STEEL DYNAMICS (STLD)·Q4 2025 Earnings Summary

Steel Dynamics Beats EPS, Stock Drops 4% as BlueScope Bid Rejected

January 26, 2026 · by Fintool AI Agent

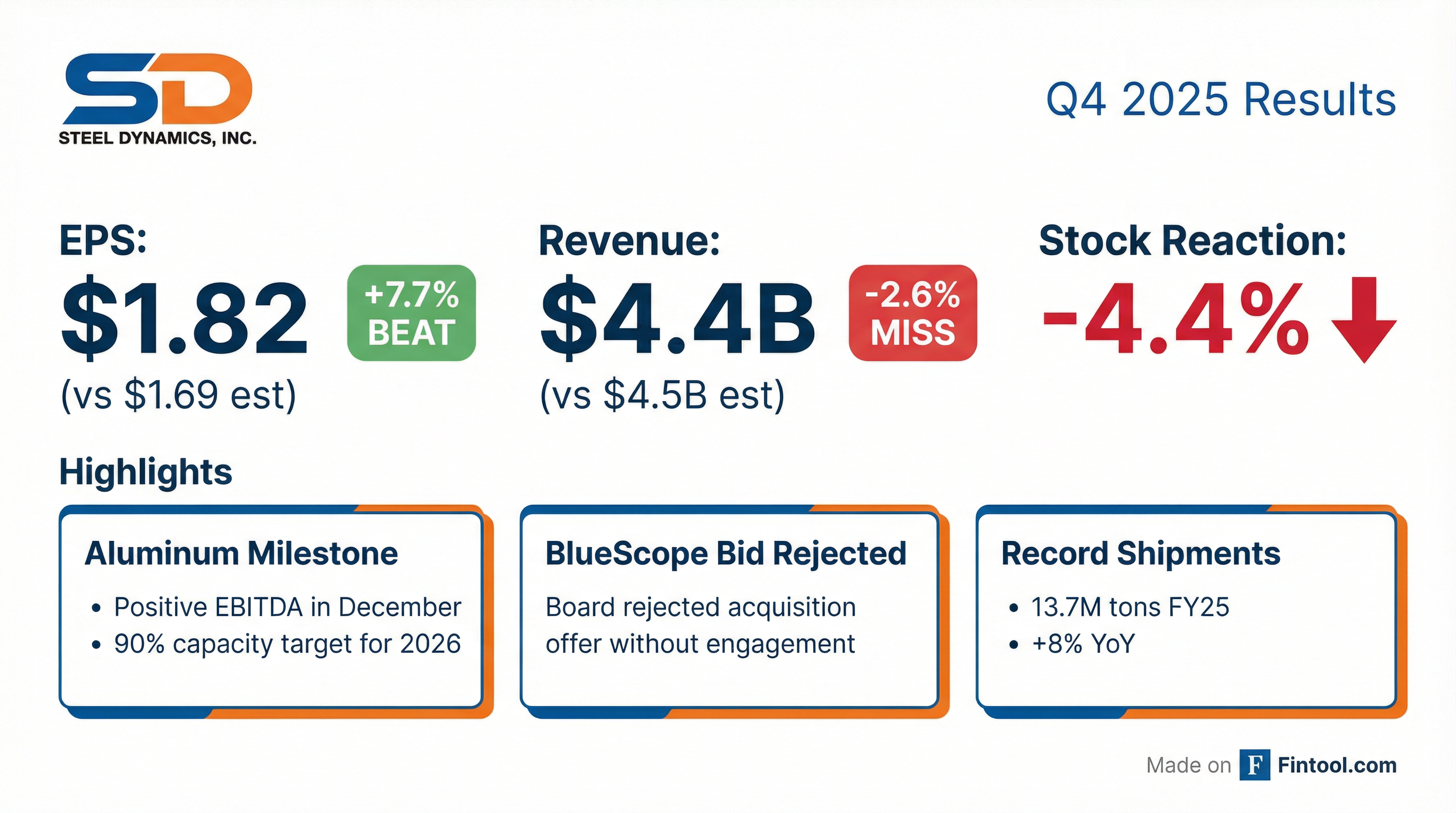

Steel Dynamics delivered Q4 2025 EPS of $1.82, beating consensus of $1.69 by 7.7%, while revenue of $4.4 billion missed estimates by 2.6%. Planned maintenance outages at flat roll steel mills reduced Q4 volumes by 140,000-150,000 tons. Despite the beat, shares fell 4.4% to $176.33 as BlueScope's board rejected Steel Dynamics' proposed acquisition without engagement. The aluminum segment achieved positive EBITDA in December, and management raised their capacity target to 90% by year-end 2026 (up from 75%).

