Earnings summaries and quarterly performance for Sonos.

Executive leadership at Sonos.

Board of directors at Sonos.

Research analysts who have asked questions during Sonos earnings calls.

Erik Woodring

Morgan Stanley

6 questions for SONO

Also covers: AAPL, CDW, CRCT +19 more

SF

Steven Frankel

Rosenblatt Securities

4 questions for SONO

Also covers: DLB, HLIT, IMAX +4 more

AF

Alex Fuhrman

Craig-Hallum Capital Group LLC

2 questions for SONO

Also covers: APYX, ATER, BNED +22 more

Brent Thill

Jefferies

2 questions for SONO

Also covers: ADBE, AMZN, ASAN +27 more

LK

Logan Katzman

Raymond James Financial

2 questions for SONO

Also covers: ARLO, NTGR, SCSC

Rayyana Matraji

Jefferies

2 questions for SONO

SF

Steve Frankel

Rosenblatt

2 questions for SONO

Also covers: DLB, IMAX, UTI

J

John

Raymond James

1 question for SONO

Also covers: BCRX, BOX, GTM +1 more

MC

Mark Cash

Raymond James

1 question for SONO

Also covers: ARLO, CFLT, FROG +5 more

Recent press releases and 8-K filings for SONO.

Sonos Reports Strong Q1 Results, Provides Mixed Q2 Guidance

SONO

Earnings

Guidance Update

Share Buyback

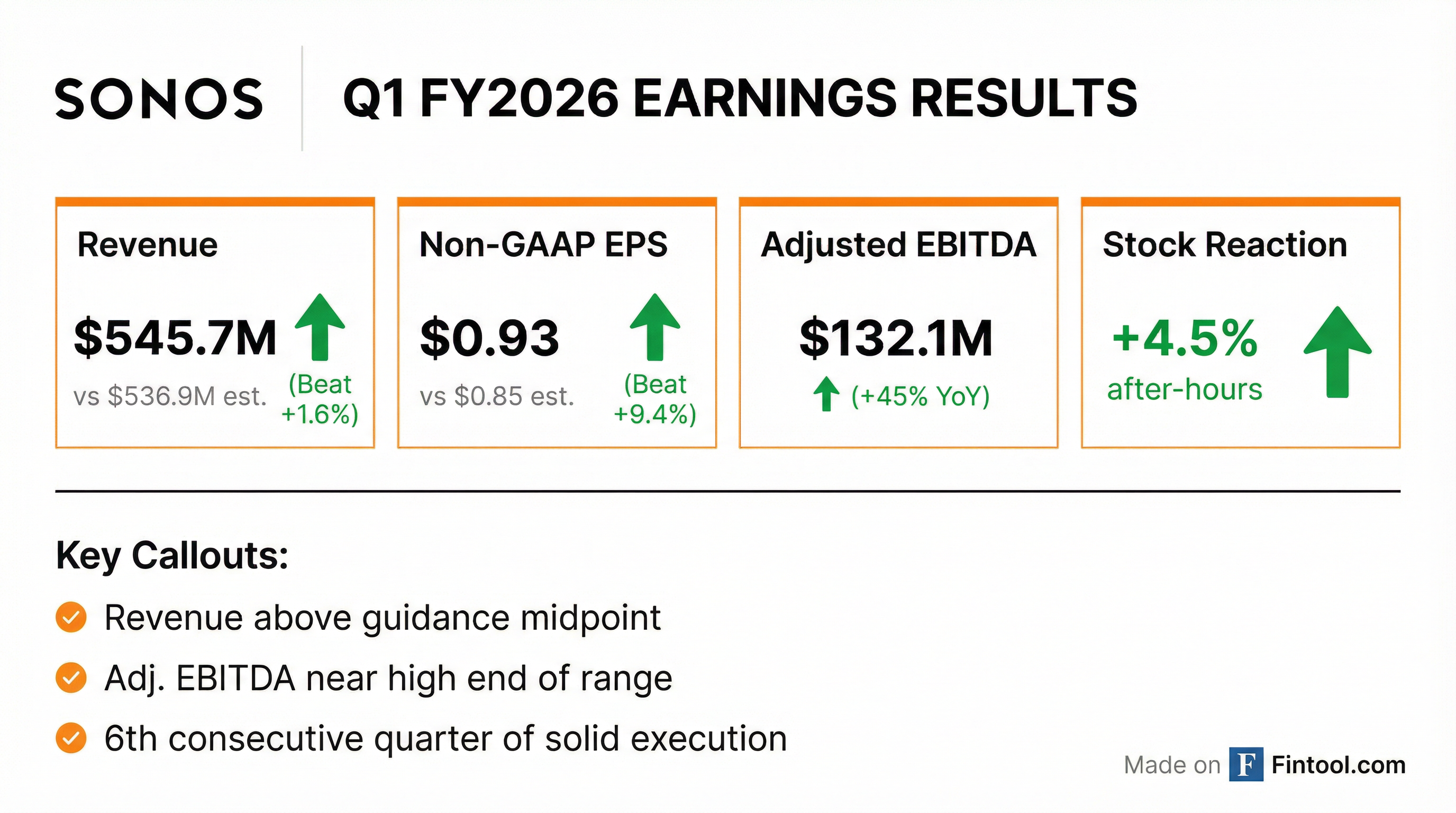

- Sonos reported Q1 revenue of $546 million (down 1% year over year) and significant margin improvements, with GAAP gross margin rising to 46.5% and adjusted EBITDA reaching $132 million, resulting in a 24.2% adjusted EBITDA margin.

- The company posted $0.93 non-GAAP earnings per share, up 37% year over year, and generated $157 million in free cash flow, ending Q1 with $363 million in net cash.

- Sonos repurchased $25 million of stock and provided mixed Q2 guidance, forecasting adjusted EBITDA between a loss of $18 million and a gain of $10 million, and GAAP gross margin of 44–46%.

- First-half revenue guidance is projected to be between $796 million and $826 million.

Feb 3, 2026, 11:35 PM

Sonos Reports Strong Q1 2026 Results and Provides Q2 Guidance

SONO

Earnings

Guidance Update

Product Launch

- Sonos reported strong Q1 fiscal 2026 financial results, with revenue of $546 million, gross profit dollars growing 5% year-over-year, and Adjusted EBITDA increasing 45% year-over-year to $132 million.

- For Q2 fiscal 2026, the company expects revenue between $250 million and $280 million and Adjusted EBITDA in the range of -$18 million to $10 million.

- The company is focused on returning to growth in fiscal 2026, with new products planned for the second half of the year, including the recently unveiled Sonos Amp Multi, and is seeing accelerating new customer growth (over 40% year-over-year) from its Era 100 product.

- Despite a 300 basis point tariff headwind, Sonos achieved a non-GAAP gross margin of 47.5% in Q1, largely due to pricing adjustments and cost reductions, and repurchased $25 million of shares.

