Snap (SNAP)·Q4 2025 Earnings Summary

Snap Beats Q4, Posts First Quarterly Profit in Years, Stock Jumps 4% After-Hours

February 4, 2026 · by Fintool AI Agent

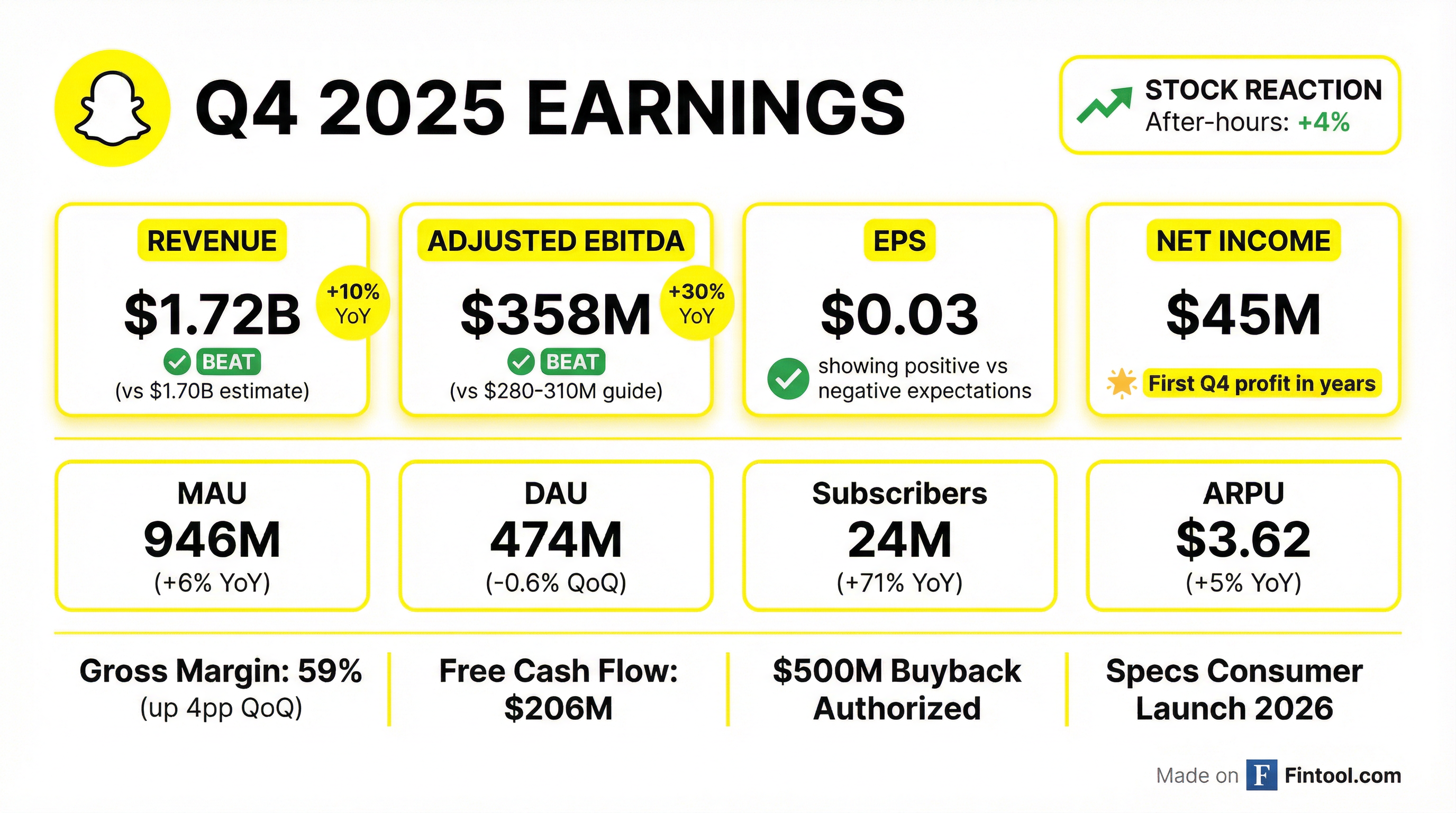

Snap delivered a pivotal Q4 2025, posting its first quarterly net income in years at $45M while beating revenue estimates and crushing its own EBITDA guidance . The "Crucible Moment" strategy CEO Evan Spiegel laid out last fall is translating into measurable margin expansion, with gross margins hitting 59% (up 4pp sequentially) and Adjusted EBITDA margins reaching 21% . The stock jumped 4% in after-hours trading on the profitability milestone, though soft Q1 guidance tempered some enthusiasm.

Did Snap Beat Earnings?

Yes — across the board.

Snap has now beaten EPS estimates in 7 of the last 8 quarters , with particularly strong performance in the back half of 2025 as the pivot to profitable growth took hold.

Revenue breakdown:

- Advertising revenue: $1.48B (+5% YoY)

- Other Revenue (Snapchat+ subscriptions): $232M (+62% YoY)

- Subscribers: 24M (+71% YoY)

The subscription business is now providing meaningful revenue diversification, contributing nearly 14% of total revenue.

What Did Management Guide?

Q1 2026 guidance came in slightly below consensus:

Full Year 2026 cost structure guidance:

- Infrastructure costs: $1.6-$1.65B (flat YoY at low end)

- Adjusted Operating Expenses: ~$3.0B

- SBC and related: ~$1.2B

- Adjusted Cost of Revenue: 16-17% of revenue (improving 1-2pp vs 2025)

The company explicitly stated its medium-term goal is achieving "meaningful Net Income profitability" — a notable shift from the historical focus on Adjusted EBITDA.

Capital allocation: Snap authorized a new $500M stock repurchase program, signaling confidence in its balance sheet ($2.9B cash) and sustained free cash flow generation .

How Did the Stock React?

The after-hours pop reflects investor relief at the profitability milestone. SNAP had been under significant pressure heading into earnings, down over 20% YTD as of late January .

Context on price levels:

- 52-week high: $11.57

