Earnings summaries and quarterly performance for Evolent Health.

Executive leadership at Evolent Health.

Board of directors at Evolent Health.

Research analysts who have asked questions during Evolent Health earnings calls.

Daniel Grosslight

Citigroup

6 questions for EVH

Charles Rhyee

TD Cowen

5 questions for EVH

David Larsen

BTIG

5 questions for EVH

Jessica Tassan

Piper Sandler

5 questions for EVH

Matthew Shea

Needham & Company

5 questions for EVH

Jailendra Singh

Truist Securities

4 questions for EVH

Jeffrey Garro

Stephens Inc.

4 questions for EVH

Kevin Caliendo

UBS

4 questions for EVH

Matthew Gillmor

KeyCorp

4 questions for EVH

Richard Close

Canaccord Genuity Group

4 questions for EVH

Jared Haase

William Blair & Company

3 questions for EVH

John Stansel

JPMorgan Chase & Co.

3 questions for EVH

Ryan Daniels

William Blair & Company, L.L.C.

3 questions for EVH

Sean Dodge

RBC Capital Markets

3 questions for EVH

Jeff Garro

Stephens

2 questions for EVH

Matthew Gilmore

KeyBanc Capital Markets

2 questions for EVH

Andrea Zayco Narvaez Alfonso

UBS

1 question for EVH

Anne Samuel

JPMorgan Chase & Co.

1 question for EVH

Constantine Davides

Citizens JMP

1 question for EVH

Eduardo Ron

Truist Securities, Inc.

1 question for EVH

Jenny Shen

TD Cowen

1 question for EVH

Kyle Aikman

JPMorgan Chase & Co.

1 question for EVH

Kyle Ekman

JPMorgan Chase & Co.

1 question for EVH

Lucas

TD Cowen

1 question for EVH

Ryan Halsted

RBC Capital Markets

1 question for EVH

Stephanie Davis

Barclays

1 question for EVH

Recent press releases and 8-K filings for EVH.

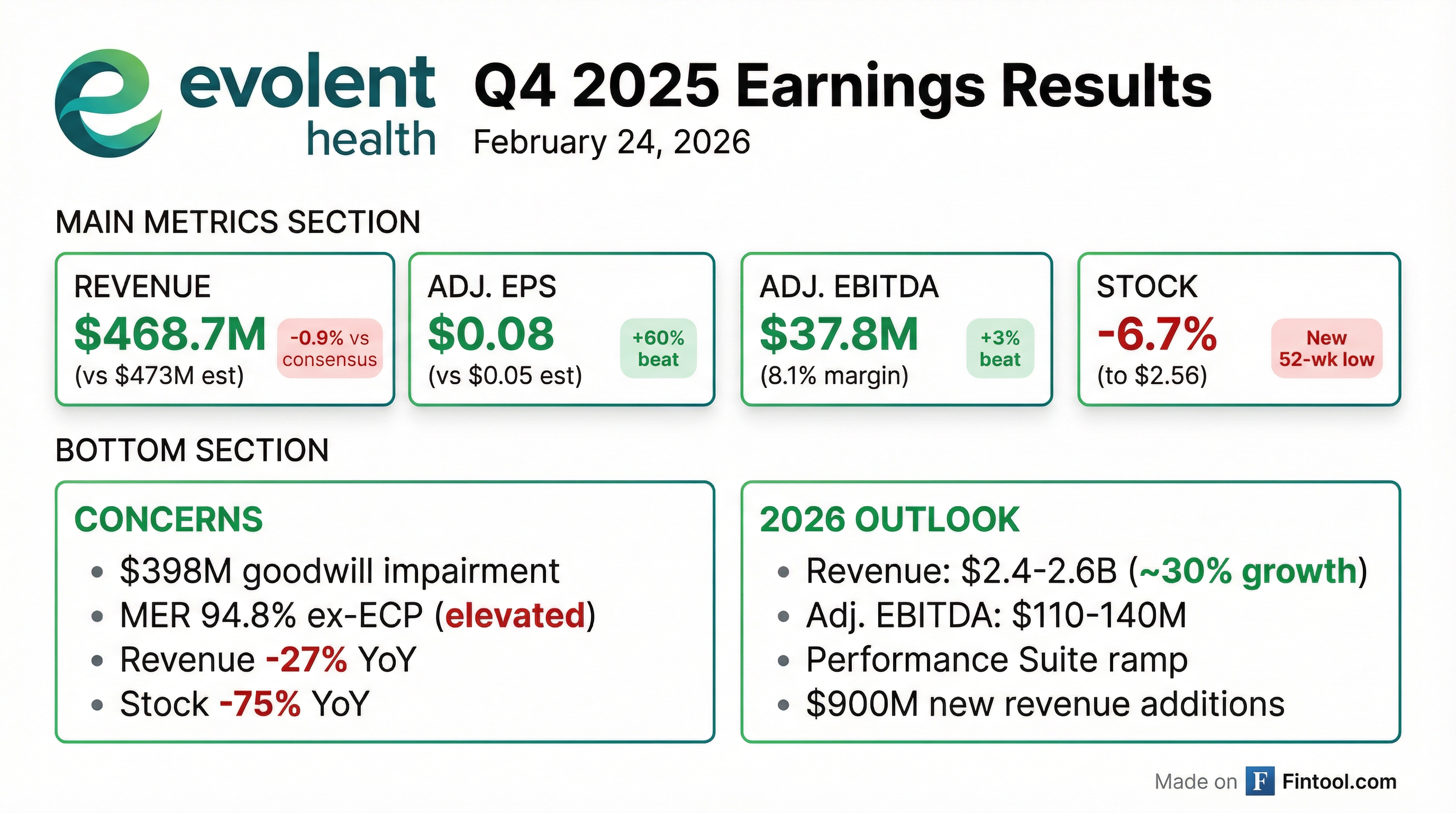

- Evolent Health reported strong Q4 2025 results, with revenue totaling $469 million and Adjusted EBITDA of $37.8 million, both landing in the upper half of guidance.

- For 2026, the company forecasts $2.5 billion of revenue at the midpoint, representing approximately 30% growth, and an Adjusted EBITDA guide of $125 million at the midpoint.

- Oncology is expected to be a significant growth driver, projected to account for approximately 65% of company revenue in 2026, an increase from 36% in 2025.

- The 2026 Adjusted EBITDA outlook includes significant impacts from new Performance Suite launches, which are expected to generate $900 million of 2026 revenue but create a $25 million headwind due to conservative reserving, and a $40 million headwind from exchange membership disenrollment related to the "One Big Beautiful Bill".

- The company ended 2025 with net debt of $782 million, below its expected range, and anticipates generating at least $10 million-$20 million in cash flow from operations in 2026.

- Evolent Health reported strong Q4 2025 results, with revenue totaling $469 million and Adjusted EBITDA at $37.8 million, both exceeding the midpoint of guidance.

- The company provided 2026 guidance, forecasting revenue of $2.4 billion - $2.6 billion (midpoint $2.5 billion) and Adjusted EBITDA of $110 million - $140 million (midpoint $125 million), representing approximately 30% revenue growth.

- Approximately 90% of Performance Suite revenue has been converted to the new Enhanced Performance Suite model, with future target margins for the entire book expected to be in the 7%-10% range.

- New Performance Suite launches, including a significant partnership with Highmark expected to contribute over $550 million in 2026 revenue, are projected to drive approximately $900 million of 2026 revenue but will create a temporary $25 million headwind to 2026 Adjusted EBITDA due to conservative reserving and timing.

- Oncology revenue is expected to comprise approximately 65% of total company revenue in 2026, a significant increase from 36% in 2025.

- Evolent Health reported Q4 2025 revenue of $469 million and Adjusted EBITDA of $37.8 million, both exceeding the midpoint of guidance. The company ended the year with net debt of $782 million.

- For 2026, the company forecasts revenue of $2.5 billion at the midpoint, representing approximately 30% growth, and Adjusted EBITDA of $125 million at the midpoint. Evolent Health expects its Q4 2026 run rate Adjusted EBITDA to be over $150 million.

- The projected growth for 2026 is significantly driven by new Performance Suite launches, including a partnership with Highmark expected to contribute over $550 million in revenue. Oncology revenue is anticipated to comprise approximately 65% of total company revenue in 2026, an increase from 36% in 2025.

- The 2026 Adjusted EBITDA outlook incorporates headwinds from new contract launches, which are expected to create a $25 million headwind, and a $40 million impact from exchange membership declines. These are partially offset by $50 million in savings from efficiency initiatives. The Medical Expense Ratio (MER) is projected to be approximately 93% at the midpoint of 2026 guidance, compared to 89% in 2025.

- Evolent Health reported Q4 2025 revenue of $468.7 million and full-year 2025 revenue of $1.88 billion, both in line with guidance.

- The company achieved Adjusted EBITDA of $37.8 million for Q4 2025 and $151.2 million for the full year 2025, also in line with guidance. The Adjusted EBITDA Margin for both Q4 and FY 2025 was 8.1%.

- Cash and cash equivalents totaled $151.9 million as of December 31, 2025 , with revolver capacity of $52.5 million.

- Period-end net leverage improved to 5.2x on LTM Adjusted EBITDA of $151.2 million, down from 6.7x in Q3 2025.

- The Medical Expense Ratio (MER) excluding Evolent Care Partners for 2025 was 89%.

- For the three months ended December 31, 2025, Evolent Health reported revenue of $468,719 thousand and a net loss attributable to common shareholders of $(429,131) thousand, with Adjusted EBITDA of $37,793 thousand.

- For the full year ended December 31, 2025, the company's revenue was $1,876,229 thousand, with a net loss attributable to common shareholders of $(579,401) thousand and Adjusted EBITDA of $151,155 thousand.

