Earnings summaries and quarterly performance for TFS Financial.

Executive leadership at TFS Financial.

Marc A. Stefanski

Detailed

Chair of the Board, President and Chief Executive Officer

CEO

AJ

Andrew J. Rubino

Detailed

Chief Operating Officer

CW

Cathy W. Zbanek

Detailed

Chief Synergy Officer

MS

Meredith S. Weil

Detailed

Chief Financial Officer, Secretary and Treasurer

MJ

Michael J. Carfagna

Detailed

Chief Information Officer

TW

Timothy W. Mulhern

Detailed

Chief Innovation Officer

Board of directors at TFS Financial.

AJ

Anthony J. Asher

Detailed

Director

AH

Ashley H. Williams

Detailed

Vice Chair of the Board

BJ

Barbara J. Anderson

Detailed

Director

DF

Daniel F. Weir

Detailed

Director

JP

John P. Ringenbach

Detailed

Director

MJ

Martin J. Cohen

Detailed

Director

RA

Robert A. Fiala

Detailed

Director

TL

Terrence L. Bauer

Detailed

Director

TR

Terrence R. Ozan

Detailed

Director

WC

William C. Mulligan

Detailed

Director

Research analysts covering TFS Financial.

Recent press releases and 8-K filings for TFSL.

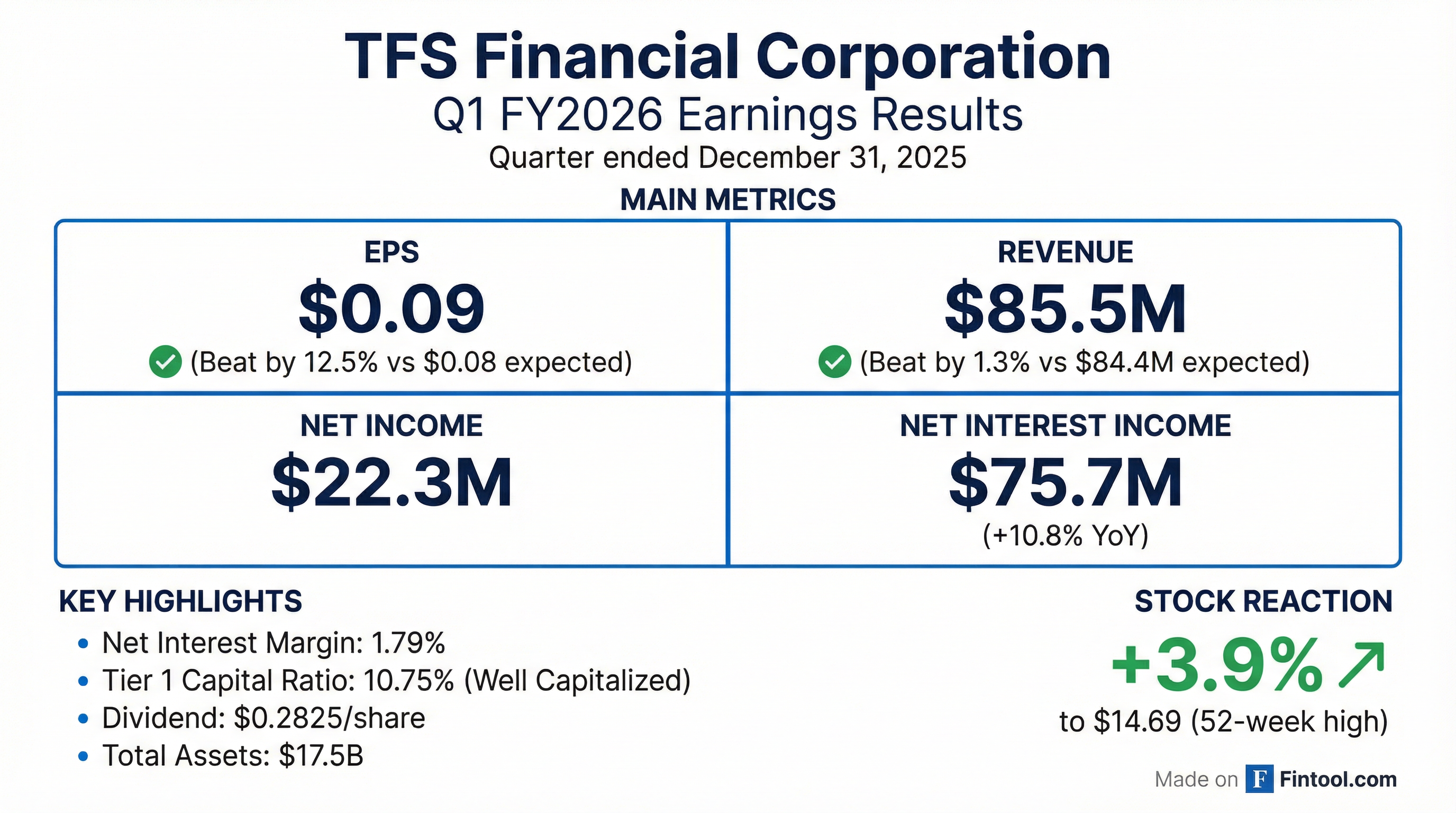

TFS Financial Corporation Announces First Quarter Fiscal Year 2026 Results

TFSL

Earnings

Demand Weakening

- TFS Financial Corporation reported net income of $22.3 million for the quarter ended December 31, 2025, a decrease from $26.0 million in the prior quarter.

- Net interest income was $75.7 million for the quarter ended December 31, 2025, decreasing by $1.6 million (2.07%) from the prior quarter, with a net interest margin of 1.79% and an interest rate spread of 1.47%.

- The company recorded a $1.0 million release of provision for credit losses for the quarter ended December 31, 2025, compared to a $1.0 million provision expense in the preceding quarter.

- Total assets increased by $42.4 million to $17.50 billion at December 31, 2025, while deposits decreased by $74.9 million to $10.37 billion.

