SYNAPTICS (SYNA)·Q2 2026 Earnings Summary

Synaptics Beats on Core IoT Strength, Stock Slides After Hours on Q3 Guidance

February 5, 2026 · by Fintool AI Agent

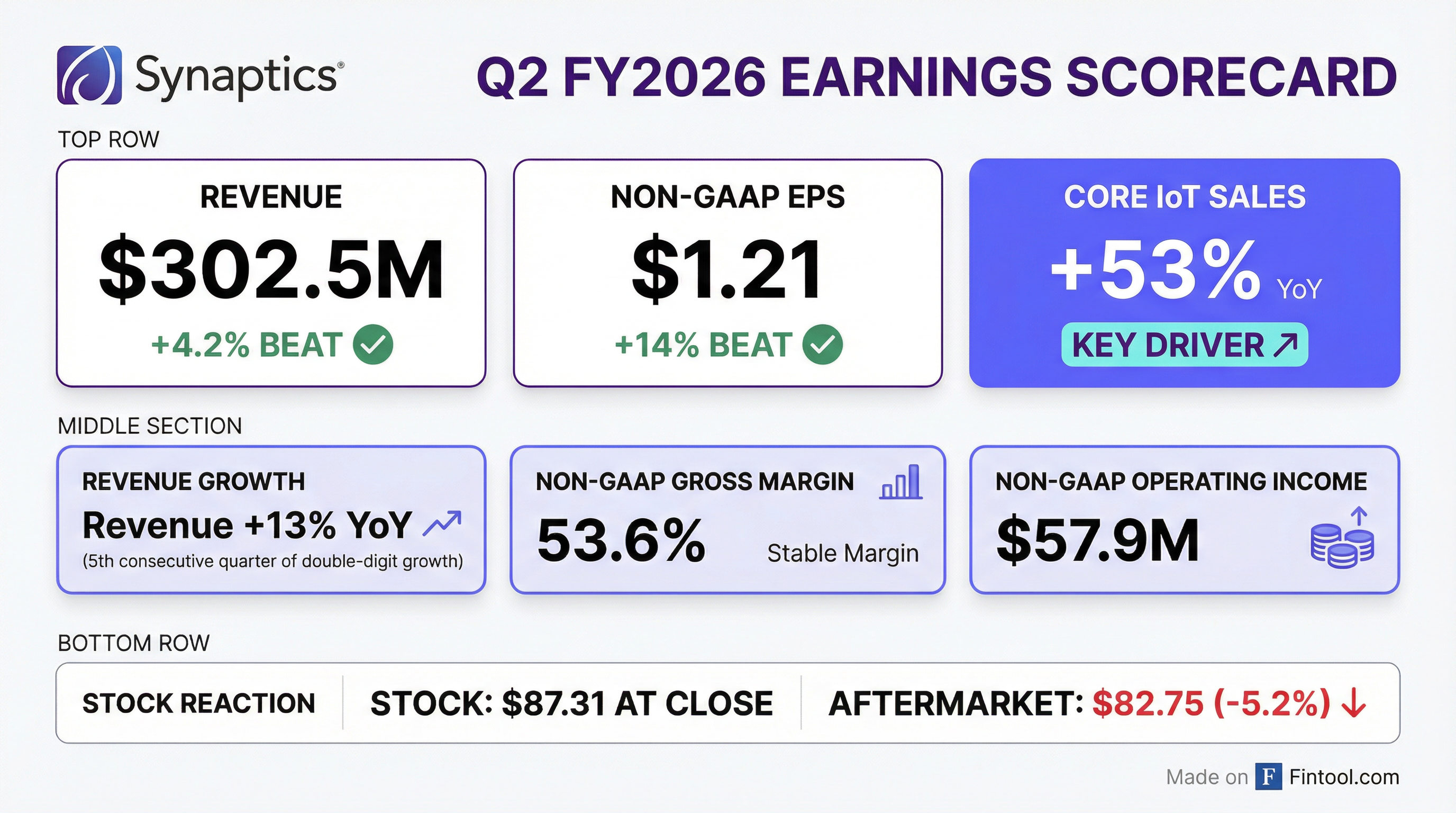

Synaptics delivered a strong beat on both revenue and earnings in its second quarter of fiscal 2026, with Core IoT product sales surging 53% year-over-year and driving the company's fifth consecutive quarter of double-digit top-line growth. However, shares fell approximately 5% in after-hours trading as guidance implied a sequential revenue decline in Q3, despite remaining above Street expectations.

Did Synaptics Beat Earnings?

Yes — Synaptics beat on both revenue and EPS:

The beat was driven by strength in the Core IoT segment, which grew 53% year-over-year to account for an increasing share of total revenue. This marks the eighth consecutive quarter of EPS beats for Synaptics.*

Beat/Miss History (Last 8 Quarters)

*Values retrieved from S&P Global

What Did Management Guide?

Q3 FY2026 guidance came in above consensus, but below Q2 actuals:

CFO Ken Rizvi emphasized the company "entered the third quarter with a healthy backlog" and that "guidance reflects continued year-over-year growth." Despite sequential softness, the guidance midpoint implies approximately 9% year-over-year revenue growth in Q3 (vs. $267M in Q3 FY25).

Guidance vs. Prior Quarter Guide

Management has consistently guided conservatively, beating the high end of guidance for three consecutive quarters.

How Did the Stock React?

Intraday and after-hours performance:

The after-hours decline likely reflects investor disappointment with the sequential revenue decline implied in Q3 guidance. The stock had rallied approximately 6% over the prior two trading sessions in anticipation of results.

What Changed From Last Quarter?

Core IoT Growth Moderated But Remained Strong

*Estimated based on mix commentary.

Key Developments This Quarter

-

Humanoid Robotics in Pilot Phase: CEO Patel revealed Synaptics is sampling silicon for "pilot builds of a humanoid at a major customer" — the industry leader plans to ship pilots this year and enter production in late 2027. Synaptics content includes touch controllers (30+ per robotic hand demonstrated at CES) and interface bridge products for high-bandwidth data transport.

-

Astra Product Portfolio Expansion: Two new products now in early sampling — an Astra MCU with integrated Wi-Fi 7 + Bluetooth 6 + Thread (only solution in its class with Wi-Fi 7), and a standalone connectivity SoC for non-Astra platforms

-

Wi-Fi 8 Development Underway: Over 500 engineers working on Wi-Fi 8, with customer sampling planned by year-end

-

Semi-Custom MCU On Track: Major customer semi-custom MCU tape out expected in April 2026

-

Organizational Restructuring: Processors and connectivity teams combined into single organization to accelerate integrated solution roadmap

-

New Design Wins: Secured Astra design with tier-one consumer electronics OEM for gesture-based TV control; added another foldable design with leading China OEM

Key Management Quotes

On Edge AI and Robotics Opportunity:

"A defining theme at CES and across the industry is the accelerating shift towards Physical and Edge AI as intelligence moves closer to the device. This evolution aligns directly with Synaptics' strategic focus and core product strengths." — Rahul Patel, President & CEO

On Humanoid Robotics Progress:

"We are now sampling silicon for a pilot build to a company that's leading the marketplace, building multiple advanced humanoids to be delivered to the marketplace at the end of this year as pilots." — Rahul Patel, President & CEO

On Competitive Positioning in Wi-Fi:

"I can't think of any microprocessor or MCU company investing in wireless connectivity at the pace at which we are... We have over 500 engineers right now working on Wi-Fi 8 at Synaptics." — Rahul Patel, President & CEO

On June Quarter Outlook:

"The starting backlog for Q4 compared to the same point in time for Q3 is up. Obviously, we need to continue to see progress in those trends in terms of bookings, but that's at least a strong data point for us as we look to June." — Ken Rizvi, CFO

Segment Performance

Revenue Mix

Core IoT continues to be the growth engine, driven by:

- Wireless connectivity products (primary driver of 53% YoY growth)

- Astra AI-native processors gaining design wins in TVs, appliances, and robotics

- New sampling of integrated Wi-Fi 7 MCU and standalone connectivity SoC

Enterprise & Automotive showed modest sequential improvement:

- Enterprise PC benefiting from market share gains AND gradual refresh cycle

- Automotive remains "range-bound" and is not a strategic focus

Mobile Touch benefited from improving supply:

- Supply constraints from Q1 are "starting to ease"

- Premium tier insulated from memory shortage pressures

- New foldable design win with leading China OEM (2x content vs. regular phones)

Financial Trends

Quarterly Financial Summary

*Q2 FY26 cash flow estimated from 6-month data.