- Evolent Health provided full year 2026 guidance, expecting revenue to be in the range of $2.4 billion to $2.6 billion and Adjusted EBITDA to be in the range of $110 million to $140 million.

- CEO Seth Blackley highlighted a total forecasted revenue growth of approximately 30% for 2026, noting that the addition of $900 million in new Performance Suite revenue and health plan customer membership decreases will impact Adjusted EBITDA in the first half of 2026.

- Evolent Health reported revenue of $468.7 million for the three months ended December 31, 2025, and $1.88 billion for the full year ended December 31, 2025.

- The company experienced a net loss attributable to common shareholders of $429.1 million for the fourth quarter of 2025 and $579.4 million for the full year 2025.

- Adjusted EBITDA was $37.8 million (8.1% margin) for the three months ended December 31, 2025, and $151.2 million (8.1% margin) for the full year ended December 31, 2025.

- For the full year ending December 31, 2026, Evolent Health expects revenue to be in the range of $2.4 billion to $2.6 billion and Adjusted EBITDA to be in the range of $110 million to $140 million.

- CEO Seth Blackley stated that the company forecasts approximately 30% total revenue growth for 2026, despite impacts on Adjusted EBITDA in the first half of the year from new Performance Suite revenue and health plan customer membership decreases in Exchange products.

- Everlywell's AI health companion, Eva Engage, achieved nearly 50% higher member engagement and a 10% increase in care activation compared to traditional Interactive Voice Response (IVR) in a program with a national health plan.

- Eva Engage's AI Voice Agent functionality placed 60,000 member calls, demonstrating particularly strong engagement among Spanish-preferred members with more than double the engagement rate and triple the order completion rate.

- The platform's interactions result in a 70% first-contact-resolution rate, meeting a strong industry benchmark typically achieved by trained human teams.

- Everlywell has delivered nearly 1 billion personalized health insights and transformed care for 60 million people, partnering with 4 of the 5 largest health plans in the U.S..

- Evolent (EVH) reiterated its 4Q and 2025 guidance as of December 2, 2025, reporting oncology trend a little under 11% and cardiology trends a little bit higher within its Performance Suite.

- The company expects 2025 adjusted EBITDA of $149 million, which includes $10 million from the divested ECP asset; the pro forma adjusted EBITDA for 2025 is $139 million.

- Evolent has implemented new contract protections in 90% of its Performance Suite contracts, including adjustments for prevalence, case mix, new drugs, unit price, and hard corridors to limit losses.

- With approximately 20% of revenue ($360 million) tied to the ACA Marketplace, Evolent anticipates a potential 40-60% shrinkage in exchanges but targets flat to modest EBITDA growth in 2026 from the pro forma 2025 base of $139 million.

- The $100 million proceeds from the ECP divestiture will be used to pay down 9.5% first lien debt, reducing the net leverage ratio to about 5.5 times by year-end and targeting one turn of deleveraging per year.

- Evolent Health reiterated its 4Q and 2025 guidance on December 2, 2025, with cost trends in oncology (under 11%) and cardiology in line with expectations.

- The company has implemented new contractual protections for its Performance Suite, covering prevalence, case mix, new drugs, indications, unit price changes, and hard corridors to limit losses.

- Evolent expects minimal EBITDA contribution in 2026 from the $750 million in new Performance Suite ACV (with $550 million expected in 2026), with these contracts reaching a 10% margin zone by mid to end of 2028.

- The 2025 adjusted EBITDA guidance is $149 million, with 80% from tech and services and 20% from the Performance Suite; pro forma for the ECP divestiture, this would be $139 million.

- Evolent is divesting ECP for $100 million to pay down 9.5% first lien debt, aiming to reduce its leverage ratio from approximately 5.5 times net at year-end by about one turn per year over the next couple of years.

- Evolent Health reiterated its 4Q and 2025 guidance and confirmed that cost trends are in line with expectations, with oncology trends under 11% and cardiology trends slightly higher, as of end of November 2025.

- The company expects $149 million in adjusted EBITDA for 2025 (midpoint), with 80% from tech and services and 20% from the Performance Suite. Excluding the divested ECP asset, the pro forma adjusted EBITDA for 2025 is $139 million.

- Evolent has implemented new contractual protections for its Performance Suite, including adjustments for prevalence, case mix, new drugs, and hard corridors, which were difficult to secure previously but are now common in new contracts.

- The company is divesting its ECP asset for $100 million, which will be used to pay down 9.5% first lien debt, aiming to reduce the net leverage ratio to approximately 5.5x by year-end and delever by about one turn per year thereafter.

- For 2026, Evolent anticipates minimal EBITDA contribution from $750 million in new Performance Suite annualized revenue, with a target to keep adjusted EBITDA flat or grow modestly from the pro forma $139 million in 2025, even with a potential 40%-60% shrinkage in ACA Marketplace exposure.

Quarterly earnings call transcripts for Evolent Health.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more