Atlassian (TEAM)·Q2 2026 Earnings Summary

Atlassian Hits $1B Cloud Quarter, Stock Falls 10% as Data Center Transition Looms

February 5, 2026 · by Fintool AI Agent

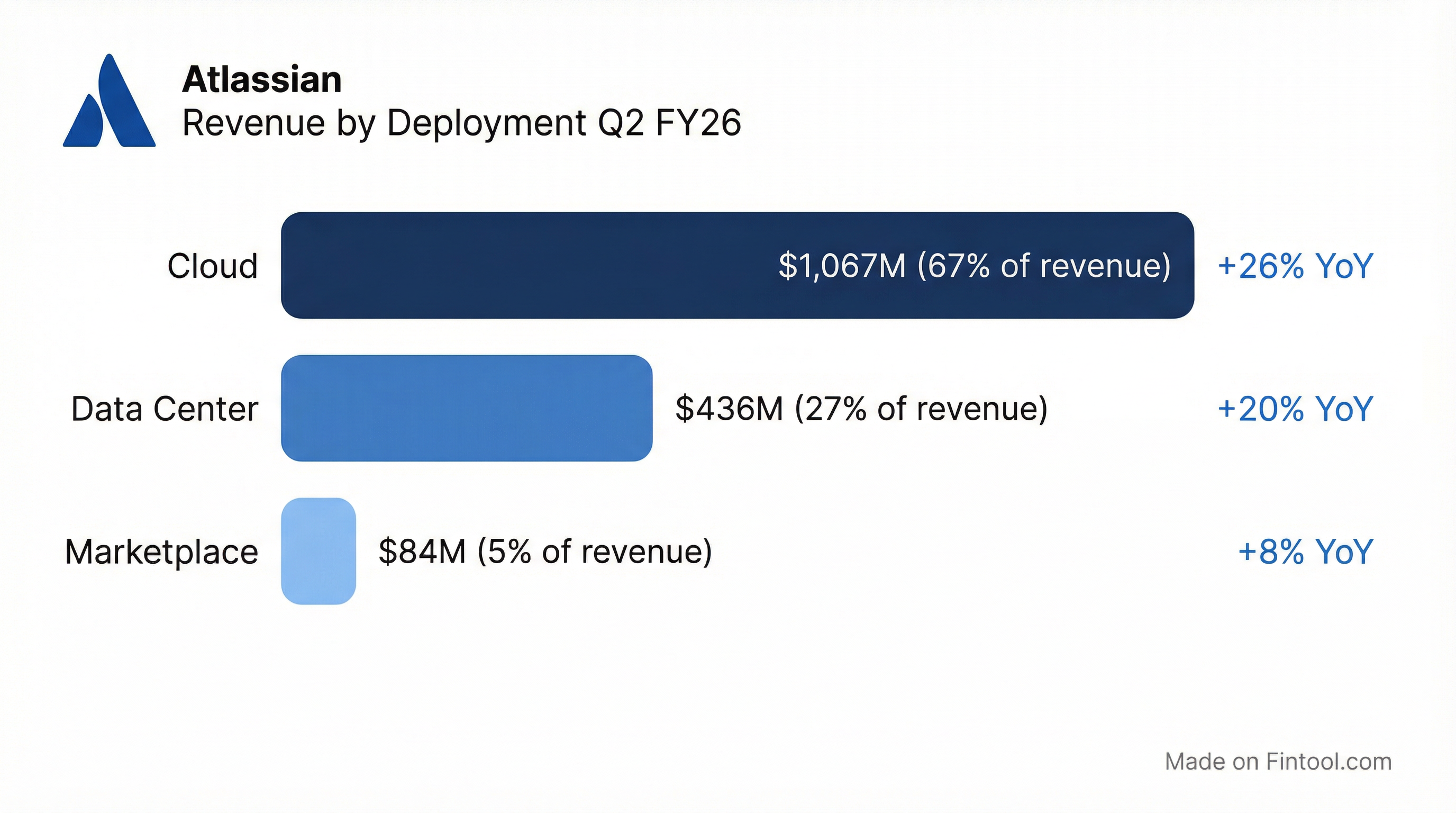

Atlassian delivered a strong Q2 FY26, crossing $1 billion in Cloud revenue for the first time and beating estimates on both revenue and EPS. Total revenue grew 23% YoY to $1.59 billion, while non-GAAP EPS of $1.22 surpassed consensus by 28%. Despite the beat and raised guidance, the stock fell approximately 10% in after-hours trading as investors digested warnings about Data Center revenue "meaningfully decelerating" in FY27 and a 51% decline in free cash flow. CEO Mike Cannon-Brookes opened the call noting the company has "surpassed $6 billion in annual run rate revenue" with "RPO growing 44% YoY to $3.8 billion."

