Snap-on (SNA)·Q4 2025 Earnings Summary

Snap-on Beats EPS as Critical Industries Improve, Revenue Slightly Misses

February 5, 2026 · by Fintool AI Agent

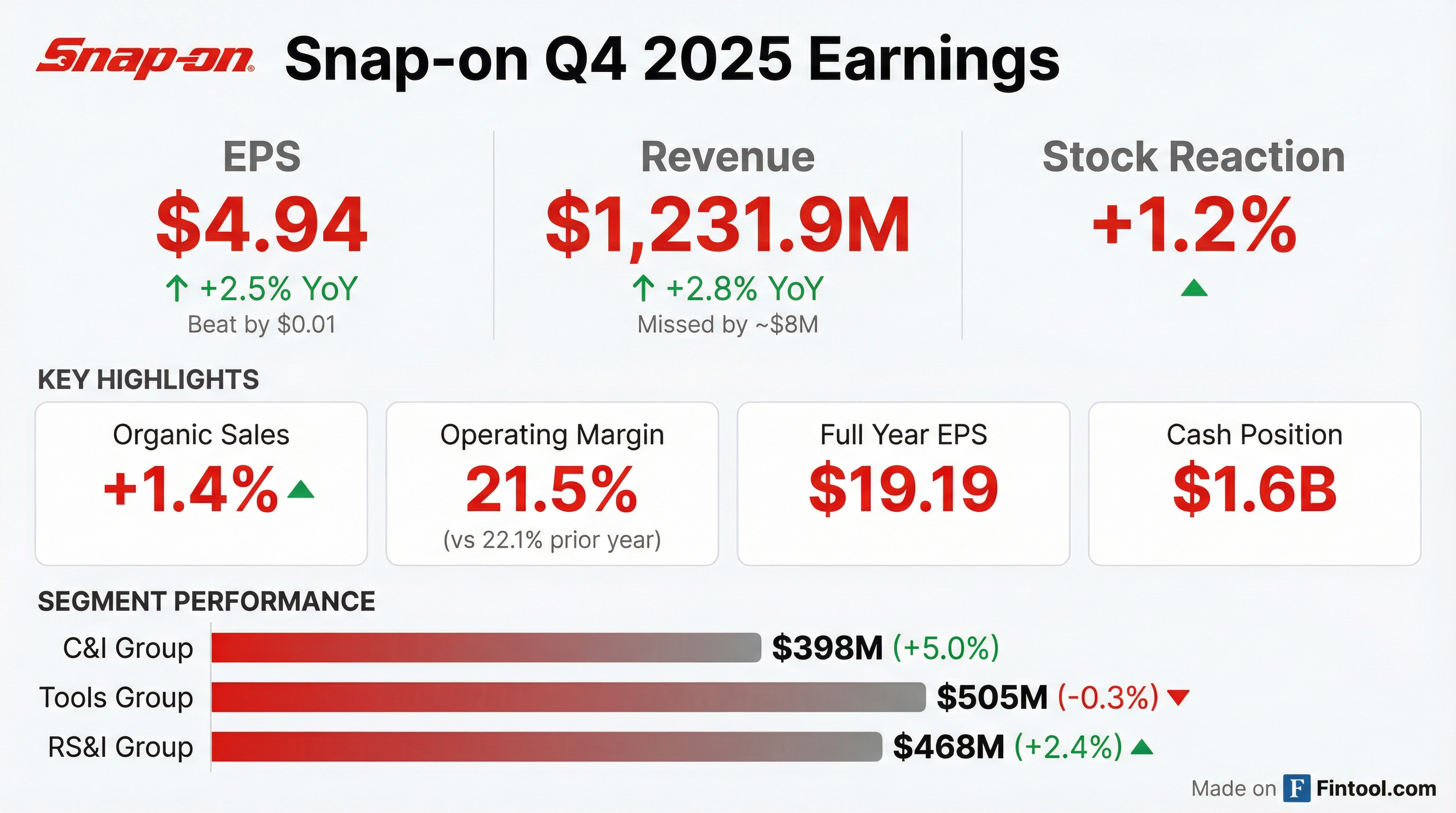

Snap-on delivered Q4 2025 diluted EPS of $4.94, beating consensus estimates by approximately 1.0% while revenue of $1,231.9 million came in slightly below expectations. The professional tools and equipment manufacturer navigated what CEO Nick Pinchuk called "extraordinary turbulence" including fluctuating tariffs and a prolonged government shutdown, demonstrating resilience in its core markets. With the average age of the U.S. car park now at 12.8 years and rising, the underlying demand for vehicle repair remains robust.

Did Snap-on Beat Earnings?

EPS: Beat by ~1.0% — Snap-on reported diluted EPS of $4.94 versus consensus expectations of approximately $4.89, representing a 2.5% increase from $4.82 in Q4 2024.

Revenue: Slight miss of ~0.4% — Net sales of $1,231.9 million came in slightly below the ~$1,237 million consensus but represented a 2.8% increase from prior year, including 1.4% organic growth and 1.4% favorable currency translation.

What Changed From Last Quarter?

Critical industries staged a late-quarter comeback. After October and November were impacted by the prolonged government shutdown, the C&I segment's industrial operations "came roaring back" in December. CEO Pinchuk noted the team was "out there in dungarees, working, packing" to catch up.

Tools Group pivoting to shorter payback items. With technician uncertainty persisting around long-payback purchases, the franchise network continued its strategic pivot toward quicker-payback items. This drove gross margin expansion of 150 bps to 46.1% despite flat volume — a significant operational win.

Originations showing stabilization signs. Tool storage originations were "almost flat" in Q4, described by management as "clearly a gain that bodes well for our future" after prior weakness. Sales off the van exceeded sales to the van — a potential "green shoot."

RS&I extended growth streak. The segment recorded its 5th consecutive quarter of organic growth, driven by OEM relationships and independent shop penetration, despite lower big-ticket diagnostic unit sales.

Brand-building investments increased. Both Tools Group and RS&I increased operating expense ratios for training, advertising, software development, and social media initiatives to ensure "full strength when the uncertainty thaws."

How Did the Stock React?

Snap-on shares closed at $382.91 on February 4, 2026, up 8.0% from the 50-day moving average of $354.74. The stock has gained approximately 32% from its 52-week low of $289.81, reflecting investor confidence in the company's resilience. In after-hours trading following the earnings release, shares were trading at $381.03, down approximately 0.5%.

