Symbotic (SYM)·Q1 2026 Earnings Summary

Symbotic Crushes EBITDA Estimates, First GAAP Profit Sends Stock Up 11%

February 4, 2026 · by Fintool AI Agent

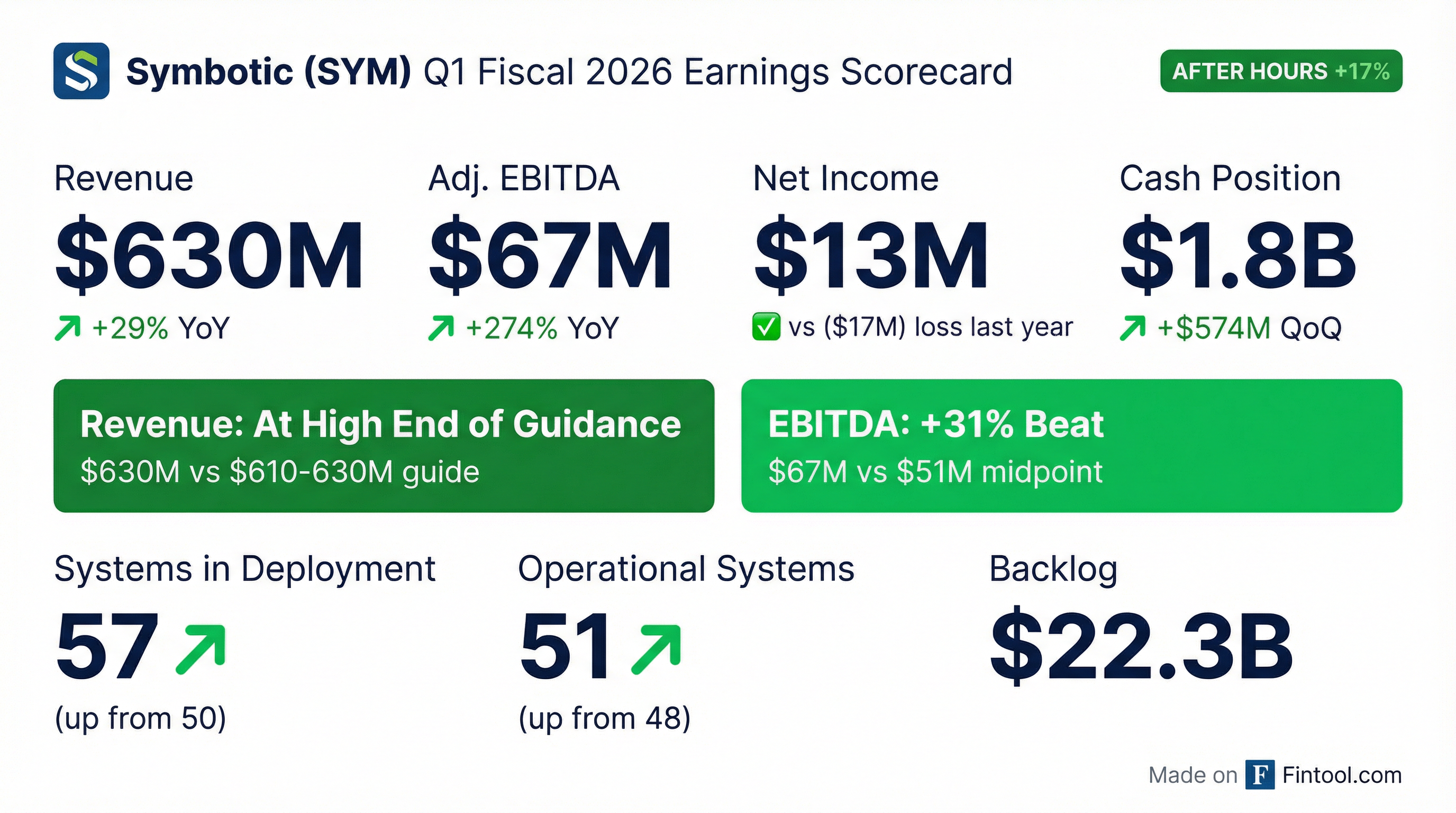

Symbotic (NASDAQ: SYM) reported Q1 FY2026 results that significantly exceeded profitability expectations, driving shares up 11% in after-hours trading. Revenue of $630 million came in at the high end of guidance while adjusted EBITDA of $67 million blew past guidance by 31% at the midpoint. The company delivered its first GAAP-profitable quarter with $13 million net income versus a $17 million loss in the year-ago quarter. On the call, management announced the Fox Robotics acquisition and confirmed expansion into direct-to-consumer e-commerce, perishables, and international markets.

Did Symbotic Beat Earnings?

