Earnings summaries and quarterly performance for SYNAPTICS.

Executive leadership at SYNAPTICS.

Rahul Patel

President and Chief Executive Officer

Ken Rizvi

Senior Vice President and Chief Financial Officer

Lisa Bodensteiner

Senior Vice President, Chief Legal Officer and Secretary

Satish Ganesan

Senior Vice President and General Manager, Intelligent Sensing Division, and Chief Strategy Officer

Vikram Gupta

Senior Vice President and General Manager, IoT Processors, and Chief Product Officer

Board of directors at SYNAPTICS.

Research analysts who have asked questions during SYNAPTICS earnings calls.

Christopher Rolland

Susquehanna Financial Group

6 questions for SYNA

Kevin Cassidy

Rosenblatt Securities

6 questions for SYNA

Peter Peng

Evercore ISI

6 questions for SYNA

Neil Young

Needham & Company

3 questions for SYNA

Sreekrishnan Sankarnarayanan

Wolfe Research, LLC

3 questions for SYNA

Robert Mertens

TD Cowen

2 questions for SYNA

Ross Seymore

Deutsche Bank

2 questions for SYNA

Tom O'Malley

Barclays

2 questions for SYNA

Jacob Grandstaff

Mizuho

1 question for SYNA

Jing Xiao Liu

Mizuho Securities

1 question for SYNA

Joe Quatrochi

Wells Fargo

1 question for SYNA

Krish Sankar

TD Cowen

1 question for SYNA

Martin Yang

Oppenheimer & Co. Inc.

1 question for SYNA

Nick Doyle

Needham & Company

1 question for SYNA

Nicolas Doyle

Needham & Company, LLC

1 question for SYNA

Quinn Bolton

Needham & Company, LLC

1 question for SYNA

Travis O'Neil

Wells Fargo

1 question for SYNA

Recent press releases and 8-K filings for SYNA.