Did Atlassian Beat Earnings?

Yes — Atlassian beat on all key metrics:

This marks Atlassian's 9th consecutive EPS beat. The company has consistently exceeded estimates as enterprise adoption accelerates and AI products gain traction.

What Did Management Guide?

Atlassian raised its full-year outlook and guided Q3 revenue significantly above consensus:

Q3 FY26 Guidance:

- Revenue: $1,689-$1,697M (midpoint $1,693M) — ~10% above consensus of $1,544M

- Cloud growth: ~23% YoY

- Data Center growth: ~33.5% YoY (benefiting from EOL recognition)

- Non-GAAP operating margin: ~27.5%

FY26 Full Year Guidance (Raised):

- Revenue growth: ~22% YoY (up from prior)

- Cloud growth: ~24.3% (including ~1pp from DX acquisition)

- Data Center growth: ~20% YoY

- Non-GAAP operating margin: ~25.5%

FY27 Warning — The Key Concern:

"As we look ahead to FY27, we expect Data Center revenue growth to meaningfully decelerate as we lap the FY26 benefit of the Data Center EOL revenue recognition impact. Additionally, we expect increasing migrations to Cloud and moderating seat expansion, which will drive additional headwinds to FY27 Data Center revenue growth."

This FY27 warning is likely the primary driver of the stock's after-hours decline.

How Did the Stock React?

TEAM shares fell sharply despite the beat:

- Regular session close: $98.41 (-6.3% on day)

- After-hours: $93.78 (-4.7% from close, ~-10% total)

- 52-week range: $97.93 - $326.00

The stock has declined significantly from its 52-week high of $326, now trading near 52-week lows. Analyst Greg Moskowitz captured the market frustration: "We are in a software twilight zone of sorts, and when a company whose stock is down almost 40% in 5 weeks on no company-specific news, just reports a strong quarter, raises guidance and makes a significant commitment to accelerate the buyback, and yet the shares are right now indicated down an additional 10%."

Investors appear concerned about:

- FY27 Data Center deceleration — The company's on-premise business will face meaningful headwinds

- Free cash flow decline — FCF down 51% YoY to $169M (though management cited timing issues)

- Valuation reset — Even at lower prices, TEAM trades at premium multiples

- Broader AI software fears — The market is reassessing all enterprise software names amid agentic AI disruption concerns

What Changed From Last Quarter?

New Developments:

- First $1B Cloud Quarter — Milestone achieved in Q2

- Rovo crossed 5M MAU — AI product gaining traction

- Record $1M+ ACV deals — Up nearly 2x YoY

- 600+ customers with $1M+ ARR — Up ~40% YoY

- Teamwork Collection passed 1M seats — AI monetization ahead of expectations

Revenue Breakdown

Cloud: Growth driven by paid seat expansion, Data Center migrations, cross-sell, and higher ARPU. DX acquisition contributed ~75bps to growth.

Data Center: Growth boosted by EOL revenue recognition impact and price increases, partially offset by Cloud migrations.

Key Management Quotes

CEO Mike Cannon-Brookes opened his shareholder letter with characteristic bluntness:

"We had a fantastic Q2. We're building a bloody great business. I'm convinced AI is great for Atlassian. Others think software is dead. In this environment, it seems that noise swamps signal, nuance gets lost. So this quarter I'm going to give you straight signal."

On long-term mindset:

"We just celebrated the 10-year anniversary of our IPO. What Scott and I wrote in our F-1 remains true today: We've run this company with a long-term mindset... We don't seek to maximize growth in any one year. We are focused on sustainable growth year after year."

CFO Joe Binz on enterprise momentum:

"We closed out Q2 with strong enterprise sales and partner execution, delivering our first-ever $1 billion Cloud revenue quarter and closing a record number of deals greater than $1 million in ACV."

On customer conversations and RPO as a vote of confidence:

"Our RPO at 44%, accelerating for the third quarter in a row, is a really fantastic vote of confidence... Those are tens of thousands of seats signing multi-year deals that are voting on not the platform for 2026 for them in AI, but the platform in 2027, 2028, and 2029. And those customers are seeing what we're doing, seeing our progress, and voting with their feet."

On capital allocation — a notable signal of confidence:

"We plan to accelerate the pace of share repurchases in H2 relative to H1. We intend to use our proven ability to generate strong free cash flow to opportunistically return capital to shareholders. In January alone, we have repurchased more shares than we did in Q2. To further underscore their conviction in our massive long-term growth opportunities, the founders will pause their selling plans that have been in place since the IPO."

Margins and Profitability

The free cash flow decline was attributed to "timing differences in cash collections and tax payments" as December billings will be collected in Q3. Management expects "significantly higher free cash flow margin in H2 relative to H1."

AI and Product Highlights

Atlassian emphasized its AI progress:

- Rovo surpassed 5M monthly active users

- Teamwork Graph reached 100B+ objects & connections — powering AI context

- Record agent & token usage — "millions of agentic workflows now running every single month"

- Teamwork Collection (primary AI monetization) passed 1M seats in under 9 months — exceeding expectations

- AI code gen users expand 5% faster — Companies using AI coding tools have 5% more MAU and 5% faster seat expansion

- AI driving upgrades — "AI capabilities are the reasons people are moving to the Teamwork Collection. They're the reasons that people are upgrading to the cloud."

Customer quote from CIO Chris Burgess:

"In probably 8 weeks, we saw full adoption [of Rovo]. It's used by 70% of our company. In about six weeks, we created 200 Rovo agents, and they're not only helping employees but also increasing productivity and capacity."

Industry Recognition:

- Leader in 2025 Gartner Magic Quadrant for Collaborative Work Management

- Leader in 2025 Gartner Magic Quadrant for Marketing Work Management Platforms

- Leader in Forrester Wave for Enterprise Service Management Platforms

Q&A Highlights

The earnings call Q&A surfaced several important themes:

On Anthropic's Cowork as Competition:

"Anthropic is a great partner of Atlassian. We use a lot of their models, we use a lot of their coding tools... The greatest users of our MCP server, as an example, is a way to get to Atlassian's offering and the Teamwork Graph, and the context we have in those other tools is through things like Cowork and use of Atlassian's MCP server. That is really good for us."

Mike framed potential competitors as integration partners, noting that agentic tools still require Atlassian's Teamwork Graph for context.

On AI Code Generation Driving Jira Usage:

"When we look at the thousands of customers using AI code generation tools, we found that they create 5% more tasks in Jira, have 5% higher monthly active users, and expand their Jira seats 5% faster than those who don't use these AI coding tools."

This data point directly refutes concerns that AI coding tools would cannibalize Jira usage.

On Seat-Based Pricing Durability:

"The customer's preferred method of payment is still an understandable, predictable pricing pattern, which tends to be a seat-based model... It is our job as an application vendor to manage the costs of everything we have in the envelope of what the customers pay. We've done that in storage, we've done that in network costs, we're now doing it in AI costs."

On Jira Service Management Momentum:

Mike highlighted JSM as "definitely our fastest growing product at significant scale" with:

- 65,000 customers (50% of Fortune 500)

- Enterprise segment growing 60%+ YoY

- 40%+ of agentic workflows built in service collection

- 2/3 of JSM customers using for non-IT use cases

- Customer service management app GA'd this quarter

On Migrations:

"We saw very healthy Cloud migrations in Q2. It contributed a mid- to high-single-digit impact to Cloud revenue growth rates."

On Mid-Term Outlook:

CFO Joe Binns confirmed: "There's no change to our midterm outlook, calling for a 20%+ compounded annual revenue growth through FY 2027... the same thing for our 25%+ non-GAAP operating margin commitment in FY 2027."

Risk Factors to Watch

-

Data Center deceleration in FY27 — Management explicitly warned this will be a meaningful headwind

-

Macro uncertainty — Guidance continues to assume "negative impacts to key growth drivers... given the uncertainty in the macroeconomic environment"

-

Free cash flow volatility — While management attributes this to timing, consistent cash generation matters

-

Stock-based compensation — SBC was $453M in Q2, representing 29% of revenue on a GAAP basis

-

Acquisition integration — DX and BCNY both closed in Q2, adding complexity

Forward Catalysts

- Q3 FY26 earnings — Will enterprise momentum sustain?

- Rovo monetization — Teamwork Collection adoption trajectory

- Data Center migration pace — How quickly do customers move to Cloud?

- FY27 guidance — Will be closely watched after Data Center warning

- Founder share purchases — Pausing sales is a confidence signal; would buying be next?

Summary

Atlassian delivered strong Q2 results with its first $1B Cloud quarter, beats on both revenue and EPS, and raised guidance. However, the stock fell ~10% after-hours on FY27 Data Center deceleration warnings. The long-term Cloud transition story remains intact, AI products are gaining traction faster than expected, and founder confidence signals (pausing sales, accelerating buybacks) suggest management believes the stock is undervalued. The next few quarters will be critical as Data Center headwinds begin to materialize while Cloud must pick up the slack.

Related: Atlassian Company Profile | Q2 FY26 8-K Filing | Prior Quarter: Q1 FY26