Feb 3, 2026, 9:30 PM

Sonos Reports Strong Q1 2026 Results and Outlines Growth Strategy

SONO

Earnings

Guidance Update

Product Launch

- Sonos reported strong Q1 fiscal 2026 results, with revenue of $546 million, Adjusted EBITDA of $132 million (up 45% year-over-year), and non-GAAP EPS of $0.93 (up 37% year-over-year).

- The company issued Q2 fiscal 2026 guidance, projecting revenue between $250 million and $280 million (up 2% year-over-year at the midpoint) and Adjusted EBITDA between -$18 million and $10 million.

- Sonos unveiled Sonos Amp Multi and plans further new product launches in the second half of fiscal 2026, anticipating a return to growth for the full fiscal year. The price reduction for Era 100 contributed to a more than 40% year-over-year increase in new customer growth starting with the product.

- In Q1 2026, Sonos repurchased $25 million of shares at an average price of $16.79, reducing its share count by 1.2%.

Feb 3, 2026, 9:30 PM

Sonos Reports Strong Q1 2026 Results and Provides Q2 Guidance

SONO

Earnings

Guidance Update

Share Buyback

- Sonos reported strong Q1 fiscal 2026 results, with revenue of $546 million, gross profit dollars growing 5% year-over-year, and Adjusted EBITDA increasing 45% to $132 million. Non-GAAP EPS reached $0.93, up 37% year-over-year.

- The company achieved Q1 Adjusted EBITDA equivalent to its entire fiscal 2025 total, reflecting over $100 million in run rate savings and a 24.2% Adjusted EBITDA margin. Gross margin was positively impacted by cost reductions and FX, despite a 300 basis point tariff headwind largely offset by pricing adjustments.

- For Q2 fiscal 2026, Sonos expects revenue between $250 million and $280 million, representing a 2% year-over-year increase at the midpoint. First-half fiscal 2026 revenue is projected to be flat year-over-year at the midpoint.

- Strategic growth initiatives, including a price reduction for Era 100, led to over 40% year-over-year growth in new customer starts in Q1. New product launches, such as Sonos Amp Multi, are slated for the second half of fiscal 2026 to accelerate growth.

- Sonos returned capital to shareholders by repurchasing $25 million in shares at an average price of $16.79 in Q1, reducing the share count by 1.2%, with $105 million remaining in its authorization. The company maintains a strong balance sheet with $363 million in net cash.

Feb 3, 2026, 9:30 PM

Sonos Reports Q1 2026 Financial Results with Strong Profitability Amidst Revenue Decline

SONO

Earnings

Layoffs

New Projects/Investments

- Sonos reported Q1 2026 revenue of $546 million, representing a 1% decrease year-over-year.