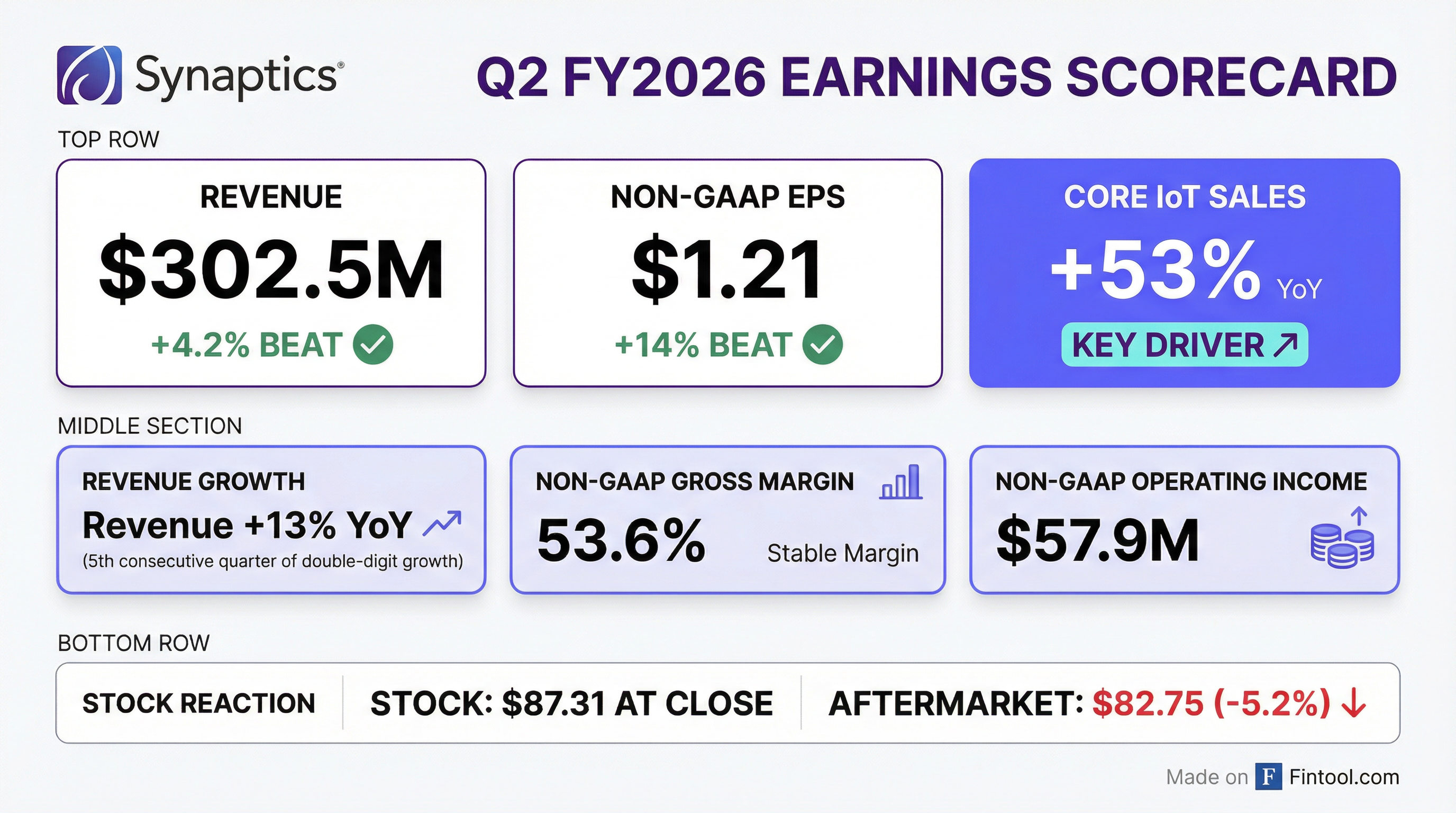

- Synaptics reported strong fiscal Q2 2026 results, with revenue increasing 13% year-over-year to $302.5 million and non-GAAP EPS growing 32% year-over-year to $1.21, primarily driven by 53% year-over-year growth in core IoT products.

- For fiscal Q3 2026, the company expects revenue of approximately $290 million and non-GAAP EPS of $1.00 at the midpoint.

- The company is expanding its Edge AI portfolio by sampling new Astra microcontrollers with integrated Wi-Fi 7, Bluetooth 6, and Thread, and a standalone Wi-Fi 7 Connectivity SoC, with revenue contribution anticipated in calendar 2027.

- Synaptics is making progress in the robotics market, actively sampling silicon for pilot builds of advanced humanoids with a leading customer, leveraging its touch controllers and Interface Bridge products.

- During Q2 2026, Synaptics repurchased $36.4 million of its shares, contributing to a total of $43.6 million in share repurchases through the fiscal quarter.

- Synaptics reported Q2 FY26 revenue of $302.5 million, an increase of 13% year-over-year.

- Core IoT revenue demonstrated strong momentum, growing 53% year-over-year in Q2 FY26.

- Non-GAAP diluted earnings per share reached $1.21, representing 32% year-over-year growth.

- The company achieved a Non-GAAP gross margin of 53.6% and generated $30 million in cash flow from operations during the quarter.

- For Q3 FY26, Synaptics guides revenue to be $290 million ± $10 million and Non-GAAP EPS to be $1.00 ± $0.15.

- Synaptics reported non-GAAP revenue of $302.5 million for the second quarter of fiscal year 2026, marking a 13% year-over-year increase, primarily driven by a 53% year-over-year increase in core IoT product revenues. Non-GAAP diluted EPS for the quarter was $1.21 per share, an increase of 32% year-over-year.

- For the third quarter of fiscal year 2026, Synaptics anticipates non-GAAP revenue to be approximately $290 million at the midpoint and non-GAAP diluted EPS to be $1 per share at the midpoint.

- The company is expanding its Edge AI portfolio, with new Astra microcontrollers featuring Wi-Fi 7, Bluetooth 6, and Thread connectivity currently sampling, and secured a design win for its Astra MCU in smart televisions with a tier one consumer electronics OEM. Revenue contribution from these new products is expected to begin in calendar 2027.

- Synaptics repurchased $36.4 million of its shares during Q2 fiscal year 2026, contributing to a total of $43.6 million in share repurchases through the fiscal second quarter.

- Synaptics delivered strong Q2 2026 financial results, with revenue increasing 13% year-over-year to $302.5 million and non-GAAP earnings per share growing 32% year-over-year to $1.21, primarily driven by 53% year-over-year growth in core IoT products.

- The company is accelerating its focus on Physical and Edge AI, showcasing new technologies at CES and actively sampling products for advanced humanoids with an industry leader.

- Synaptics introduced new products, including an Astra MCU with integrated Wi-Fi 7, Bluetooth 6, and Thread, and a standalone Connectivity SoC supporting Wi-Fi 7, with expected revenue contribution beginning in calendar 2027.

- For Q3 2026, Synaptics expects revenue of approximately $290 million and non-GAAP earnings per share of $1.00 at the midpoint.

- The company repurchased $36.4 million of its shares in Q2 2026, bringing the total repurchases through Q2 to $43.6 million.

