Earnings summaries and quarterly performance for SIMILARWEB.

Research analysts who have asked questions during SIMILARWEB earnings calls.

Adam Hotchkiss

Goldman Sachs

6 questions for SMWB

Raimo Lenschow

Barclays

6 questions for SMWB

Arjun Bhatia

William Blair

5 questions for SMWB

Luke Horton

Northland Capital Markets

5 questions for SMWB

Surinder Thind

Jefferies Financial Group

5 questions for SMWB

Tyler Radke

Citigroup Inc.

5 questions for SMWB

Jason Helfstein

Oppenheimer & Co. Inc.

4 questions for SMWB

Kincaid LaCorte

Citizen JMP

3 questions for SMWB

Patrick Walravens

Citizens JMP

3 questions for SMWB

Scott Berg

Needham & Company, LLC

3 questions for SMWB

Willow Miller

William Blair & Company, L.L.C.

3 questions for SMWB

Ken Wong

Oppenheimer & Co. Inc.

2 questions for SMWB

Ken Wong

Oppenheimer & Co.

2 questions for SMWB

Lucas John Horton

Northland Capital Markets

2 questions for SMWB

Lucas Metcalf

Needham & Company

2 questions for SMWB

Ryan MacWilliams

Barclays

2 questions for SMWB

Ashley Kim

Citigroup Inc.

1 question for SMWB

Greyson Sklba

Goldman Sachs

1 question for SMWB

Kincaid

Citizens Bank

1 question for SMWB

Nicholas Jones

Citizens JMP

1 question for SMWB

Recent press releases and 8-K filings for SMWB.

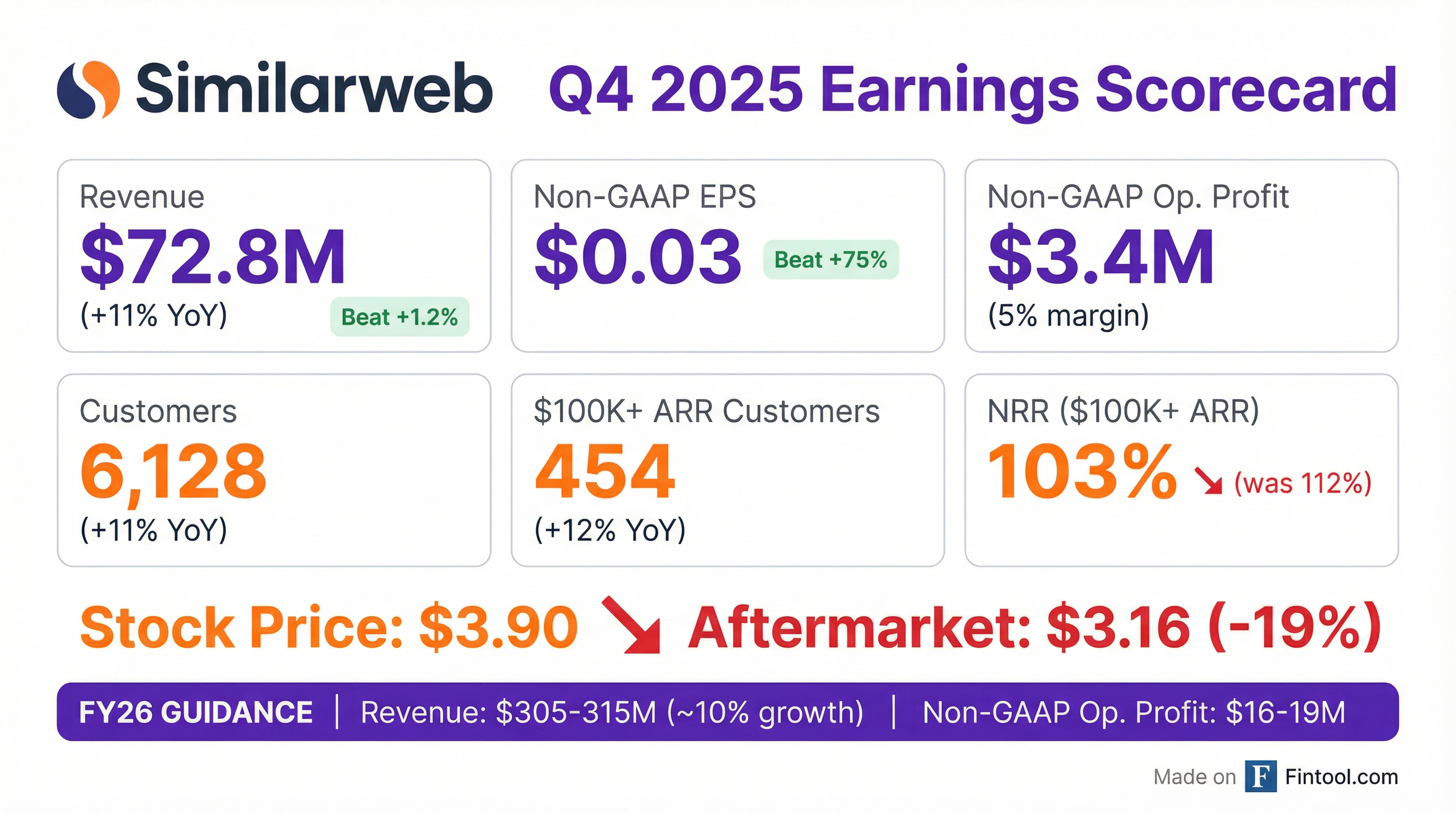

- Q4 2025 revenue reached $72.8 million, an 11% year-over-year increase, but was below guidance primarily due to the delayed closing of two large LLM data training contracts.

- Similarweb achieved its second consecutive year of positive non-GAAP operating profit and free cash flow in 2025, generating approximately $13 million in free cash flow for the year.

- AI-related revenue grew 3x year-over-year, constituting 11% of Q4 2025 sales, up from 8% in Q2 2025, driven by new AI offerings such as AI Studio.

- For full year 2026, the company expects total revenue between $305 million and $350 million, representing 10% year-over-year growth at the midpoint, and non-GAAP operating profits between $16 million and $19 million.

- Ran joined as the new CFO in December 2025, with priorities including accelerating revenue growth, extending profitability, and delivering durable free cash flow.

- Similarweb reported Q4 2025 revenue of $72.8 million, an 11% year-over-year increase, which was below guidance primarily due to delayed closing of two large LLM data training contracts.

- The company achieved its second consecutive year of positive non-GAAP operating profit and free cash flow, generating approximately $13 million in free cash flow for 2025.

- AI-related revenue reached 11% of sales in Q4 2025, growing 3x year-over-year, and 60% of Annual Recurring Revenue (ARR) is now multi-year, up from 49% a year ago.

- For full-year 2026, Similarweb expects total revenue between $305 million and $350 million and non-GAAP operating profits between $16 million and $19 million.

- Similarweb reported Q4 2025 revenue of $72.8 million, an 11% year-over-year increase, which was below guidance due to delayed large LLM data training contracts.

- For the full year 2025, the company achieved its second consecutive year of positive non-GAAP operating profit and generated approximately $13 million in free cash flow.

- AI-related revenue reached 11% of sales in Q4 2025, growing 3x year-over-year, and 60% of ARR is now multi-year, up from 49% a year ago.

- Ran Vered joined as the new CFO in December 2025, and the company launched new AI-first solutions, including AI Studio, to expand user access and monetization.

- For full year 2026, Similarweb expects revenue between $305 million and $350 million and non-GAAP operating profit between $16 million and $19 million.

- Similarweb reported Q4 2025 revenue of $72.8 million, an 11% year-over-year increase.

- For Q4 2025, the company achieved a Non-GAAP operating profit of $3.4 million (5% margin) and Normalized free cash flow of $1.0 million (1% margin).

- For the full fiscal year 2025, revenue reached $282.6 million, growing 13% year-over-year, with a Non-GAAP operating profit of $9.1 million (3% margin) and Normalized free cash flow of $14.7 million (5% margin).

- Remaining Performance Obligation (RPO) stood at $288.8 million in Q4 2025, with 69% expected to be recognized over the next 12 months. The company also reported 6,128 total ARR customers and 454 $100K+ ARR customers in Q4 2025.

- Similarweb provided FY 2026 revenue guidance of $305 million to $315 million (10% YoY at midpoint) and Non-GAAP operating profit guidance of $16 million to $19 million (6% margin at midpoint).

- Similarweb reported Q4 2025 revenue of $72.8 million, an 11% increase year-over-year, and fiscal year 2025 revenue of $282.6 million, up 13% from fiscal year 2024.

- For fiscal year 2025, the company achieved Non-GAAP operating profit of $9.1 million and Non-GAAP net income of $5.1 million, alongside $13.0 million in free cash flow.

- Similarweb provided FY 2026 revenue guidance between $305.0 million and $315.0 million and Non-GAAP operating profit guidance between $16.0 million and $19.0 million.

- Multi-year subscriptions grew to 60% of ARR as of December 31, 2025, up from 49% a year ago, while the overall Dollar-based net retention rate (NRR) was 98% in Q4 2025, compared to 101% in Q4 2024.

- Similarweb reported Q4 2025 revenue of $72.8 million, an 11% increase year-over-year, and fiscal year 2025 revenue of $282.6 million, a 13% increase year-over-year.

- The company achieved its ninth consecutive quarter of positive free cash flow in Q4 2025, with $1.0 million for the quarter and $13.0 million for the full year 2025. Non-GAAP diluted net income per share was $0.03 for Q4 2025 and $0.06 for fiscal year 2025.

- Customer count increased 11% year-over-year to 6,128 as of December 31, 2025, and Remaining Performance Obligations (RPO) grew 17% year-over-year to $288.8 million.

- Revenue from generative AI data and solutions reached 11% of Q4 2025 revenue, up from 8% at the beginning of the year, supported by the launch of Similarweb AI Studio and a partnership with Manus.

- For fiscal year 2026, the company estimates total revenue between $305.0 million and $315.0 million (approximately 10% growth at the mid-point) and non-GAAP operating profit between $16.0 million and $19.0 million.

- **Similarweb (SMWB) reported Q3 2025 revenue of $71.8 million, an 11% year-over-year increase, with a strong non-GAAP gross margin of 81%. **

- **The company achieved a non-GAAP operating profit of $4.6 million (6% margin) and non-GAAP normalized free cash flow of $3.0 million (4% margin) in Q3 2025. **

- **Key customer metrics include a 105% dollar-based net retention rate (NRR) for $100K+ ARR customers, who also account for 63% of total ARR. The total ARR customer base grew to 6,127. **

- **For fiscal year 2025, Similarweb projects revenues between $285 million and $288 million (15% YoY growth at midpoint) and non-GAAP operating profit of $8.5 million to $9.5 million (3% margin at midpoint). **

- Similarweb reported Q3 2025 revenue of $71.8 million, an 11% increase year-over-year, and reiterated its full-year 2025 revenue guidance of $285 million to $288 million.

- The company raised its non-GAAP operating profit guidance for 2025 to between $8.5 million and $9.5 million and generated $3 million in free cash flow in Q3 2025, marking its eighth consecutive quarter of positive free cash flow.

- The customer base grew 15% year-over-year to more than 6,000 ARR customers, and remaining performance obligations (RPO) totaled $268 million, up 26% year-over-year.

- New product lines demonstrated strong growth, with GenAI Intelligence products reaching over $1 million in ARR since their April launch, and App Intelligence exceeding $10 million in ARR with more than 580 customers.

- Ran Vered will join Similarweb as the new Chief Financial Officer in December, succeeding Jason Schwartz.

- Similarweb reported Q3 2025 revenue of $71.8 million, an 11% increase year-over-year, and grew its customer base by 15% to over 6,000 ARR customers.

- The company achieved its eighth consecutive quarter of positive free cash flow, generating $3 million in Q3 2025, and reported $268 million in Remaining Performance Obligations (RPO), up 26% year-over-year.

- For the full year 2025, Similarweb reiterated its revenue guidance of $285 million-$288 million and raised its non-GAAP operating profit guidance to between $8.5 million and $9.5 million.

- ARR from GenAI Intelligence products surpassed $1 million since its April launch, and App Intelligence ARR increased to over $10 million with more than 580 customers.

- Ron Verrett is set to join as the new Chief Financial Officer in December 2025.

- Similarweb reported Q3 2025 revenue of $71.8 million, an 11% year-over-year increase, and grew its customer base by 15% year over year to over 6,000 ARR customers.

- The company achieved its eighth consecutive quarter of positive free cash flow, generating $3 million in Q3 2025, with a 4% free cash flow margin.

- Similarweb reiterated its full-year 2025 revenue guidance of $285 million-$288 million and raised its non-GAAP operating profit guidance to between $8.5 million and $9.5 million.

- GenAI Intelligence ARR rapidly grew to over $1 million since its April launch, while App Intelligence ARR increased to above $10 million with over 580 customers.

- Remaining Performance Obligations (RPO) totaled $268 million, a 26% year-over-year increase, with 58% of ARR contracted under multi-year agreements.

Quarterly earnings call transcripts for SIMILARWEB.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more