Earnings summaries and quarterly performance for Stellar Bancorp.

Executive leadership at Stellar Bancorp.

Robert R. Franklin, Jr.

Chief Executive Officer

Joe F. West

Chief Credit Officer

Justin M. Long

General Counsel and Corporate Secretary

Okan I. Akin

Chief Risk Officer

Paul P. Egge

Chief Financial Officer

Ramon A. Vitulli, III

President

Steven F. Retzloff

Executive Chairman

Board of directors at Stellar Bancorp.

Cynthia A. Dopjera

Director

Frances H. Jeter

Director

Fred S. Robertson

Director

Joe E. Penland, Sr.

Director

John Beckworth

Lead Independent Director

John E. Williams, Jr.

Director

Jon-Al Duplantier

Director

Joseph B. Swinbank

Director

Laura D. Bellows

Director

Michael A. Havard

Director

Reagan A. Reaud

Director

Tymothi O. Tombar

Director

Research analysts who have asked questions during Stellar Bancorp earnings calls.

David Feaster

Raymond James

6 questions for STEL

Matt Olney

Stephens Inc.

6 questions for STEL

Stephen Scouten

Piper Sandler & Co.

3 questions for STEL

Will Jones

Keefe, Bruyette & Woods (KBW)

3 questions for STEL

John Rodis

Janney Montgomery Scott LLC

2 questions for STEL

William Jones

Truist Securities

2 questions for STEL

Andrew Gorczyca

Piper Sandler

1 question for STEL

Catherine Mealor

Keefe, Bruyette & Woods

1 question for STEL

Recent press releases and 8-K filings for STEL.

- Stellar Bancorp, Inc. entered into an Agreement and Plan of Merger with Prosperity Bancshares, Inc. on January 27, 2026, under which Stellar will merge with and into Prosperity.

- Each share of Stellar Common Stock will be converted into the right to receive 0.3803 shares of Prosperity Common Stock and $11.36 in cash.

- The merger is subject to customary conditions, including approval by Stellar's shareholders, regulatory approvals from the Federal Reserve Board, FDIC, and Texas Department of Banking, and authorization for listing on the NYSE of the Prosperity Common Stock to be issued.

- A termination fee of $78 million will be payable by Stellar under certain circumstances.

- Ademi LLP is investigating Stellar (NYSE: STEL) for potential breaches of fiduciary duty and other legal violations concerning its recently announced transaction with Prosperity Bancshares, Inc..

- In the transaction, Stellar stockholders are set to receive 0.3803 shares of common stock and $11.36 in cash for each outstanding share, valuing the deal at approximately $2.002 billion based on Prosperity's closing price of $72.90 on January 27, 2026.

- The investigation raises concerns that Stellar insiders will receive substantial benefits from change of control arrangements and that the transaction agreement unreasonably limits competing transactions by imposing a significant penalty.

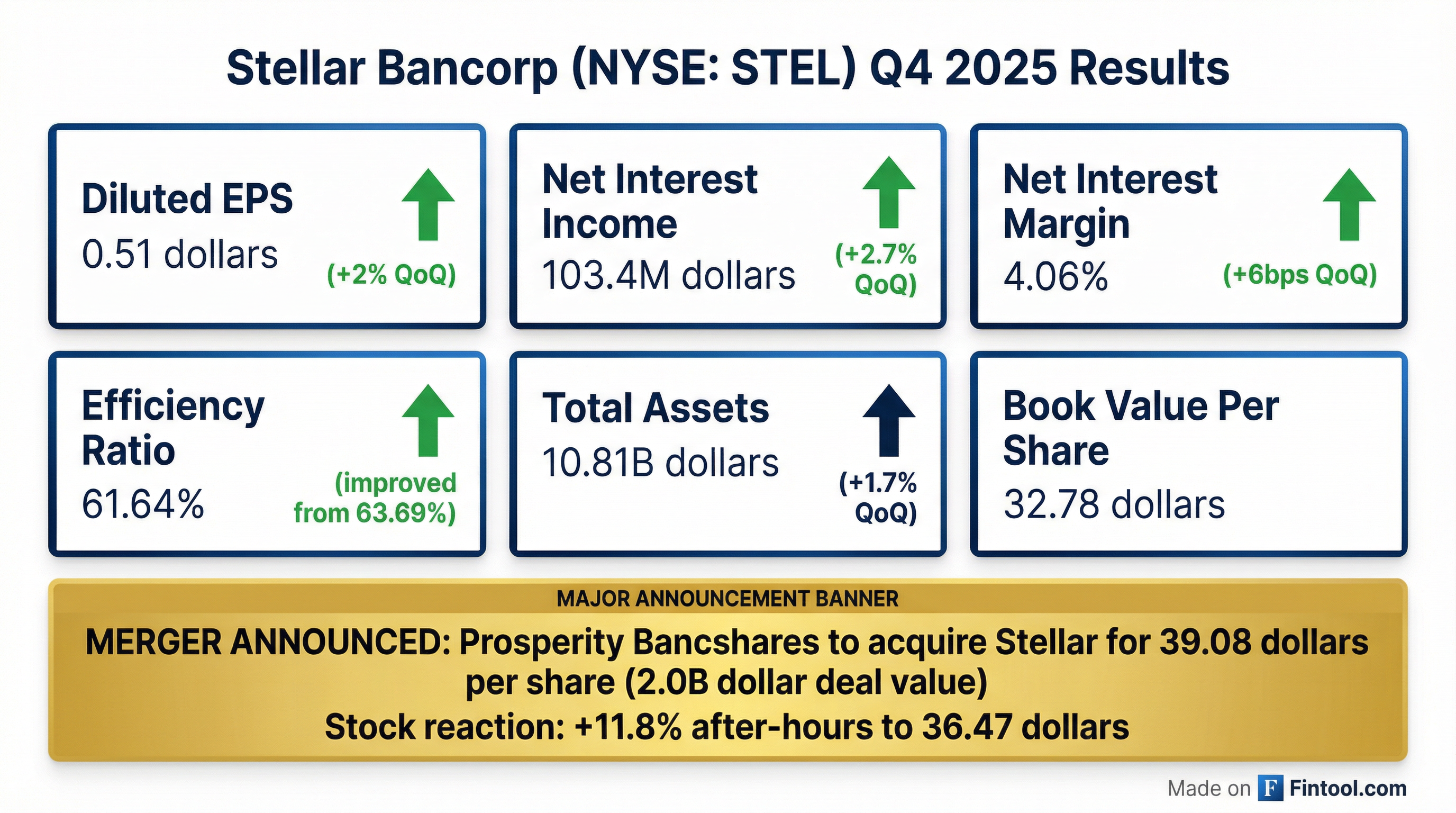

- Stellar Bancorp, Inc. reported net income of $26.1 million, or diluted earnings per share of $0.51, for the fourth quarter of 2025, and net income of $102.9 million, or diluted earnings per share of $1.99, for the full year 2025.

- The company announced it has entered into a merger agreement with Prosperity Bancshares, Inc..

- Net interest income for the fourth quarter of 2025 was $103.4 million, an increase from $100.6 million in the third quarter of 2025, with the tax equivalent net interest margin (excluding PAA) increasing to 4.06%.

- Book value per share increased to $32.78 at December 31, 2025, from $30.09 at December 31, 2024, and tangible book value per share grew to $21.62 from $19.05 over the same period.

- During the fourth quarter of 2025, Stellar Bancorp, Inc. repurchased 299,347 shares at a weighted average price of $30.44.

- Stellar Bancorp, Inc. reported net income of $26.1 million and diluted earnings per share of $0.51 for the fourth quarter of 2025, with full-year 2025 net income of $102.9 million and diluted EPS of $1.99.

- Net interest income for Q4 2025 was $103.4 million, up from $100.6 million in Q3 2025, and the tax equivalent net interest margin, excluding PAA, was 4.06%.

- The company's book value per share increased to $32.78 at December 31, 2025, from $30.09 at December 31, 2024, and tangible book value per share rose to $21.62 at December 31, 2025, from $19.05 at December 31, 2024.

- During the fourth quarter of 2025, Stellar Bancorp repurchased 299,347 shares at a weighted average price of $30.44 and paid down $30 million of subordinated debt.

- The company cancelled its previously announced conference call for the fourth quarter results due to entering into a merger agreement with Prosperity Bancshares, Inc..

- Stellar Bancorp, Inc. (NYSE: STEL) announced a definitive merger agreement to be acquired by Prosperity Bancshares, Inc. (NYSE: PB), with the announcement made on January 28, 2026, for an approximate total consideration of $2.002 billion.

- The consideration for each Stellar share consists of 0.3803 shares of Prosperity common stock and $11.36 in cash, representing approximately 70% stock and 30% cash.

- As of December 31, 2025, Stellar reported total assets of $10.807 billion, total loans of $7.301 billion, and total deposits of $9.021 billion.

- The merger is anticipated to close in the second quarter of 2026 and is expected to be 9.2% accretive to 2027E EPS for Prosperity, though it will result in (7.8%) tangible book value dilution.

- Key Stellar executives, including Robert R. Franklin, Jr. (CEO) and Ramon Vitulli (President), will join Prosperity Bank in leadership roles, and two Stellar directors will join Prosperity's Board.

- Stellar Bank reported Q3 2025 net income of $25.7 million, or $0.50 per diluted share, a slight decrease from the prior quarter.

- Net interest income increased to $100.6 million, with the net interest margin improving to 4.2% in Q3 2025. The net interest margin, excluding purchase accounting accretion, reached 4%.

- Non-interest expense rose to $73.1 million in Q3 2025, including $5 million in severance expenses. The company anticipates Q4 expenses to be closer to the first half run rate.

- The company maintained a strong capital position with a total risk-based capital of 16.33% and repurchased just under $5 million in shares during Q3 2025, contributing to $64 million in year-to-date repurchases. Additionally, $30 million of subordinated debt was paid down after quarter-end.

- Deposit growth was strong, with 51% of new deposits from new customers. Loan originations in Q3 2025 were almost $500 million, and year-to-date originations are up 62% compared to the first three quarters of the previous year.

- Stellar (STEL) reported net income of $25.7 million and diluted earnings per share of $0.50 for the third quarter of 2025.

- The company maintained a strong capital position with a total risk-based capital ratio of 16.33% and tangible book value per share of $21.08 at September 30, 2025.

- Asset quality improved, with nonperforming loans to total loans decreasing to 0.65% at September 30, 2025, and the allowance for credit losses on loans to nonperforming loans increasing to 170.65%.

- STEL holds the 6th largest deposit market share in the Houston region and the 1st among Texas-based banks in the region, with noninterest-bearing deposits representing 36.4% of total deposits at September 30, 2025.

- The company completed the redemption of $30 million of subordinated debt on October 1, 2025.

- Stellar Bancorp reported Q3 2025 net income of $25.7 million ($0.50 per diluted share), with an annualized ROA of 0.97% and annualized ROATCE of 11.45%.

- Net interest income increased to $100.6 million and net interest margin (NIM) improved to 4.2% in Q3 2025, with NIM excluding purchase accounting accretion reaching 4.0%.

- The company maintained a strong capital position, with total risk-based capital at 16.33% and tangible book value per share growing 9.3% year-over-year to $21.08. Stellar Bancorp repurchased just under $5 million in shares during Q3 and paid down $30 million of subordinated debt after quarter end.

- Credit quality remained stable, with net charge-offs of $3.3 million in Q3 2025, primarily from previously identified credits, and an allowance for credit losses on loans of $78.9 million (1.1% of loans).

- Non-interest expense rose to $73.1 million in Q3 2025 due to one-time items, but Q4 expenses are projected to return closer to the first half run rate of approximately $70 million.

- Stellar Bancorp reported net income of $25.7 million and diluted EPS of $0.50 for the third quarter of 2025.

- The company's net interest income increased to $100.6 million and net interest margin rose to 4.2% in Q3 2025, with the net interest margin excluding purchase accounting accretion reaching 4%.

- Credit quality included $3.3 million in net charge-offs for Q3 2025, and the allowance for credit losses on loans stood at $78.9 million, or 1.1% of loans.

- Non-interest expense was $73.1 million in Q3 2025, which is viewed as an outlier, with expectations for Q4 expenses to be closer to the first half run rate of approximately $70 million.

- Stellar Bancorp repurchased just under $5 million in shares during Q3 2025, contributing to approximately $64 million in share repurchases year-to-date, and paid down $30 million of subordinated debt just after quarter-end. Deposit growth was strong, with 51% from new customers.

- Stellar Bancorp reported net income of $25.7 million or $0.50 per diluted share for Q3 2025, with net interest income increasing to $100.6 million and net interest margin improving to 4.2%.

- The company demonstrated strong capital management, repurchasing just under $5 million in shares during Q3 (totaling $64 million year-to-date) and paying down $30 million of subordinated debt after quarter-end, contributing to a total risk-based capital of 16.33%. Balance sheet expansion was primarily driven by deposit growth, with 51% of new deposits in Q3 from new customers.

- While experiencing $3.3 million in net charge-offs in Q3, these were mostly identified and reserved for, with the allowance for credit losses at $78.9 million or 1.1% of loans. Non-interest expenses rose to $73.1 million in Q3 due to severance and elevated medical insurance, but Q4 expenses are expected to return closer to the first half run rate of approximately $70 million.

- Loan originations reached almost $500 million in Q3, contributing to a 62% year-to-date increase compared to the prior year, though net loan growth was impacted by elevated payoffs of $330 million in the quarter.

Quarterly earnings call transcripts for Stellar Bancorp.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more