Segment Performance Deep Dive

Commercial & Industrial Group — The Bright Spot

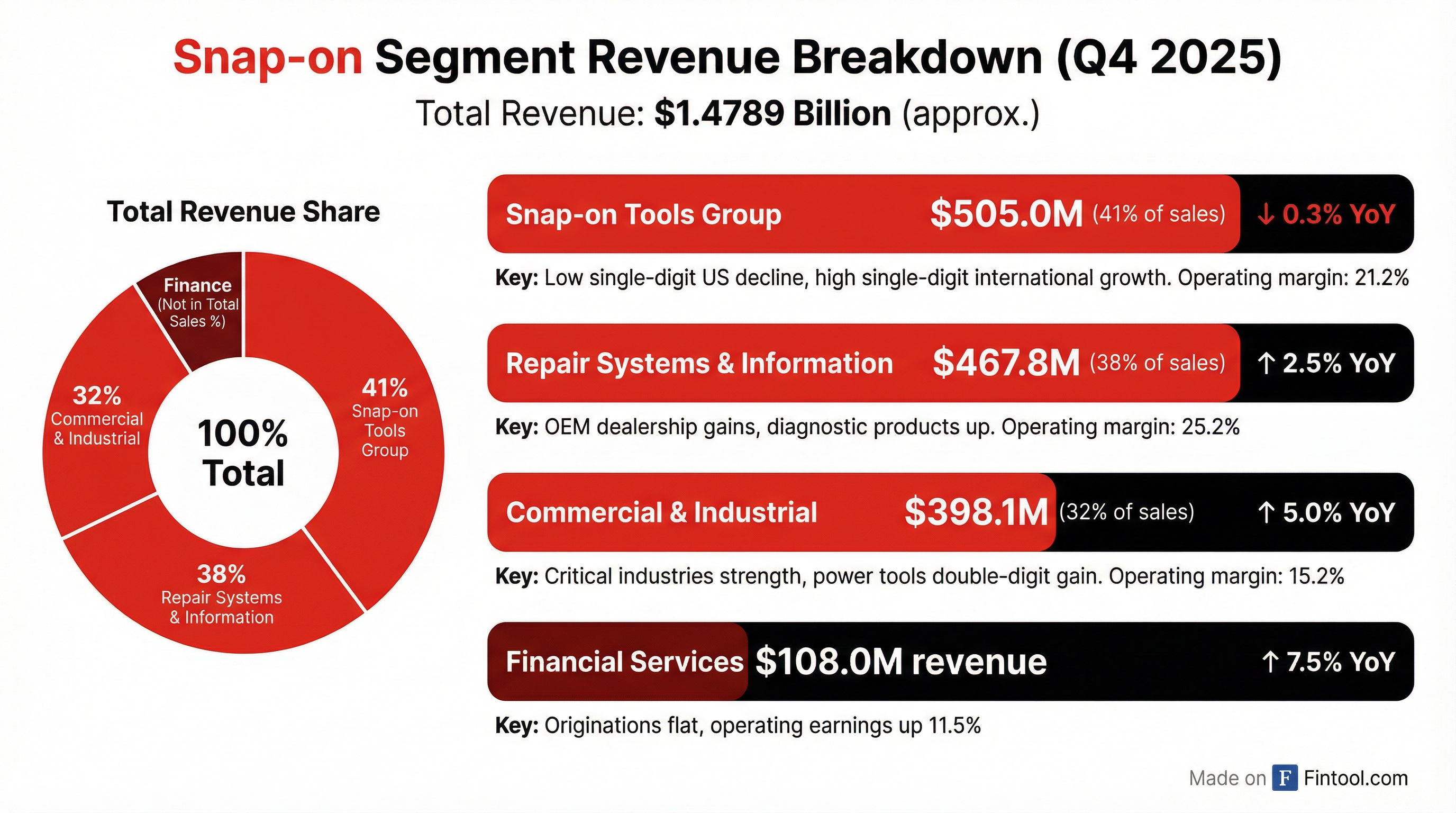

Sales of $398.1 million (+5.0% YoY) reflected strength across critical industries:

- Double-digit gains in power tools operations

- Mid single-digit increases in specialty torque

- Offset by lower sales to U.S. markets from Asia Pacific business

- Operating margin of 15.2% (vs 16.7% last year) impacted by mix shift to lower-margin businesses

Key product launches driving growth:

- NanoAxcess Cordless Lineup — Compact power tools small enough to fit in the palm of your hand with an internal battery driving 600+ fasteners per charge. Both models (straight and 90-degree pistol driver) "set new records for new power tool rollouts"

- ControlTech+ Torque Wrench — High-precision instrument for critical industries with all-steel construction, large LED display visible in bright sunlight, intrinsically safe for flammable areas

Notable item: The segment recorded a net benefit of $4.5 million from footprint refinement, including a building sale gain offset by trademark retirements and restructuring charges.

