Spectrum Brands Holdings (SPB)·Q1 2026 Earnings Summary

Spectrum Brands Beats Q1 Estimates as Pet Care Returns to Growth, Stock Jumps 4.5%

February 5, 2026 · by Fintool AI Agent

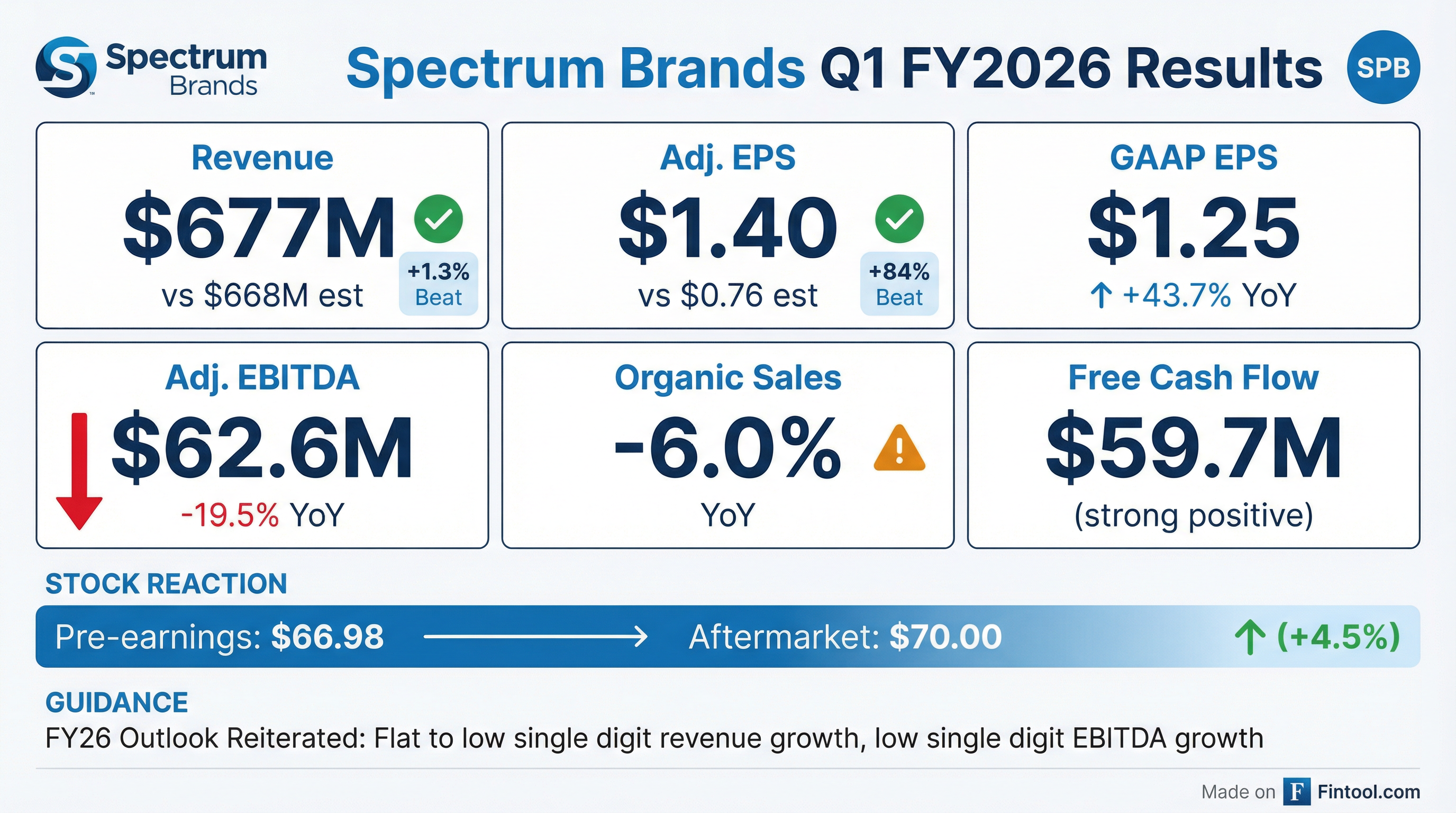

Spectrum Brands Holdings (NYSE: SPB) delivered a strong fiscal Q1 2026 earnings beat on February 5, 2026, with adjusted EPS of $1.40 crushing the $0.76 consensus estimate by 84% . Revenue of $677.0 million topped analyst expectations of $668 million by 1.3%, though declined 3.3% year-over-year . The stock surged 4.5% to $70.00 in after-hours trading following the release.

