Earnings summaries and quarterly performance for Symbotic.

Executive leadership at Symbotic.

Richard Cohen

Chief Executive Officer

Corey Dufresne

Senior Vice President, General Counsel & Secretary

Izilda Martins

Chief Financial Officer

James Kuffner

Chief Technology Officer

Michael Dunn

Senior Vice President, Sales, Marketing & Product Strategy

Miriam Ort

Chief Human Resources Officer

Walter Odisho

Chief Manufacturing & Supply Chain Officer

William Boyd III

Chief Strategy Officer

Board of directors at Symbotic.

Research analysts who have asked questions during Symbotic earnings calls.

Derek Soderberg

Cantor Fitzgerald

8 questions for SYM

Colin Rusch

Oppenheimer & Co. Inc.

7 questions for SYM

Guy Hardwick

Freedom Capital Markets

7 questions for SYM

Joseph Giordano

TD Cowen

7 questions for SYM

Mark Delaney

The Goldman Sachs Group, Inc.

7 questions for SYM

Greg Palm

Craig-Hallum Capital Group LLC

6 questions for SYM

Kenneth Newman

KeyBanc Capital Markets

6 questions for SYM

Andrew Kaplowitz

Citigroup

5 questions for SYM

Mike Latimore

Northland Capital Markets

5 questions for SYM

Nicole DeBlase

BofA Securities

5 questions for SYM

Robert Mason

Robert W. Baird & Co.

5 questions for SYM

Keith Housum

Northcoast Research

4 questions for SYM

Matt Summerville

D.A. Davidson & Co.

3 questions for SYM

Damian Karas

UBS

2 questions for SYM

Gregory Palm

Craig Hallum Capital Group

2 questions for SYM

James Ricchiuti

Needham & Company, LLC

2 questions for SYM

James Riccitelli

Needham & Company

2 questions for SYM

Jim Ricchiuti

Needham & Company

2 questions for SYM

Ken Newman

KeyBanc

2 questions for SYM

Michael Latimore

Northland Capital Markets

2 questions for SYM

Nicole DeBlase

Deutsche Bank

2 questions for SYM

Piyush Avasthy

Citi

2 questions for SYM

Ross Sparenblek

William Blair & Company

2 questions for SYM

Michael Atanacio

TD Cowen

1 question for SYM

Natalie Back

Citigroup

1 question for SYM

Robert Jamieson

Vertical Research Partners

1 question for SYM

Rob Mason

Baird

1 question for SYM

Will Bryant

Goldman Sachs

1 question for SYM

Recent press releases and 8-K filings for SYM.

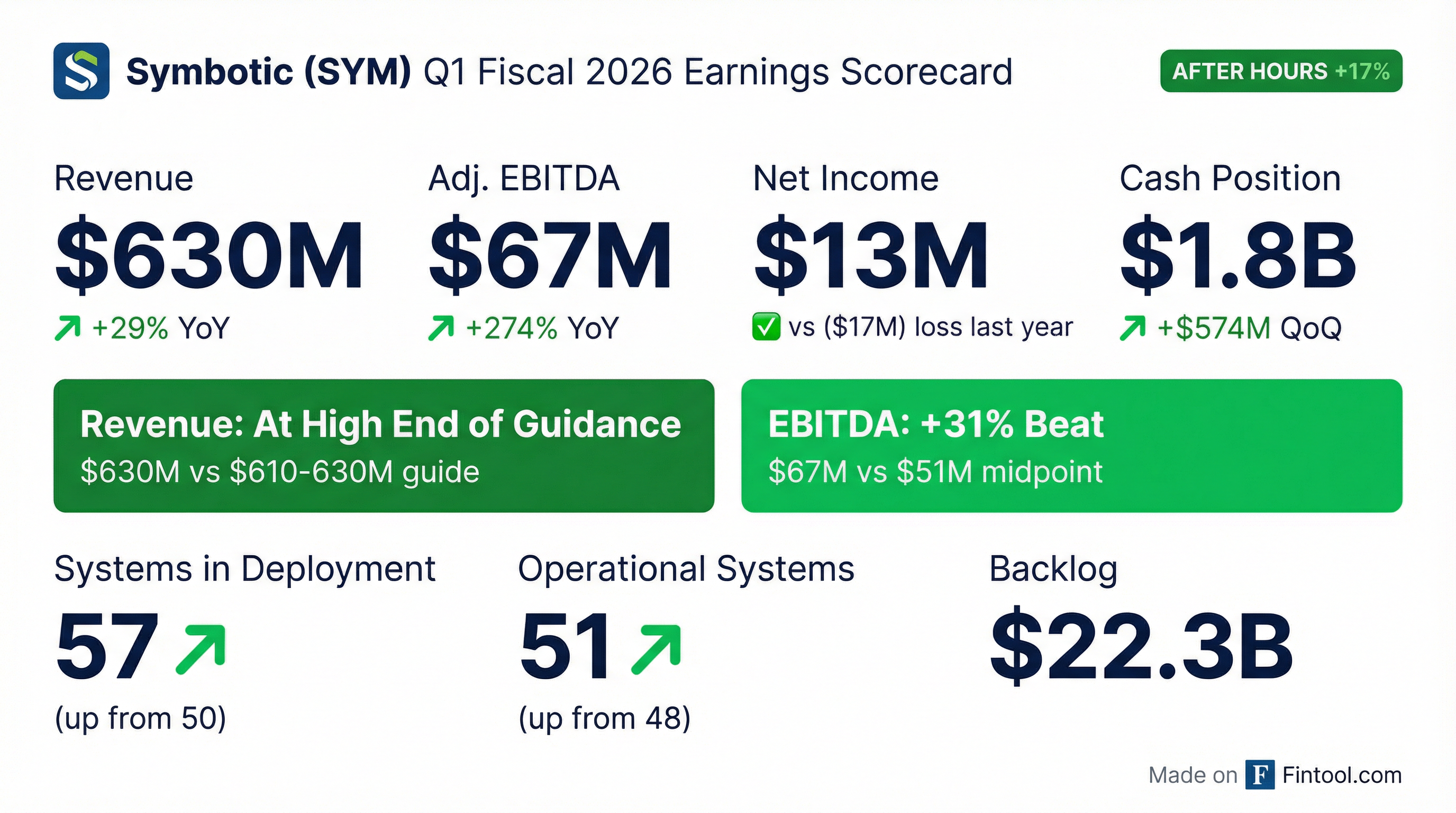

- Symbotic reported $630 million in total revenue for Q1 2026.

- The company achieved $13 million in GAAP Net Income and $67 million in Adjusted EBITDA for Q1 2026.

- As of Q1 2026, Symbotic has 57 systems in deployment and 51 operational systems.

- Symbotic maintains a significant $22.3 billion in contracted backlog.

- Symbotic reported Q1 2026 revenue of $630 million, representing a 29% year-over-year increase, and achieved GAAP profitability with $13 million in net income, a significant improvement from a net loss of $17 million in Q1 2025.

- Adjusted EBITDA reached $67 million, up from $18 million in Q1 2025, marking the first time the company achieved a double-digit EBITDA margin.

- The company provided Q2 2026 guidance, projecting revenue between $650 million and $670 million and Adjusted EBITDA between $70 million and $75 million.

- Operational highlights for the quarter included 10 new system deployments, bringing the total to 57 systems in deployment, and the acquisition of Fox Robotics to enhance autonomous forklift solutions.

- Symbotic achieved GAAP profitability in Q1 2026 with $13 million in net income, a significant improvement from a net loss of $17 million in Q1 2025, and an Adjusted EBITDA of $67 million, marking its first double-digit EBITDA margin.

- Q1 2026 revenue increased 29% year-over-year to $630 million, driven by 27% year-over-year systems revenue growth to $590 million, 97% year-over-year software revenue growth to $10.9 million, and 68% year-over-year operations services revenue growth to $28.8 million.

- The company provided Q2 2026 guidance, projecting revenue between $650 million and $670 million and Adjusted EBITDA between $70 million and $75 million.

- Strategic developments include the acquisition of Fox Robotics to enhance autonomous forklift solutions and continued progress with Walmart on enhanced second-generation e-commerce fulfillment solutions.

- Symbotic maintains a strong backlog of $22.3 billion and is actively expanding its market presence into Europe, Canada, Central and South America, and Mexico.

- Symbotic achieved GAAP profitability in Q1 2026 with $13 million in net income and $67 million in adjusted EBITDA, marking its first double-digit EBITDA margin, on $630 million in revenue.

- For Q2 2026, the company forecasts revenue between $650 million and $670 million and Adjusted EBITDA between $70 million and $75 million, reflecting continued strong top-line growth and margin expansion.

- Symbotic acquired Fox Robotics, a leader in autonomous forklift solutions, to enhance its strategy of orchestrating robots across the supply chain and broaden its customer opportunities.

- Operational execution saw 10 new system deployments in Q1 2026, and SymBots demonstrated improved performance with over a 25% increase in miles driven and transactions per bot daily compared to a year ago.

- Symbotic Inc. announced strong first quarter fiscal year 2026 results, with revenue of $630 million, marking a 29% year-over-year increase, and a net income of $13 million (compared to a net loss of $17 million in Q1 FY25). Adjusted EBITDA reached $67 million, significantly up from $18 million in the prior year.

- The company's cash and cash equivalents totaled $1.8 billion at the end of Q1 FY26, reflecting a $574 million increase from the prior quarter, which includes $424 million of net proceeds from a follow-on offering.

- For the second quarter of fiscal 2026, Symbotic expects revenue between $650 million and $670 million and adjusted EBITDA between $70 million and $75 million.

- Symbotic reported revenue of $630 million for the first quarter of fiscal year 2026, which ended on December 27, 2025, marking a 29% year-over-year increase.

- The company achieved net income of $13 million in Q1 FY2026, compared to a net loss of $17 million in the first quarter of fiscal year 2025.

- Adjusted EBITDA reached $67 million, a significant rise from $18 million in the first quarter of fiscal year 2025.

- Cash and cash equivalents totaled $1.8 billion at the end of Q1 FY2026, an increase of $574 million from the prior quarter, including $424 million from a follow-on offering.

- For the second quarter of fiscal 2026, Symbotic anticipates revenue of $650 million to $670 million and adjusted EBITDA of $70 million to $75 million.

- Symbotic Inc. announced the pricing of an underwritten public offering of 10,000,000 shares of its Class A common stock at a public offering price of $55.00 per share.

- Of the total shares, 6,500,000 shares are being sold by Symbotic, and 3,500,000 shares are being sold by SVF Sponsor III (DE) LLC, an affiliate of SoftBank Group Corp..

- Symbotic intends to use its net proceeds from the offering for general corporate purposes, while the Selling Securityholder will receive all net proceeds from their sale.

- The underwriters have been granted a 30-day option to purchase up to an additional 1,500,000 shares of Class A common stock.

- The offering is expected to close on December 8, 2025.

- Symbotic reported Q4 2025 revenue of $618 million, a 10% year-over-year increase, and adjusted EBITDA of $49 million. For the full fiscal year 2025, revenue grew 26% year over year.

- The company concluded Q4 2025 with a backlog of $22.5 billion and cash exceeding $1.2 billion.

- Symbotic signed Medline as a new customer in the healthcare vertical and initiated 10 new system deployments in Q4, increasing the total operational systems to 48.

- For Q1 fiscal year 2026, Symbotic anticipates revenue between $610 million and $630 million and adjusted EBITDA between $49 million and $53 million.

- Strategic developments include expanding into micro-fulfillment, upgrading to a next-gen storage design, and investing in Nyobolt battery technology to enhance bot reliability.

- Symbotic reported Q4 2025 revenue of $618 million, a 10% year-over-year increase, and a net loss of $19 million. For the full fiscal year 2025, revenue increased 26% year-over-year.

- The company's backlog remained strong at $22.5 billion, and cash equivalents reached $1.2 billion at the end of Q4 2025.

- Symbotic expanded into the healthcare vertical by signing Medline as a new customer and increased its operational footprint to 48 systems by deploying 10 new systems in Q4 2025.

- For Q1 2026, the company forecasts revenue between $610 million and $630 million and Adjusted EBITDA between $49 million and $53 million.

- Management expressed confidence in continued system gross margin expansion driven by disciplined cost management and the deployment of its next-gen storage structure.

- Symbotic reported Q4 2025 revenue of $618 million, a 10% year-over-year increase, and adjusted EBITDA of $49 million. For the full fiscal year 2025, revenue grew 26% year-over-year.

- The company ended Q4 2025 with $1.2 billion in cash equivalents and a backlog of $22.5 billion.

- Strategic developments include the expansion of its product portfolio with micro-fulfillment and a next-generation storage design, and the signing of Medline as its first customer in the healthcare vertical.

- For Q1 2026, Symbotic expects revenue between $610 million and $630 million and adjusted EBITDA between $49 million and $53 million. The introduction of next-gen storage is expected to result in less pronounced sequential revenue growth in the first half of fiscal year 2026.

Quarterly earnings call transcripts for Symbotic.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more