SmartRent (SMRT)·Q4 2025 Earnings Summary

SmartRent Hits EBITDA Breakeven, Delivers First Revenue Growth in 7 Quarters

February 5, 2026 · by Fintool AI Agent

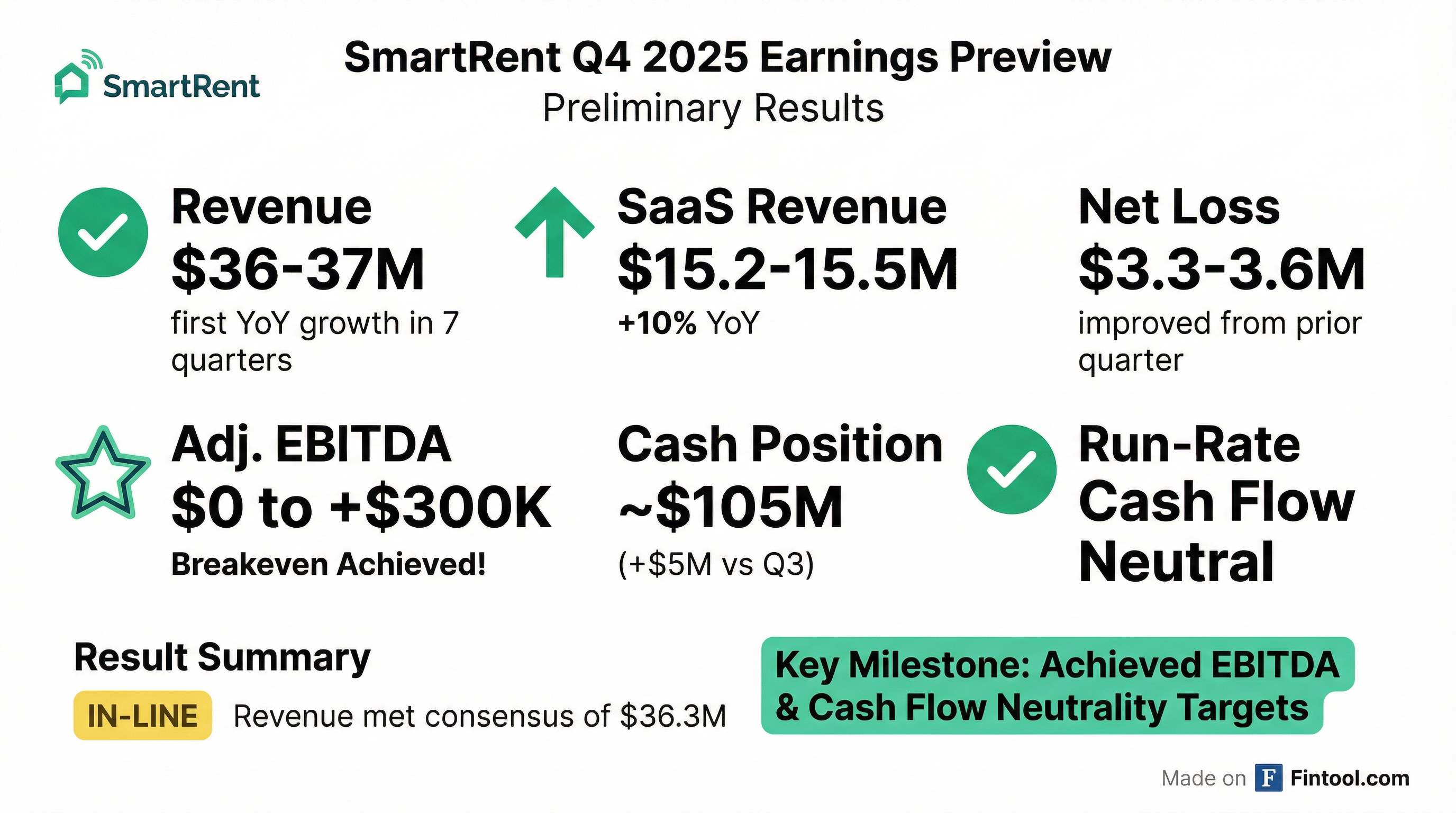

SmartRent (NYSE: SMRT) delivered on its turnaround commitments, releasing preliminary Q4 2025 results showing the first quarter of year-over-year revenue growth since Q1 2024 and achieving Adjusted EBITDA breakeven for the first time. The smart home technology provider for rental housing guided revenue of $36-37M—roughly in-line with consensus—while narrowing net loss to $3.3-3.6M and growing cash to $105M.