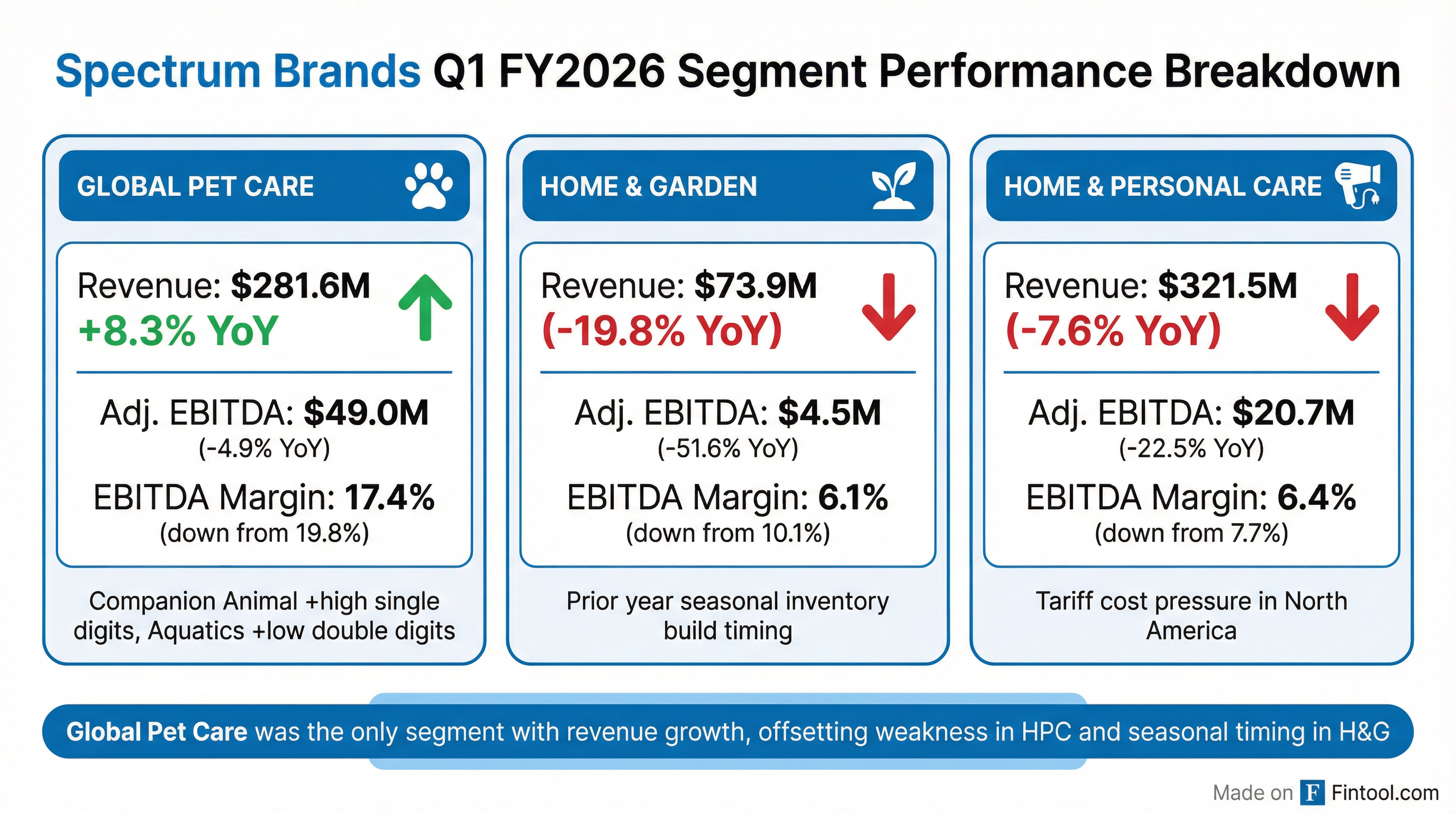

The headline story: Global Pet Care, the company's largest and most profitable segment, returned to growth with 8.3% revenue increase . This was partially offset by Home & Garden declining 19.8% due to prior-year seasonal timing and Home & Personal Care down 7.6% on tariff pressures .

Did Spectrum Brands Beat Earnings?

Yes — both revenue and EPS exceeded consensus estimates.

The massive EPS beat was driven by a one-time tax benefit and lower share count from ongoing buybacks, partially offsetting lower operating income . The company repurchased 0.6 million shares for $36 million during the quarter and announced a new $300 million share repurchase authorization .

What Did Management Guide?

FY2026 framework reiterated — no changes to outlook.

Spectrum Brands maintained its full-year fiscal 2026 guidance :

CEO David Maura emphasized confidence in the outlook: "We remain confident that Global Pet Care and Home & Garden will return to growth this fiscal year while we continue to improve the fundamentals of our Home & Personal Care business, and deliver improved profitability across all three businesses" .

The company ended Q1 with net debt leverage of 1.65x adjusted EBITDA, well below its long-term target range .

How Did the Stock React?

SPB shares rose 2.2% during regular trading to close at $68.44, then extended gains to $70.00 (+4.5% from prior close) in after-hours trading .

The stock has gained 20.3% over the past six months, outperforming the consumer products industry's 4.9% gain . Greenlight Capital recently disclosed a new position in SPB, viewing challenges past 2025 as largely resolved .

What Changed From Last Quarter?

The big shift: Global Pet Care returned to growth after quarters of decline.

Segment Performance

Global Pet Care (GPC): The star performer. Organic net sales increased 5.8% excluding favorable FX . Companion Animal grew high single digits and Aquatics grew low double digits, benefiting from a softer prior-year comparison and strategic order shifts .

Key brand momentum :

- Good 'n' Fun, DreamBone, Nature's Miracle, FURminator — all gaining market share in chews, stain and odor, and grooming categories despite premium positioning

- Good Boy — Became the third-largest brand in the overall UK pet market; expansion across continental Europe gaining traction

- Tetra NutriEvolution — Driving strong market share wins in Germany

- IAMS — Advanced nutrition positioning driving market share gains in UK dog and cat; brand expansion in France off to good start

Home & Garden (H&G): The -19.8% decline was entirely driven by prior-year timing — certain retailers pulled forward seasonal inventory purchases in Q1 FY25, creating a tough comp . Management expects H&G to return to growth for the full fiscal year.

Innovation highlights :

- Spectracide Wasp/Hornet Trap — "One of the highest penetration of any new items in overall pest control"; expanded distribution and capacity coming in FY26

- Hot Shot Flying Insect Trap — Awarded "Product of the Year"; expanded distribution planned

- Repel — Personal insect repellent brand outperforming market with refreshed graphics

Spring weather forecast favorable: "Above-average temperatures across the Southern and Eastern United States, with average precipitation levels — favorable conditions for our pest control category."

Home & Personal Care (HPC): Organic sales down 11.1% excluding FX . North American volumes fell mid-teens due to higher tariff-driven product costs . EMEA was down mid-teens with one retailer carrying higher inventory after a weak holiday season .

However, LATAM grew high teens driven by successful new product launches . Bright spots in developed markets:

- Remington — Recognized as #1 flat iron in the U.S.; AirWeave line resonating internationally

- BLACK+DECKER Ice Cream Maker — Strong consumer response at holiday launch

- TikTok Shop — UK success being rolled out to Germany and U.S.

- Coffee & Espresso — One category showing positive POS

CEO Maura flagged a new headwind: "What is occurring globally is because barriers went up here, but not other places, cheap Chinese product is hitting the rest of the globe, and it's being dumped into other markets. That is disruptive. It's causing issues for us right now in Europe."

Key Margin Dynamics

Margins compressed despite strategic cost actions:

Key margin headwinds :

- Higher tariff costs

- Lower volumes across HPC and H&G

- Increased trade spend and investment

Offsetting factors:

- Pricing actions

- Cost improvement initiatives

- Operational efficiencies

- Favorable foreign exchange

Operational Initiatives

SAP S/4HANA Deployment :

- Already implemented in North America Global Pet Care and Home & Garden

- Preparation underway for appliance business and remaining international regions

- CEO thanked teams "for their expertise, perseverance, and diligence throughout this project"

Adjusted Free Cash Flow: Generated nearly $60M in Q1 despite typically being a cash usage period . CFO noted working capital management "has been really great" and expects it to remain stable for the full year .

Capital Allocation and Balance Sheet

Spectrum Brands maintains a fortress balance sheet positioned for M&A:

Q1 Capital Deployment:

- Share repurchases: 0.6M shares for $36M

- Dividends: $10.9M

- New $300M buyback authorization approved

CEO Maura signaled M&A appetite: "We continue to believe our strong balance sheet, positive cash flow, and low leverage are a competitive advantage in an evolving M&A landscape, and that we are uniquely positioned to act as the M&A partner of choice for high-quality, synergistic assets in our sector" .

