workers at peak buildout.

- Amazon will fully fund required energy and grid upgrades and invest up to $400 million in local water infrastructure, using only “verified surplus water” without burdening existing utility customers.

- Amazon overtook Walmart, posting $716.9–717 billion in revenue versus Walmart’s $713 billion, ending Walmart’s 13-year reign atop the Fortune 500.

- Growth powered by non-retail segments: AWS generated $129 billion, alongside over $100 billion from advertising and Prime subscriptions.

- In 2025, Amazon’s revenue mix included $464 billion from direct sales (online and physical stores plus third-party sellers).

- Amazon now captures 40% of U.S. online sales and boasts about 180 million Prime members.

- Walmart still achieved a 4.6% gain in U.S. sales in the most recent quarter despite ceding the top revenue spot.

- Milan prosecutors searched Amazon’s Milan headquarters, seven managers’ homes and KPMG offices in a probe into a hidden permanent establishment in Italy from 2019–2024 that may involve hundreds of millions in unpaid taxes.

- Authorities seized computers and hard drives—recovering files Amazon purges every three months—and cite the 2024 firing and rehiring of 159 workers as evidence of pre-agreement operations in Italy.

- The investigation follows Amazon’s prior €510 million settlement with Italian tax authorities and reflects broad European scrutiny of multinational tax arrangements.

- Amazon maintains financial strength with a $2.13 trillion market capitalization, 74% retail revenue mix, trailing twelve-month sales near $717 billion and ~9.5% revenue growth over three years.

Fintool News

In-depth analysis and coverage of AMAZON COM.

Amazon Bets $12 Billion on Louisiana AI Data Centers as Investors Flee

Amazon Dethrones Walmart as World's Largest Company by Revenue

Amazon Snaps 9-Day Losing Streak After $483B AI Capex Rout

Amazon's Federal Tax Bill Plunges 87% Even as Profits Soar to $90 Billion

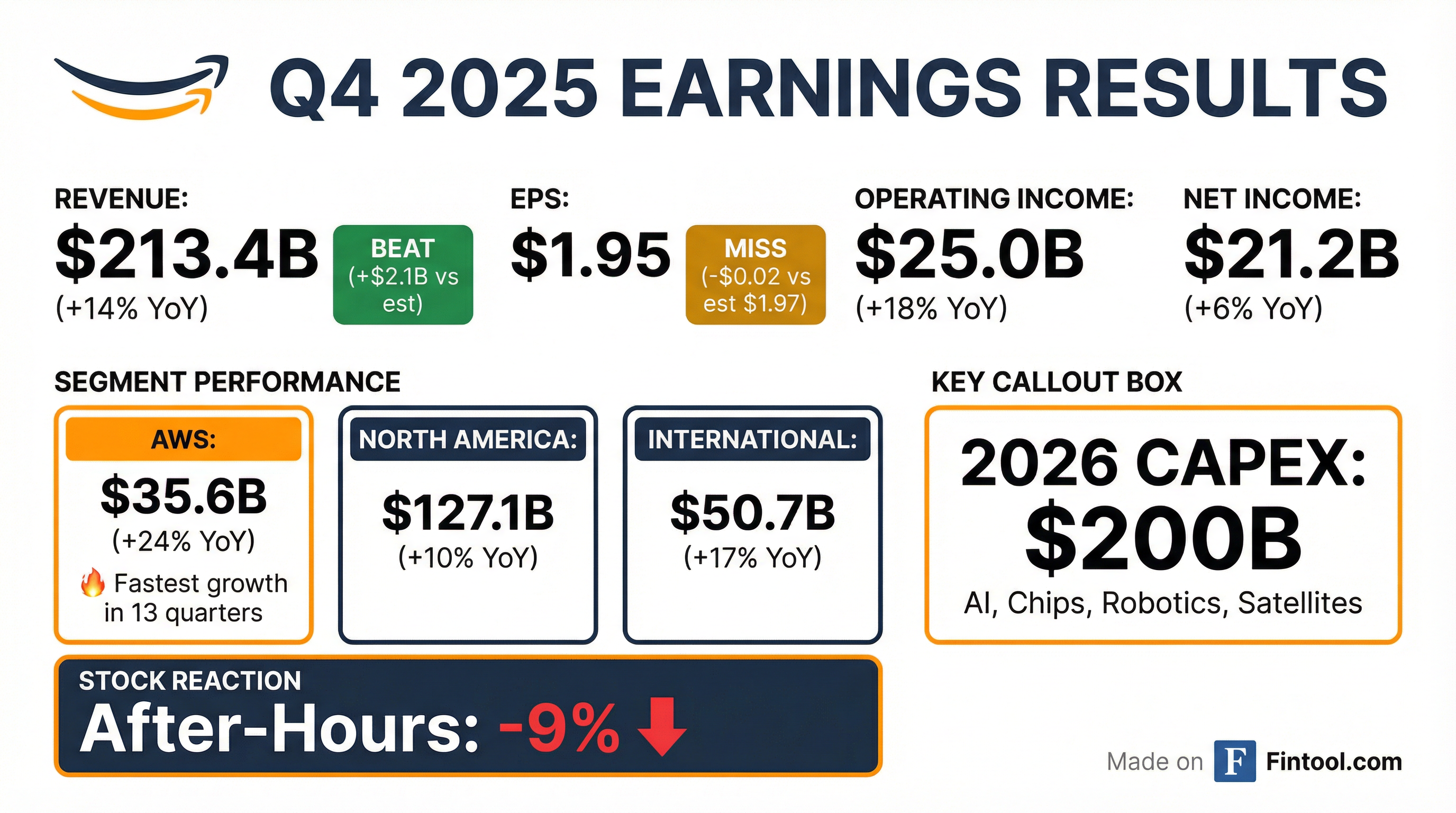

Amazon's $200 Billion AI Bet Spooks Wall Street Despite Record AWS Growth

Amazon Stuns Wall Street With $200 Billion AI Bet—Largest Corporate Capex in History

Quarterly earnings call transcripts for AMAZON COM.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more