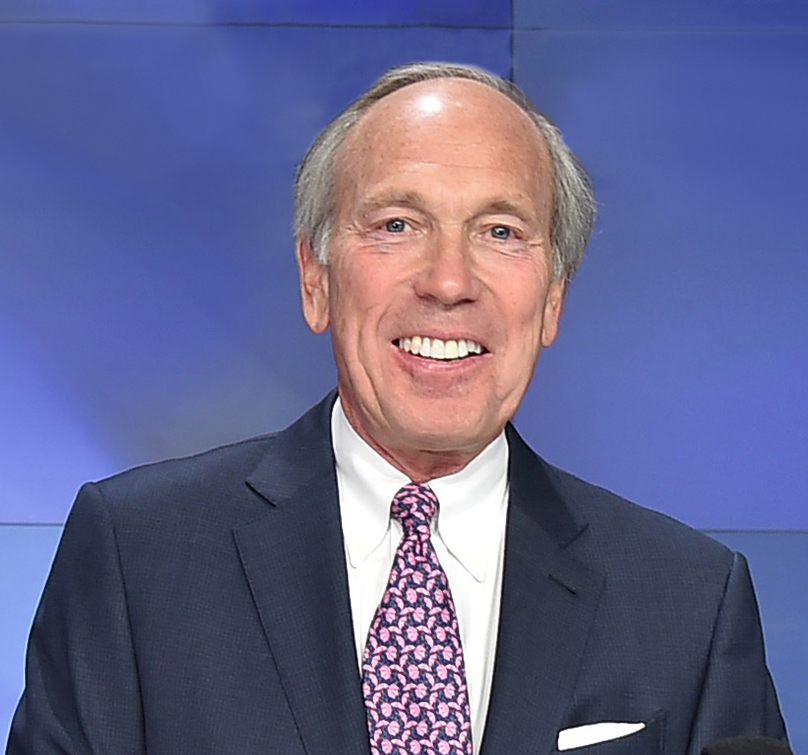

Marc A. Stefanski

About Marc A. Stefanski

Marc A. Stefanski is Chair of the Board, President, and Chief Executive Officer of TFS Financial Corporation (Third Federal Savings and Loan) and has served as a director since 1987; he joined the company in 1982 and was elected Chair and CEO in 1987, and President in 2000. He is 70 years old and is not classified as independent by the Board due to his executive role . Company performance under his leadership in FY2024 included net income of $79.6 million (+6% y/y), with cumulative TSR tracking at a value of $118 for a fixed $100 investment in FY2024, alongside sustained ROAA-driven metrics used in long-term incentives (e.g., 0.46% ROAA across FY2023–FY2024 cycles) .

Past Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Third Federal Savings and Loan Association | Chair & CEO | Since 1987 | Oversaw growth through cycles; branding leverages family heritage; deep industry/community knowledge . |

| Third Federal Savings and Loan Association | President | Since 2000 | Executive leadership and spokesperson for the company; aligned Board and management decision-making . |

| Third Federal Savings and Loan Association | Associate | Since 1982 | Early career foundation, continuity of leadership . |

External Roles

| Organization | Role | Years | Strategic Impact |

|---|---|---|---|

| Not disclosed in proxy | — | — | The 2025 DEF 14A does not list external public company directorships or roles for Mr. Stefanski . |

Fixed Compensation

| Metric | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|

| Base Salary ($) | 1,500,000 | 1,500,000 | 1,500,000 |

| Stock Awards ($) | 758,280 | 1,100,676 | 790,634 |

| Non-Equity Incentive ($) | 2,062,500 | 1,799,713 | 2,062,500 |

| Change in Pension/Deferred ($) | 27,084 | 124,200 | 4,339 |

| All Other Compensation ($) | 282,019 | 294,770 | 292,577 |

| Total Compensation ($) | 4,629,883 | 4,819,359 | 4,650,050 |

Additional salary context: The Compensation Committee kept his base salary flat at $1,500,000 for 2022–2024 . He does not receive director fees for board service .

Performance Compensation

Annual Cash Bonus Structure and Outcomes

| Component | Target/Mechanics | FY 2024 Outcome | Vesting/Payment |

|---|---|---|---|

| Management Incentive Compensation Plan | Incentive pool based on Adjusted Net Income vs budget; committee can reduce pool for risk factors; Mr. Stefanski’s allocation set to deliver 125% of direct reports’ bonus % of salary; max payout 110% of base salary . | Adjusted Net Income $79.6m (123.6% of target) → pool $3,976,500; Mr. Stefanski bonus $2,062,500 (110% of target) . | Paid annually; committee reviewed enterprise risk and made no downward adjustments in FY2024 . |

Equity Awards (FY2024 Grants)

| Grant Type | Grant Date | Shares/Units | Terms | Grant Date Fair Value ($) |

|---|---|---|---|---|

| Performance Share Units (PSUs) | 03/04/2024 | Target 20,400; Threshold 10,200; Max 30,600 | Earned 0–150% based on ROAA over FY2024–FY2025; vest in December of third year; dividend equivalents paid with earned shares; accelerated vesting for death/disability/change in control; retirement eligibility affects proration . | 263,976 |

| Restricted Stock Units (RSUs) | 03/04/2024 | 40,700 | Vests 33 1/3% annually beginning ~1 year after grant; dividend equivalents; immediate vesting in full upon retirement for awards granted >1 year prior; proration if <1 year; distribution upon vesting . | 526,658 |

PSU Performance Metrics

| Metric | Threshold | Target | Maximum | Earned (Recent Cycles) |

|---|---|---|---|---|

| ROAA (two-year period) | 0.30% → 50% payout | 0.50% → 100% payout | ≥0.70% → 150% payout | FY2022–FY2023 ROAA 0.48% → 95% of target; FY2023–FY2024 ROAA 0.46% → 90% of target . |

Equity Ownership & Alignment

Beneficial Ownership and Instruments

| Item | Amount | Notes |

|---|---|---|

| Beneficially Owned Common Shares | 702,473 | Includes trusts, spouse, 401(k), ASOP, and 196,700 options exercisable within 60 days; percent of class “<1%” per proxy . |

| Options Outstanding (Exercisable within 60 days) | 196,700 | Strikes: $19.06 (196,700, expiring 12/17/2025); older $14.85 options existed; at 9/30/2024 stock price $12.86, these options were out-of-the-money . |

| Unvested RSUs (by grant) | 9,800 (12/16/2021), 26,800 (12/15/2022), 40,700 (03/04/2024) | Market values at $12.86: $126,028; $344,648; $523,402 . |

| Unvested PSUs (by grant) | 12,540 (12/16/2021), 36,180 (12/15/2022), 20,400 (03/04/2024) | Market/payout values at $12.86: $161,264; $465,275; $262,344 . |

| RSUs withheld until termination (legacy) | 762,148 | Prior RSUs will not be distributed until employment ends (retention-aligned) . |

| Stock Ownership Guidelines | None | Company does not have specific executive ownership guidelines; proxy cites existing holdings and awards as alignment . |

| Hedging/Pledging Policy | Prohibited | Insider trading policy prohibits hedging and pledging for officers/directors (alignment positive) . |

Vesting cadence for current unvested RSUs (excludes retirement acceleration): 12/10/2024: 36,766; 12/10/2025: 26,967; 12/10/2026: 13,567 . PSU vesting schedule next events: 12/10/2024: 12,540; 12/10/2025: 36,180; 12/10/2026: 20,400 .

Employment Terms

- Agreements: No employment or severance agreements; severance reviewed case-by-case .

- Change-in-Control: Immediate vesting for stock options, RSUs, PSUs upon death, disability, or change in control; retirement eligibility provides scheduled vesting mechanics; CIC triggers defined broadly (25% beneficial ownership, board turnover, merger, liquidation, asset sale, successful tender) .

- Clawback: Dodd-Frank/NYSE-NASDAQ compliant clawback adopted—recovers erroneously awarded incentive-based comp for the prior 3 fiscal years in restatement scenarios .

- Non-compete / Non-solicit: Not disclosed in proxy; no employment agreement present .

Potential Payments upon Termination or Change-in-Control (as of 9/30/2024)

| Scenario | RSUs ($) | PSUs ($) | Total ($) |

|---|---|---|---|

| Death | 10,795,301 | 888,883 | 11,684,184 |

| Disability | 10,795,301 | 888,883 | 11,684,184 |

| Change in Control | 10,795,301 | 888,883 | 11,684,184 |

| Other Termination (incl. retirement mechanics) | 10,533,600 | 778,699 | 11,312,299 |

Retirement and Deferred Benefits

| Plan | Balance/Value | Notes |

|---|---|---|

| Defined Benefit Retirement Plan – Present Value | 1,835,385 | Credited service 29 years; plan frozen; benefit per plan formula . |

| Executive Retirement Benefit Plan (Non-Qualified) | 774,920 | Closed to contributions since 10/1/2008; earnings credited at 10-year Treasury rate . |

| Benefit Equalization Plan (Non-Qualified) | 1,376,796 | Company matches/profit sharing above qualified plan limits; 2024 earnings $52,008 . |

| Total Non-Qualified Deferred (as of 9/30/2024) | 2,151,716 | Aggregate of plans above . |

| Executive Life Insurance Bonus Program | $6.0m + $5.5m death benefits; Company-paid premiums included in All Other Compensation | Estate planning/perquisite structure . |

Board Governance

- Roles: Chair of the Board; member of Executive Committee; the full Board acts as Nominating Committee due to controlled company status .

- Independence: Not independent; majority of Board and all Audit/Compensation/Directors Risk Committee members are independent .

- Leadership structure: Combined Chair & CEO; no Lead Independent Director; Board cites majority independence, discrete committees, and executive sessions as oversight mitigants .

- Meetings/Attendance: Board met 12 times in FY2024; no director attended fewer than 75% of Board/committee meetings; all directors attended prior annual meeting .

- Committee Chairs: Audit—Mulligan; Compensation—Fiala; Directors Risk—Ozan; Executive—Williams (Vice Chair, daughter of Mr. Stefanski) .

Director compensation: Executives (including Mr. Stefanski) do not receive director fees; non-employee directors receive retainers, meeting fees, and RSUs; Williams/Vice Chair received larger RSU grant .

Compensation Structure Analysis

- Cash vs Equity Mix: FY2024 total comp decreased vs FY2023 due to lower stock awards ($790.6k vs $1.10m) while non-equity incentive rose back to max; base salary flat at $1.5m .

- Shift to RSUs/PSUs: No options granted in FY2024; equity grants comprised RSUs and PSUs (dividend equivalents) with ROAA performance conditions; company indicates options unlikely in go-forward compensation .

- Performance Calibration: Cash bonus tied to Adjusted Net Income; FY2024 pool reached 110% of target with risk review resulting in no reductions .

- Pay-for-Performance Signals: CAP (SEC-defined Compensation Actually Paid) trended directionally with TSR and net income per the pay-versus-performance analysis .

Say-on-Pay & Peer Group

- Say-on-Pay: 93% approval at 2/22/2024 meeting; no significant program changes in FY2024 based on the vote .

- Compensation Consultant and Peer Group: Exequity LLP engaged; comparator group of regional banks/thrifts/mortgage finance firms around ~0.5x–2x Company assets informed competitiveness; Committee uses judgment rather than fixed percentile targets .

Related Party Transactions and Risk Indicators

- Controlled Company: Third Federal Savings and Loan Association of Cleveland, MHC owns ~80.9% of common stock; determinative voting control for proposals .

- Family Ties: Vice Chair Ashley H. Williams is Marc A. Stefanski’s daughter; son Bradley Stefanski employed as Chief Strategy Officer with FY2024 salary+bonus $530,000; Audit Committee reviewed compensation .

- Loans to Insiders: Aggregate loans to officers/directors and related entities totaled $533 as of 9/30/2024; made on market terms, compliant with banking regulations .

- Section 16 Compliance: Late Form 4 filings noted for Mr. Stefanski and others (e.g., PSU vesting-related entries and a family trust transfer) .

- Hedging/Pledging: Prohibited by insider trading policy (alignment positive) .

Performance Context

| Metric | FY 2021 | FY 2022 | FY 2023 | FY 2024 |

|---|---|---|---|---|

| Net Income ($mm) | 81.0 | 74.6 | 75.3 | 79.6 |

| Adjusted Net Income ($mm) | 67.7 | 80.6 | 77.3 | 79.6 |

| TSR – $100 initial investment (Company) | 137 | 100 | 100 | 118 |

Investment Implications

- Alignment: Strong linkage of annual cash incentives to Adjusted Net Income and long-term equity to ROAA, plus clawback and a prohibition on hedging/pledging, supports alignment; legacy RSUs withheld until termination further tie outcomes to long-term stewardship .

- Retention and Selling Pressure: Mr. Stefanski is retirement-eligible and carries significant unvested RSUs/PSUs and legacy RSUs payable at termination; monitor 8-K 5.02 filings and December vesting windows for potential supply and trading signals .

- Governance Risk: Combined CEO/Chair without a Lead Independent Director and family involvement (daughter as Vice Chair, son employed) in a controlled company structure elevate independence concerns, though majority-independent committees and executive sessions are mitigating factors; investors should weigh governance posture in valuation/discount rate .

- Compensation Trends: No stock options in FY2024 and equity reduced vs FY2023 temper dilution; cash bonus reached plan maximum in FY2024—sensitivity to net income trajectory and ROAA performance will influence future payouts and signals .

- Risk Oversight: Robust risk committee structure (Directors Risk Committee, ALCO, Investment Committee) and Compensation Committee discretion to adjust bonus pools for enterprise risk is constructive for bank risk posture during margin compression cycles .