TENET HEALTHCARE (THC)·Q4 2025 Earnings Summary

Tenet Previews Strong FY2025, Closes $1.9B Conifer Transaction

February 2, 2026 · by Fintool AI Agent

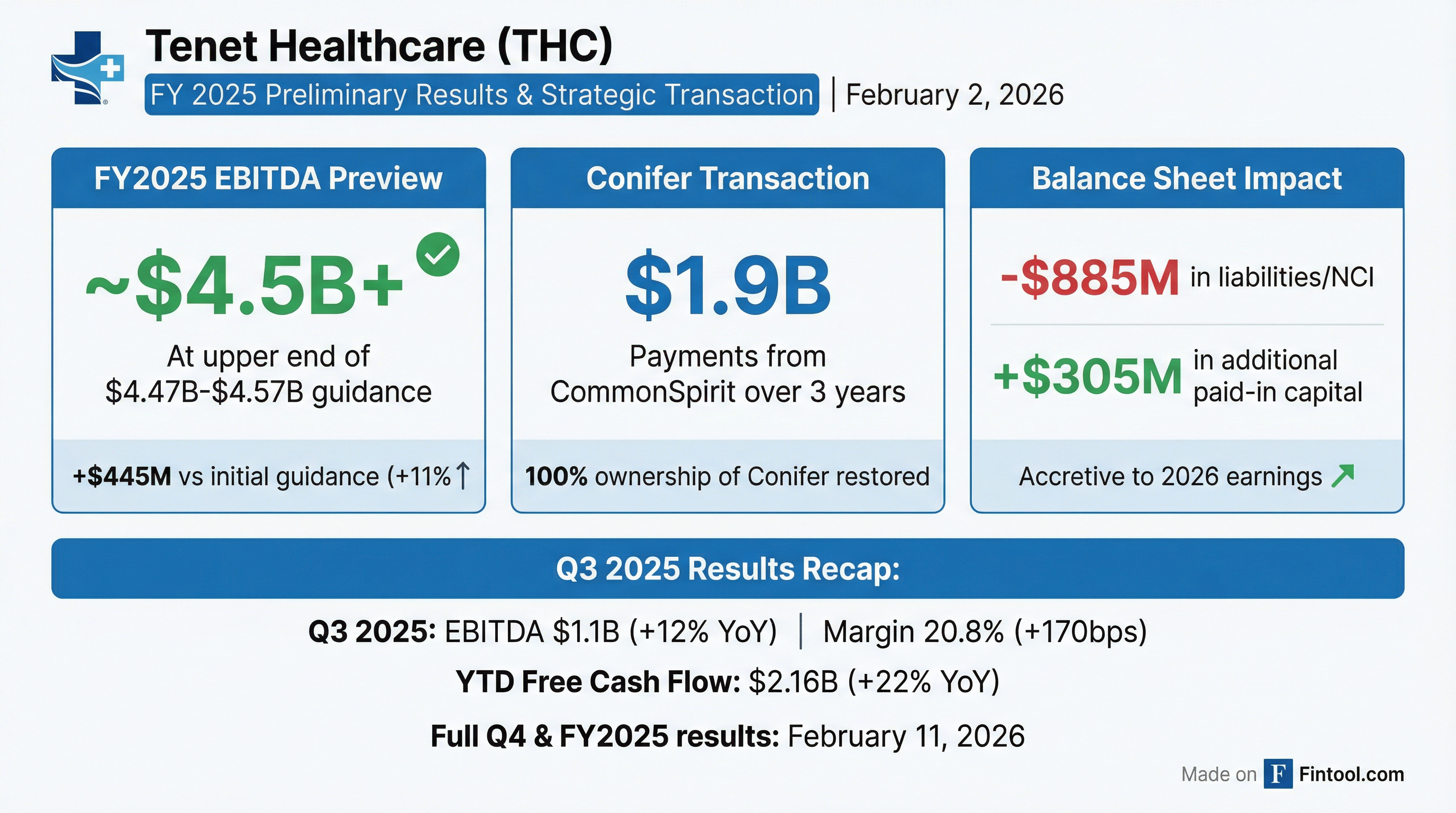

Tenet Healthcare (NYSE: THC) announced a major strategic transaction and previewed strong FY2025 results ahead of their full earnings release on February 11, 2026. The company completed a transaction with CommonSpirit Health to regain 100% ownership of Conifer Health Solutions, its revenue cycle management subsidiary, while signaling that FY2025 Adjusted EBITDA will land at the upper end of the $4.47B-$4.57B guidance range .

The announcement caps a year of consistent operational outperformance. Tenet raised guidance three times in 2025, with cumulative increases of $445M (11%) from initial expectations .

What Happened With Conifer?

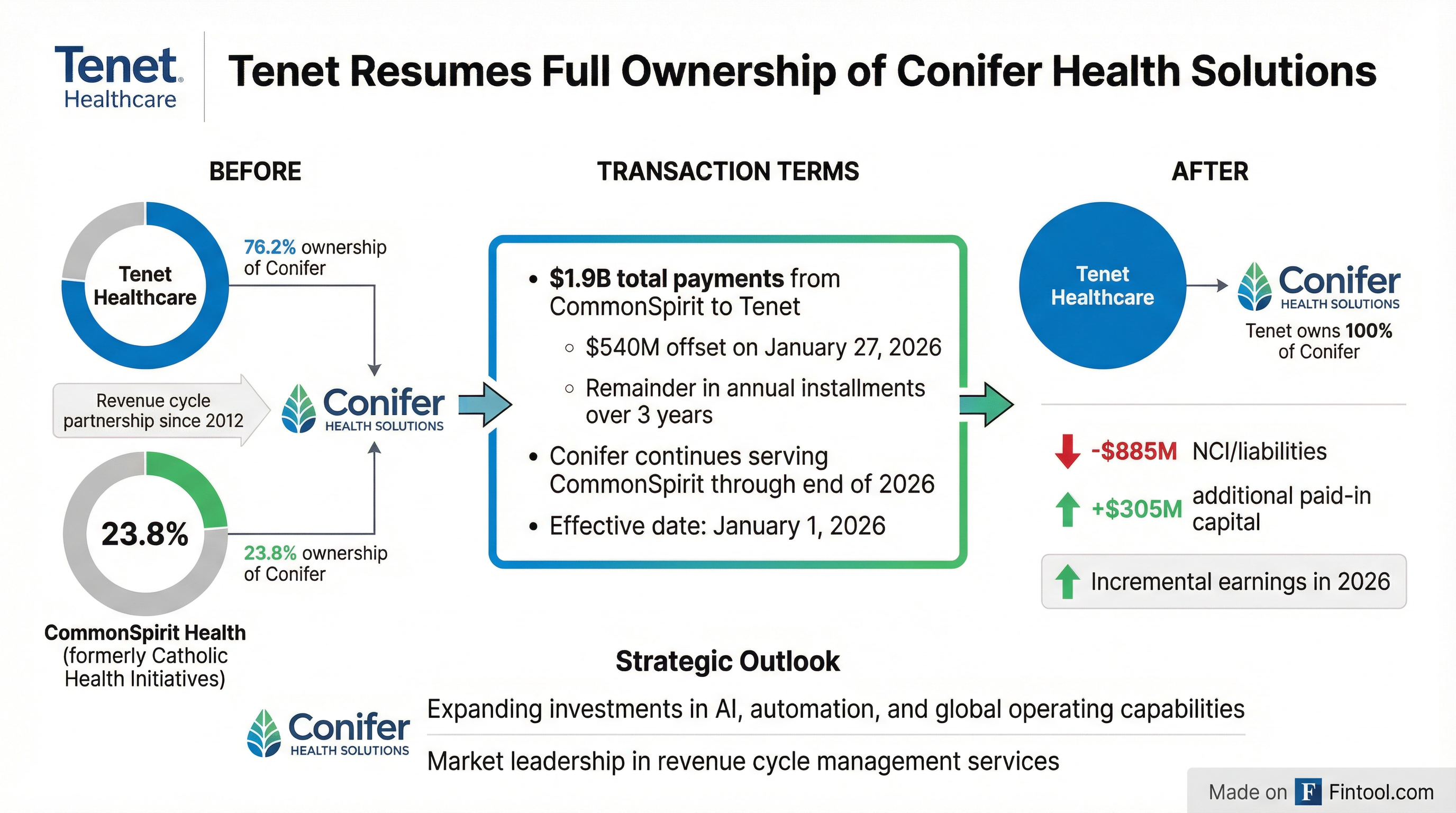

Tenet completed a transaction with CommonSpirit Health (formerly Catholic Health Initiatives) to end their 23.8% ownership stake in Conifer Health Solutions, Tenet's revenue cycle management business .

