Stellar Bancorp (STEL)·Q4 2025 Earnings Summary

Stellar Bancorp Surges 12% After-Hours on $2B Prosperity Merger Announcement

January 28, 2026 · by Fintool AI Agent

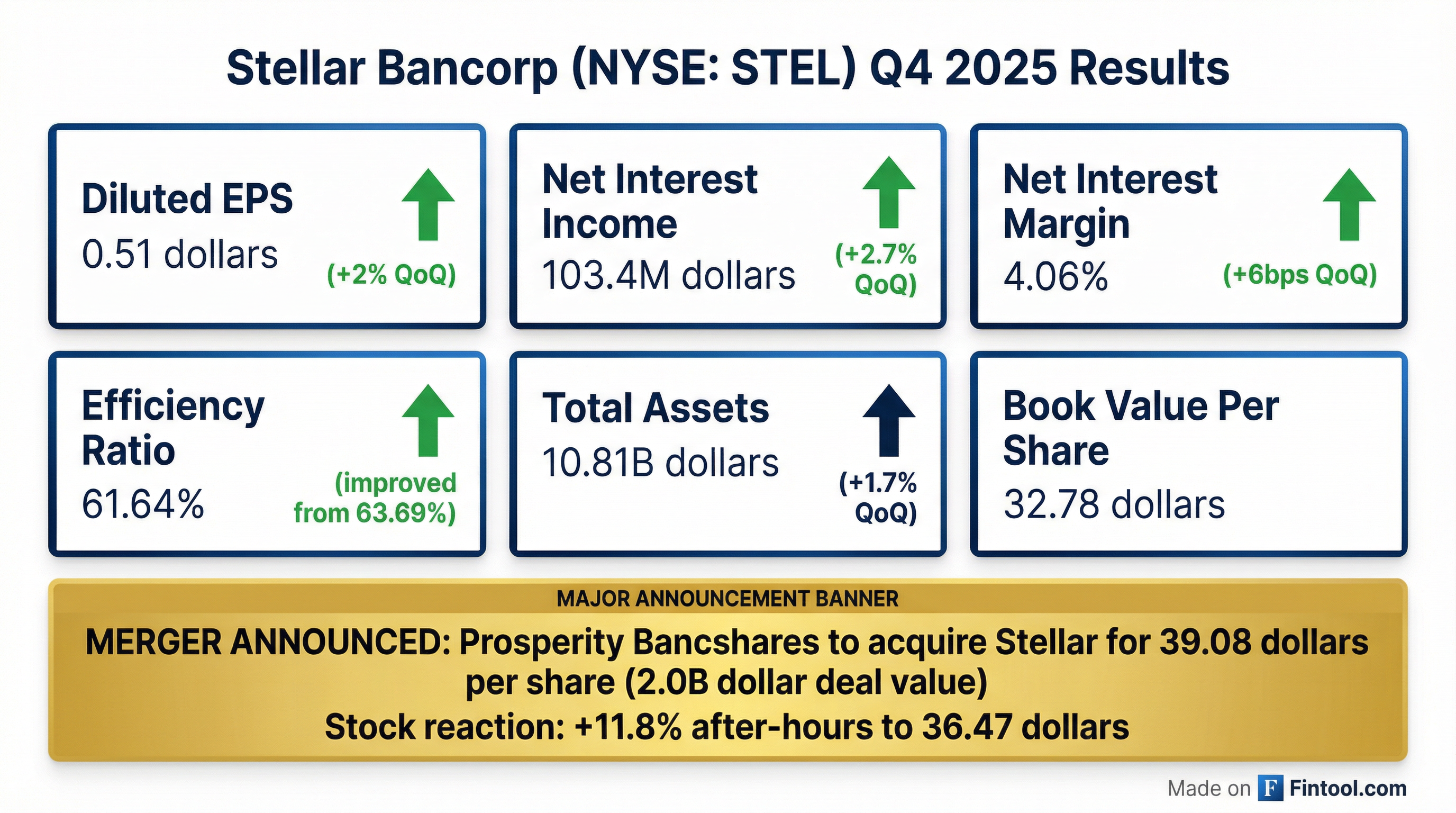

Stellar Bancorp (NYSE: STEL) reported solid Q4 2025 results with diluted EPS of $0.51 and net income of $26.1 million . But the earnings release was overshadowed by a much bigger announcement: Prosperity Bancshares will acquire Stellar in an all-stock-and-cash deal valued at $2.0 billion, or $39.08 per share .

The stock surged 11.8% after-hours to $36.47, still trading at a 6.7% discount to the merger price as investors price in regulatory and shareholder approval risk.

Did Stellar Bancorp Beat Earnings?

Yes. Stellar delivered a beat on both earnings and net interest income:

The improvement was driven by lower funding costs as interest-bearing liabilities repriced down. The cost of deposits fell to 1.77% from 1.96% in Q3 . Net interest margin (tax equivalent, excluding purchase accounting adjustments) expanded 6 basis points to 4.06%, the best showing since Q1 2024.

Full Year 2025: Net income of $102.9 million, or diluted EPS of $1.99, translating to a 0.97% return on average assets and 11.48% return on average tangible equity .

What's the Merger Deal?

This is the headline story. Prosperity Bancshares (NYSE: PB) will acquire Stellar in a transaction that creates the #2 bank by deposits headquartered in Texas .

Deal Terms

The deal is approximately 70% stock / 30% cash . Stellar shareholders will own approximately 16% of the combined company .

Strategic Rationale

David Zalman, Prosperity's CEO, highlighted the Houston market opportunity:

"This is a rare opportunity to significantly enhance our presence in the Houston area, a market with a diverse economy that is continually attracting investment and has a growing population."

Robert Franklin, Stellar's CEO, emphasized scale benefits:

"By joining forces, we are creating one of the strongest Texas banking franchises, supported by an exceptional deposit base and a shared commitment to relationship-driven community banking."

Pro Forma Financial Impact

Cost savings are estimated at 35% of Stellar's non-interest expense, phased in at 25% in 2026 and fully realized thereafter .

How Did the Stock React?

The after-hours surge prices in most of the merger premium, but the 6.7% discount to the deal price reflects typical arbitrage spread for deals requiring regulatory and shareholder approval. Expect the stock to trade in a tight range around $36-38 until closing conditions are satisfied.

Balance Sheet Highlights

Stellar's balance sheet remained solid heading into the merger:

Loan growth resumed with a $132.7 million increase in the quarter, led by commercial and industrial loans (+$143.8 million) . Deposits grew $204 million, driven by increases in noninterest-bearing and interest-bearing demand deposits .

Asset Quality

Credit metrics deteriorated modestly but remain manageable:

Nonperforming assets increased to $60.0 million from $54.2 million, primarily due to higher nonaccrual commercial real estate loans . However, net charge-offs were minimal at just $71 thousand, a sharp improvement from $3.3 million in Q3 .

The provision for credit losses was $5.1 million, up from $305 thousand in Q3, primarily to support loan growth .

Capital Actions

- Share Repurchases: Repurchased 299,347 shares at a weighted average price of $30.44 during Q4

- Subordinated Debt Paydown: Redeemed $30 million of $60 million subordinated debt on October 1, 2025

- Dividends: $0.15 per share for Q4, up from $0.14 in prior quarters

Capital ratios remain strong with estimated CET1 of 14.18% and total capital ratio of 15.73% .

What Changed From Last Quarter?

The most significant change is obviously the merger announcement. As an independent company, Stellar was executing well on margin expansion and cost control. As a Prosperity subsidiary, shareholders get certainty of value at a meaningful premium.

Risks and Considerations

-

Regulatory Approval: The deal requires approval from banking regulators and may face scrutiny given Prosperity's recent acquisition activity (American Bank Holding Corp closed January 1, 2026; Southwest Bancshares pending)

-

Shareholder Vote: Stellar shareholders must approve the transaction. The premium is substantial, making passage likely.

-

Integration Risk: Prosperity expects $100 million in one-time transaction expenses and plans 35% cost savings from Stellar's non-interest expense base

-

Stock Consideration: 70% of the deal is in Prosperity stock, so STEL shareholders have exposure to PB's stock price through closing

Conference Call Cancelled

The previously scheduled earnings conference call for January 30, 2026 was cancelled due to the merger announcement . Investors seeking more detail should review the merger presentation filed with the 8-K.

Forward Catalysts

View the full Q4 2025 earnings release and merger agreement for additional details.