- 52-week low: $5.86 (hit today)

- Current market cap: ~$10B

What Changed From Last Quarter?

The Q4 results validate the strategic pivot Snap announced in its "Crucible Moment" letter last fall :

The margin expansion is coming from three sources:

- Infrastructure efficiency: Better calibrating cost-to-serve with monetization potential by geography

- Higher-margin ad placements: Sponsored Snaps and Spotlight growing faster than lower-margin inventory

- Subscription scale: Snapchat+ at 24M subscribers provides high-margin recurring revenue

Notably, CFO Derek Andersen clarified that AI/ML investment will continue — the infrastructure moderation is focused on cost-to-serve optimization by geography, not cutting compute for the ad platform or content ranking .

Key Management Quotes

"Our Q4 results began to reflect the impact of our strategic pivot toward profitable growth, translating into revenue diversification and meaningful margin expansion. This progress reflects our commitment to building a more financially efficient and profitable business while continuing to invest in the future of augmented reality and the consumer launch of Specs." — Evan Spiegel, CEO

The investor letter emphasized that Snap will "grade our performance on our progress toward achieving meaningful Net Income profitability over the medium term" .

Advertising Platform Update

Direct Response (DR) continues to outperform:

- In-App Optimizations revenue: +89% YoY

- Dynamic Product Ads revenue: +19% YoY

- Total active advertisers: +28% YoY

SMBs drove the majority of ad revenue growth for the sixth consecutive quarter , highlighting Snap's success in expanding beyond large brand advertisers.

Sponsored Snaps gaining traction:

- Click-through rates: +7% QoQ

- Click-through purchases: +17% QoQ

Platform performance improvements:

- DPA: 55% reduction in cost per action for 7-0 conversions, 45% for 1-0 conversions

- Promoted Places: 65% reduction in cost for incremental visit, double-digit visitation lift

The format allows brands to engage directly in the inbox, offering a differentiated placement that commands premium pricing.

