Earnings summaries and quarterly performance for STEEL DYNAMICS.

Executive leadership at STEEL DYNAMICS.

Mark Millett

Chief Executive Officer

Barry Schneider

President and Chief Operating Officer

Christopher Graham

Senior Vice President, Flat Roll Steel Group

Miguel Alvarez

Senior Vice President, Aluminum Group

Theresa Wagler

Executive Vice President, Chief Financial Officer and Corporate Secretary

Board of directors at STEEL DYNAMICS.

Research analysts who have asked questions during STEEL DYNAMICS earnings calls.

Tristan Gresser

BNP Paribas

10 questions for STLD

Lawson Winder

Bank of America

9 questions for STLD

Bill Peterson

JPMorgan Chase & Co.

8 questions for STLD

Carlos de Alba

Morgan Stanley

8 questions for STLD

Katja Jancic

BMO Capital Markets

8 questions for STLD

Alex Hacking

Citigroup

6 questions for STLD

John Tumazos

John Tumazos Very Independent Research

6 questions for STLD

Philip Gibbs

KeyBanc Capital Markets

6 questions for STLD

Andy Jones

UBS Group

5 questions for STLD

Mike Harris

Goldman Sachs

5 questions for STLD

Timna Tanners

Wolfe Research

5 questions for STLD

Andrew Jones

UBS

3 questions for STLD

William Peterson

JPMorgan Chase & Co.

2 questions for STLD

Christopher LaFemina

Jefferies

1 question for STLD

Martin Englert

S&P Global Commodity Insights

1 question for STLD

Michael Harris

Goldman Sachs

1 question for STLD

Phil Gibbs

Keybanc Capital Markets

1 question for STLD

Recent press releases and 8-K filings for STLD.

- Board approved a $0.53 per share cash dividend for Q1 2026, a 6% increase over the prior year’s quarterly rate.

- Dividend is payable to shareholders of record at close of business on March 31, 2026, with payment on or about April 10, 2026.

- CEO Mark D. Millett highlighted confidence in the company’s cash generation, consistent dividend growth, and commitment to an investment-grade credit rating.

- Steel Dynamics, alongside SGH Ltd, submitted a revised non-binding offer of A$32.35 per share in cash to acquire 100% of BlueScope Steel Ltd, valuing the equity at A$15 billion (US$11 billion).

- The proposal represents premiums of 47% to BSL’s undisturbed closing price at the initial proposal, 56% to its 52-week VWAP, 32% to its 15-year high, and is 14% higher than the original A$28.35 offer.

- Under the planned transaction, SGH would on-sell BlueScope’s North American operations to Steel Dynamics and retain the Australia & Rest of World businesses.

- The NBIO remains non-binding and is subject to satisfactory due diligence, regulatory and shareholder approvals, with no certainty the deal will complete.