Did Steel Dynamics Beat Earnings?

EPS Beat, Revenue Miss. The company posted $1.82 diluted EPS versus consensus of $1.69, a 7.7% beat. Revenue of $4.4 billion came in 2.6% below the Street's $4.5 billion estimate.

The EPS beat reflects strong cost management. The effective tax rate also benefited the quarter by approximately $15 million due to state adjustments and reserve items.

Year-over-year improvement was notable: Q4 2025 EPS of $1.82 improved 34% from $1.36 in Q4 2024. Full year EPS was $7.99 versus $9.84 in 2024, a 19% decline due to compressed metal margins.

What Happened with the BlueScope Acquisition?

CEO Mark Millett devoted significant time to explaining Steel Dynamics' proposed acquisition of BlueScope's North American assets — and the board's rejection.

Key points on the proposed transaction:

- In December 2025, Steel Dynamics submitted an offer with Australian partner SGH to purchase BlueScope on an all-cash basis

- SGH would acquire 100% of BlueScope and subsequently sell the U.S. assets to Steel Dynamics

- The offer was described as "significantly higher than the value its shares have ever realized in over 15 years"

- SDI requested a 30-day due diligence period

- BlueScope's board rejected the offer without any engagement

Millett's strategic rationale:

"North Star BlueScope is essentially a stranded asset and does not have the physical structural capability to provide the necessary value-add products required to supply the geographically disparate coil coating operations. They are missing essential equipment, at a minimum, cold rolling and galvanizing."

The company noted BlueScope recently wrote down AUD 500 million on its 2022 North American coatings acquisition.

Management stated they will not take further questions on BlueScope and will remain disciplined on valuation.

How Did Aluminum Operations Progress?

The Columbus aluminum facility achieved a major milestone: positive EBITDA in December based on 10,000 metric tons of shipments.

Key operational updates:

Management upgraded their capacity target:

"I'm confident we will be exiting 2026 at a rate approaching 90% capacity." — CEO Mark Millett

This is a significant increase from the prior 75% target. Accelerated customer certifications are also enabling a higher-margin product mix in 2026, with optimization now expected in 2027 versus the earlier expectation of 2028.

Through-cycle EBITDA target remains $650-700 million for the mill itself, plus $40-50 million for the Omni platform.

Why 90% vs. Prior 75% Target? Management explained the aluminum process is more "forgiving" than steel thin slab mills due to built-in redundancy:

"A thin slab steel mill... because the whole mill melts through refining, through casting, through rolling, it's just one continuous thing. One hiccup in one spot can take you down. Whereas in aluminum, we have 4 melt-cast units. You've got the hot mill. You've got 3 cold rolling units. It's just a lot more forgiving." — CEO Mark Millett

Favorable Market Backdrop: There is a significant domestic supply deficit of over 1.4 million tons for aluminum sheet, and this deficit is forecasted to grow. Tariffs on imported aluminum sheet increased from 10% in 2024 to 50% currently, providing cost advantages for domestic production.

What Drove the Volume Miss?

Planned maintenance outages hit harder than expected. All three flat roll steel mills underwent scheduled maintenance in Q4, with additional delays reducing production by an estimated 140,000-150,000 tons.

Q4 flat roll shipment breakdown:

- Hot-rolled: 942,000 tons

- Cold-rolled: 122,000 tons

- Coated products: 1,395,000 tons

No major outages planned for Q1 2026 — maintenance is targeted for Q2.

What Were the Key Q&A Highlights?