User Metrics: Quality Over Quantity

The tradeoff is intentional:

Snap is explicitly deprioritizing community growth in low-monetization markets to focus on profitable users:

"The decline in Global DAU in Q4 reflects, in part, our decision to substantially reduce our community growth marketing investments in order to focus on more profitable growth."

Regional DAU trends:

- North America: 94M (-5% YoY) — decline in lower-value users

- Europe: 98M (-1% YoY)

- Rest of World: 282M (+11% YoY)

The North America DAU decline is concerning, but ARPU expanded 12% YoY to $10.88, suggesting Snap is successfully monetizing its core audience more effectively .

Specs Consumer Launch 2026

Snap confirmed the consumer launch of Specs (next-gen AR glasses) is on track for 2026 :

- All Lenses built today for Spectacles will be compatible with Specs at launch

- Testing Snap Cloud (powered by Supabase) for advanced backend capabilities

- Partners building experiences: Star Wars: Holocron Histories from ILM now live

- 450,000+ creators have built 5M+ lenses using Snap's AR and AI tools

Evan emphasized developing a standalone brand identity for Specs, noting the product appeals to a different audience segment than core Snapchat users . On capitalization, he left the door open to raising external capital post-launch: "There may be opportunities to raise additional capital to accelerate, balancing that with ownership interest and potential dilution" .

Adjusted Operating Expense guidance includes incremental investments for Specs go-to-market .

Risks and Regulatory Headwinds

Age verification requirements: Snap implemented platform-level age verification in Australia, removing ~400K accounts . Testing Apple's Declared Age Range API and awaiting Google's solution. This could create near-term engagement pressure as implementation expands .

Perplexity integration uncertainty: Q1 guidance explicitly excludes potential revenue from the Perplexity AI integration as the companies have "yet to mutually agree on a path to a broader roll out" .

Legal costs elevated: Higher litigation and regulatory compliance costs were flagged as an ongoing OpEx driver .

Key Engagement KPIs

Evan Spiegel highlighted strong engagement trends across Snap's core surfaces:

The 90% YoY growth in monthly gamers reflects new 2-player turn-based games like mini golf and Magic Jump, designed for low-friction friend engagement .

Q&A Highlights

On Specs Capitalization (Ken Gawrelski, Wells Fargo):

"Longer term... there may be opportunities to raise additional capital to accelerate, balancing that obviously with our own sort of ownership interest and any potential dilution. Right now, given that we're so close to launch, the key here is really just nailing the launch." — Evan Spiegel

On AI-Generated Code (Justin Patterson, KeyBank):

"Something like 40% of new code at Snap is AI-generated. We made a ton of headway with trust and safety and customer service in terms of automating those workflows... This is just a massive force multiplier for a small team like ours." — Evan Spiegel

On Regulatory Revenue Exposure (Dan Salmon, New Street Research):

"If you look at global ad revenue from impressions served to users under the age of 18, that revenue is not material. So looking at the revenue-generating potential of business looking forward, we're not overly concerned about the changing regulatory environment." — Evan Spiegel

On Subscription Growth Drivers (Rich Greenfield, LightShed):

"Memory storage plans were a big driver of the subscriber growth that we've seen recently and also have helped improve retention rates overall... We've got some other great features on deck coming up this year for the direct pay segment." — Evan Spiegel

On Ad Business Momentum (Ross Sandler, Barclays):

"We've seen especially strong growth in the medium customer segment globally, with medium customers in North America, in particular, being the largest contributor to absolute dollar growth... We do continue to face some headwinds in the North America large customer business, but there are some bright spots there, including Financial Services and Autos." — Derek Andersen, CFO

Forward Catalysts to Watch

- Q1 2026 earnings (late April/May): Will net income profitability sustain?

- Specs consumer launch: Pricing, distribution, and initial reception

- Subscriber growth: Can Snapchat+ reach 30M+ by year-end?

- ARPU expansion: NA ARPU trajectory toward Instagram/Facebook levels

- Share repurchases: Pace of $500M buyback execution

Key Takeaways

Related: