SEQUANS COMMUNICATIONS (SQNS)·Q4 2025 Earnings Summary

Sequans Q4 2025: Revenue Beats as IoT Momentum Builds, Stock Falls on Bitcoin Losses

February 10, 2026 · by Fintool AI Agent

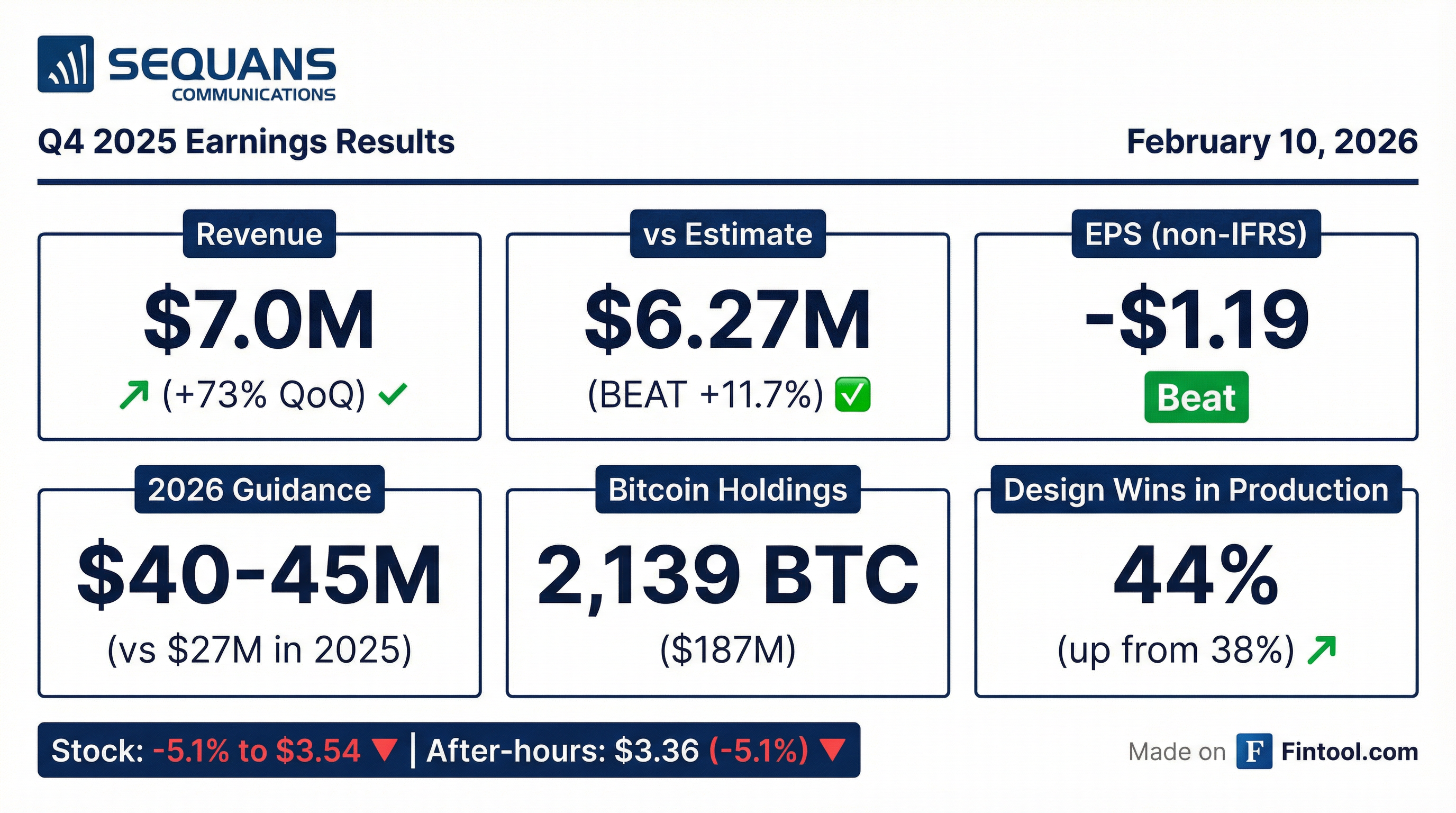

Sequans Communications reported Q4 2025 results that beat on both revenue and EPS, with the IoT semiconductor business delivering $7 million in revenue (+73% sequentially). However, shares fell 5.1% to $3.54 as investors digested a massive $87.1 million IFRS net loss, driven primarily by non-cash Bitcoin treasury impairments and debt redemption charges. The company's underlying IoT business continues to strengthen, with 44% of design wins now in production and 2026 guidance of $40-45 million representing ~65% growth.

Did Sequans Beat Earnings?

Yes — Sequans beat on both revenue and EPS:

Revenue was 94% product-based and 6% services, reflecting strong product shipment momentum. Gross margin of 37.7% was impacted by provisions for slow-moving inventory; excluding these provisions, gross margin would have been approximately 43%.

The IFRS net loss of $87.1 million was driven by:

- $56.9M Bitcoin mark-to-market impairment

- $29.1M loss on early debt redemption (primarily non-cash)

- $8.4M realized loss on Bitcoin sale

Excluding these non-cash and Bitcoin-related items, the non-IFRS loss would have been approximately $10 million.

What Did Management Guide?

2026 Revenue Guidance: $40-45 million (vs $27.2M in 2025 = ~65% growth)

Q1 2026 Guidance: ~$6.5 million with ~$1M at risk of shifting to Q2 due to manufacturing and shipment timing.

Management expects revenue to ramp through the year with a clear path to cash flow breakeven by Q4 2026.

CEO Georges Karam outlined the assumptions: "In our model, we're assuming the $15-16M number where $3M of this is services and the remaining product... We continue to believe we can approach cash flow breakeven in Q4."

How Did the Stock React?

Stock fell 5.1% on earnings day despite the beat:

The stock has collapsed from its 52-week high of $58.30, now trading near multi-year lows. The decline reflects multiple factors:

- Overall Bitcoin market weakness impacting treasury value

- Convertible debt overhang ($94.5M remaining)

- Ongoing operating losses despite improving trajectory

What Changed From Last Quarter?

Key sequential changes from Q3 2025:

The company redeemed 50% of its convertible debt in October 2025 and repurchased 9.7% of outstanding ADSs during Q4. The board approved an additional 10% buyback authorization.

The Bitcoin Treasury Elephant in the Room

Sequans' dual strategy of running an IoT semiconductor business while managing a Bitcoin treasury creates significant P&L noise:

CEO Karam explained the capital allocation framework: "In the current environment where many digital asset treasury peers are trading below an MNAV of 1, we believe the most value accretive lever available to us has been repurchasing ADS when our share price implies a significant discount to our net cash and net digital asset value."

With Bitcoin at ~$70,000 (per management's reference), the Bitcoin NAV is approximately $150 million. Combined with cash and netting out convertible debt, the company's net asset value significantly exceeds its ~$55M market cap.

IoT Business: The Actual Value Driver

Design Win Pipeline: $550M+ in 3-year potential revenue

Key verticals driving growth:

- Smart Metering — Honeywell, Itron entering production

- Telematics & Asset Tracking — Customers doing 1M+ units/year

- Security & Industrial — Growing Cat-1bis adoption

Product roadmap highlights:

- Cat-1bis — Breakout year expected in 2026 for telematics/security

- RF Transceivers — Targeting $7M+ in 2026 from Chinese customers plus new defense/drone applications

- 5G eRedCap — Test chips expected this quarter, customer sampling mid-2027, revenue mid-2028

5G eRedCap: The 2028 Catalyst

Management emphasized strong carrier push for 5G eRedCap as carriers seek to transition IoT from 4G to 5G:

"Mobile network operators in the U.S. are accelerating the transition from 4G to 5G to reform spectrum, and IoT applications remain the final bottleneck in completing that transition."

5G eRedCap Timeline:

The competitive landscape is favorable: "On eRedCap, it's very early... The two guys that have Cat-1bis, it's not Chinese. It's Qualcomm and Sequans."

Supply Chain Pressures

Management flagged ongoing supply chain challenges:

- Substrate constraints — Adding suppliers to reduce single-source exposure

- Memory pricing — AI demand impacting even non-AI memory costs

- Price increases — Being passed through to customers where appropriate

"I don't qualify it like in the COVID days, but it's there. We're spending time on it. My team is working day and night on securing supply."

Expected impact: Little to no effect in H1 2026; limited impact in H2 2026.

Q&A Highlights

On 2027 growth trajectory: "By definition, we can double... The growth is big. If you assume all this just only convert, and they will be there... Maybe we'll be in a 60%+ growth [in 2027]." — CEO Georges Karam

On RF transceiver opportunity: "This could be a business for sure, maybe in the $15-$20 million run rate. This is doable if we are successful." — CEO Georges Karam

On buyback pace: "We are free on doing this... the intention there is clear. We believe if our share price is not appreciated, it's good things to do to buy back shares." — CEO Georges Karam

On convertible debt: "If Bitcoin is not rallying and going to the moon, there is no interest to keep the debt forever and better to redeem it sooner than later." — CEO Georges Karam

The Bottom Line

Sequans delivered a solid operational quarter with revenue beating estimates by 12% and meaningful progress on its path to profitability. The IoT semiconductor business is gaining traction with 44% of design wins in production and a clear runway to $40-45M in 2026 revenue.

However, the stock remains under pressure from:

- Bitcoin treasury volatility creating massive IFRS P&L noise

- Convertible debt overhang ($94.5M at 15.8% interest starting July 2026)

- Extended timeline to sustained profitability (breakeven not until Q4 2026)

The market cap of ~$55M versus net asset value (Bitcoin + cash - debt) of >$68M suggests deep skepticism about the IoT business value or Bitcoin price direction. For believers in either the IoT turnaround or Bitcoin recovery, the current valuation offers significant optionality.

Related Links: