Earnings summaries and quarterly performance for Spectrum Brands Holdings.

Executive leadership at Spectrum Brands Holdings.

Board of directors at Spectrum Brands Holdings.

Research analysts who have asked questions during Spectrum Brands Holdings earnings calls.

Ian Zaffino

Oppenheimer & Co. Inc.

5 questions for SPB

Chris Carey

Wells Fargo Securities

4 questions for SPB

Carla Casella

JPMorgan Chase & Co.

3 questions for SPB

Madison Callinan

Canaccord Genuity

3 questions for SPB

Olivia Tong Cheang

Raymond James Financial, Inc.

3 questions for SPB

Peter Grom

UBS Group

3 questions for SPB

Will Gildea

CJS Securities

3 questions for SPB

Bob LeBig

CJS Securities

2 questions for SPB

Olivia Tong

Raymond James

2 questions for SPB

Peter Lukas

CJS Securities

2 questions for SPB

Steve Powers

Deutsche Bank

2 questions for SPB

Bob Labick

CJS Securities

1 question for SPB

Brian McNamara

Canaccord Genuity - Global Capital Markets

1 question for SPB

Christopher Carey

Wells Fargo & Company

1 question for SPB

Recent press releases and 8-K filings for SPB.

- Superior Plus Corp. reported full-year 2025 Adjusted EBITDA of $463.5 million, a 2% increase, and Free Cash Flow per share of $0.87, an 89% increase, driven by strong operating performance.

- For full-year 2026, the company expects Adjusted EBITDA to increase approximately 2% over 2025, with continued growth in propane operations offsetting a lower contribution from CNG.

- Superior repurchased 8% of its outstanding common shares in fiscal year 2025 and 13% since November 2024. A quarterly common share dividend of C$0.045 per share was also declared.

- Long-term growth expectations were revised, with the compound annual growth rate for Adjusted EBITDA from 2024 to 2027 now projected at approximately 2% (down from 8%) and free cash flow at 20-25% (down from 40%).

- The company's Q4 2025 leverage was 4.0x, and it aims to achieve a leverage ratio of approximately 3.8x by the end of 2026 and 3.5x by the end of 2027.

