Earnings summaries and quarterly performance for SmartRent.

Executive leadership at SmartRent.

Board of directors at SmartRent.

Research analysts who have asked questions during SmartRent earnings calls.

RT

Ryan Tomasello

Keefe, Bruyette & Woods

7 questions for SMRT

Also covers: BLND, CSGP, FIGR +6 more

Yi Fu Lee

Cantor Fitzgerald

5 questions for SMRT

Also covers: COUR, CSGS, DCBO +4 more

TW

Thomas White

D.A. Davidson & Co.

2 questions for SMRT

Also covers: ABNB, BKNG, CARS +5 more

BO

Barry Oxford

Colliers

1 question for SMRT

Also covers: BRT, CHCT, CIO +8 more

Erik Woodring

Morgan Stanley

1 question for SMRT

Also covers: AAPL, CDW, CRCT +19 more

Recent press releases and 8-K filings for SMRT.

SmartRent Provides Update on Q4 2025 Financial Results

SMRT

Earnings

Guidance Update

Revenue Acceleration/Inflection

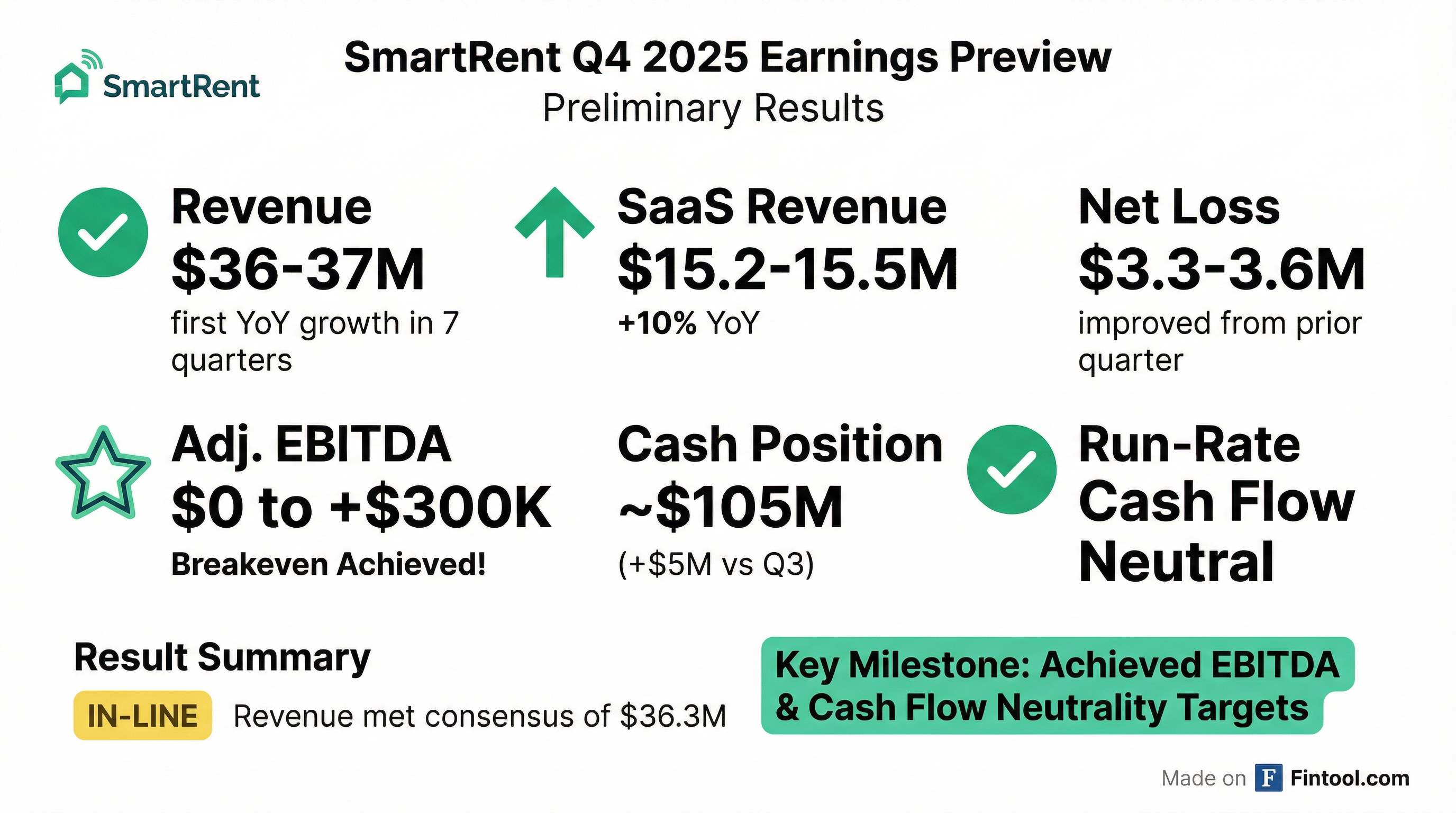

- SmartRent anticipates Q4 2025 revenue between $36 million and $37 million, marking the first quarter of year-over-year revenue growth in seven quarters. SaaS revenue is projected to be between $15.2 million and $15.5 million, representing a year-over-year increase of more than ten percent.

- The company expects a net loss in the range of $3.6 million to $3.3 million and Adjusted EBITDA between $0 and $300,000 for Q4 2025.

- SmartRent's ending cash balance is projected to be approximately $105 million, an increase of $5 million compared to September 30, 2025.

- The company expects its Q4 2025 results to reflect the achievement of its objectives, including improved revenue performance, positive Adjusted EBITDA on a run-rate basis, and cash flow neutrality on a run-rate basis.

Feb 5, 2026, 2:08 PM

SmartRent Provides Q4 2025 Preliminary Financial Results Update

SMRT

Earnings

Guidance Update

Revenue Acceleration/Inflection

- SmartRent anticipates Q4 2025 revenue to be between $36 million and $37 million, marking the first year-over-year growth in seven quarters, with SaaS revenue projected between $15.2 million and $15.5 million.

- The company expects a Q4 2025 net loss in the range of $3.6 million to $3.3 million and Adjusted EBITDA between $0 and $300,000.