Key Transaction Terms :

CEO Saum Sutaria noted that "this milestone gives Tenet greater flexibility to support Conifer's long-term potential" and that Conifer will "expand its investments in artificial intelligence, automation and global operating capabilities" .

Did Tenet Beat FY2025 Guidance?

Yes. Tenet previewed that FY2025 Adjusted EBITDA will be at the upper end of their $4.47B-$4.57B guidance range . This represents:

- +$445M (+11%) from initial guidance of $3.98B-$4.18B set in February 2025

- ~13% growth over FY2024's $4.0B Adjusted EBITDA

Guidance Evolution in 2025:

Management attributed the strong performance to "strong same store revenue growth and disciplined expense management" .

What Changed From Last Quarter?

Q3 2025 Results Recap (reported October 28, 2025):

Q3 2025 Beat/Miss vs Consensus:

*Values retrieved from S&P Global

Tenet has beaten EBITDA consensus for four consecutive quarters heading into Q4.

How Did the Stock React?

THC shares closed at $189.28 on January 30, 2026, ahead of the February 2 announcement. The stock is:

- -15% from 52-week high of $222.82

- +72% from 52-week low of $109.82

- Trading at a market cap of ~$16.6B

The aftermarket quote following the announcement showed the stock at $186.69, down modestly (-1.4%), suggesting the market may have largely priced in strong results heading into the full earnings release .

What Did Management Say?

CEO Saum Sutaria, M.D. on performance:

"We continue to deliver strong revenue growth, improved margins and attractive free cash flow as a result of effective execution of our strategies."

On the CommonSpirit transaction:

"CommonSpirit worked closely with us to structure a mutually beneficial transaction that reflects our longstanding partnership and commitment to the joint venture... The transaction will enable a thoughtful, collaborative transition over the coming year."

CommonSpirit CFO Michael Browning:

"Conifer has been a strong and reliable revenue cycle partner since 2012, bringing consistency to a previously fragmented environment... Conifer meaningfully contributed to these hospitals achieving 100% of their cash collection goals."

What's the 2026 Outlook?

Management provided preliminary color on 2026 during the Q3 2025 call :

Positives:

- Healthy patient demand supporting same-store volume growth

- USPI expected to deliver same-store revenue growth in line with long-term targets (3-6%)

- Freestanding ASC rates insulate USPI from site neutrality regulatory changes

- Conifer now 100% owned — incremental 2026 earnings from eliminated NCI distributions

Uncertainties:

- Enhanced premium tax subsidies (ACA exchanges) still pending

- State-directed Medicaid payment program approvals for 2026 pending

- Tariff dynamics require continued management

Capital Allocation Priorities

Tenet's priorities remain unchanged :

- USPI M&A — Spent nearly $300M YTD in 2025, pipeline remains strong

- Hospital growth investments — Increased CapEx guidance to $875M-$975M (+$150M)

- Debt retirement/refinancing — Leverage at 2.3x EBITDA

- Share repurchases — $1.2B YTD through Q3 2025 (7.8M shares)

The Conifer transaction provides additional flexibility with $1.9B in cash payments over three years .

Key Risks and Concerns

- Regulatory uncertainty — ACA exchange subsidies and Medicaid payment programs still pending

- Conifer client transition — CommonSpirit services end 2026; revenue impact unclear

- Stock down from highs — Shares -15% from 52-week high despite strong results

- Forward estimates — Preliminary; actual Q4 results may differ

What to Watch February 11

Full Q4 and FY2025 results will be announced on February 11, 2026 . Key items to watch:

- Final FY2025 EBITDA — Confirmation at upper end of range

- FY2026 guidance — Initial targets for revenue, EBITDA, free cash flow

- USPI growth trajectory — Same-store revenue and M&A pipeline

- Conifer outlook — Impact of CommonSpirit transition on 2026-2027

- Capital return — Share repurchase plans at current valuation

Historical Performance

Quarterly EBITDA Beat/Miss History:

*Values retrieved from S&P Global

Tenet has delivered EBITDA beats in all four quarters of 2025, with particularly strong outperformance in Q1 (+16.9%) and Q2 (+13.0%).

This analysis covers Tenet Healthcare's February 2, 2026 preliminary results announcement and Conifer transaction. Full Q4 and FY2025 results will be released February 11, 2026.