Earnings summaries and quarterly performance for TERADYNE.

Executive leadership at TERADYNE.

Gregory Smith

President and Chief Executive Officer

John Lukez

President, LitePoint Corporation

John Wood

President, Systems Test Group

Michelle Turner

Chief Financial Officer and Treasurer

Richard Burns

President, Semiconductor Test

Ryan Driscoll

Vice President, General Counsel and Secretary

Board of directors at TERADYNE.

Research analysts who have asked questions during TERADYNE earnings calls.

Brian Chin

Stifel Financial Corp.

8 questions for TER

Samik Chatterjee

JPMorgan Chase & Co.

8 questions for TER

Timothy Arcuri

UBS

8 questions for TER

Mehdi Hosseini

Susquehanna Financial Group

7 questions for TER

David Duley

Steelhead Securities LLC

5 questions for TER

Shane Brett

Morgan Stanley

5 questions for TER

Jim Schneider

Goldman Sachs

4 questions for TER

Vedvati Shrotre

Evercore ISI

4 questions for TER

Vivek Arya

Bank of America Corporation

4 questions for TER

Christopher Muse

Cantor Fitzgerald

3 questions for TER

CJ Muse

Cantor Fitzgerald

3 questions for TER

Krish Sankar

TD Cowen

3 questions for TER

Sreekrishnan Sankarnarayanan

Wolfe Research, LLC

3 questions for TER

C J Muse

Tanner Fitzgerald

2 questions for TER

Stephen

TD Cowen

2 questions for TER

Toshiya Hari

Goldman Sachs Group, Inc.

2 questions for TER

Atif Malik

Citigroup Inc.

1 question for TER

Auguste Richard

Northland Capital Markets

1 question for TER

Dave Duley

Steelhead Securities

1 question for TER

Gus Richard

Northland Capital Markets

1 question for TER

Jacob Moore

Sidoti & Company, LLC

1 question for TER

James Schneider

Goldman Sachs

1 question for TER

Steve Barger

KeyBanc Capital Markets Inc.

1 question for TER

Recent press releases and 8-K filings for TER.

- Teradyne reports a massive increase in test intensity driven by AI compute in both memory (HBM) and SoC (AI accelerators), pushing semiconductor test TAM above historical levels.

- The company plans merchant GPU tester qualification in H1 2026, targeting low-single-digit share in H2 2026 and a path to ~30% via fast-follower and tester-agnostic development.

- In HBM DRAM, Teradyne holds >50% wafer stack test share and strong final-test positions, with TAM expansion tied to higher stack heights and evolving HBM standards.

- HDD system-test demand has inflected with a third major customer win, while SSD front-end investments remain muted despite rising data-center flash capacity needs.

- Management expects a front-half weighted 2026 revenue profile amid limited second-half visibility in an extended multi-quarter semiconductor test boom.

- The semiconductor test market reached $9 billion in 2025, surpassing a 1% buy rate relative to the semiconductor industry, driven by rising capital intensity in AI compute (memory HBM and AI accelerators).

- The current AI-driven cycle is broader and more durable than the 2020–2021 mobile surge, with multi-year data-center build timelines into 2027 and future waves from co-packaged optics and edge AI.

- Teradyne’s long-term model targets $6 billion in revenue supported by an ATE TAM of $12–14 billion, with compute representing about $8 billion of that TAM.

- In compute, Teradyne holds a strong position in networking, ~50% share in hyperscaler ASIC (“VIP”) compute, and is on track for merchant GPU tester qualification in H1 2026 with production revenue and low single-digit share in H2 2026, aiming for up to 30% share over time.

- Memory and storage test intensity is rising: Teradyne has >50% share in HBM stack testing and strong DRAM final-test positions, sees an inflection in HDD testing with a new customer win, while SSD test demand has yet to meaningfully pick up.

- Teradyne expects the semiconductor test market to expand beyond the COVID-era mobile boom, with AI compute and high-margin memory (HBM, AI accelerators) driving record-high test intensity amid multi-year data center CAPEX cycles.

- The company leads in networking test, holds ~50% share in hyperscaler ASIC (VIP compute), and >50% in HBM stack wafer test; merchant GPU tester qualification is on track for H1 2026, with first production revenue in H2 2026 (low single-digit share).

- DRAM test is evolving from commoditized wafer sort to differentiated stack and performance testing; Teradyne’s share exceeds 50% in post-stack wafer test, with new standards (HBM3→4E) and stack heights driving TAM.

- HDD testing demand has inflected as installed capacity fills and a new third customer in system test boosts share; SSD front-end investment lags data center flash capacity growth, suggesting potential TAM upside.

- 2026 demand is first-half weighted driven by limited second-half visibility and front-loaded capacity adds, within a multi-quarter cycle peaking in Q2 2026.

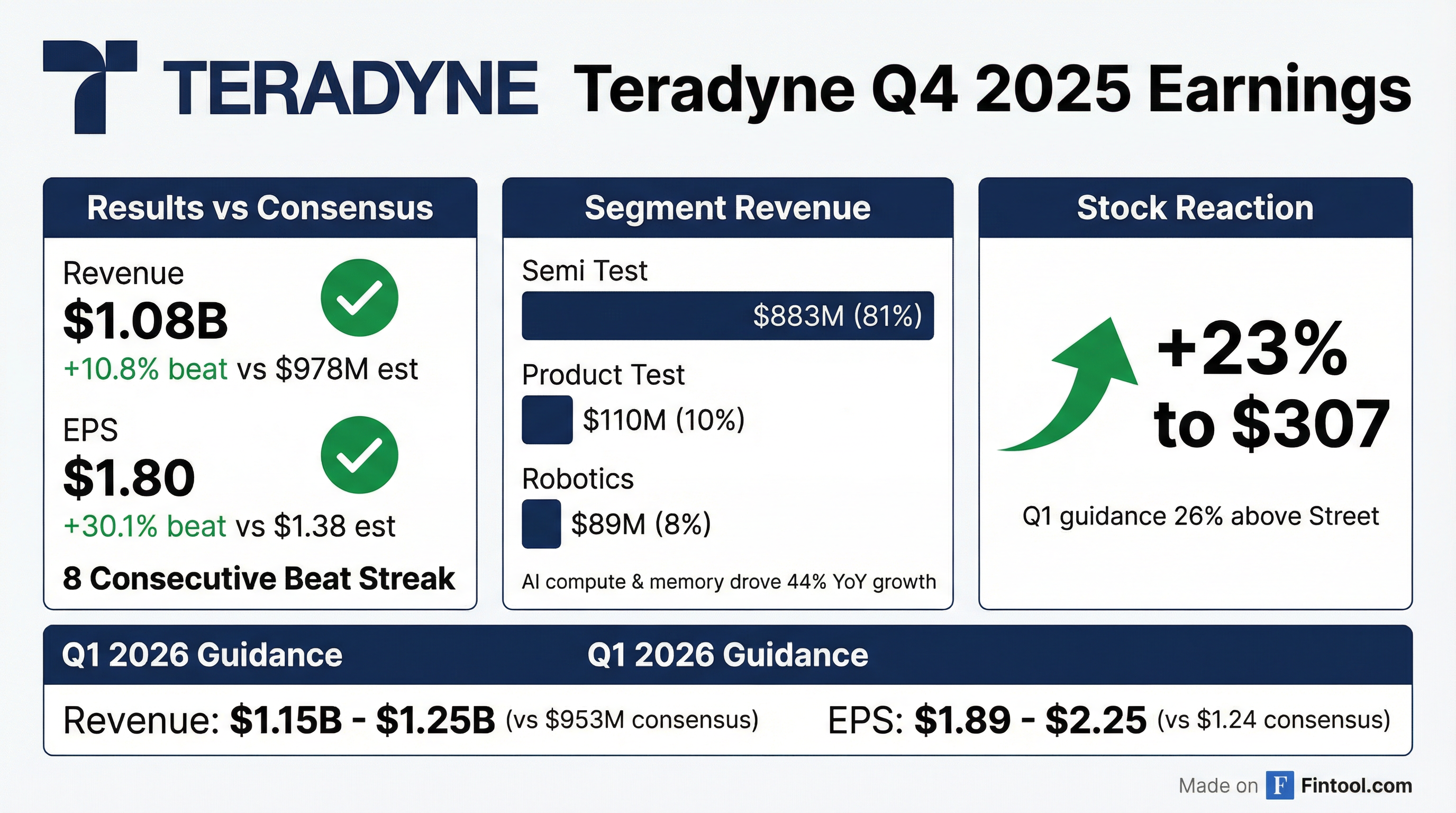

- Teradyne delivered $1.083 billion in Q4 revenue and $1.80 non-GAAP EPS, materially above Street expectations.

- Management guided Q1 revenue to $1.15–1.25 billion and adjusted EPS to $1.89–$2.25, reflecting continued AI-driven demand.

- Shares rallied, climbing roughly 13% to $282.98 in after-hours trading on heavy volume as investors viewed the results as an early indicator of chip production ramps.

- The company formed a joint venture with MultiLane to develop high-speed data-link testing for AI data centers, extending its addressable market beyond chip-level test gear.

- Q4 2025 revenue of $1.083 billion and non-GAAP EPS of $1.80, above guidance, driven by AI applications contributing over 60% of sales

- SemiTest group sales of $883 million; SoC revenue $647 million (+47% q-o-q) and memory $206 million (+61% q-o-q)

- Full-year 2025 revenue of $3.2 billion (+13% y-o-y) with non-GAAP EPS $3.96, free cash flow of $450 million, and $785 million returned to shareholders

- Q1 2026 guidance calls for $1.15–1.25 billion revenue, non-GAAP EPS $1.89–2.25, and gross margin 58.5–59.5%

- Midterm target model at an ATE TAM of $12–14 billion anticipates $6 billion revenue, 59–61% gross margin, 27–29% OpEx, and non-GAAP EPS $9.50–11

- $1,083 million in Q4 sales and $1.80 non-GAAP EPS, both above guidance

- AI demand drove >60% of Q4 revenue and is expected to drive >70% in Q1 2026

- SemiTest revenue of $883 million: SoC $647 M (+47% qoq) and memory $206 M (+61% qoq); product test $110 M; robotics $89 M

- Full-year 2025 revenue $3.2 billion (+13% yoy), non-GAAP EPS $3.96, free cash flow $450 million, and $785 million returned to shareholders

- Q1 2026 outlook: revenue $1.15 billion–$1.25 billion (75% yoy), non-GAAP EPS $1.89–$2.25, gross margin 58.5–59.5%, and operating profit rate 32%

- Teradyne reported Q4 ’25 revenue of $1,083 million, up 41% sequentially and 44% YoY, marking the largest quarter of 2025.

- Non-GAAP EPS was $1.80, reflecting over 100% sequential growth and 89% YoY increase, exceeding guidance.

- All three segments (Semiconductor Test, Product Test, Robotics) delivered double-digit sequential revenue growth.

- For Q1 ’26, Teradyne guides revenue of $1.15–$1.25 billion and EPS of $1.89–$2.25, expecting another record quarter with over 70% AI-driven revenue.

- Q4 sales were $1,083 million with non-GAAP EPS of $1.80, marking the highest quarterly revenue of 2025 and exceeding the top end of guidance.

- AI-driven demand accounted for over 60% of Q4 revenue and is expected to drive more than 70% of revenue in Q1 2026.

- Full-year 2025 revenue was $3.2 billion (+13% YoY), with non-GAAP EPS of $3.96, free cash flow of $450 million, and $785 million returned to shareholders.

- Q1 2026 outlook: revenue of $1.15 billion–$1.25 billion (midpoint +11% QoQ, +75% YoY), non-GAAP EPS of $1.89–$2.25, and gross margin of 58.5%–59.5%.

- Introduced a new target earnings model: at an ATE TAM of $12–$14 billion, Teradyne aims for ~$6 billion in revenue, 59%–61% gross margins, 27%–29% OpEx as % of revenue, and non-GAAP EPS of $9.50–$11.

- Revenue of $1.083 billion in Q4 2025, up 44% year-over-year and 41% sequentially, driven by strong AI-related demand in compute and memory.

- Full-year 2025 revenue of $3.19 billion, a 13% increase over 2024.

- Q4 2025 GAAP EPS of $1.63 and non-GAAP EPS of $1.80, both above the high end of guidance.

- Q4 revenues by segment: Semiconductor Test $883 million, Product Test $110 million, Robotics $89 million.

- Q1 2026 guidance: revenue $1.15 billion to $1.25 billion, GAAP EPS $1.82 to $2.19, non-GAAP EPS $1.89 to $2.25.

- Teradyne achieved Q4’25 revenue of $1.083 billion, up 44% year-over-year, led by strong AI-related demand in compute and memory.

- Full-year 2025 revenue was $3.19 billion, marking 13% growth over 2024, with non-GAAP EPS of $3.96.

- In Q4’25, Teradyne delivered GAAP EPS of $1.63 and non-GAAP EPS of $1.80.

- For Q1 2026, the company guides revenue of $1.15–$1.25 billion, GAAP EPS of $1.82–$2.19, and non-GAAP EPS of $1.89–$2.25.

Fintool News

In-depth analysis and coverage of TERADYNE.

Quarterly earnings call transcripts for TERADYNE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more