Q&A Highlights

The analyst Q&A session provided key color on forward expectations and strategic progress:

On whether pet industry has bottomed (Canaccord Genuity):

"I've been humbled more than once in my life, calling tops and bottoms, so I'm gonna pass on that. But we're significantly focused on what we can do... we're really pleased with the new leadership in pet and the investments we're making there, and the fact that we're taking market share with our main brands." — David Maura

On retailer commitment to Home & Garden (Canaccord Genuity):

"I'm actually very bullish on our Home and Garden business... honestly, as I look forward, I think we are the foot traffic driver to that category, and we see retailers leaning in with us because they get that joke, too." — David Maura

Management provided specific Q2 phasing guidance: "Q2, I wouldn't get over your skis there as you model it. I think it'll be flat, slightly up year-over-year. But that's just the phasing and then big back half for Home and Garden."

On HPC strategic process (Wells Fargo):

"A year ago, we were staring at a $500 million tariff problem... We shut down buying for literally two months. Like, that puts a lot of air in your pipeline. And we dealt with the harsh realities of that volatility, and we were upfront with our retailers, and we took pricing immediately... For us to put $20 million EBIT on the board in the last 90 days in that business, I'm pleased with it." — David Maura

Maura was blunt about competitive positioning: "Most of those other players are in a more difficult position than I am, operationally and financially. Very few players have an unlevered balance sheet and an outlook that's gonna improve profitability. This company has both... most of my competitors have got 6-12 times leverage sitting on their balance sheets, and good luck."

On Global Pet Care growth potential (Oppenheimer):

"In companion animal... that's Good 'n' Fun. It's DreamBone, it's FURminator, Nature's Miracle. To have four of these big brands back in growth feels good. More work to do. Somebody asked earlier, are we happy with innovation? I'm never happy with innovation. We need more and more and more." — David Maura

Key Management Quotes

On Q1 Performance:

"We are pleased with our results this quarter, particularly that our most profitable and largest Adjusted EBITDA contributing business, Global Pet Care, returned to growth. Our Net Sales and Adjusted EBITDA exceeded expectations despite the ongoing macroeconomic challenges that continue to impact overall consumer demand." — David Maura, Chairman and CEO

On the "Tariff Torpedo":

"This company has been healing from the tariff torpedo that hit us in fiscal 2025, as we have restored our supply chains and have taken pricing actions." — David Maura

On Strategic Direction:

"These results reinforce the effectiveness of our strategic initiatives and validate our belief that the difficult, but necessary, steps we implemented in fiscal 2025 were indeed the right course of action." — David Maura

Investment Levels and EBITDA Phasing

On brand investment (CJS Securities) :

- Corporate: ~$20M headwind from HHI TSA income exit; roughly half covered this year

- Global Pet Care & Home & Garden: "At the right level of investment"

- Home & Personal Care: Investment pulled back given top-line pressure; can dial up if second half recovers

EBITDA Phasing (Wells Fargo) :

- Q2 expected "to continue to be a little messy" in HPC

- Q3 and Q4 to deliver year-over-year EBITDA growth in HPC despite current headwinds

- Full-year HPC EBITDA expected to grow vs. FY25

Risks and Concerns

Tariff Exposure: The company flagged higher tariff costs as a significant headwind, particularly in North American HPC . Statements reflect currently known tariffs and do not include additional tariffs that could result from further trade policy changes .

Consumer Demand Softness: Macroeconomic challenges continue to impact overall consumer demand, particularly in discretionary categories .

Chinese Dumping in International Markets: CEO Maura flagged that U.S. tariffs are redirecting Chinese products to Europe and other markets, creating new competitive pressure for HPC internationally .

HPC Segment Strategic Optionality: The company ran a divestiture process that "attracted a lot of interest" but the "tariff situation threw cold water on that." Management is waiting for the industry to stabilize on input costs, sales rates, and margin structures before restarting strategic discussions.

Forward Catalysts

- Global Pet Care momentum: Four major brands (Good 'n' Fun, DreamBone, Nature's Miracle, FURminator) back in growth and gaining share

- Aquatics strategic reset: CEO Maura: "Tetra is the leader globally. It's time we start acting like it... we're gonna go out and sit down with our retailers, and we're gonna talk about the new strategy, new price points, new ways to manage the category."

- H&G seasonal normalization: Strong early POS trends; spring weather forecast favorable for pest control

- HPC consolidation positioning: "Given our outlook for improved profitability in appliances in fiscal 2026, that is going to cause the consolidation I'm sick of talking about to finally occur, and we believe we will be the strategic merger partner choice."

- Share repurchases: New $300M authorization; 800K shares repurchased YTD through February 5 for $42.3M

Related: SPB Company Profile | Q4 2025 Earnings | Latest Transcript