- SmartRent achieved run-rate cash flow neutrality and expects an ending cash balance of approximately $105 million for Q4 2025, an increase of $5 million compared to September 30, 2025.

Feb 5, 2026, 2:00 PM

SmartRent Reports Q3 2025 Results with Narrowed Operating Loss and Increased SaaS Revenue

SMRT

Earnings

Accounting Changes

New Projects/Investments

- SmartRent reported Q3 2025 total revenue of $36.2 million, an 11% decrease year-over-year, primarily reflecting a strategic move away from bulk hardware sales towards a more sustainable SaaS-focused revenue mix.

- SaaS revenue grew 7% year-over-year to $14.2 million, now representing 39% of total revenue, up from 33% in the same period prior year. The installed unit base expanded to over 870,000 units, an 11% increase from the prior year.

- The company significantly narrowed its operating loss, with Adjusted EBITDA improving 23% year-over-year to a loss of $2.9 million in Q3 2025, down from a $7.4 million loss in Q2 2025. This was aided by the completion of a $30 million annualized expense reduction program.

- SmartRent ended Q3 2025 with $100 million in unrestricted cash and no debt, with net cash burn improving 79% from $24 million in the prior year to $5 million. The company expects to achieve adjusted EBITDA and cash flow neutrality on a run rate basis exiting 2025.

Nov 5, 2025, 4:30 PM

SmartRent Reports Q3 2025 Results, Highlighting SaaS Growth and Cost Reduction

SMRT

Earnings

New Projects/Investments

- SmartRent reported Q3 2025 total revenue of $36.2 million, a 11% decrease year-over-year, primarily due to a strategic shift away from hardware-led growth towards a SaaS-focused revenue mix.

- Annual Recurring Revenue (ARR) increased 7% year-over-year to $56.9 million, with SaaS revenue growing 7% to $14.2 million and now representing approximately 39% of total revenue.

- The company improved its profitability, achieving an Adjusted EBITDA of $(2.9) million and a net loss of $(6.3) million, which are improvements of $0.9 million and $3.6 million respectively, compared to the prior year.

- Operationally, SmartRent's installed base grew 11% year-over-year to approximately 870,000 units deployed, maintaining a low customer churn rate of 0.05% and 113% customer net revenue retention. The $30 million cost reduction plan was completed, and the company remains on track to achieve cash flow neutrality by the end of 2025, supported by $100 million in cash and no debt.

Nov 5, 2025, 4:30 PM

SmartRent Reports Q3 2025 Results, Highlights SaaS Growth and Reduced Losses

SMRT

Earnings

Revenue Acceleration/Inflection

Guidance Update

- SmartRent reported Q3 2025 total revenue of $36.2 million, an 11% decrease year over year, primarily reflecting a strategic move away from bulk hardware sales.

- SaaS revenue grew 7% year over year to $14.2 million, now representing 39% of total revenue, and Annual Recurring Revenue (ARR) increased 7% to $56.9 million.

- The company significantly narrowed its Adjusted EBITDA loss to $2.9 million in Q3 2025, an improvement of 23% year over year, and reduced net cash burn by 79% to $5 million.

- SmartRent completed $30 million in annualized expense reductions and expects to achieve adjusted EBITDA and cash flow neutrality on a run rate basis exiting 2025.

- The installed unit base expanded by 11% from the prior year to 870,000 units, with 22,000 new units deployed during the quarter.

Nov 5, 2025, 4:30 PM

SmartRent Reports Q3 2025 Results

SMRT

Earnings

Guidance Update

New Projects/Investments

- SmartRent reported total revenue of $36.2 million for Q3 2025, an 11% decrease year over year, primarily reflecting a strategic shift away from bulk hardware sales.

- SaaS revenue grew 7% year over year to $14.2 million, now representing 39% of total revenue, while the installed unit base expanded by 11% from the prior year to 870,000 units.

- The company significantly narrowed its Adjusted EBITDA loss to $2.9 million in Q3 2025, an improvement of 23% compared to the prior year, driven by the completion of a $30 million annualized cost reduction program.

- SmartRent maintained a strong liquidity position, ending the quarter with $100 million in unrestricted cash and no debt, with net cash burn improving by 79% to $5 million.

- Management expects to achieve adjusted EBITDA and cash flow neutrality on a run rate basis exiting 2025, driven by continued expansion of the installed base and strategic investments.

Nov 5, 2025, 4:30 PM

SmartRent Reports Q3 2025 Financial Results and Completes Cost Reduction Program

SMRT

Earnings

Guidance Update

- SmartRent reported revenue of $36.2 million for the third quarter of 2025, an 11% decrease from the prior year, primarily due to a strategic shift away from bulk hardware sales.

- The company significantly improved its profitability, with a net loss of $(6.3) million and Adjusted EBITDA of $(2.9) million in Q3 2025, representing improvements of $3.6 million and $0.9 million, respectively, compared to the prior year.

- Annual Recurring Revenue (ARR) increased 7% to $56.9 million, now accounting for 39% of total revenue, and Units Deployed grew 11% to over 870,000 as of September 30, 2025.

- SmartRent completed its $30 million cost reduction program and is on track to achieve run rate cash flow neutrality exiting 2025.

- The company maintains a strong liquidity position with $100 million in cash and an undrawn credit facility of $75 million.

Nov 5, 2025, 1:05 PM

SmartRent Reports Third Quarter 2025 Financial Results

SMRT

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- SmartRent reported Q3 2025 revenue of $36.2 million, an 11% decrease year-over-year, primarily due to a strategic shift away from bulk hardware sales, while Annual Recurring Revenue (ARR) increased 7% to $56.9 million.

- The company significantly improved profitability, with net loss improving by $3.6 million to $(6.3) million and Adjusted EBITDA improving by $0.9 million to $(2.9) million, largely due to the completion of a $30 million cost reduction program.

- SmartRent ended the quarter with a strong liquidity position, including $100 million in cash and an undrawn credit facility of $75 million.

Nov 5, 2025, 1:00 PM

Quarterly earnings call transcripts for SmartRent.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more