Did SmartRent Beat Earnings?

SmartRent's preliminary results came in roughly in-line to slightly ahead of Street expectations, with the bigger story being operational milestone achievement rather than pure beat/miss metrics.

*Values retrieved from S&P Global

The headline is the EBITDA swing: consensus expected a loss of -$5.4M, but SmartRent delivered breakeven to slightly positive Adjusted EBITDA of $0 to $300K—a ~$5.5M beat on operating profitability.

What Milestones Did SmartRent Achieve?

CEO Frank Martell emphasized that Q4 results reflect "decisive action and disciplined execution" over the second half of 2025. The company hit all three operational priorities outlined on the Q2 2025 call:

This follows the $30M cost reduction program completed in Q3 2025.

How Did SmartRent's Revenue Trend?

Q4 2025 marks a critical inflection point: the first quarter of year-over-year revenue growth in seven quarters.

The revenue decline bottomed in Q4 2024 as the company worked through bulk hardware sales made in prior years. Management expects hardware revenue to normalize in 2026 as shipments become more closely coupled with deployment timing.

What's Driving SaaS Growth?

SaaS revenue of $15.2-15.5M grew more than 10% year-over-year, now representing ~42% of total revenue. This continues the mix shift toward higher-margin recurring revenue:

Key SaaS drivers include:

- Installed base expansion: 870,000+ units as of Q3, up 11% YoY

- Higher pricing: ARPU increases on new and existing contracts

- Net revenue retention above 100%: Customers expanding their SmartRent footprint

How Did the Stock React?

SMRT closed at $1.66 on February 4, down 2.9% ahead of the preliminary release. In after-hours trading following the announcement, shares traded at $1.68, up 1.2% from the close.

The stock has rallied 147% from its 52-week low of $0.67, reflecting improving execution and the path to profitability.

What Did Management Say?

CEO Frank Martell struck an optimistic but measured tone:

"Our expected fourth quarter results reflect the impact of decisive action and disciplined execution over the course of the second half of 2025. Importantly, we delivered on our commitments, including investing in our revenue-generating teams, driving productivity and resetting expense levels, as well as maintaining significant cash reserves."

Looking ahead:

"As we enter 2026, our focus remains squarely on continued cost discipline and building a more predictable growth profile primarily driven by recurring software-related revenue. We also expect to continue to realize cost and productivity benefits in the coming quarters based on a more fulsome flow-through from our 2025 cost reset program."

On the Q3 call, Martell promised a three-year strategic framework to be unveiled on the next call.

What's the Balance Sheet Position?

SmartRent ended Q4 2025 with approximately $105M in cash, an increase of $5M from the $100M at September 30, 2025.

The cash build in Q4 2025 is significant—it's the first quarter of positive cash generation since Q4 2023. The company also has $75M in undrawn credit available.

What's the Forward Outlook?

Analyst consensus for 2026 shows gradual revenue recovery and improving profitability:

*Values retrieved from S&P Global

Consensus implies ~12% revenue growth in FY2026 and a path to EPS breakeven by Q4 2026.

What Changed From Last Quarter?

The Q4 results validate the turnaround thesis management laid out in mid-2025. The next catalyst is the full Q4 earnings call and 10-K filing, where management is expected to provide the three-year strategic framework.

Key Risks and Considerations

-

Preliminary Numbers: These are unaudited, preliminary results subject to change.

-

Macro Headwinds: Management noted "some challenges in the macro environment" creating friction in customer demand.

-

Revenue Scale: At ~$145M annualized revenue, SmartRent remains a small-cap with limited margin for error.

-

Hardware Dependency: Despite the SaaS shift, ~58% of revenue still comes from hardware and professional services, which are lower margin and less predictable.

The Bottom Line

SmartRent delivered exactly what it promised: EBITDA breakeven, cash flow neutrality, and the first revenue growth in seven quarters. The turnaround is on track, but the stock's 147% rally from lows means expectations have reset higher. The next catalyst is the full Q4 earnings call, where investors will look for the three-year strategic framework and evidence that revenue growth can accelerate in 2026.

Related: SmartRent Company Profile | Q3 2025 Transcript