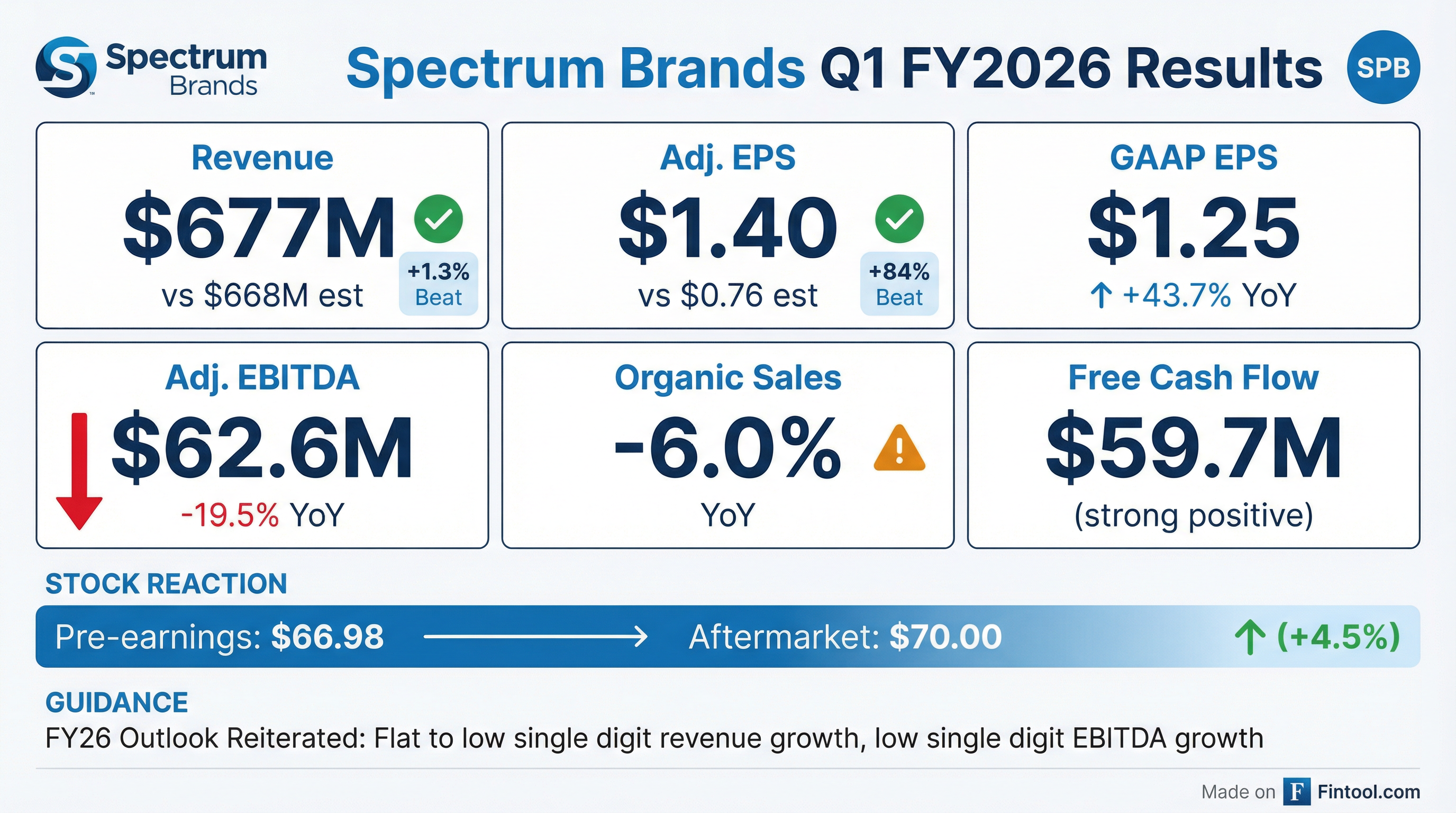

- Spectrum Brands' Q1 2026 financial results exceeded expectations, despite a 3.3% decrease in net sales (6% organic) and a $15.2 million decrease in Adjusted EBITDA to $62.6 million. However, Adjusted Diluted EPS increased to $1.40, driven by a one-time tax benefit and a lower share count.

- The Global Pet Care business returned to growth with an 8.3% increase in reported net sales (5.8% organic), while the Home and Garden segment saw a 19.8% decrease in net sales, and the Home and Personal Care business continued to face demand softness.

- The company generated nearly $60 million of adjusted free cash flow in the first quarter and repurchased approximately 600,000 shares. A new $300 million share repurchase program was also authorized.

- Management reiterated its fiscal 2026 earnings framework, expecting net sales to be flat to up single digits and Adjusted EBITDA to grow low single digits, with Adjusted Free Cash Flow conversion around 50% of Adjusted EBITDA.

- Spectrum Brands reported Q1 2026 net sales of $677.0 million, a 3.3% decrease from the prior year, with Adjusted EBITDA at $62.6 million.

- The company generated nearly $60 million in Adjusted Free Cash Flow and maintained a net leverage of 1.65x at quarter-end.

- Global Pet Care (GPC) net sales increased 8.3% to $282 million, driven by 5.8% organic sales growth, while Home & Garden (H&G) and Home & Personal Care (HPC) experienced net sales declines of 19.8% and 7.6%, respectively.

- For FY26, the company projects flat to low single-digit net sales growth and low single-digit Adjusted EBITDA growth, targeting ~50% Adjusted Free Cash Flow conversion.

- Spectrum Brands Holdings (SPB) reported Q1 2026 Net Sales decreased 3.3% (Organic Net Sales down 6%) and Adjusted EBITDA of $62.6 million, a decrease of $15.2 million. Adjusted diluted EPS increased to $1.40 due to a one-time tax benefit and reduced share count.

- The company ended Q1 2026 with a strong financial position, including $126.6 million in cash, $0 drawn on its revolver, and a net leverage of 1.65 times. SPB returned $46 million to shareholders through buybacks and dividends during the quarter.

- Global Pet Care net sales increased 8.3% (Organic net sales up 5.8%) and is expected to deliver modest growth for fiscal 2026. Home and Garden is anticipated to be the fastest-growing business in fiscal 2026, with growth weighted towards the second half. The Home and Personal Care business is expected to decline in net sales for the full year, and the company is seeking a strategic solution for this unit.

- SPB reiterated its fiscal 2026 outlook, expecting net sales to be flat to up single digits and Adjusted EBITDA to grow low single digits. Adjusted Free Cash Flow as a percentage of Adjusted EBITDA is projected to be around 50%.

- Spectrum Brands' Q1 2026 net sales and adjusted EBITDA exceeded expectations, despite a 3.3% decrease in net sales and a $15.2 million decrease in Adjusted EBITDA to $62.6 million.

