Earnings summaries and quarterly performance for Keysight Technologies.

Executive leadership at Keysight Technologies.

Board of directors at Keysight Technologies.

Charles Dockendorff

Director

James Cullen

Director

Jean Nye

Lead Independent Director

Joanne Olsen

Director

Kevin Stephens

Director

Michelle Holthaus

Director

Paul Lacouture

Director

Richard Hamada

Director

Robert Rango

Director

Ronald Nersesian

Chair of the Board

Research analysts who have asked questions during Keysight Technologies earnings calls.

Aaron Rakers

Wells Fargo

9 questions for KEYS

Mark Delaney

The Goldman Sachs Group, Inc.

9 questions for KEYS

Meta Marshall

Morgan Stanley

9 questions for KEYS

Mehdi Hosseini

Susquehanna Financial Group

8 questions for KEYS

Samik Chatterjee

JPMorgan Chase & Co.

8 questions for KEYS

David Ridley-Lane

Bank of America

6 questions for KEYS

Robert Jamieson

Vertical Research Partners

6 questions for KEYS

Adam Thalhimer

Thompson, Davis & Company, Inc.

5 questions for KEYS

Robert Mason

Robert W. Baird & Co.

5 questions for KEYS

Tim Long

Barclays

5 questions for KEYS

Andrew Spinola

UBS

4 questions for KEYS

Atif Malik

Citigroup Inc.

4 questions for KEYS

Matthew Niknam

Deutsche Bank

4 questions for KEYS

Rob Mason

Baird

4 questions for KEYS

Timothy Long

Barclays

4 questions for KEYS

Priyanka Thapa

J.P. Morgan

1 question for KEYS

Rob Jamieson

TD Cowen

1 question for KEYS

Recent press releases and 8-K filings for KEYS.

- Keysight Technologies and Qualcomm Technologies have launched a collaboration to develop high-fidelity RF digital twins aimed at accelerating and validating massive MIMO for 5G-Advanced and emerging 6G, with a demonstration at Mobile World Congress 2026.

- Early validation of the digital twin showed strong correlation across key KPIs such as RSRP, rank, and throughput, boosting confidence in real-world algorithm performance.

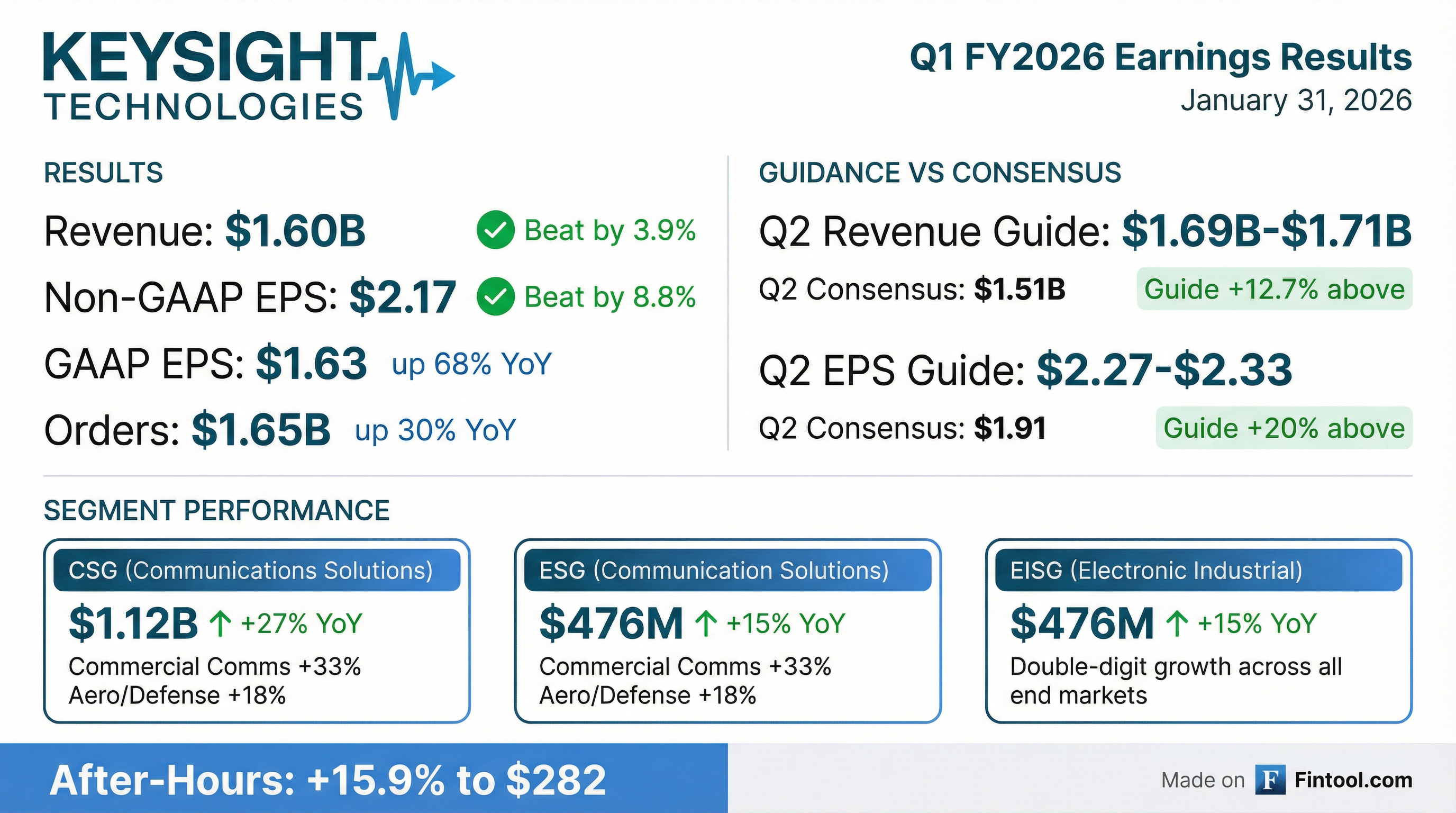

- Keysight reported stronger-than-expected Q1 results—$2.17 EPS on $1.6 billion revenue—and provided Q2 guidance of $2.27–$2.33 EPS and $1.69–$1.71 billion in revenue.

- Keysight delivered $1.6 billion in Q1 revenue, up 23% year-over-year on a reported basis and 14% on a core basis; orders reached $1.645 billion, up 30% reported and 22% core.

- Gross margin expanded to 66.7%, while net income was $376 million and EPS was $2.17, both up 19% year-over-year.

- Communication Solutions Group revenue was $1,124 million (up 27% reported, 16% core) with a 68.5% gross margin and 27.5% operating margin; Electronic Industrial Solutions Group revenue was $476 million (up 15%) with a 62.4% gross margin and 27.2% operating margin.

- Q2 guidance calls for $1.69 billion–$1.71 billion in revenue (30% YoY growth) and $2.27–$2.33 EPS (35% YoY growth); full-year revenue and earnings are now expected to grow just above 20% all-in.

- Cash flow from operations was $441 million, free cash flow $407 million; Keysight repurchased 420,000 shares for $87 million and ended the quarter with $2.2 billion in cash and equivalents.

- Revenue of $1.6 billion (+23% YoY; +14% core) and orders of $1.645 billion (+30% reported; +22% core) reflect strong demand across business segments.

- Gross margin expanded 90 bps to 66.7%, operating margin rose 20 bps to 27.4%, with net income of $376 million and EPS of $2.17 (+19% YoY).

- Communication Solutions Group generated $1.124 billion (+27% reported; +16% core); Electronic Industrial Solutions Group delivered $476 million (+15%), with software & services at ~40% of revenue.

- Ended Q1 with $2.2 billion in cash, $441 million operating cash flow, $407 million free cash flow, and repurchased ~420k shares for $87 million.

- Q2 guidance calls for $1.69–$1.71 billion revenue (+30% YoY) and EPS of $2.27–$2.33 (+35% YoY); full-year revenue and EPS growth now expected just above 20%.

- Record Q1 orders of $1.645 B (+30% y/y) and revenue of $1.600 B (+23% y/y) driven by Communications Solutions (+27%) and Electronic Industrial Solutions (+15%)

- Non-GAAP EPS of $2.17 (+19% y/y), gross margin of 66.7% (+90 bps) and operating margin of 27.4% (+20 bps)

- Free cash flow of $407 M and $87 M in share repurchases during Q1

- Q2 guidance: revenue of $1.690 B–$1.710 B and non-GAAP EPS of $2.27–$2.33; FY26 revenue and EPS growth expected just above 20%

- Keysight delivered $1.6 B in Q1 revenue, up 23% reported (core +14%), with orders of $1.645 B (+30% reported, +22% core), gross margin of 66.7%, operating margin of 27.4%, and EPS of $2.17 (+19%).

- Communication Solutions Group revenue reached $1.124 B (+27% reported, +16% core) with a 68.5% gross margin and 27.5% operating margin; EISG revenue was $476 M (+15%) with a 62.4% gross margin and 27.2% operating margin.

- Ended the quarter with $2.2 B in cash, generated $441 M in operating cash flow and $407 M in free cash flow, and repurchased 420,000 shares for $87 M at an average price of $207.

- For Q2, Keysight guides revenue of $1.69–$1.71 B (+30% YoY) and EPS of $2.27–$2.33 (+35% YoY); full‐year growth is expected just above 20%, with $375 M in acquisition‐related revenue and over $100 M in synergies for FY 2026.

- Demand remains broad‐based—driven by AI infrastructure, next-gen connectivity, defense modernization and semiconductor complexity—with an all-time high order funnel across short- and long-term pipelines signaling sustained momentum.

- Keysight reported Q4 revenue of $1.6 billion, up 23.3% year-over-year, and adjusted EPS of $2.17, beating expectations.

- Its communications solutions unit saw 27% revenue growth to $1.12 billion, driven by AI-focused data-center infrastructure and other applications.

- Management raised Q2 guidance to $1.69–$1.71 billion in revenue and $2.27–$2.33 in EPS.

- Longer-term metrics include a five-year revenue CAGR of ~5.7%, two-year CAGR of ~3.1%, trailing 12-month revenue of $5.375 billion, and a declining operating margin around 16.3%.

- Keysight delivered $1.60 billion in revenue for Q1 FY2026, up 23% year-over-year from $1.30 billion.

- GAAP net income was $281 million, or $1.63 per diluted share; non-GAAP net income was $376 million, or $2.17 per diluted share.

- By segment, Communications Solutions Group revenue was $1,124 million (up 27%) and Electronic Industrial Solutions Group revenue was $476 million (up 15%).

- For Q2 FY2026, the company expects revenue of $1.690 billion to $1.710 billion (≈30% growth) and non-GAAP EPS of $2.27 to $2.33.

- Delivered $1.60 billion in Q1 revenue, up 23% year-over-year [$1.30 billion in Q1 2025].

- Recorded GAAP net income of $281 million ($1.63 EPS) and non-GAAP net income of $376 million ($2.17 EPS).

- Achieved broad-based growth with Communications Solutions revenue of $1.124 billion (+27%) and Electronic Industrial revenue of $476 million (+15%).

- Issued Q2 FY2026 guidance for $1.690–$1.710 billion in revenue (≈30% YoY growth) and $2.27–$2.33 non-GAAP EPS.

- Keysight delivered 8% revenue growth in 2025 (up from an initial 5% target) and guided 10% growth for Q1 2026, supported by a strong order book and technology tailwinds across AI, wireless, semiconductors, and aerospace defense.

- The company’s AI segment spans chipset testing through hyperscaler emulation, highlighted by the formal launch of the Keysight AI Data Center Builder, which emulates AI workload traffic for data center design.

- In wireless, ongoing investment in 5G Advanced (Releases 18/19), expansion of non-terrestrial networks (NTN), and early pre-standards 6G R&D are driving a gradual recovery and future growth.

- Aerospace & defense achieved record orders in 2025 despite government pauses, with accelerating U.S. and European budgets and new programs (e.g., Golden Dome, GCAP) fueling demand for antenna, radar, and cybersecurity test solutions.

- Software & services now represent the high 30s % of revenue and are expected to exceed 40 % through organic innovation and recent acquisitions, contributing to gross margins in the mid-sixties.

- Keysight built momentum in 2025, raising its full-year growth target from 5% at the start of the year to 8%, and guided 10% revenue growth for Q1 2026.

- AI is driving the wireline business, with Keysight providing end-to-end test and emulation solutions—from chip and component testing to hyperscaler workload benchmarking—highlighted by its AI Data Center Builder product.

- The wireless segment returned to growth in 2025, supported by non-terrestrial networks, Open RAN, early 6G R&D and ongoing 5G Advanced standards (Releases 18/19), with a steady ramp expected into 6G later this decade.

- Recent acquisitions have lifted software and services to the high 30s % of revenue and added three percentage points to mix; Keysight targets a 40% software/services mix, mid-sixties % gross margins, and $100 million of cost synergies, with M&A accretive to 2027 earnings.

- The aerospace & defense business set record orders in 2025 despite shutdowns and funding delays, and stands to benefit from U.S. and European defense budget increases, new programs (e.g., Golden Dome, GCAP) and growth in defense-tech startups.

Fintool News

In-depth analysis and coverage of Keysight Technologies.

Quarterly earnings call transcripts for Keysight Technologies.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more