- Non-interest expense increased by $4.2 million to $56.2 million from the prior quarter, driven by increases in salaries and employee benefits (including a one-time bonus), marketing costs, and office property, equipment and software expenses.

Jan 29, 2026, 9:11 PM

TFS Financial Corporation Announces First Quarter Fiscal Year 2026 Results

TFSL

Earnings

Dividends

Share Buyback

- TFS Financial Corporation reported net income of $22.3 million for the quarter ended December 31, 2025.

- Net interest income for the quarter ended December 31, 2025, was $75.7 million, representing a 2.07% decrease from the prior quarter but a 10.83% increase compared to the same quarter a year ago.

- As of December 31, 2025, the company's capital ratios exceeded "well capitalized" requirements, with a Tier 1 leverage ratio of 10.75% and Common Equity Tier 1 and Tier 1 ratios each at 17.35%.

- During the quarter ended December 31, 2025, the company declared and paid a quarterly dividend of $0.2825 per share and repurchased 139,442 shares of its stock at an average cost of $13.66 per share.

Jan 29, 2026, 9:09 PM

TFSL Reports Q1 2026 Financial Results

TFSL

Earnings

Dividends

Share Buyback

- TFSL reported net income of $22.274 million and Non-GAAP Earnings Per Minority Share of $0.42 for the three months ended December 31, 2025.

- The company maintains strong capital levels, with a Tier I Capital to Average Assets ratio of 10.75% for TFS Financial Corporation at December 31, 2025, which is significantly above the 5% "Well-Capitalized" level.

- TFSL declared an annualized dividend of $1.13 per share, representing an 8.45% yield based on the stock price of $13.38 at December 31, 2025. The dividend waiver was approved by 97% of MHC eligible votes through July 8, 2026. Additionally, 139k shares were repurchased during the quarter.

- The loan portfolio exhibited strong quality with a delinquency rate of 0.23% on its $15.74 billion loan portfolio as of December 31, 2025, and recorded net recoveries of $0.7 million for the three months ended December 31, 2025.

Jan 29, 2026, 9:00 PM

TFS Financial Corporation Declares Quarterly Dividend

TFSL

Dividends

- TFS Financial Corporation's Board of Directors declared a quarterly cash dividend of $0.2825 per share, payable on December 16, 2025, to stockholders of record on December 2, 2025.

- Third Federal Savings and Loan Association of Cleveland, MHC, which owns 81% of the Company's common stock, has waived its right to receive this dividend.

- The MHC has approval to waive dividends up to an aggregate amount of $1.13 per share through July 8, 2026, having previously waived $0.2825 per share for the quarter ending September 30, 2025.

- As of September 30, 2025, the Company's assets totaled $17.46 billion.

Nov 20, 2025, 9:02 PM

TFSL Reports Q4 and Fiscal Year 2025 Results with Strong Capital and Dividend

TFSL

Earnings

Dividends

Share Buyback

- TFSL reported net income of $90,959 thousand for the fiscal year ended September 30, 2025, with Non-GAAP Earnings Per Minority Share of $1.70.

- The company maintains strong capital levels, with a Tier I Leverage Capital to Average Assets ratio of 10.76% for TFS Financial Corporation, exceeding the "well-capitalized" level of 5%.

- TFSL declared an annualized dividend of $1.13 per share, representing an 8.57% yield based on the stock price of $13.18 at September 30, 2025, and 97% of MHC eligible votes approved the dividend waiver through July 8, 2026.

- The loan portfolio demonstrates quality with a delinquency rate of 0.21% on its $15.66 billion portfolio as of September 30, 2025, and reported net recoveries of $4.0 million for the fiscal year ended September 30, 2025.

- The company repurchased 190,000 shares in the quarter ended September 30, 2025, and 245,000 shares year-to-date.

Nov 4, 2025, 4:00 AM

TFS Financial Reports Record FY 2025 Earnings and Strong Q4 Performance

TFSL

Earnings

Dividends

Share Buyback

- TFS Financial reported record net income of $91.0 million for the fiscal year ended September 30, 2025, representing a 14.3% increase compared to the prior fiscal year.

- For the quarter ended September 30, 2025, net income grew 20.9% to $26.0 million from the previous quarter, driven by increases in net interest income and non-interest income, and decreases in the provision for credit losses and non-interest expense.

- The company's financial condition remains robust, with total assets reaching $17.46 billion and deposits increasing to $10.45 billion at September 30, 2025.

- TFS Financial maintains strong capital ratios, including a Tier 1 leverage ratio of 10.76% and Common Equity Tier 1 and Tier 1 ratios of 17.60% each, all exceeding "well capitalized" regulatory requirements.

- The company declared a quarterly dividend of $0.2825 per share during each quarter of fiscal year 2025 and resumed stock buybacks.

Oct 30, 2025, 8:17 PM

TFSL Reports Fiscal Year 2025 Earnings and Financial Condition

TFSL

Earnings

Share Buyback

- TFS Financial Corporation reported net income of $91.0 million for the fiscal year ended September 30, 2025, marking a 14.3% increase compared to $79.6 million in the prior fiscal year.

- Total assets increased by 2.1% to $17.46 billion at September 30, 2025, driven by a 2.2% increase in loans held for investment to $15.66 billion and a 2.5% rise in deposits to $10.45 billion compared to September 30, 2024.

- The company recorded a $2.5 million provision for credit losses for fiscal year 2025, contrasting with a $1.5 million release in the prior year, and total loan delinquencies increased to 0.22% of total loans receivable.

- Total shareholders' equity grew by 1.7% to $1.89 billion at September 30, 2025, and the company repurchased 247,865 shares of common stock during the fiscal year at an average cost of $13.05 per share.

Oct 30, 2025, 8:08 PM

Quarterly earnings call transcripts for TFS Financial.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more