Revenue: $630M — at high end of guidance, +29% YoY

Adjusted EBITDA: $67M — well above guidance range, +274% YoY

Net Income: $13M — vs. $(17M) loss in Q1 FY25, a $30M swing to profitability

The standout was profitability — adjusted EBITDA margin expanded to 10.6%, up nearly 700 basis points year-over-year and 270 basis points sequentially. This marks the company's strongest EBITDA margin on record.

What Did Management Guide?

Symbotic raised expectations with Q2 FY2026 guidance above the quarter just reported:

CEO Rick Cohen struck an optimistic tone: "We're off to a great start this year as our operational execution, product innovation, and financial discipline are translating into improved results... We see our offerings as the future of e-commerce, as retailers are increasingly seeking to take advantage of their store footprints and localized presence to offer customers unparalleled availability and order fulfillment speed through automation."

On the acquisition strategy: "We're looking at beginning the process of how we can invent stuff to think about different parts of the warehouse... We may only have 75% of the customer's problem solved, and then we would say, either we can invent it or we can buy it."

CFO Izzy Martins on the margin trajectory: "These results demonstrate the operating leverage available to us and reinforce our confidence in our ability to continue expanding our EBITDA margins and delivering sustained GAAP profitability."

What Changed From Last Quarter?

Several key developments differentiate Q1 FY26 from Q4 FY25:

1. First GAAP Profitable Quarter The company swung from a $9 million net loss in Q4 FY25 to $13 million net income in Q1 FY26 — Symbotic's first GAAP-profitable quarter as a public company.

2. Double-Digit EBITDA Margin Adjusted EBITDA margin reached 10.6%, the first time the company has achieved double-digit profitability. This compares to 7.9% in Q4 FY25 and 3.7% in Q1 FY25.

3. 10 New System Deployments Ten systems were added to deployment in Q1, including several phase-one deployments for Walmart that "will do twice the work of historical phase one deployments" due to the next-gen storage density. One deployment was for GreenBox (Exol).

4. Fox Robotics Acquisition Symbotic closed the acquisition of Fox Robotics, adding autonomous forklift solutions to extend orchestration from warehouse to dock door. Fox brings 25 customers, many new to Symbotic.

5. Massive Cash Build Cash and equivalents totaled $1.8 billion, up from $1.2 billion in Q4, driven by project milestones, new project signings, and $424 million in net proceeds from the December follow-on offering.

6. Accounting Change Stock-based compensation recognition shifted from graded vesting to straight-line method, following completion of accelerated vesting from the IPO transition. Prior periods were recast but adjusted EBITDA is unchanged.

How Did the Stock React?

SYM shares closed regular trading at $53.48, down 4.7% — reflecting broader market weakness rather than anticipation of results. After the earnings release, shares surged ~11% to $59.20 in after-hours trading.

The after-hours move likely reflects:

- EBITDA beat magnitude: 31% above guidance midpoint is a substantial surprise

- First double-digit EBITDA margin: 10.6% vs. 3.7% a year ago

- GAAP profitability: First positive net income quarter signals operating leverage

- Strategic announcements: Fox acquisition, SymMicro timeline, perishables progress

At the after-hours price of ~$59, SYM trades at approximately 16x trailing EV/Revenue — a premium multiple reflecting the company's unique positioning in warehouse automation and the clarity provided on strategic growth vectors.

Key Operational Metrics

The gap between systems in deployment (57) and operational systems (51) represents the revenue pipeline — six systems currently being installed that will convert to operational status and recurring revenue over the coming quarters. Installation timelines have improved, with installation-to-acceptance now averaging approximately 10 months.

Margin Expansion Story

Symbotic's margin trajectory has been the standout narrative:

In the Q4 FY25 earnings call, CFO Izzy Martins attributed margin gains to:

- Disciplined cost management — no cost creep in supply chain and installation

- Solid project execution — faster installation timelines reducing labor costs

- Strong supply chain partnerships — as the next-gen storage structure rolls out

- Operating leverage — fixed cost absorption as revenue scales

The company expects continued margin expansion as the next-generation storage structure — which offers higher density and faster installation — becomes a larger share of deployments.

Q&A Highlights

The Q&A session revealed several key operational and strategic updates:

Paid Development Program The Walmart-funded e-commerce development program reached double-digit percentage of revenue in Q1, up from high single-digits in Q4. CFO Izzy Martins noted this will be "lumpy" and expects it to drop back below double-digits in Q2 as resources are redeployed.

Deployment Timeline Improvements Overall project timelines remain at ~2 years from announcement to completion. However, the critical installation-to-acceptance phase has improved to approximately 10 months on average, down from historical levels.

Fox Robotics Acquisition Rationale Rick Cohen highlighted that Fox has 25 customers, many of whom are not current Symbotic customers. The acquisition targets dock automation — a "very big market" that can be sold separately from warehouse automation. Key differentiator: Fox uses autonomous fork trucks on docks, extending Symbotic's software orchestration from warehouse to dock.

SymMicro (Micro-Fulfillment) Timeline Prototypes for the second-generation SymMicro system will be installed within 12 months, possibly sooner. Once prototypes are complete, the $5 billion Walmart backlog for 400 stores will be triggered. Rick emphasized the addressable market extends beyond grocery to healthcare (Medline), auto parts, convenience stores, and more.

GreenBox (Exol) Progress The first GreenBox site is 9-10 months away from shipping to customers. Symbotic is actively negotiating contracts with prospective customers who can now visit and tour the sites.

Mexico and International Expansion The Mexico building is complete with installation starting soon. Rick noted they will "do far more sites in Mexico than we initially expected" and are also exploring Central and South America. In Europe, Symbotic now has 3-4 people on the ground and has spent "100x more hours" there in the last 6 months than the prior 5 years.

Perishables Opportunity The company is actively designing perishable (chilled/frozen) solutions for several customers. The next-gen structure's density advantage is particularly compelling for perishables — saving 40% of building footprint could mean $100M+ in construction savings for a 500K sq ft facility. Rick expects to announce perishable sites "fairly soon."

Sequential Growth Cadence CFO Martins clarified that Q2 and Q3 will see similar sequential growth, with "more pronounced growth in Q4" driven by the next-gen storage structure deployments that began in Q4 FY25.

Technology & Innovation Update

Symbotic shared impressive operational metrics demonstrating its scale in "physical AI":

Rick Cohen noted this "may be the most traveled, fully autonomous vehicle fleet in the world."

Bot Platform Expansion:

- SymBot: Standard 24-inch box capacity

- Stretch Bot: New 36-inch box capacity for larger items

- Mini Bot: Second-gen break pack system with LIDAR

- Fox Fork Trucks: Autonomous dock handling (via acquisition)

All bots now feature 8 cameras and LIDAR, enabling free-floating navigation in congested areas like docks.

Forward Catalysts

Near-Term (1-2 Quarters):

- Q2 FY26 earnings (May 2026) — continued margin expansion validation

- GreenBox site customer shipments — 9-10 months out

- SymMicro prototype installations — within 12 months, triggers $5B backlog

Medium-Term (FY26):

- Revenue acceleration in Q4 FY26 as next-gen storage structure deployments ramp

- Mexico site operational — building complete, installation starting

- European market entry — 3-4 people on ground, active customer discussions

- Perishables contracts — active design work with several customers

Long-Term:

- GreenBox JV scaling — 6-year, ~$11B contract with SoftBank unlocks $500B+ TAM

- Healthcare vertical expansion — Medline partnership and 500+ U.S. distribution centers

- Dock automation market — Fox acquisition opens new customer base

- Direct-to-consumer e-commerce — confirmed as strategic priority

Risks and Concerns

Customer Concentration: Walmart remains the dominant customer, though Fox acquisition brings 25 new customer relationships, many of whom could become full Symbotic customers over time.

Backlog Conversion Timing: The $22.3B backlog provides visibility, but revenue recognition depends on deployment schedules. CFO noted Q4 FY26 will see "more pronounced" growth as next-gen deployments that started in Q4 FY25 hit revenue recognition milestones.

Paid Development Lumpiness: The Walmart e-commerce development revenue hit double-digits in Q1 but will be "lumpy" going forward, dropping below that level in Q2. This creates quarter-to-quarter volatility.

Valuation: At ~17x EV/Revenue, the stock prices in substantial execution. Any deployment delays or margin compression could pressure the multiple.

Competition: While Symbotic claims differentiation, AutoStore, Ocado, and others continue to innovate in warehouse automation. Rick noted "a lot of German companies that make stuff" but believes customers are beginning to understand Symbotic's technology differentiation.

The Bottom Line

Symbotic delivered a standout Q1 FY26 with its first GAAP-profitable quarter and adjusted EBITDA that crushed guidance by 31%. The margin expansion story is accelerating — EBITDA margins nearly tripled year-over-year to 10.6%. With $1.8B in cash, $22.3B in contracted backlog, and 2 billion cases processed annually, the company is executing at scale.

The earnings call provided significant strategic clarity: Fox Robotics opens the dock automation market, SymMicro prototypes within 12 months trigger $5B of Walmart backlog, GreenBox is 9-10 months from customer shipments, and perishables solutions are in active development. The expansion into Europe and Mexico adds geographic diversification to the growth story.

The 11% after-hours surge reflects investor enthusiasm for both the margin beat and the strategic roadmap. Key questions: Can margins hold as paid development becomes lumpy? Will non-Walmart customers scale meaningfully? And can the technology advantage translate internationally?

View Symbotic Company Profile | Read Q1 FY26 Earnings Transcript