Snap-on Tools Group — Mixed Performance

Sales of $505.0 million (-0.3% YoY) showed geographic divergence:

- Low single-digit decline in U.S. sales

- High single-digit gains in international operations

- Operating margin improved 10 bps to 21.2%

- Gross margin up 150 bps to 46.1% (vs 44.6% last year) — driven by higher sales of new products and RCI savings

- Operating expenses rose 140 bps on brand-building and product development investments

Key product launches:

- 307RIPLMS Impact Flex Socket Set — 7-piece set with extra-long, reduced-diameter shafts enabling access to deeply recessed fasteners without removing additional parts. Another "$1 million hit product"

- KTL1021 Roll Cab — 54-inch single-bank storage unit with all 7 drawers spanning full width, 9,300 sq inches of storage, 3.5-ton load capacity. "Just the storage product for this environment"

Repair Systems & Information Group — Steady Growth

Sales of $467.8 million (+2.5% YoY) marked the 5th consecutive quarter of growth. Key drivers:

- Low single-digit gains with OEM dealerships

- Increased sales of diagnostic and repair information products

- Undercar equipment sales essentially flat

- Operating margin of 25.2% (vs 26.6% prior year) reflecting investments in software development and brand building

Key product launch:

- MT2600 Diagnostic Platform — Entry-level device communicating with 50 OEMs on models dating back to 1983. Automatically identifies vehicle via VIN-specific information, eliminating software loading time. "A hit with franchisees and customers alike"

Strategic advantage highlighted: Management emphasized RS&I's ability to convert "billions of data points within microseconds" using large language models to match problem signatures with repair procedures — a key differentiator in managing growing vehicle complexity.

Financial Services — Strong Earnings Growth

Revenue of $108.0 million (+7.5% YoY) with operating earnings of $74.4 million (+11.5%):

- Originations unchanged at $285.1 million — reflecting "stable originations of tool storage products," described as a positive sign after prior weakness

- Average yield on finance receivables: 17.6% (vs 17.7% prior year)

- 60+ day delinquency at 2.1% (up 10 bps YoY and 10 bps QoQ, reflecting typical seasonal increase)

- Trailing 12-month net losses of $72.1 million (3.67% of outstandings)

53rd Week Impact: The fiscal 2025 calendar included 53 weeks, uniquely benefiting financial services with ~$7.4 million of extra interest income. For operating companies, the extra week during the holiday period was a slight negative due to fixed personnel costs with minimal sales.

What Did Management Say?

CEO Nick Pinchuk struck a cautiously optimistic tone, acknowledging significant headwinds while highlighting the company's resilience:

"These times are some. Seems like every day brings a new twist of considerable significance. Fluctuating tariffs with big swings, unprecedented domestic and international events that dominate the news, prolonged government shutdowns... But as we speak about the period, I believe you'll see that in the middle of it all, Snap-on shined through with strength."

On the Tools Group's 150 bps gross margin improvement:

"Boom, shakalaka! This is an eye-popper."

On the automotive repair market and technician demand:

"A recent article in The Economist, 'Ditch textbooks and learn how to use a wrench to AI-proof your job.' That piece emphasized the considerable need for more technicians and the solid security provided by the profession, and it cites vehicle repair as one of the most AI-proof of jobs."

On market outlook and potential "thaw":

"The uncertainty appears to be in for a thaw, and we believe the resilience of our markets will continue, essential and critical as they are. We are building our advantages, and they are powerful."

Q&A Highlights

On Tools Group Performance and Technician Sentiment: Asked about the slight decline in Tools Group, CEO Pinchuk noted the quarter was "pretty turbulent" with the government shutdown affecting franchisees in Maryland and Virginia, and tariff uncertainty weighing on customers. He pointed to originations being "kind of flattish year-over-year" as a positive sign: "That's better than it's been... You kind of believe that, boy, things are... that's a change, and part of it is pivot, but some of it may be some thaw."

On Diagnostics Being Down: Management explained the decline was due to product mix, not demand issues. "In the second and third quarter, we had launched the Triton... it must be $4,000-$4,500. This quarter we launched the MT2600, which is an entry-level thing, which is substantially lower in price."