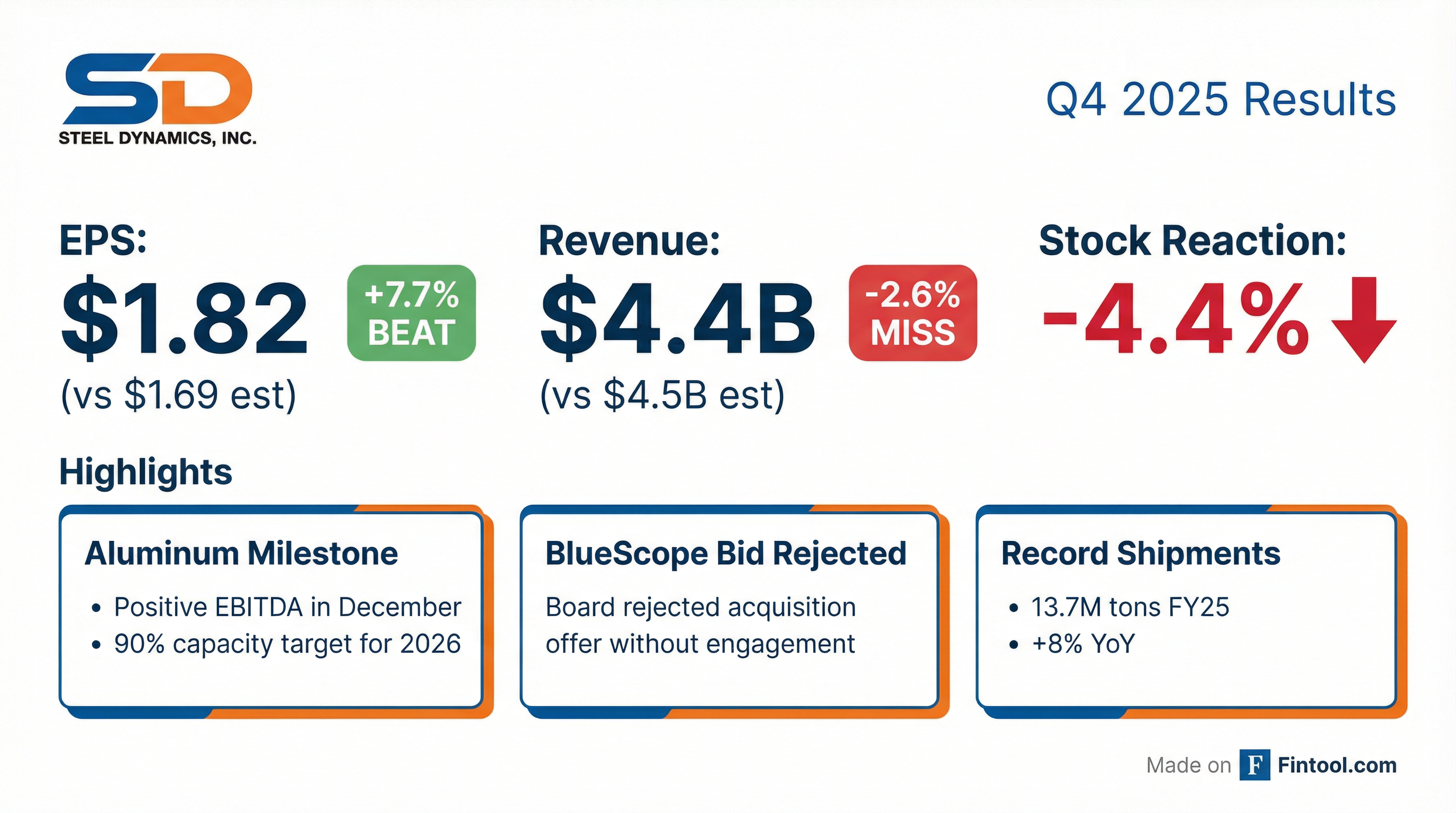

- Fourth quarter net sales of $4.4 billion and net income of $266 million (diluted EPS $1.82); full-year net sales of $18.2 billion and net income of $1.2 billion (diluted EPS $7.99).

- Record annual steel shipments of 13.7 million tons, $2.2 billion of adjusted EBITDA, and $1.4 billion in cash flow from operations; liquidity over $2.2 billion as of December 31, 2025.

- Returned capital via $901 million of share repurchases (over 4% of shares) and $291 million of dividends in 2025.

- Issued $800 million of unsecured notes (4.000% due 2028; 5.250% due 2035) and redeemed $400 million of notes due 2026.

- Steel Dynamics achieved record annual steel shipments of 13.7 million tons, with $1.4 billion cash from operations and $2.2 billion Adjusted EBITDA in 2025.

- In Q4 2025, revenue was $4.4 billion, net income $266 million ($1.82/share), and operating income $310 million, down sequentially due to lower pricing and volumes.

- Liquidity remained strong at >$2.2 billion, complemented by an $800 million investment-grade note issuance and $240 million in share repurchases in the quarter.

- Closed acquisition of the remaining 55% of New Process Steel in December 2025; proposed all-cash bid for BlueScope North America was ultimately rejected by BlueScope’s board.

- Steel Dynamics achieved 2025 operating income of $1.5 billion and net income of $1.2 billion ( $7.99 per diluted share ); in Q4 2025, revenue was $4.4 billion, operating income $310 million, and net income $266 million ($1.82 per diluted share)

- Cash flow from operations totaled $1.4 billion in 2025 with year-end liquidity over $2.2 billion; the company invested $948 million in capital expenditures and expects ~$600 million in CapEx for 2026

- Completed the acquisition of the remaining 55% equity interest in New Process Steel effective December 1, 2025, and in December submitted an all-cash offer for BlueScope alongside partner SGH to unlock value in North American assets

- Steel operations set a record with 13.7 million tons of shipments in 2025; in Q4 2025 flat-rolled steel operating income was $322 million, with shipments of 942,000 tons hot-rolled, 122,000 tons cold-rolled, and 1,395,000 tons coated products

- Aluminum Dynamics achieved positive EBITDA in December with 10,000 metric tons shipped; through-cycle EBITDA is forecast at $650–700 million, and the rolling mill is expected to reach 90% utilization by end-2026

- In 2025, Steel Dynamics reported $1.5 billion operating income and $1.2 billion net income ($7.99 per diluted share); cash flow from operations was $1.4 billion and liquidity exceeded $2.2 billion.

- In Q4 2025, net income was $266 million ($1.82 per diluted share), revenue was $4.4 billion, and operating income was $310 million.

- Record steel shipments of 13.7 million tons drove full-year volume, though flat-rolled operations saw Q4 operating income of $322 million after planned maintenance outages.

- Aluminum flat-rolled operations in Columbus and San Luis Potosí became EBITDA-positive in December, shipping 10 000 metric tons amid ongoing commissioning.

- The company issued $800 million in unsecured notes, repurchased $900 million of common stock (with $801 million of authorization remaining), and forecasts $600 million in capex for 2026.

- Full Year 2025: Revenue of $18.2 billion, Net Income of $1.2 billion, Adjusted EBITDA of $2.2 billion (12% margin), Diluted EPS of $7.99, and 4.4% share repurchase

- Q4 2025: Net Sales of $4.414 billion (down 9% sequential), Net Income of $266 million, Adjusted EBITDA of $505 million (11% margin), Diluted EPS of $1.82, and 1.0% share repurchase

- Operational highlights: Record steel shipments; completed acquisition of remaining 55% of New Process Steel; ramp-up of Aluminum Dynamics; first biocarbon shipments to Columbus mill

- Safety performance: Total Recordable Injury Rate of 1.5 versus industry steel rate 1.7; Lost Time Injury Rate of 0.34 for 2025

- Q4 2025 net sales of $4.4 billion and net income of $266 million ($1.82 EPS), down from $404 million ($2.74 EPS) in Q3 and up from $207 million ($1.36 EPS) in Q4 2024.

- Full-year 2025 net sales of $18.2 billion, operating income of $1.5 billion, net income of $1.2 billion ($7.99 EPS), and adjusted EBITDA of $2.2 billion, with record steel shipments of 13.7 million tons, $1.4 billion cash flow from operations, and liquidity of over $2.2 billion.

- Executed $901 million of share repurchases (4% of shares) and paid $291 million in dividends in 2025.

- Issued $800 million of unsecured notes (4.00% due 2028; 5.25% due 2035) to redeem $400 million of 2026 notes and for general corporate purposes.

- Steel Dynamics (SDI) and SGH Ltd have jointly submitted a non-binding indicative offer to acquire 100% of BlueScope Steel Ltd for AUD 30.00 per share (USD 20.041), valuing the deal at AUD 13.2 billion (USD 8.8 billion).

- The offer represents a 27% premium to BlueScope’s closing price and 33% premiums to its 3-month and 52-week VWAPs, with valuation multiples of 18.6x EV/FY25A EBIT and 9.5x EV/FY25A EBITDA.

- Under the proposal, SDI would acquire BlueScope’s North American operations, while SGH would retain the Australia + Rest of World businesses post-close.

- The transaction will be funded via existing cash reserves and debt financing, without issuing new equity, and remains subject to customary due diligence, shareholder, and regulatory approvals.

- Steel Dynamics forecasts Q4 2025 EPS of $1.65–$1.69, compared to $2.74 in Q3 2025 and $1.36 in Q4 2024.

- Lower steel operations profitability driven by 140,000–150,000 tons of reduced flat rolled steel production due to planned maintenance and > $70/ton drop in hot rolled steel prices sequentially.

- Metals recycling and steel fabrication earnings are also expected to decline sequentially due to seasonal shipment reductions and maintenance outages, despite a healthy order backlog into Q2 2026.

- The company has repurchased approximately $200 million (1%) of its common stock during Q4 2025.

Fintool News

In-depth analysis and coverage of STEEL DYNAMICS.

Quarterly earnings call transcripts for STEEL DYNAMICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more