Balance Sheet Highlights

CFO Rizvi noted the inventory increase "reflects our strategic decision to purchase inventory slightly ahead of demand" — positioning for expected Astra and connectivity product ramps.

Forward Catalysts

-

Astra Platform Revenue Ramp (Calendar 2027): Astra microprocessor production expected end of Q3/early Q4 FY2026. CEO confirmed "meaningful revenue contribution in calendar 2027" with "very accretive" gross margin impact.

-

Integrated MCU + Wi-Fi 7 Product: Now in early sampling phase — the only MCU in its class with Wi-Fi 7, Bluetooth 6, and Thread. Integrates touch and voice interfaces. Revenue contribution expected calendar 2027.

-

Humanoid Robotics Opportunity: Major customer planning pilot shipments in late 2026, production in late 2027. Synaptics provides touch controllers and bridge solutions. Could expand to broader robotics market from vacuum cleaners to industrial automation.

-

Semi-Custom MCU Tape Out (April 2026): Major OEM engagement for hybrid compute AI applications — creates reference design for first and third-party products.

-

Wi-Fi 8 Leadership: 500+ engineers developing Wi-Fi 8; sampling expected by year-end 2026. Positions Synaptics ahead of MCU competitors stuck at Wi-Fi 6.

-

June Quarter Uptick: Starting backlog for Q4 FY2026 is higher than Q3 at the same point, suggesting sequential revenue recovery after March quarter softness.

Q&A Highlights

On Memory Shortage Impact (Ross Seymore, Deutsche Bank): Management stated the premium tier of mobile and enterprise PC markets appears "immune" to memory supply challenges affecting the broader market. Their focus on high-end segments provides insulation from demand elasticity concerns.

On Astra Revenue Timing (Ross Seymore, Deutsche Bank): CEO Patel confirmed "meaningful revenue contribution in calendar 2027" from Astra products and emphasized they are "very accretive to gross margin" — suggesting both top-line and margin expansion as Astra ramps.

On Channel Inventory (Christopher Roland, Susquehanna): CFO Rizvi noted distribution channel inventory "remains very lean" following the COVID boom/bust cycle. "We're shipping really towards end market demand" — suggesting no inventory overhang risk.

On Competitive Positioning (Kevin Cassidy, Rosenblatt): CEO Patel stated there is no competing MCU or microprocessor with Wi-Fi 7 integrated: "The last thing I saw was Wi-Fi 6." With Wi-Fi 8 sampling planned for year-end, Synaptics maintains a technology lead in wireless connectivity.

On Pipeline Mix (Neil Young, Needham): Consumer pipeline is larger than industrial, which is "expected in our launch of the Astra lineup." However, industrial is "falling right behind consumers" with humanoid and robotics engagements building.

Risks and Concerns

- Sequential Revenue Decline: Q3 guidance implies ~4% sequential decline, potentially signaling demand moderation

- Tariff Uncertainty: Management explicitly cited "ongoing global trade and tariff uncertainties" in outlook

- Automotive Weakness: Automotive remains "range-bound" and a small portion of overall business; more focus on enterprise and Core IoT going forward

- GAAP Losses Continue: Despite non-GAAP profitability, GAAP losses persist due to acquisition-related costs and share-based compensation

Analyst Estimates (Forward)

*Values retrieved from S&P Global

The Street models continued sequential recovery through fiscal 2027, with expectations of accelerating growth as Astra platform design wins convert to revenue.

Related Resources: