Earnings summaries and quarterly performance for SIMON PROPERTY GROUP.

Executive leadership at SIMON PROPERTY GROUP.

David Simon

Chairman, Chief Executive Officer and President

Adam J. Reuille

Senior Vice President and Chief Accounting Officer

Brian J. McDade

Executive Vice President and Chief Financial Officer

Eli Simon

Executive Vice President – Chief Investment Officer

John Rulli

Chief Administrative Officer

Steven E. Fivel

General Counsel and Secretary

Board of directors at SIMON PROPERTY GROUP.

Daniel C. Smith, Ph.D.

Director

Gary M. Rodkin

Director

Glyn F. Aeppel

Director

Larry C. Glasscock

Lead Independent Director

Marta R. Stewart

Director

Nina P. Jones

Director

Peggy Fang Roe

Director

Randall J. Lewis

Director

Reuben S. Leibowitz

Director

Richard S. Sokolov

Vice Chairman

Stefan M. Selig

Director

Research analysts who have asked questions during SIMON PROPERTY GROUP earnings calls.

Alexander Goldfarb

Piper Sandler

7 questions for SPG

Michael Goldsmith

UBS

7 questions for SPG

Ronald Kamdem

Morgan Stanley

7 questions for SPG

Vince Tibone

Green Street

7 questions for SPG

Craig Mailman

Citigroup

6 questions for SPG

Linda Tsai

Jefferies

6 questions for SPG

Caitlin Burrows

Goldman Sachs

5 questions for SPG

Greg McGinniss

Scotiabank

5 questions for SPG

Haendel St. Juste

Mizuho Financial Group

5 questions for SPG

Michael Mueller

JPMorgan Chase & Co.

5 questions for SPG

Omotayo Okusanya

Deutsche Bank AG

5 questions for SPG

Floris van Dijkum

Compass Point Research & Trading

4 questions for SPG

Jeffrey Spector

BofA Securities

4 questions for SPG

Juan Sanabria

BMO Capital Markets

4 questions for SPG

Floris Gerbrand van Dijkum

Compass Point Research & Trading, LLC

3 questions for SPG

Samir Khanal

Bank of America

3 questions for SPG

Steve Sakwa

Evercore ISI

3 questions for SPG

Caitlin Szczupak

Goldman Sachs

2 questions for SPG

Hong Zhang

JPMorgan Chase & Co.

2 questions for SPG

Michael Corkery

Evercore ISI

2 questions for SPG

Michael Griffin

Citigroup Inc.

2 questions for SPG

Rich Hightower

Barclays

2 questions for SPG

Ki Bin Kim

Truist Securities

1 question for SPG

Linda Yu Tsai

Jefferies Financial Group Inc.

1 question for SPG

Nicholas Joseph

Citigroup

1 question for SPG

Ravi Vaidya

Mizuho

1 question for SPG

Recent press releases and 8-K filings for SPG.

- The Board of Directors authorized a $2.0 billion common stock repurchase program through February 29, 2028.

- This program replaces a prior $2.0 billion plan set to expire on February 15, 2026, of which $1.7 billion remained available.

- Repurchases may occur in the open market or via privately negotiated transactions at prices deemed appropriate by the Company.

- The program is discretionary; Simon is not obligated to repurchase any shares and may suspend or terminate the program at any time.

- Simon Property Group plans an over $250 million investment in three premier retail centers: The Mall at Green Hills (Nashville), Cherry Creek Shopping Center (Denver), and International Plaza (Tampa).

- Redevelopment will feature luxury-focused upgrades, including grand flagship entrances, jewel-box boutique spaces, refined architectural finishes, and a 50,000 sq ft open-air expansion at International Plaza.

- Construction is set to begin in 2026, following Simon’s full acquisition of the properties from Taubman Realty Group in November.

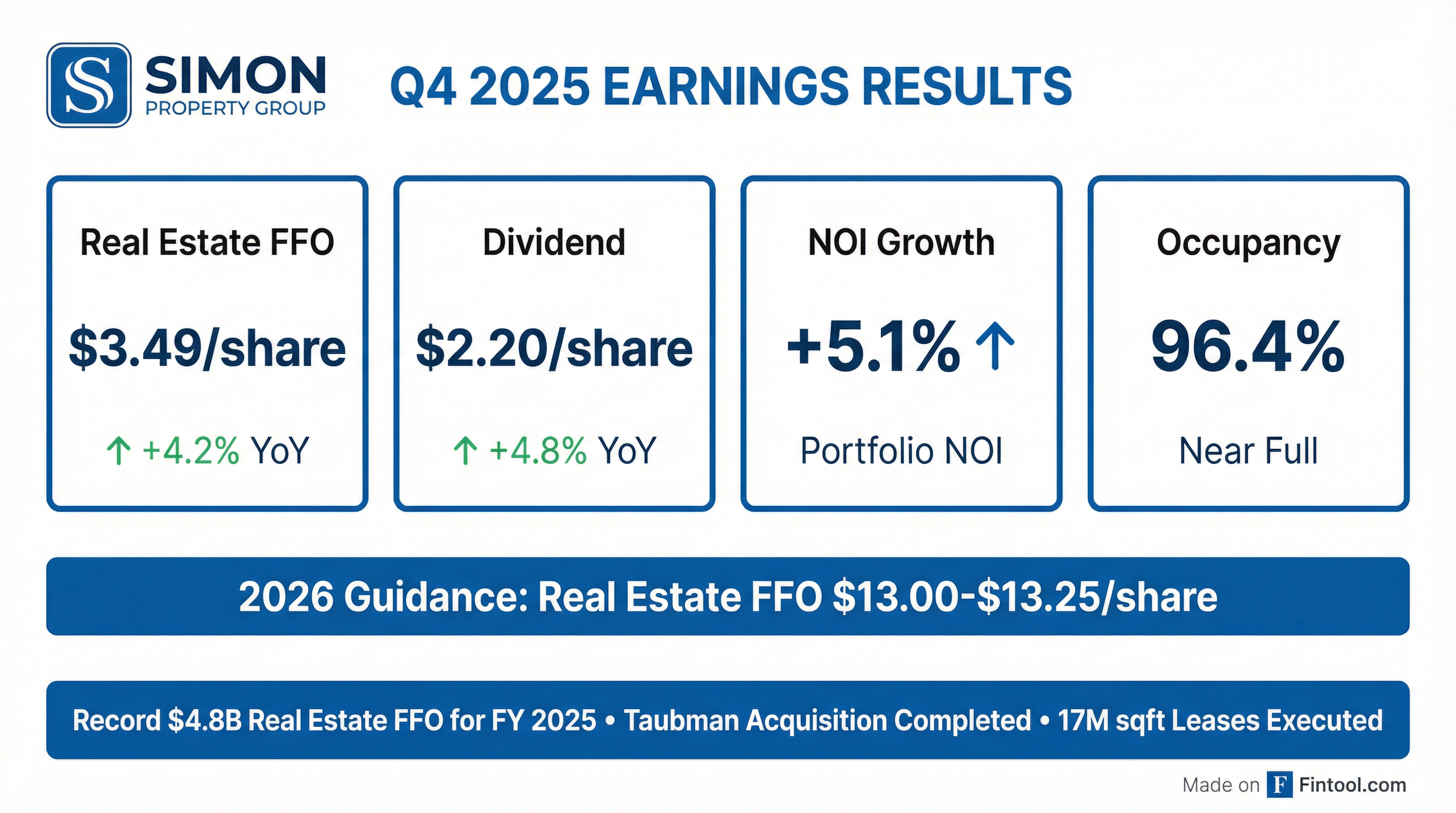

- Real estate FFO was $3.49 per share, up 4.2% year-over-year from $3.35.

- Portfolio NOI grew 5.1% in Q4 2025 (domestic NOI +4.8%) with occupancy at 96.4% for malls/premium outlets and 99.2% for The Mills.

- Declared a $2.20 per share dividend for Q1 2026 (up 4.8% YoY) and repurchased 1.2 million shares ($227 million) in 2025 plus 273,000 shares ($50 million) post-year-end.

- 2026 guidance: real estate FFO of $13.00–$13.25 per share (midpoint $13.13), assuming ≥3% domestic NOI growth and $0.25–$0.30 higher net interest expense per share.

- Acquisitions and development: 2025 net development costs of $1.5 billion at a 9% blended yield with a pipeline exceeding $4 billion; notable deals include The Mall (Italy), Brickell City Centre, and remaining 12% of Taubman.

- In Q4 2025, Simon reported net income attributable to common stockholders of $3.048 billion, or $9.35 per diluted share, versus $667.2 million, or $2.04 per diluted share in Q4 2024.

- Real Estate FFO was $1.328 billion, or $3.49 per diluted share, a 4.2% increase over Q4 2024.

- Domestic property NOI increased 4.8% and portfolio NOI rose 5.1% year-over-year.

- For FY 2026, Simon forecasts net income of $6.87–$7.12 per diluted share and Real Estate FFO of $13.00–$13.25 per diluted share.

- Simon ended 2025 with $9.1 billion of liquidity and declared a Q1 2026 dividend of $2.20 per share, up 4.8% year-over-year.

- Record full-year FFO of $4.8 billion ($12.73/share) and Q4 FFO of $3.49 per share, up 4.2% YoY; portfolio NOI grew 5.1% in Q4 (domestic +4.8%) with mall/outlet occupancy at 96.4%.

- Acquired $2 billion of high-quality retail assets (including Italian outlets, Brickell City Centre interest and TRG stake) and completed > 20 redevelopments; development pipeline exceeds $4 billion.

- Completed $9 billion of financing in 2025 (including $1.5 B senior notes at 1.77% and $7 B secured refinancings), ended year with $9 billion liquidity and net debt/EBITDA of 5.0x; returned ~$3.5 B to shareholders and declared Q1 dividend of $2.20 (up 4.8%).

- 2026 guidance: real estate FFO of $13.00–$13.25 per share (midpoint $13.13), assuming ≥ 3% domestic NOI growth and $0.25–$0.30 higher net interest expense per share.

- Delivered record FY 2025 FFO of $4.8 billion ($12.73/share) and Q4 FFO of $3.49 per share, up 4.2% year-over-year.

- Achieved strong operating metrics with 96.4% occupancy at malls/premium outlets, 99.2% at mills, and same-currency NOI growth of 5.1% in Q4 (4.7% for the year).

- Expanded portfolio with $2 billion of acquisitions—including The Mall and remaining Taubman interest—signed 4,600 leases (17 million sq ft), and completed over 20 redevelopments in 2025.

- Returned approximately $3.5 billion to shareholders via buybacks/dividends and set Q1 2026 dividend at $2.20 per share, a 4.8% increase.

- Issued 2026 guidance of $13.00–$13.25 FFO per share, assuming at least 3% domestic NOI growth and higher net interest expense.

- Simon Property generated net income attributable to common stockholders of $3.048 billion (EPS $9.35), versus $667.2 million (EPS $2.04) in Q4 2024.

- Real Estate FFO for Q4 was $1.328 billion (FFO per share $3.49), up 4.2% year-over-year from $1.261 billion ($3.35 per share).

- For the full year 2025, the company achieved record Real Estate FFO of $4.812 billion (per share $12.73), a 4.0% increase over 2024.

- Domestic property NOI increased 4.8% and total portfolio NOI rose 5.1% compared to Q4 2024.

- The Board declared a Q1 2026 common dividend of $2.20 per share, a 4.8% increase year-over-year.

- Q4 net income of $3.048 billion ($9.35/diluted share), including a $2.89 billion non-cash gain from remeasurement of its Taubman Realty interest; Real Estate FFO was $1.328 billion ($3.49/share, +4.2% YoY).

- 2025 Real Estate FFO reached $4.812 billion ($12.73/share, +4.0% YoY), with net income of $4.624 billion ($14.17/share).

- U.S. mall occupancy at 96.4%, base minimum rent per square foot $60.97 (+4.7% YoY), and trailing-12-month retailer sales per square foot $799 (+8.1% YoY) as of December 31, 2025.

- Board declared Q1 2026 dividend of $2.20 (up 4.8% YoY) and issued guidance of $6.87–7.12 net income per diluted share and $13.00–13.25 Real Estate FFO per diluted share for 2026.

- Simon Property Group’s operating partnership agreed to sell $800 million of 4.300% senior notes due 2031, expected to close on January 13, 2026.

- Proceeds will fully repay $800 million of outstanding 3.300% notes maturing in 2026.

- The offering is managed by BofA Securities, Deutsche Bank Securities, Goldman Sachs & Co. and RBC Capital Markets as joint book-running managers.

- Notes are being issued under the Operating Partnership’s shelf registration, with sales conducted via a prospectus supplement and accompanying prospectus.

- Simon Property Group has acquired Phillips Place, a 134,000 sq ft open-air retail center in SouthPark, Charlotte, North Carolina.

- Phillips Place features 25+ specialty shops and restaurants, including alice+olivia, Peter Millar, rag & bone, Ralph Lauren, Veronica Beard, RH Gallery with a Rooftop Restaurant, and The Palm.

- The property is part of an iconic mixed-use destination that also includes a 180+ room hotel and a multi-family residential component, both owned by Simon.

- Simon intends to continue delivering the center’s exceptional shopping experience and will enhance it over time through new offerings, merchandising, and ongoing investment.

Fintool News

In-depth analysis and coverage of SIMON PROPERTY GROUP.

Quarterly earnings call transcripts for SIMON PROPERTY GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more