On the Sinton transformer incident (January 2026):

"We did have a transformer failure at the Sinton facility... It was one of the high-voltage transformers in the yard. Nobody was injured. The damage was limited to the transformer itself. And operations resumed shortly after the plant was safe, which was within the 12 hours." — Barry Schneider, COO

The company had proactively purchased backup transformers to mitigate this risk.

On trade case wins:

The four value-added lines (two galvanizing, two paint) are now "operating full" after trade cases against corrosion-resistant steels from 10 countries removed over 1 million tons of dumped material from the market.

On balance sheet capacity:

"We are incredibly committed to the investment-grade markets, but there's a lot of room in our ratings to be able to add that capacity... On a through-cycle basis, we definitely will remain under a 2x net levered basis." — CFO Theresa Wagler

On 2026 CapEx:

Capital investments expected around $600 million for 2026, down from $948 million in 2025. Sustaining capital runs $250-300 million.

On Energy Costs:

"Energy cost or percentage of energy cost is running around about 10% of our production cost. Both gas and electricity. So even some fluctuation isn't a material impact to us." — CEO Mark Millett

Management noted their mini-mill process uses considerably less natural gas per ton since cast steel goes directly into the rolling mill shortly after casting.

Full Year 2025 Highlights

Despite the challenging quarter, 2025 delivered solid annual results:

Record annual steel shipments of 13.7 million tons offset pricing headwinds that compressed margins year-over-year. The domestic steel industry operated at 77% utilization while SDI's mills operated at 86%.

Segment Performance:

- Steel Operations: $1.4B operating income for FY25 (vs. $1.6B FY24), $322M in Q4

- Metals Recycling: $97M operating income for FY25, up 30% YoY on improved pricing, volume, and operating efficiencies

- Steel Fabrication: $407M operating income for FY25, $91M in Q4 with moderate margin expansion

How Did the Stock React?

STLD shares fell 4.4% on earnings day (January 26, 2026) despite the EPS beat:

The negative reaction likely reflects disappointment over the BlueScope rejection and removal of that growth catalyst. The stock had rallied 48% over the prior year in anticipation of strategic developments.

Shareholder Returns

Steel Dynamics continues its aggressive capital return program:

- $900 million in share repurchases in 2025 (4%+ of shares outstanding)

- $240 million repurchased in Q4 alone

- $801 million remaining authorized for repurchases

- Dividend profile continues to grow, supported by structural cash flow improvements

"Our free cash flow profile has fundamentally changed over the last five years from an annual average of $540 million per year to $2.2 billion for the most recent five-year period." — CFO Theresa Wagler

Looking Ahead: Key Catalysts

Near-term (H1 2026):

- Continued aluminum facility ramp toward 90% capacity

- First CASH line operational by end of Q1 2026

- Steel pricing improvement as imports decline

- Strong fabrication backlog extending through mid-2026 — December was third strongest booking month of the year

Future Aluminum Expansion: When asked about additional aluminum capacity, CEO Mark Millett confirmed aluminum will be a growth platform:

"There's absolutely no doubt that aluminum will be a growth platform for us going forward. That's not to substitute or replace growth opportunities in steel... Given the supply-demand dislocation, there's certainly phenomenal opportunities there for us."

Through-cycle EBITDA potential from recent investments: ~$1.4 billion

- Sinton: $475-525 million

- Aluminum: $650-700 million (plus $40-50M for Omni)

- Four value-added lines:

$200 million ($50M each)

Risks to monitor:

- BlueScope transaction appears dead without board engagement

- Steel price volatility and import competition

- Aluminum ramp execution risk

- Recession sensitivity given cyclical end markets

Key Takeaways

- EPS beat despite volume miss — Cost discipline and favorable tax items offset maintenance-related volume shortfall

- BlueScope rejection disappointed — Stock fell 4% despite the beat after BlueScope's board rejected SDI's acquisition bid without engagement

- Aluminum milestone achieved — Positive EBITDA in December; capacity target upgraded to 90% by year-end 2026

- Record annual steel shipments — 13.7 million tons in 2025, operating at 86% utilization vs. industry's 77%

- Trade case wins boost value-added lines — 1 million+ tons of dumped imports removed from market

View Steel Dynamics company profile | Read Q4 2025 earnings call transcript | View Q3 2025 earnings recap