- The company achieved significant profitability improvements, with Adjusted EBITDA increasing by 45% year-over-year to $132 million, and Non-GAAP EPS rising by 37% year-over-year to $0.93.

- These improvements were driven by a 280 basis point expansion in Non-GAAP Gross Margin to 47.5% and a 19% reduction in Non-GAAP Operating Expenses to $137 million.

- Sonos generated $157 million in Free Cash Flow in Q1 2026, an increase of $14 million year-over-year.

- The company's transformation efforts, including functional reorganization, prioritization of customer acquisition cost (CAC) efficiency, and workforce optimization, contributed to these financial improvements.

Feb 3, 2026, 9:30 PM

Sonos Reports First Quarter Fiscal 2026 Results

SONO

Earnings

Product Launch

Guidance Update

- Sonos, Inc. reported First Quarter Fiscal 2026 revenue of $546 million, which was above the midpoint of its guidance range.

- The company achieved GAAP net income of $94 million and GAAP diluted earnings per share of $0.75 for the quarter ended December 27, 2025.

- Adjusted EBITDA for Q1 FY26 was $132 million, representing a 45% expansion over the prior year and surpassing the total profit generated in all of Fiscal 2025.

- Non-GAAP diluted earnings per share for the quarter was $0.93.

- CEO Tom Conrad stated that Fiscal 2026 is off to a good start, with a focus on returning to growth and product innovation, including the announcement of Amp Multi.

Feb 3, 2026, 9:11 PM

Sonos Reports First Quarter Fiscal 2026 Results

SONO

Earnings

Revenue Acceleration/Inflection

Product Launch

- Sonos reported First Quarter Fiscal 2026 revenue of $546 million.

- The company achieved GAAP net income of $94 million and diluted EPS of $0.75, with Non-GAAP diluted EPS at $0.93.

- Adjusted EBITDA reached $132 million, representing a 45% expansion over the prior year and generating more profit in Q1 than in all of Fiscal 2025.

- Sonos's CEO noted a good start to Fiscal 2026 with progress toward growth, focusing on product innovation including the announcement of Amp Multi.

Feb 3, 2026, 9:01 PM

Sonos Unveils Amp Multi for Professional Installers

SONO

Product Launch

Demand Weakening

New Projects/Investments

- Sonos has launched the Amp Multi, a new rack-mountable, professional-grade streaming amplifier designed for large residences and custom installers.

- This product is positioned as a return to the custom-install channel and is part of a renewed hardware push under CEO Tom Conrad to boost device usage per household.

- The launch comes amid broader financial pressure, with Sonos shares having fallen approximately 14.8% in early 2026 and analysts noting multi-year revenue challenges.

Jan 27, 2026, 4:43 PM

Sonos CEO Tom Conrad Outlines Strategic Priorities and Growth Initiatives

SONO

Management Change

New Projects/Investments

Revenue Acceleration/Inflection

- Tom Conrad was named CEO of Sonos at the end of July 2025, following six months as interim CEO, and has focused on restoring software performance and operational efficiency, including removing almost $100 million of OPEX on a go-forward run rate basis for 2025-2026.

- The company's strategic direction under Conrad includes three pillars: enhanced marketing with Colleen DeCourcy joining as Chief Marketing Officer, a renewed focus on excellence in software performance and reliability, and a product assortment designed to increase the value of the overall Sonos system.

- Sonos identifies a significant growth opportunity within its existing 17 million households, estimating a $12 billion opportunity by increasing the number of products per household.

- A strategic decision to lower the price of the Era 100 speaker to $199 successfully led to a dramatic increase in new household acquisition, proving the effectiveness of this customer growth strategy.

Dec 8, 2025, 8:40 PM

Sonos CEO Tom Conrad Details Company Strategy and Operational Improvements

SONO

CEO Change

Management Change

New Projects/Investments

- Tom Conrad, named CEO at the end of July 2025, outlined Sonos's strategic direction, focusing on combining hardware excellence with platform value, emphasizing software quality, world-class marketing, and a product assortment that enhances the overall Sonos system.

- As interim CEO, Conrad and CFO Saara Casey implemented operational efficiencies, removing almost $100 million of OPEX on a go-forward run rate basis for 2025-2026.

- Sonos identifies a significant market opportunity, with 17 million existing households and a $12 billion opportunity within this installed base by increasing product penetration.

- The company is strengthening its marketing efforts with Colleen DeCourcy joining as Chief Marketing Officer in four weeks (from December 8, 2025), bringing extensive experience from Wieden+Kennedy and Snap.

- A recent strategic move to lower the price of the Era 100 speaker from $249 to $199 dramatically increased new household acquisition, validating the company's approach to expanding its customer base and demonstrating strong lifetime value from these new customers.

Dec 8, 2025, 8:40 PM

Fintool News

In-depth analysis and coverage of Sonos.

Quarterly earnings call transcripts for Sonos.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more