- Synaptics reported revenue of $302.5 million for the second quarter of fiscal 2026, marking a 13% increase year-over-year.

- Core IoT product sales grew by 53% year-over-year in Q2 Fiscal 2026.

- The company's Non-GAAP diluted earnings per share for Q2 Fiscal 2026 was $1.21.

- For the third quarter of fiscal 2026, Synaptics expects revenue to be $290 million ± $10 million and Non-GAAP diluted earnings per share to be $1.00 ± $0.15.

- Synaptics reported net revenue of $302.5 million for the second quarter of fiscal 2026, an increase of 13% year-over-year, with Core IoT product sales growing by 53% year-over-year.

- For Q2 FY2026, the company recorded a GAAP loss per share of $0.38 and Non-GAAP diluted earnings per share of $1.21.

- The company expects third quarter fiscal 2026 revenue to be $290M ± $10M and Non-GAAP diluted earnings per share to be $1.00 ± $0.15.

- This marks the fifth consecutive quarter of double-digit year-over-year revenue growth for Synaptics.

- Synaptics is evolving into an AI at the edge solutions company, focusing on sensing, processing, and connectivity, with its new Astra AI native embedded compute platform currently sampling and expected to go GA by the end of Q1 or beginning of Q2.

- The company has a strategic partnership with Google, integrating Google's Coral RISC-V NPU into its Astra platform, which enhances compute capabilities at lower power consumption and leverages an open-source approach.

- Synaptics' wireless connectivity business has grown north of 50% on average over the last six quarters, driven by Wi-Fi 7 adoption in IoT, with a clear roadmap to Wi-Fi 8.

- In July 2025, Synaptics announced a $150 million share repurchase program, demonstrating its commitment to returning capital to shareholders while also prioritizing organic investments and tuck-in acquisitions.

- Synaptics is transforming into an AI at the edge solutions company, leveraging its Astra platform, which includes the 2600 series processor sampling now and expected to go GA in late Q1/early Q2 (calendar year).

- The Astra platform is differentiated by its low power consumption and a unique collaboration with Google to embed their Coral RISC-V NPU, with initial applications in industrial, consumer, and robotics.

- The company's IoT connectivity business has been growing north of 50% on average over the last six quarters, driven by Wi-Fi 7 adoption, and secured a design win for horizontal foldable phones expected to ramp in the second half of calendar year 2026.

- Synaptics prioritizes organic investment, tuck-in acquisitions, and returning capital to shareholders, having returned approximately $128 million in fiscal 2025 and announcing a $150 million share repurchase program in July.

- Synaptics is focusing on AI at the edge with its Astra platform (2600 series processor), which is currently sampling with customers and is expected to go GA (General Availability) by the end of Q1 or beginning of Q2. This platform features a unique architecture, including a collaboration with Google to embed their Coral RISC-V NPU, and is designed for low power consumption.

- The company's wireless connectivity business has seen substantial growth, averaging north of 50% over the last five to six quarters, driven by the adoption of Wi-Fi 7 solutions in the IoT market. Synaptics is also developing a wirelessly connected MCU with AI integrated on a single chip for applications like smart home and wearables.

- Synaptics anticipates a PC refresh cycle and movement to AI PCs in 2026, and has secured a design win for horizontal foldable phones expected to ramp in the second half of calendar year 2026.

- Capital allocation priorities include organic investment, tuck-in M&A, maintaining a strong balance sheet, and returning capital to shareholders, with approximately $128 million returned in fiscal 2025 and a $150 million share repurchase program announced in July.

- Synaptics is focusing on the edge AI and IoT market, differentiating from data center AI by addressing latency, privacy, and user experience needs.

- The company's IoT business, currently at a $400 million annual run rate, has grown 50% year-over-year on a quarterly basis and is projected to grow 25%-30% over the next three to four years. This growth is driven by Wi-Fi 7 leadership and upcoming processor products with edge AI capabilities.

- Synaptics has a strategic partnership with Google, integrating Google's Coral NPU into its Astra family of products, and acquired Broadcom's Wi-Fi IP and 130 engineers to enhance its wireless connectivity offerings, providing a 18-24 month competitive advantage.

- In capital allocation, Synaptics prioritizes investing in high-growth segments like AI at the edge and core IoT, pursuing tuck-in M&A, and returning capital to shareholders, including $128 million in share repurchases in fiscal 2025 and a new $150 million authorization.

- The auto business, currently about 10% of total revenue, is expected to become a smaller portion, while the mobile segment sees market share gains in foldables, offering greater than 2x revenue per device.

Quarterly earnings call transcripts for SYNAPTICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more