- The Global Pet Care business returned to growth in Q1 2026, with reported net sales increasing 8.3% (5.8% organic). The Home and Garden business is expected to achieve sales growth in the second half of fiscal 2026, while the Home and Personal Care business is projected to decline for the full year.

- The company generated nearly $60 million of adjusted free cash flow in Q1 2026 and repurchased approximately 600,000 shares during the quarter. A new $300 million share repurchase program has been authorized.

- Spectrum Brands reiterated its full-year fiscal 2026 expectations for flat to up single-digit net sales and low single-digit Adjusted EBITDA growth, with Adjusted Free Cash Flow expected to be around 50% of Adjusted EBITDA.

- Spectrum Brands Holdings reported Q1 fiscal 2026 net sales of $677.0 million, a 3.3% decrease, with organic net sales decreasing 6.0% for the quarter ended December 28, 2025.

- For the first quarter, net income from continuing operations was $29.4 million and Adjusted EBITDA was $62.6 million.

- The company repurchased 0.6 million shares for $36 million in Q1 and approved a new $300 million share repurchase authorization.

- Spectrum Brands reiterated its fiscal 2026 framework, projecting net sales to be flat to up low single digits and low single digit growth in Adjusted EBITDA.

- Spectrum Brands Holdings reported Fiscal 2026 First Quarter Net Sales of $677.0 million, a 3.3% decrease, and Adjusted EBITDA of $62.6 million, a 19.5% decrease for the period ended December 28, 2025.

- Net Income from Continuing Operations was $29.4 million, with Adjusted Diluted EPS of $1.40.

- The company generated $67.7 million in operating cash flow and $59.7 million in adjusted free cash flow, ending the quarter with net debt leverage of 1.65x Adjusted EBITDA.

- Spectrum Brands repurchased 0.6 million shares for $36 million in Q1 and approved a new $300 million share repurchase authorization.

- The company reiterated its Fiscal 2026 framework, expecting net sales to be flat to up low single digits and low single digit growth in Adjusted EBITDA.

- Spectrum Brands Holdings reported a 5.2% decline in net sales for both Q4 and fiscal year 2025, with organic net sales decreasing 6.6% in Q4 and 5.3% for the full year, primarily due to macroeconomic conditions and supply shortages.

- The company generated $171 million in adjusted free cash flow (approximately $7 per share) in fiscal 2025, exceeding expectations, and returned approximately $375 million to shareholders through buybacks and dividends.

- For fiscal year 2026, net sales are expected to be flat to up low single digits, and adjusted EBITDA is projected to grow low single digits, with Global Pet Care and Home & Garden businesses anticipated to return to growth.

- Management believes the worst of tariff and economic disruptions are over, having reduced annualized tariff exposure from $450 million to $70-$80 million and achieved over $50 million in cost savings in fiscal 2025.

- The company remains committed to finding a strategic solution for its Home & Personal Care business and is optimistic about M&A opportunities in its Global Pet Care and Home & Garden divisions.

- SPB reported a 5.2% decrease in Q4 2025 net sales (excluding FX) and adjusted EBITDA of $63.4 million, while adjusted diluted EPS increased to $2.61. The company generated $171 million in adjusted free cash flow for fiscal 2025.

- For fiscal year 2026, SPB expects net sales to be flat to up low single digits and adjusted EBITDA to show low single-digit growth. Adjusted free cash flow conversion is projected to be around 50% of adjusted EBITDA.

- The company has significantly reduced its annualized tariff exposure from approximately $450 million to $70-$80 million, largely offsetting it through vendor concessions, cost reductions, supply-based reconfiguration, and pricing actions.

- SPB anticipates its Global Pet Care and Home & Garden businesses to return to growth in fiscal 2026, offsetting an expected decline in the Home & Personal Care business due to category softness and supply chain simplification. The company remains committed to finding a strategic solution for its Home & Personal Care business.

- Spectrum Brands reported net sales of $734 million for Q4 2025 and $2,809 million for the full year 2025, reflecting organic sales decreases of 6.6% and 5.3% respectively.

- Adjusted EBITDA was $63 million for Q4 2025 and $289 million for the full year 2025, a decrease from $372 million in FY24.

- The company generated over $170 million in Adjusted Free Cash Flow for FY25 and concluded the year with a net leverage of 1.58x.

- For fiscal year 2026, Spectrum Brands projects flat to low single-digit net sales growth and low single-digit Adjusted EBITDA growth.

Quarterly earnings call transcripts for Spectrum Brands Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more