Sanofi (SNY)·Q4 2025 Earnings Summary

Sanofi Delivers Double Beat as Dupixent Surges 32% in Q4

January 29, 2026 · by Fintool AI Agent

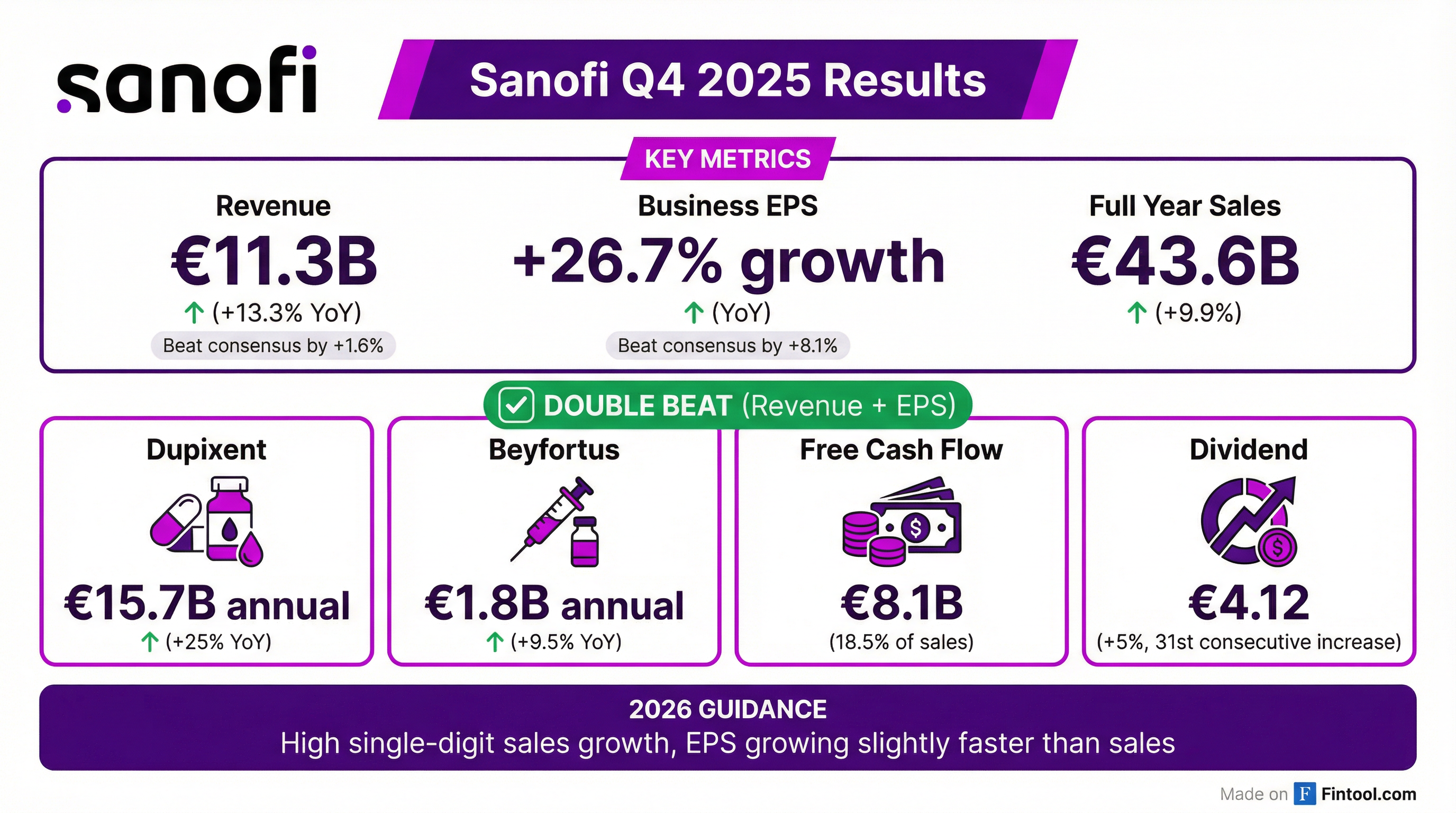

Sanofi reported Q4 2025 results that exceeded expectations on both revenue and earnings, capping a transformational year for the French biopharma company. Revenue beat consensus by 1.6% while business EPS surprised by 8.1%, driven by blockbuster growth from Dupixent and disciplined operational execution. The stock is trading up ~1% following the release.

Did Sanofi Beat Earnings?

Yes — Sanofi delivered a double beat in Q4 2025. The company posted its strongest quarterly sales growth, with net sales reaching €11.3 billion (+13.3% at constant exchange rates) and business EPS growth of 26.7%.

Values retrieved from S&P Global

For the full year 2025, Sanofi achieved sales of €43.6 billion (+9.9% CER), at the upper end of guidance, with business EPS growing 15% including the benefit of share buybacks.

What Drove the Beat?

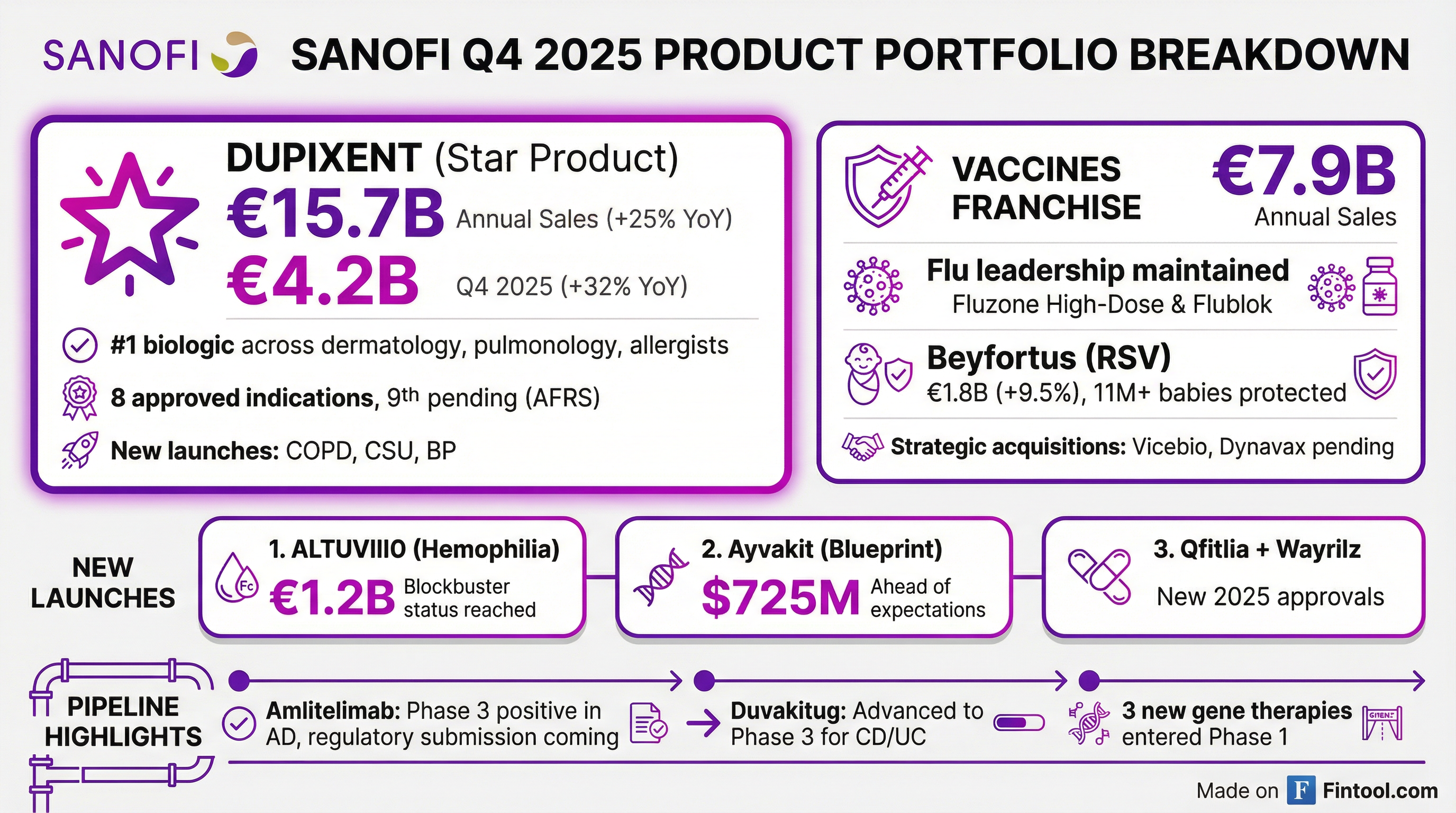

Dupixent remains the star performer, delivering €4.2 billion in Q4 alone (+32% YoY) and €15.7 billion for the full year. The company added more than 30% new patients over the past year across all indications.

Key growth drivers in Q4:

- Dupixent: €4.2B quarterly sales, now the #1 prescribed biologic across dermatologists, pulmonologists, allergists, and ENT specialists. New indications in COPD, CSU, and bullous pemphigoid accelerated growth.

- Vaccines: €7.9B full year sales. Beyfortus (RSV) reached €1.8B (+9.5%), protecting 11+ million babies across 45+ countries and preventing an estimated 200,000 hospitalizations.

- ALTUVIIIO: Achieved blockbuster status with €1.2B in annual sales, with patients switching from both factor and non-factor medicines.

- Operational leverage: Business gross margin expanded 1.8 percentage points to 77.5%, while OPEX as a percentage of sales declined to 39.9%.

