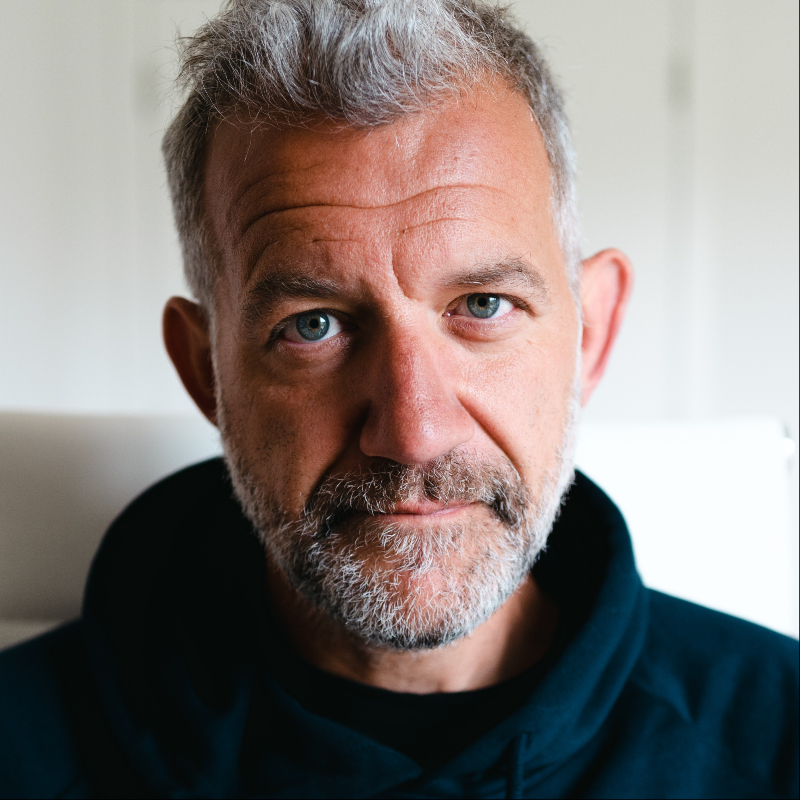

Tom Conrad

About Tom Conrad

Tom Conrad, 55, is Sonos’ Interim Chief Executive Officer and President (appointed January 13, 2025) and a director since March 2017. He holds a B.S.E. in computer science from the University of Michigan and is a seasoned product and technology leader across consumer software and audio streaming . During FY2024, Sonos delivered $1,518.1 million in revenue, Adjusted EBITDA of $107.9 million, and free cash flow of $135 million; NEO annual bonuses paid 0% and PSUs for the FY2024 tranche earned 0% based on below-threshold revenue and margin—evidence of pay-for-performance rigor heading into his tenure .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Zero Longevity Science (Zero app) | Chief Executive Officer | 2021–2025 | Led growth of subscription digital health platform |

| Quibi | Chief Product Officer | 2019–2021 | Built team and product from scratch for short-form streaming service |

| Snap Inc. | VP, Product | 2016–2018 | Oversaw product innovations to strengthen engagement and user growth |

| Pandora Media | CTO and EVP, Product | 2004–2014 | Drove development of personalized streaming at scale; core audio content expertise |

| Apple | Early career, UI work on Macintosh | Early career | Foundational UI experience |

External Roles

| Organization | Role | Years | Notes |

|---|---|---|---|

| Public company boards | None | — | Sonos proxy lists none for Tom Conrad |

Fixed Compensation

| Role | Period | Base Salary (Cash) | Director Fees (Cash) | Director Equity (Grant-Date Value) | Notes |

|---|---|---|---|---|---|

| Interim CEO & President | Commencing Jan 13, 2025 (until permanent CEO appointed) | $2,100,000 annual ($175,000/month) | $0 while serving as Interim CEO | $2.65 million RSUs (service-vesting) | RSUs vest 1/6 per month of Interim CEO service; vesting ceases when service ends |

| Director (non-employee) | FY2024 | — | $75,000 | $203,103 | Elected to defer settlement of annual RSU grants (see ownership) |

Performance Compensation

Sonos’ executive incentive structure emphasizes revenue and margin with DEI modifiers; FY2024 outcomes paid at zero for NEOs.

- Annual bonus framework (FY2024): 45% revenue, 45% Adjusted EBITDA margin, 10% DEI; revenue and margin below threshold; DEI result waived → 0% payout .

| Metric | Weighting | FY2024 100% Payout Target | FY2024 Actual | Payout |

|---|---|---|---|---|

| Revenue ($ millions) | 45% | $1,750 | $1,518.1 | 0% (below threshold) |

| Adjusted EBITDA Margin (%) | 45% | 10.60% | 7.1% (Adj. EBITDA $107.9m) | 0% (below threshold) |

| DEI Objectives | 10% | Qualitative (miss/met/exceed) | 25% achievement determined; waived to 0% due to financials | 0% |

PSUs (FY2024 performance tranches):

- FY2024 tranches (for FY2024, FY2023, FY2022 PSU grants) earned 0.0% based on revenue and Adj. EBITDA margin below threshold .

| PSU Tranche | Performance Period | Metric Mix | Attainment | Notes |

|---|---|---|---|---|

| FY2024 tranche of FY2024 awards | FY2024 | 50% Revenue / 50% Adj. EBITDA Margin | 0.0% | Earned at 0% for year 1 |

| FY2024 tranche of FY2023 awards | FY2024 | Same as above | 0.0% | Earned at 0% for FY2024 tranche |

| FY2024 tranche of FY2022 awards | FY2024 | Same as above | 0.0% | Earned at 0% for FY2024 tranche |

Tom-specific equity as Interim CEO: $2.65 million RSUs vesting monthly (time-based), no explicit performance conditions tied to this interim grant .

Equity Ownership & Alignment

| Aspect | Detail |

|---|---|

| Total beneficial ownership (12/31/2024) | 69,100 shares; <1% of outstanding |

| Breakdown | 19,830 shares held; 31,766 options exercisable within 60 days; 7,493 RSUs vested (settle Jan 1, 2025); 10,011 RSUs vested (settle Jan 1, 2026) |

| Director RSUs (as of 9/28/2024) | 10,656 unvested; 17,504 vested but settlement deferred (director program) |

| Interim CEO grant | $2.65m RSUs vest 1/6 per month of interim service; ceases upon end of interim role |

| Ownership guidelines | CEO 10x salary; other NEOs 5x; Directors 5x; 5-year compliance window; retain 50% after-tax shares until met |

| Hedging/pledging | Hedging prohibited; pledging only in limited cases with approval; none approved FY2024 |

| Trading controls | Officers/directors must transact under Rule 10b5-1 trading plans; blackout restrictions and preclearance in policy |

Implications:

- Monthly vesting RSUs can create steady vest-driven liquidity windows (potential selling pressure) but are offset by stringent ownership guidelines and anti-hedging rules .

Employment Terms

| Term | Key Provisions |

|---|---|

| Appointment | Interim CEO and President effective Jan 13, 2025; continues until permanent CEO appointment |

| Cash compensation | $175,000 per month ($2.1m annualized) |

| Equity | $2.65m RSUs, vesting 1/6 per month of Interim CEO service; vesting stops when interim service ends |

| Director pay | Suspended while serving as Interim CEO |

| Change-in-control and acceleration (plan-level) | Company equity plan provides no single-trigger acceleration; double-trigger acceleration within 2 months prior to or 12 months post change-in-control for employee RSUs/PSUs; PSU treatment at target or based on earned tranche per plan |

| Clawback | Dodd-Frank compliant clawback policy for excess incentive comp tied to restatements |

| Insider trading | 10b5-1 plan requirement; blackout and preclearance; hedging prohibited; pledging restricted |

Board Service and Governance

- Director since March 2017; previously chaired the Compensation, People and Diversity & Inclusion (CPD&I) Committee; upon Interim CEO appointment, he stepped down from the CPD&I Chair and membership and ceased serving on any board committee .

- Independence status: Non-independent director while serving as Interim CEO; six of seven directors otherwise independent; Chair and CEO roles remain separated (Chair: Julius Genachowski) .

- Director compensation policy: $55,000 cash retainer; additional retainers for chair/committee roles; ~ $200,000 annual RSU; change-in-control acceleration for director RSUs; deferral optionality used by Conrad .

- Say-on-pay support: >96% approval at 2024 annual meeting; Board recommends annual frequency .

Performance & Track Record Context

| Metric | FY2023 | FY2024 | Notes |

|---|---|---|---|

| Revenue ($ millions) | 1,655.0 | 1,518.1 | FY2024 below FY2023 amid app issues and category softness |

| Adjusted EBITDA ($ millions) | 153.9 | 107.9 | Margin sensitive to execution and investment |

| Free Cash Flow ($ millions) | 50.1 | 135.0 | Significant improvement FY2024 |

| Capital returns | $100m repurchases FY2023; $129m repurchases under 2023–2024 authorizations | ||

| Execution updates | Major app redesign in May 2024 underperformed; recovery plan with $20–$30m investment and ~20 software updates; quality/process commitments outlined Oct 2024 |

Compensation Structure Analysis

- Shift towards retention: Interim CEO package is 100% time-based RSUs with monthly vesting—appropriate for a transitional mandate but lower performance linkage than PSU-heavy structure used for permanent NEOs (50% RSU/50% PSU) .

- Pay-for-performance discipline intact: FY2024 NEO annual bonus and PSU tranches paid at 0%—clear downside alignment when financial thresholds are missed .

- Ownership alignment: Elevated ownership multiples (10x CEO) and 10b5-1, anti-hedging policy support alignment; director RSU deferrals increase long-term exposure .

Investment Implications

- Incentive alignment and downside risk-sharing are robust: zero FY2024 payouts on core incentives, anti-hedging, and rigorous ownership policy reduce misalignment risk during Conrad’s interim leadership .

- Watch monthly vest-driven supply and 10b5-1 plans: the $2.65m RSU grant vesting monthly could create periodic selling pressure; monitor Form 4s and plan adoptions alongside progress on app remediation and product execution .

- Governance quality mitigates dual-role risk: Chairman/CEO split maintained; Conrad is non-independent and off committees, addressing independence concerns; say-on-pay support (>96%) suggests low near-term governance contention .

- Execution pivot is key catalyst: Conrad’s product pedigree (Pandora, Snap, Quibi) aligns with near-term mandate to restore app reliability and customer experience; performance recovery should flow through FY2025–FY2026 PSU tranches for the broader team and margin trajectory .