TERADYNE (TER)·Q4 2025 Earnings Summary

Teradyne Crushes Q4 on AI Surge, Stock Rockets 8% as AI Drives 70% of Q1 Revenue

February 3, 2026 · by Fintool AI Agent

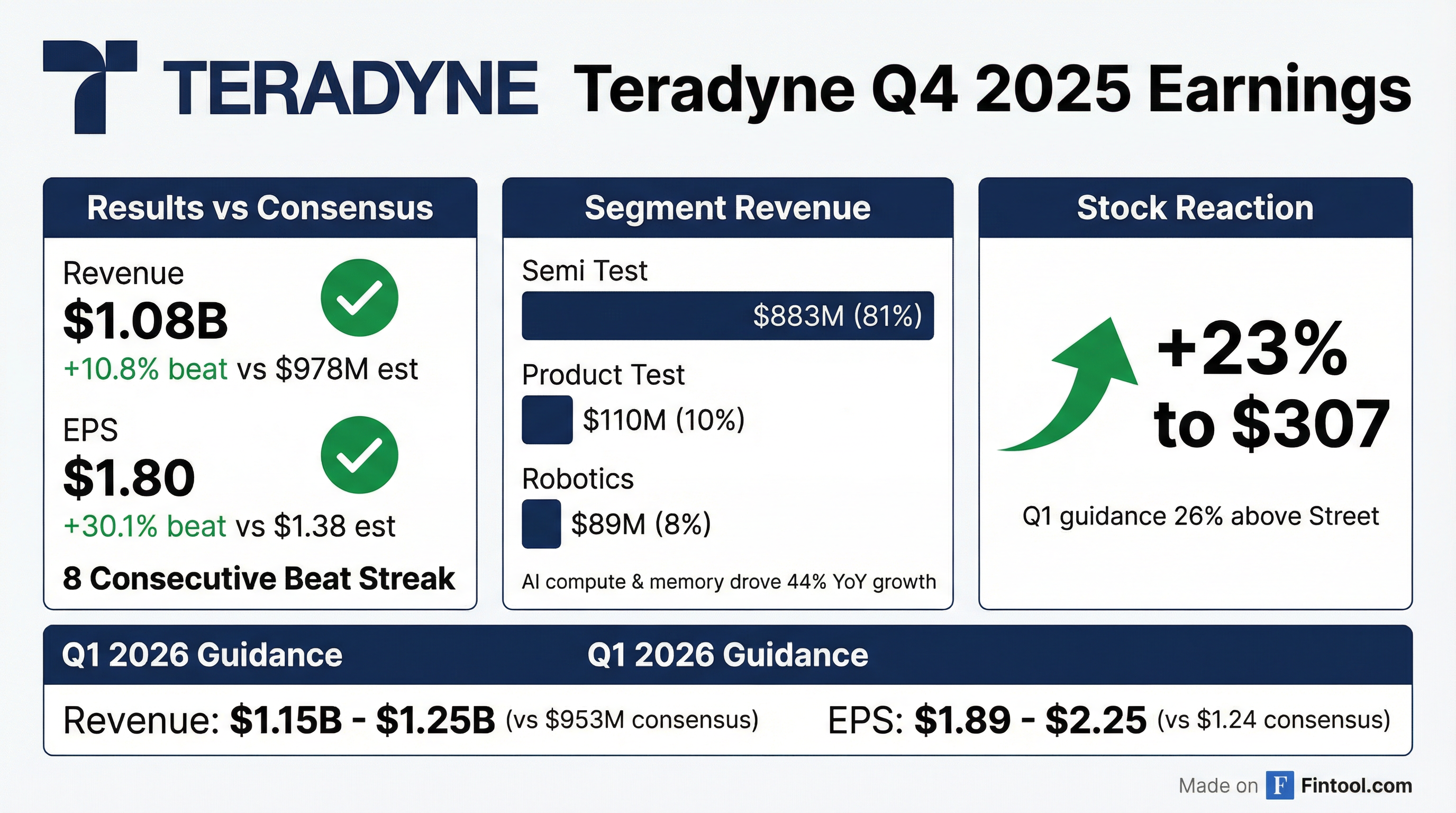

Teradyne delivered a blowout Q4 2025, with revenue of $1.08 billion beating consensus by 10.8% and non-GAAP EPS of $1.80 crushing estimates by 30% . The semiconductor test equipment leader posted 41% sequential revenue growth, its second-highest quarter ever, as AI-related demand accelerated across compute, networking, and memory applications . The stock surged 8% on the first trading day after earnings to $269 as Q1 2026 guidance came in 26% above Street expectations.

The key takeaway: AI is now Teradyne's dominant growth driver. In Q3, AI drove 40-50% of revenue. In Q4, it exceeded 60%. For Q1 2026, management expects upwards of 70% of revenue to be AI-driven .

Did Teradyne Beat Earnings?

Yes—and it wasn't close. Teradyne beat on every metric and extended its earnings streak to eight consecutive quarters of beats on both revenue and EPS.

*Values retrieved from S&P Global

Q4 was Teradyne's second-largest quarter in history, only $3 million below the 2021 mobile boom peak . Over 60% of Q4 revenue was AI-driven, up from 40-50% in Q3 .

Historical Beat/Miss Record

*Values retrieved from S&P Global

What Did Management Guide?

Q1 2026 guidance blew past Street expectations, signaling the AI-driven Semi Test momentum is accelerating.

*Values retrieved from S&P Global

Q1 2026 will be a new quarterly revenue record, up 11% sequentially and 75% year-over-year . Management expects over 70% of Q1 revenue to be AI-driven, up from over 60% in Q4 .

2026 Seasonality: The Inverse of 2025

CFO Michelle Turner (on her first Teradyne earnings call) provided critical color on 2026 patterns :

- 2025 sales split: 40% first half, 60% second half

- 2026 expected: ~60% first half, 40% second half (the inverse)

- Backlog: Entering 2026 with "healthy backlog" providing better first-half visibility

Management cautioned against linear extrapolation: "The lumpiness of this new sales pattern... we could see things move between quarters and between years" .

Full Year 2025 Results

The $6B Target Earnings Model

Management unveiled a new "evergreen" target model—not tied to a specific year—illustrating what Teradyne looks like at scale :

The implied EPS of $9.50-$11.00 is roughly 2.5x current earnings .

CEO Greg Smith on the path to $6B: "We foresee a future where the ATE TAM will be $12-14 billion... In that market, Teradyne will deliver nearly 2x 2025's revenue and 2.5x the earnings per share" .

What Changed From Last Quarter?

The Q4 acceleration was dramatic. Revenue jumped 41% sequentially from Q3's $769M .

Segment Performance

Memory test revenue of $206M was a record quarter . All three segments delivered double-digit sequential growth .

The Compute Transformation

Teradyne's business mix has fundamentally shifted :

CEO Greg Smith: "This balance de-risks our target earnings model" .

2025 SoC TAM Breakdown (Q&A Detail)

Management provided specific 2025 TAM estimates :

The SoC TAM reached record levels in 2025, nearly 60% larger than 2024 .

Q&A Highlights

GPU Merchant Win Timeline

The anticipated merchant GPU qualification is on track but will be a second-half story:

"We're making great progress, and we expect to achieve production qualification... Our guidance for Q1 does not include any merchant GPU revenue. We see that as more of a factor in the second half of 2026" .

Management expects to start at single-digit share and work up to 30%-70% balanced share over several years .

VIP Market Share

Teradyne maintained approximately 50% market share in the VIP (Vertically Integrated Producer) compute market in 2025 . CEO Smith cautioned: "No share is safe. We are challenging for sockets that we don't have. We're being challenged for sockets that we do have" .

2026 TAM Outlook

Management declined to give a specific 2026 TAM number but provided a wide range: "If you wanted to put a big wide range around it, it'd be like 20%-40% growth for the year, but we don't know where in that range it would land" .

MultiLane Joint Venture

Teradyne announced a strategic joint venture with MultiLane, a leader in high-speed IO and data center interconnect test :

- Teradyne will be majority owner

- Expected to close in Q2 2026

- Results will consolidate into Product Test group

- Expected to be accretive in 2026 with de minimis EPS impact

Customer Concentration

In 2025, Teradyne had three >10% customers :

- Two specifying customers (one mobile, one compute)

- One purchasing customer (does it all)

- Each roughly at the 10% threshold, not substantially higher

How Did the Stock React?

The stock gained 7.8% on the first trading day after earnings (Feb 3):

- Previous close (Feb 2): $249.53

- Day's high: $281.00 (new 52-week high)

- Current price: $268.96 (+7.8%)

The stock is now up ~309% from its 52-week low of $65.77.

Robotics Update

Robotics remains the weak spot, but management sees a path forward:

- Q4 revenue of $89M, up 19% sequentially but down 9% YoY

-

5% of Q4 robotics revenue came from a large e-commerce customer

- E-commerce revenue expected to triple from 2025 to 2026

- Targeting breakeven in 2026, then positive contribution beyond

IST Business Expansion

The In-Socket Test (IST) business delivered >50% growth in 2025 with significant customer diversification:

- Won new mobile SLT customer (ramping 2025)

- Entered compute SLT market (two new customers)

- New HDD customer won in late 2025

- HDD revenue expected to double in 2026

Capital Allocation

Teradyne returned 174% of free cash flow to shareholders in 2025 :

- Share repurchases: $709M for FY 2025

- Dividends: $76M for FY 2025

- Cash position: $448M in cash and marketable securities

- Since 2015: Returned over $5.4B to shareholders

Key Risks to Watch

- Customer concentration: Three >10% customers in 2025

- Second half uncertainty: Management has limited visibility beyond Q2

- VIP share volatility: "No share is safe" in the competitive compute space

- Robotics execution: Must reach breakeven in 2026 for thesis to work

- Mobile TAM uncertainty: Questions about unit volume, product mix, and capital efficiency improvements

The Bottom Line

Teradyne delivered a statement quarter that validates its position as a primary beneficiary of AI infrastructure buildout. The combination of a 30% EPS beat, Q1 guidance 26% above consensus, and a new $6B target model with implied EPS of $9.50-$11.00 makes the bull case compelling.

The key debate is timing. Management introduced an "evergreen" model rather than tying targets to specific years because they can't predict how quickly the AI TAM grows. The current run rate suggests they could get there faster than skeptics expect—but as CEO Smith cautioned, "external conditions change things."

With AI now driving 60-70%+ of revenue and the compute transformation essentially complete, Teradyne has successfully de-risked from mobile dependence. The $6B target at 30-34% operating margins represents an entirely different company than the one investors knew even two years ago.

Related: View Teradyne Company Profile | Read Q3 2025 Earnings Call