How Did the Stock React?

Sanofi shares (SNY) are trading up approximately 1% at $46.22 in early trading following the earnings release. The stock had declined ~3.5% over the prior two trading sessions ahead of the report.

Market data as of January 29, 2026

The muted reaction likely reflects that much of the beat was anticipated, with the stock having declined into earnings and the company maintaining (rather than raising) its growth trajectory for 2026.

What Did Management Guide?

Sanofi guided for continued profitable growth in 2026, expecting high single-digit sales growth with business EPS growing slightly faster than sales. Management emphasized this growth profile should continue for "at least five years."

CFO François noted several dynamics impacting 2026:

- Regeneron reimbursement: R&D reimbursement from Regeneron to decrease by ~€400M in 2026 and ~€700M in 2027

- Amvutra royalties: Expected to reach ~€1B in 2026, up from ~€500M in 2025, more than offsetting the Regeneron headwind

- Tariffs: Minimal impact following agreement with U.S. administration in December 2025

What Changed From Last Quarter?

Several notable shifts emerged in Q4 versus Q3 2025:

1. Dupixent acceleration: Q4 growth of 32% significantly outpaced Q3's performance, driven by new indication launches reaching scale. The company is now "well on track" to deliver >€22B by 2030.

2. Free cash flow normalization: FCF returned to €8.1B (18.5% of sales), up meaningfully from earlier quarters. Management targets sustainable FCF of ≥20% of sales in the medium term.

3. Strategic M&A activity: Completed acquisition of Vicebio (bivalent RSV/hMPV vaccine candidate) and announced proposed Dynavax acquisition (Heplisav-B hepatitis vaccine, shingles pipeline).

4. Buyback completion: Finished €5B share buyback program, with €1B new program announced for 2026.

5. Dividend increase: Proposed dividend of €4.12 (+5%), marking the 31st consecutive year of dividend increases.

Q&A Highlights: What Analysts Asked About

Dupixent Competition & Biologic Penetration

When asked about competition from Rhapsido in CSU and Nucala in COPD, management emphasized the low penetration rates across immunology indications:

"AD is only 18% still to date, and it's more than eight years into our launch. CSU, we believe, is in the low teens... This is a place where you're going to continue to see the market growth as well, which is great when we have new competitors come in."

Amlitelimab Opportunity in Atopic Dermatitis

On the phase 3 data for their novel T-cell modulator Amlitelimab:

"The addition of a T cell modulator with the promise of long-term immune normalization is obviously very attractive in the conversation... This molecule remains aligned with our initial benefit-risk assessment, which is ever so important in this space, which is hugely biologically underpenetrated."

Management expects to present COAC1 data at the American Academy of Dermatology meeting in late March 2026.

Dupixent Patent Protection Post-2031

On intellectual property defense:

"We do expect Dupixent to be protected by its patents beyond March 2031 in the U.S. That's the reality... We believe we have a very strong patent portfolio, which we intend to vigorously defend."

The company cited multiple patents ranging from 2031 to 2035 across various indications and innovations.

Capital Allocation Priorities

On M&A firepower and strategy:

"We will remain very disciplined... €15 billion was the technical limitation to preserve our wallet rating... We are interested predominantly in strengthening our position in our four existing TAs plus potentially white spaces."

Management emphasized focus on phase 1/2 assets as a priority, with potential for commercialized assets to mitigate the Dupixent LOE impact.

Key Pipeline Updates

Risks and Concerns

1. U.S. pediatric vaccination schedule changes: Recent shifts to a three-tiered childhood vaccination framework could create confusion for parents and providers, potentially impacting Beyfortus uptake. However, medical societies continue to recommend current schedules and all vaccines remain covered by insurance.

2. Regeneron profit-sharing headwind: R&D reimbursement from Regeneron will decline ~€700M in 2027 as the Dupixent development program matures. Partially offset by Amvutra royalties.

3. Vaccine volatility: Management expects vaccine sales to slightly decline in 2026, with Beyfortus dynamics uncertain in the U.S. following regulatory changes.

4. Pipeline setbacks: Tolebrutinib did not meet its primary endpoint in PPMS and will not be pursued for that indication.

Forward Catalysts

The Bottom Line

Sanofi delivered a clean double beat in Q4 2025, capping a strong year of execution. Dupixent continues to be the primary growth engine with substantial runway remaining across underpenetrated indications. The company's transformation into an "R&D-driven, AI-powered biopharma company" appears on track, with promising late-stage assets in Amlitelimab and Duvakitug potentially extending growth beyond the Dupixent patent cliff in the early 2030s.

The guidance for high single-digit growth in 2026 is consistent with prior messaging, suggesting no major surprises ahead. Key debates for investors center on Dupixent's competitive moat post-2031, Amlitelimab's commercial potential in atopic dermatitis, and the company's ability to deploy its €15B+ M&A firepower effectively.