On Critical Industries Momentum: Regarding the mid-single digit growth in critical industries exiting Q4, Pinchuk was bullish: "Our array of custom kits keeps growing... that's what allowed us to catch up at the end. We really pumped it up. If you looked at October and November, it wasn't the greatest time... and then they came roaring back." He added momentum should carry into 2026.

On Competition: Pinchuk dismissed competitive concerns: "When I get on a van, and I do all the time... they seldom mention the competition. People decide to buy a Snap-on product, or they decide to choose from a bunch of other alternatives. That's really the way it is. We're not actually competing with those guys for the same people."

On Capital Allocation Priorities: Management outlined priorities: (1) working capital to fund potential sales growth, (2) dividend perpetuity and growth (16 consecutive annual increases), (3) acquisitions (though "quite often you look closer, and you find out so many warts"), and (4) share buybacks (~$80M in Q4).

Full Year 2025 Results

Key adjustments in FY 2025:

- $16.2M ($0.31/share) after-tax benefit from a legal settlement

- $18.5M ($0.35/share) after-tax YoY increase in non-service net periodic benefit costs

Balance Sheet & Capital Allocation

Snap-on ended fiscal 2025 with a fortress balance sheet:

- Cash: $1,624.5M (up $264M YoY)

- Total Debt: $1,202.6M

- Net Debt: Negative $421.9M (net cash position)

- Net Debt to Capital: -7.7%

Capital returns in Q4 2025:

- Dividends paid: $126.7M

- Share repurchases: $80.4M

- Total return to shareholders: $207.1M

Full year capital returns:

- Dividends: $462.2M (vs $406.4M prior year)

- Share repurchases: $328.6M (vs $290.0M prior year)

What Did Management Guide?

For 2026, Snap-on provided limited but constructive commentary:

- Capital expenditures: ~$100 million

- Effective tax rate: 22-23%

- Strategy: Continued progress along "decisive runways for coherent growth"

Management highlighted three strategic priorities:

- Enhance the franchise network through design, manufacturing, and marketing investments

- Expand position with shop owners and managers serving rising vehicle repair complexity

- Extend in critical industries with customized solutions

Risks and Concerns

Tariff uncertainty remains elevated. Management called out "fluctuating tariff levels" as a key source of customer uncertainty. With significant manufacturing operations globally, further trade policy changes could impact margins.

U.S. technician demand softening. The Snap-on Tools segment saw low single-digit declines in U.S. sales, suggesting the core franchise customer base remains cautious on big-ticket purchases.

Margin pressure persists. Despite RCI initiatives, higher material costs and mix shifts to lower-margin businesses compressed operating margins across segments.

Working capital investment. Changes in working investment increased by $148.6 million in 2025 vs $16.1 million in 2024, primarily due to inventory build and receivables growth.

Forward Analyst Estimates

Looking ahead, consensus expectations for the coming quarters:

*Values retrieved from S&P Global

Key Takeaways

-

EPS beat, revenue slight miss — Solid execution in a challenging environment, with critical industries momentum offsetting U.S. Tools softness. The "Boom, shakalaka" 150 bps gross margin improvement in Tools Group was a standout.

-

Green shoots emerging — Originations stabilizing, sales off van exceeding sales to van, and management citing a potential "thaw" in technician uncertainty all suggest improving conditions ahead.

-

Product innovation pipeline firing — NanoAxcess power tools, MT2600 diagnostics, and new tool storage configurations are driving both sales and margin improvement with shorter payback items.

-

Balance sheet optionality — $1.6B cash and net cash position provides flexibility for M&A (actively looking), 17th consecutive dividend increase, or weathering macro storms.

-

AI positioning underappreciated — RS&I's large language model-powered diagnostic tools converting "billions of data points within microseconds" positions Snap-on as a tech-enabled industrial, not just a tool company.

Analysis based on Snap-on Q4 2025 earnings release and investor presentation dated February 5, 2026.

Related Links: