Earnings summaries and quarterly performance for SEQUANS COMMUNICATIONS.

Research analysts who have asked questions during SEQUANS COMMUNICATIONS earnings calls.

SS

Scott Searle

ROTH MKM

6 questions for SQNS

Also covers: ADEA, AIOT, AIRG +22 more

Fedor Shabalin

B. Riley Securities

2 questions for SQNS

Also covers: ABTC, BITF, BTDR +6 more

Jacob Stephan

Lake Street Capital Markets, LLC

2 questions for SQNS

Also covers: ALKT, ARLO, CDLX +16 more

MG

Mike Grondahl

Lake Street Capital Markets

2 questions for SQNS

Also covers: ABL, ACCS, APLD +36 more

ND

Nicolas Doyle

Needham & Company, LLC

1 question for SQNS

Also covers: CRNC, LSCC, MX +9 more

Recent press releases and 8-K filings for SQNS.

Sequans Communications Reports Q4 2025 Results, Provides 2026 Outlook, and Announces Share Buyback

SQNS

Earnings

Guidance Update

Share Buyback

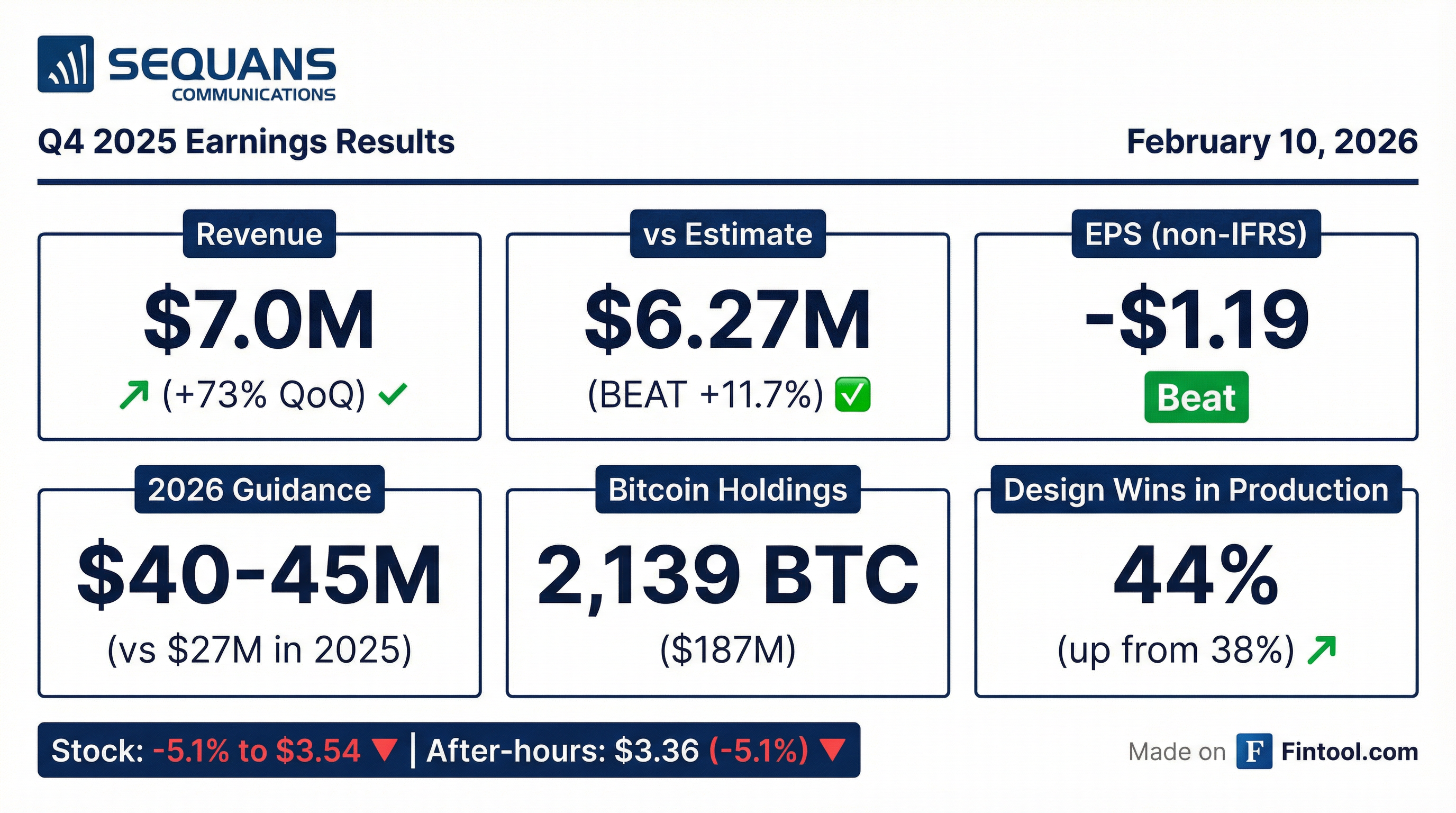

- Sequans Communications reported Q4 2025 revenue of $7 million and full-year 2025 revenue of $27.2 million, with the underlying business revenue closer to $20 million.

- The company projects Q1 2026 revenue of approximately $6.5 million and targets full-year 2026 total global revenue of $40 million-$45 million, with an objective to reach cash flow breakeven by Q4 2026.

- In Q4 2025, Sequans repurchased approximately 9.7% of its outstanding ADSs and authorized a new program for an additional 10% buyback.

- As of year-end 2025, the company held 2,139 Bitcoin valued at $187.1 million, and its net cash equivalent position exceeds $68 million.

- The IoT business shows continued momentum, with 44% of design win projects now in production and a revenue funnel exceeding $550 million in potential three-year product revenue.

4 days ago

Sequans Communications Reports Q4 2025 Results, Provides 2026 Revenue Guidance, and Announces Share Buyback Program

SQNS

Earnings

Guidance Update

Share Buyback

- Sequans Communications reported Q4 2025 revenue of $7 million and full-year 2025 revenue of $27.2 million, with an underlying business closer to $20 million excluding Qualcomm-related revenue.

- The company provided 2026 total global revenue guidance of $40 million-$45 million and expects Q1 2026 revenue around $6.5 million, with a risk of $1 million shifting to Q2.

- In Q4 2025, Sequans repurchased approximately 9.7% of its outstanding ADSs and authorized an additional 10% buyback program.

- As of Q4 2025, the company held 2,139 Bitcoin with a market value of $187.1 million, and its net cash equivalent position exceeded $68 million.

- Sequans is focused on its IoT business, with 44% of design wins now in production, and aims to reach cash flow breakeven by Q4 2026.

4 days ago

Sequans Communications Reports Q4 2025 Results, Provides 2026 Guidance, and Details Capital Allocation

SQNS

Earnings

Guidance Update

Share Buyback

- Sequans Communications reported Q4 2025 revenue of $7 million and full-year 2025 revenue of $27.2 million, with a 2026 revenue target of $40 million-$45 million.

- The company repurchased approximately 9.7% of outstanding ADSs in Q4 2025 and authorized a new program for an additional 10%, reflecting a focus on unlocking shareholder value.

- At the end of Q4 2025, Sequans held 2,139 Bitcoin with a market value of $187.1 million and reported a net cash equivalent position exceeding $68 million.

- Operational highlights include a design win pipeline exceeding $550 million in potential three-year product revenue, with 44% of design wins already in production.

- Sequans is targeting cash flow breakeven by Q4 2026 and expects to begin customer sampling for its 5G eRedCap chip in mid-2027, with revenue anticipated in 2028.

4 days ago

Sequans Communications Announces Unaudited Q4 and Full Year 2025 Financial Results

SQNS

Earnings

Share Buyback

New Projects/Investments

- Sequans Communications reported Q4 2025 revenue of $7.0 million, an increase of 72.6% compared to Q3 2025 but a decrease of 37.0% compared to Q4 2024, with full year 2025 revenue totaling $27.2 million.

- The company posted a net loss of $87.1 million, or ($5.62) per diluted ADS, for Q4 2025, which included a $56.9 million unrealized loss on Bitcoin investment impairment and an $8.4 million realized net loss from Bitcoin sales.

- Sequans repurchased approximately 9.7% of its outstanding ADSs in Q4 2025 and has Board authorization to repurchase an additional 10%.

- The company exited 2025 with a strong order backlog and a design-win pipeline of over $300 million in potential three-year product revenue, with over 44% of these design-wins already in mass production.

- Sequans is positioned to drive sustainable growth with a clear path toward projected cash-flow break-even by the end of 2026.

4 days ago

Sequans Communications Regains NYSE Listing Compliance

SQNS

Delisting/Listing Issues

- Sequans Communications S.A. regained compliance with the New York Stock Exchange (NYSE) continued listing standards on January 15, 2026.

- The company had been notified of non-compliance on June 5, 2025, because its average global market capitalization and stockholders' equity both fell below $50 million.

- Compliance was restored after a $195 million equity private placement that closed on July 7, 2025, which increased its stockholders' equity and market capitalization.

Jan 15, 2026, 11:01 AM

Sequans Reports Q3 2025 Results, Reduces Debt, and Outlines IoT Growth Strategy

SQNS

Earnings

Debt Issuance

Share Buyback

- Sequans reported Q3 2025 total revenues of $4.3 million, a 47.3% decrease compared to Q2 2025, and a net loss of $6.7 million, or $0.48 per diluted ADS. Cash and cash equivalents totaled $13.4 million at September 30, 2025, with a pro forma ending cash of $23.4 million after a $10 million payment released from escrow in October 2025.

- The company proactively reduced its convertible debt by 50% through the tactical sale of 970 Bitcoin at an average price of $108,600 per Bitcoin. This action lowered the debt-to-NAV ratio closer to 35% and freed up 647 unpledged Bitcoin for potential use in an approved ADS buyback program.

- Sequans' IoT business pipeline reached $550 million in potential three-year product revenue, with $300 million in design win projects, marking a 20% increase. The company expects to enter 2026 with over 45% of design win projects in production, which could generate $45 million in average annual product revenue over the next three years.

- For Q4 2025, Sequans anticipates total revenue to exceed $7 million, comprising over $6 million in product revenue and approximately $1 million from services and IP licensing. The company is implementing a 20% cost reduction program to limit cash burn in 2026, targeting cash operating expenses below $10 million per quarter and aiming for break-even in Q4 2026.

Nov 4, 2025, 1:00 PM

Sequans Announces Q3 2025 Results and Strategic Debt Reduction

SQNS

Earnings

Debt Issuance

Share Buyback

- Sequans reduced its convertible debt by 50% through a tactical sale of a portion of its Bitcoin holdings, aiming to lower its debt-to-NAV ratio to the 35% range and enable an ADS buyback program.

- For Q3 2025, total revenues were $4.3 million, a 47.3% decrease compared to Q2 2025, with a gross margin of 40.9% and a net loss of $6.7 million.

- As of September 30, 2025, the company held 3,234 Bitcoin with a market value of $365.6 million and reported cash and cash equivalents of $13.4 million, which increased to a pro forma $23.4 million after a $10 million payment released in October 2025.

- Sequans expects Q4 2025 revenue to exceed $7 million and is implementing a 20% cost reduction program across functions, targeting breakeven in Q4 2026.

- The IoT business pipeline represents about $550 million in potential three-year product revenue, with $300 million in design win projects, and the company is evaluating strategic alternatives for this business.

Nov 4, 2025, 1:00 PM

Sequans Communications Announces Preliminary Third Quarter 2025 Financial Results

SQNS

Earnings

Debt Issuance

Share Buyback

- Sequans Communications reported preliminary Q3 2025 revenue of $4.3 million, representing a 47.3% decrease from Q2 2025 and a 57.5% decrease from Q3 2024, primarily due to lower high-margin license revenue.

- The company recorded a net loss of $6.7 million, or ($0.48) per diluted ADS, which included an $8.2 million unrealized loss on impairment of its Bitcoin investment.

- As of September 30, 2025, cash and cash equivalents totaled $13.4 million. The company held 3,234 Bitcoin with a market value of $365.6 million, pledged as security for convertible debt.

- Sequans has leveraged a portion of its Bitcoin holdings to reduce half of its debt and reinforce its ADS repurchase program, having sold 970 Bitcoin as of November 4, 2025.

- The three-year revenue design win pipeline for its IoT product business increased to $300 million in Q3 2025, with expectations for the business to ramp in Q4 2025.

Nov 4, 2025, 11:16 AM

Sequans Communications Redeems Convertible Debt

SQNS

Debt Issuance

Share Buyback

- Sequans Communications S.A. announced the redemption of 50% of its convertible debt issued on July 7, 2025, with a face value of $94.5 million.

- This strategic move, announced on November 4, 2025, was funded through the sale of 970 Bitcoin.

- As a result, the company's total outstanding debt was reduced from $189 million to $94.5 million, and its debt-to-NAV ratio decreased from 55% to 39%.

- The company's Bitcoin holdings now stand at 2,264 BTC, down from 3,234 BTC, and this deleveraging is expected to boost Sequans' previously announced ADS buyback program.

Nov 4, 2025, 11:00 AM

Sequans Communications Announces American Depositary Share Buyback Program

SQNS

Share Buyback

- Sequans Communications S.A. (SQNS) has authorized a program to repurchase up to 1.57 million American Depositary Shares (ADSs), representing approximately 10% of its currently outstanding ADSs.

- This buyback program is authorized through June 30, 2026, and is intended to support the share price and enhance market net asset value (NAV) as part of the Company's Bitcoin Treasury strategy.

- The company will repurchase ADSs at its discretion, subject to market conditions and compliance with applicable legal requirements.

Sep 30, 2025, 10:03 AM

Quarterly earnings call transcripts for SEQUANS COMMUNICATIONS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more