Earnings summaries and quarterly performance for ASTRONICS.

Executive leadership at ASTRONICS.

Peter J. Gundermann

President and Chief Executive Officer

James F. Mulato

Executive Vice President and President of Astronics Test Systems, Inc.

Mark A. Peabody

Executive Vice President and President of Aerospace Segment

Nancy L. Hedges

Vice President, Chief Financial Officer and Treasurer

Board of directors at ASTRONICS.

Research analysts who have asked questions during ASTRONICS earnings calls.

Michael Ciarmoli

Truist Securities, Inc.

5 questions for ATRO

Jonathan Tanwanteng

CJS Securities

3 questions for ATRO

Gautam Khanna

TD Cowen

2 questions for ATRO

Greg Palm

Craig-Hallum Capital Group LLC

2 questions for ATRO

Will Gildea

CJS Securities

2 questions for ATRO

Samuel Struhsaker

Truist Securities, Inc.

1 question for ATRO

Recent press releases and 8-K filings for ATRO.

- Astronics Corporation closed 2025 with a strong fourth quarter, reporting record revenue of $240 million, operating income of 14.8%, and adjusted EBITDA of 19%.

- The company achieved record year-end backlog of $674 million and Q4 2025 bookings of $257 million, resulting in a book-to-bill ratio of 1.07.

- For fiscal year 2026, Astronics anticipates revenue between $950 million and $990 million, with Q1 2026 sales projected at $220 million-$230 million and subsequent quarters expected to exceed $250 million.

- Available liquidity at year-end 2025 stood at $231 million, while net debt increased to $324.8 million due to refinancing actions.

- Astronics Corporation reported record fourth quarter 2025 revenue of $240 million, a 15% increase year-over-year, with an operating income of 14.8% and adjusted EBITDA of 19%. The company also achieved a record year-end backlog of $674.5 million.

- For the full year 2025, revenue growth was 8.4%, with adjusted operating margin improving to 12.2% from 7.7% in 2024, and adjusted EBITDA reaching 15.6%.

- The company provided 2026 revenue guidance of $950 million to $990 million, projecting 12.5% to nearly 15% growth, and anticipates continued margin expansion. Q1 2026 sales are expected to be between $220 million and $230 million.

- The strong performance was driven by robust market conditions, efficiency initiatives, pricing actions, and a favorable product mix, particularly in the aerospace segment. Astronics expects the U.S. Army Radio Test Program to begin volume production in early Q2 2026.

- Astronics reported record revenue of $240 million for Q4 2025, marking a 15% increase year-over-year, with an operating income of $35.5 million and adjusted EBITDA of 19% for the quarter.

- The company closed 2025 with a record year-end backlog of $674.5 million, supported by $257 million in bookings during Q4 2025, achieving a book-to-bill ratio of 1.07.

- For fiscal year 2025, revenue grew 8.4%, and the adjusted operating margin improved to 12.2% from 7.7% in 2024, with adjusted EBITDA reaching 15.6%.

- Astronics issued 2026 revenue guidance of $950 million to $990 million, with the midpoint representing 12.5% growth, and anticipates continued operating margin expansion, targeting 19%-20% EBITDA margin in Q2-Q4.

- The company maintained a strong liquidity position with $231 million available at year-end 2025 and plans $40 million to $50 million in capital expenditures for 2026, in addition to a $14 million to $18 million investment in an ERP system.

- Astronics Corporation reported record fourth quarter 2025 sales of $240.1 million, representing a 15.1% increase year-over-year, primarily driven by record Aerospace sales.

- The company achieved net income of $29.6 million, or $0.78 per diluted share, in Q4 2025, a significant improvement from a net loss in the prior-year period.

- Astronics ended 2025 with a record backlog of $674.5 million and booked $257.2 million in orders during the fourth quarter.

- The company generated $27.6 million in cash from operations in Q4 2025, contributing to $74.8 million for the full year 2025.

- Astronics maintained its 2026 revenue guidance at $950 million to $990 million.

- Astronics Corporation reported record fourth quarter 2025 sales of $240.1 million, a 15.1% increase year-over-year, primarily driven by record Aerospace sales of $219.6 million.

- For Q4 2025, the company achieved net income of $29.6 million, or $0.78 per diluted share, and adjusted EBITDA of $45.7 million, or 19.0% of sales.

- Astronics ended 2025 with a record backlog of $674.5 million, having booked $257.2 million in orders during the fourth quarter, and generated $27.6 million in cash from operations in the quarter.

- The company maintained its 2026 revenue guidance at $950 million to $990 million.

- Astronics (ATRO) projects top-line revenue pushing $1 billion in 2026, with anticipated 10%-15% growth and improved income statement results, following a record Q4 2025.

- The company expects a $215 million IDIQ radio test program for the U.S. Army to begin in early Q2 2026, which is forecast to add $40 million-$50 million annually to its Test business.

- Astronics is a significant supplier for the FLRAA program (MV-75), with an estimated $1 million ship set content per aircraft, and development completion expected by late 2026 into 2027.

- The company refinanced its convertible note, issuing a $225 million, 0% note and repurchasing 80% of the original, thereby eliminating 5.8 million shares of potential dilution. A capped call effectively sets the conversion price at ~$83, limiting further dilution exposure.

- Astronics anticipates top-line revenue pushing $1 billion in 2026, with expected 10%-15% growth and improved income statement results for the year. The company reported a record fourth quarter and currently holds a record backlog.

- The company is a key supplier for the FLRAA program (MV-75), with an estimated $1 million ship set content per aircraft, and expects development to conclude in late 2026 into 2027. This program is considered a "game changer" for the company.

- Astronics' Test business is poised for growth with a $215 million IDIQ radio test program for the U.S. Army, projected to commence in the first half of 2026 and contribute an additional $40-$50 million annually.

- The company recently refinanced its convertible debt, issuing a $225 million, 0% note and repurchasing 80% of the previous convert, which eliminated 5.8 million shares of potential dilution. A capped call sets the functional conversion price at approximately $83, limiting further dilution unless the stock price exceeds this level.

- Astronics anticipates top-line revenue pushing $1 billion in 2026, with expected 10%-15% growth and improved income statement results, following a record fourth quarter.

- The company's core business is 90% aerospace, with 70% in commercial transport, split evenly between new production and retrofit opportunities in in-flight entertainment and connectivity.

- Significant growth drivers include the FLRAA program, with an estimated $1 million ship set content per aircraft, and a $215 million IDIQ radio test program for the U.S. Army in its Test segment, expected to commence in early Q2 2026 and add $40 million to $50 million annually.

- Astronics recently refinanced a convertible bond, issuing a $225 million, 0% note and buying back 80% of the initial convert, which eliminated 5.8 million shares of potential dilution and lowered the average cost of debt. A capped call limits dilution from the new convert until the stock price exceeds $83.

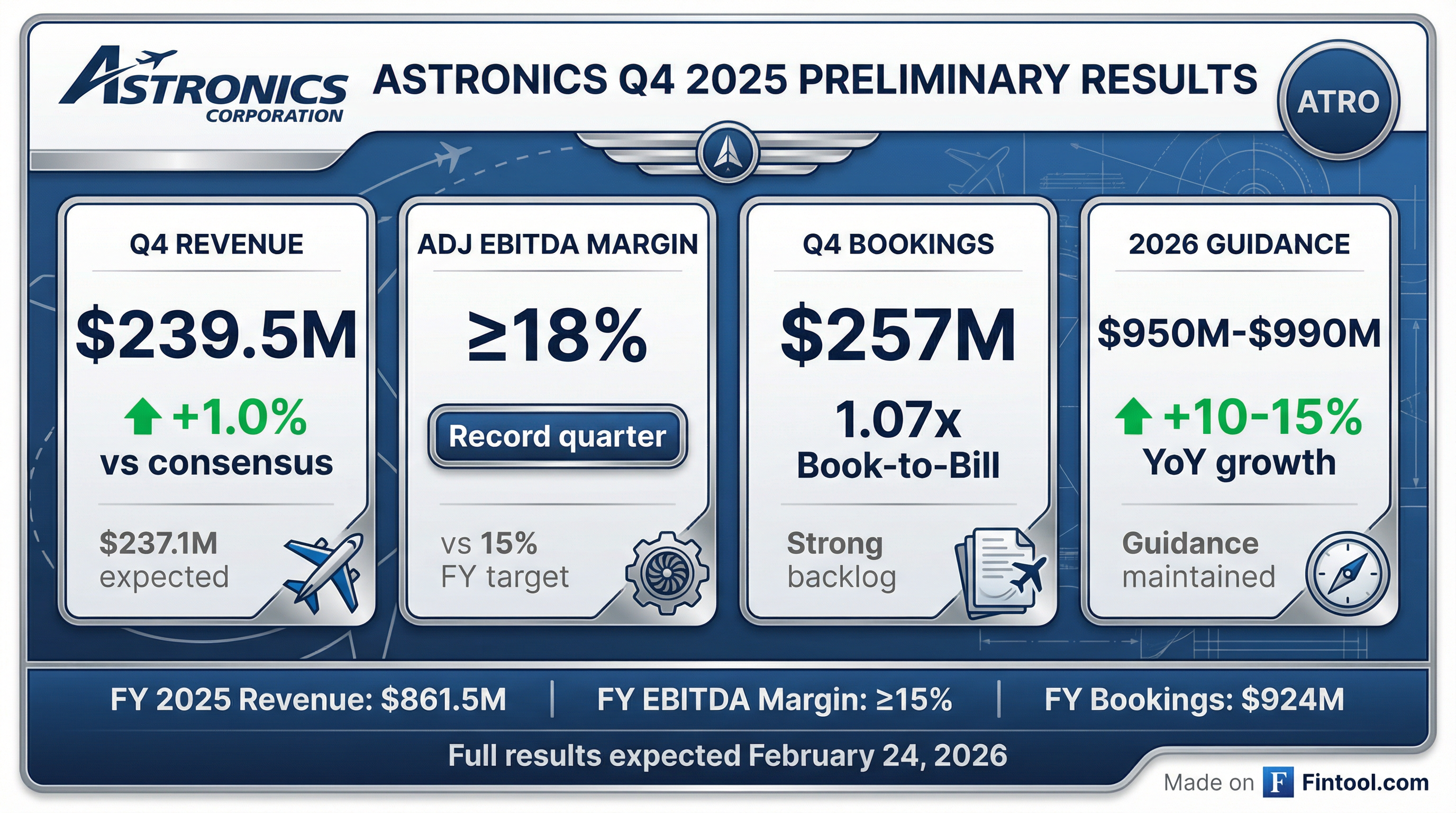

- Astronics Corporation announced preliminary unaudited fourth quarter 2025 revenue estimated at $239.5 million and a preliminary adjusted EBITDA margin estimated at a minimum of 18% of revenue.

- For the full year 2025, preliminary unaudited revenue is estimated at $861.5 million, with a preliminary adjusted EBITDA margin estimated at a minimum of 15% of revenue.

- Preliminary bookings for the fourth quarter were approximately $257 million, bringing total orders for the full year 2025 to approximately $924 million.

- The company maintained its initial 2026 revenue guidance of $950 million to $990 million, representing an increase of 10% to 15% over 2025.

- Astronics Corporation provided preliminary unaudited revenue and bookings for Q4 and full year 2025, along with its 2026 revenue outlook, expecting full year 2025 revenue of $795 million and 2026 revenue between $950 million and $990 million.

- Preliminary full year 2025 bookings were $808.1 million, with backlog reaching $924.0 million.

- The company completed two acquisitions in 2025: Envoy Aerospace in June and Bühler Motor Aviation in October, aimed at adding capabilities and expanding market share.

- Astronics issued a $225 million 0.0% convertible note and secured a $300 million senior secured cash flow revolver, resulting in $169 million in total liquidity as of November 4, 2025.

Quarterly earnings call transcripts for ASTRONICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more