Earnings summaries and quarterly performance for TENET HEALTHCARE.

Executive leadership at TENET HEALTHCARE.

Saum Sutaria

Chief Executive Officer

Lisa Foo

Chief Operating Officer

Paola Arbour

Executive Vice President and Chief Information Officer

Sun Park

Executive Vice President and Chief Financial Officer

Thomas Arnst

Executive Vice President, Chief Administrative Officer, General Counsel and Corporate Secretary

Board of directors at TENET HEALTHCARE.

Cecil Haney

Director

Christopher Lynch

Director

J. Robert Kerrey

Lead Independent Director

James Bierman

Director

Meghan FitzGerald

Director

Nadja West

Director

Richard Fisher

Director

Richard Mark

Director

Roy Blunt

Director

Stephen Rusckowski

Director

Tammy Romo

Director

Vineeta Agarwala

Director

Research analysts who have asked questions during TENET HEALTHCARE earnings calls.

Justin Lake

Wolfe Research, LLC

8 questions for THC

Benjamin Rossi

JPMorgan Chase & Co.

7 questions for THC

Whit Mayo

Leerink Partners

7 questions for THC

Ryan Langston

TD Cowen

6 questions for THC

Ann Hynes

Mizuho Financial Group

5 questions for THC

Craig Hettenbach

Morgan Stanley

5 questions for THC

John Ransom

Raymond James

5 questions for THC

Kevin Fischbeck

Bank of America

5 questions for THC

A.J. Rice

UBS

4 questions for THC

Andrew Mok

Barclays

4 questions for THC

Brian Tanquilut

Jefferies

4 questions for THC

Josh Raskin

Nathron Research

4 questions for THC

Joshua Raskin

Nephron Research

4 questions for THC

Pito Chickering

Deutsche Bank

4 questions for THC

Sarah James

Cantor Fitzgerald

4 questions for THC

Scott Fidel

Stephens Inc.

4 questions for THC

Stephen Baxter

Wells Fargo & Company

4 questions for THC

Thomas Walsh

Barclays

4 questions for THC

A.J. Rice

UBS Group AG

3 questions for THC

Benjamin Hendrix

RBC Capital Markets

3 questions for THC

Joanna Gajuk

Bank of America

3 questions for THC

Matthew Gillmor

KeyCorp

3 questions for THC

Ben Hendricks

RBC Capital Markets

2 questions for THC

Jamie Perse

The Goldman Sachs Group, Inc.

2 questions for THC

Jason Cassorla

Guggenheim Partners

2 questions for THC

Matthew Gilmore

KeyBanc Capital Markets

2 questions for THC

Michael Ha

Robert W. Baird & Co.

2 questions for THC

Peter Chickering

Deutsche Bank AG

2 questions for THC

Albert Rice

UBS

1 question for THC

Benjamin Mayo

Leerink Partners

1 question for THC

Mike Murray

RBC Capital Markets

1 question for THC

Stephen Baxter

Wells Fargo

1 question for THC

Recent press releases and 8-K filings for THC.

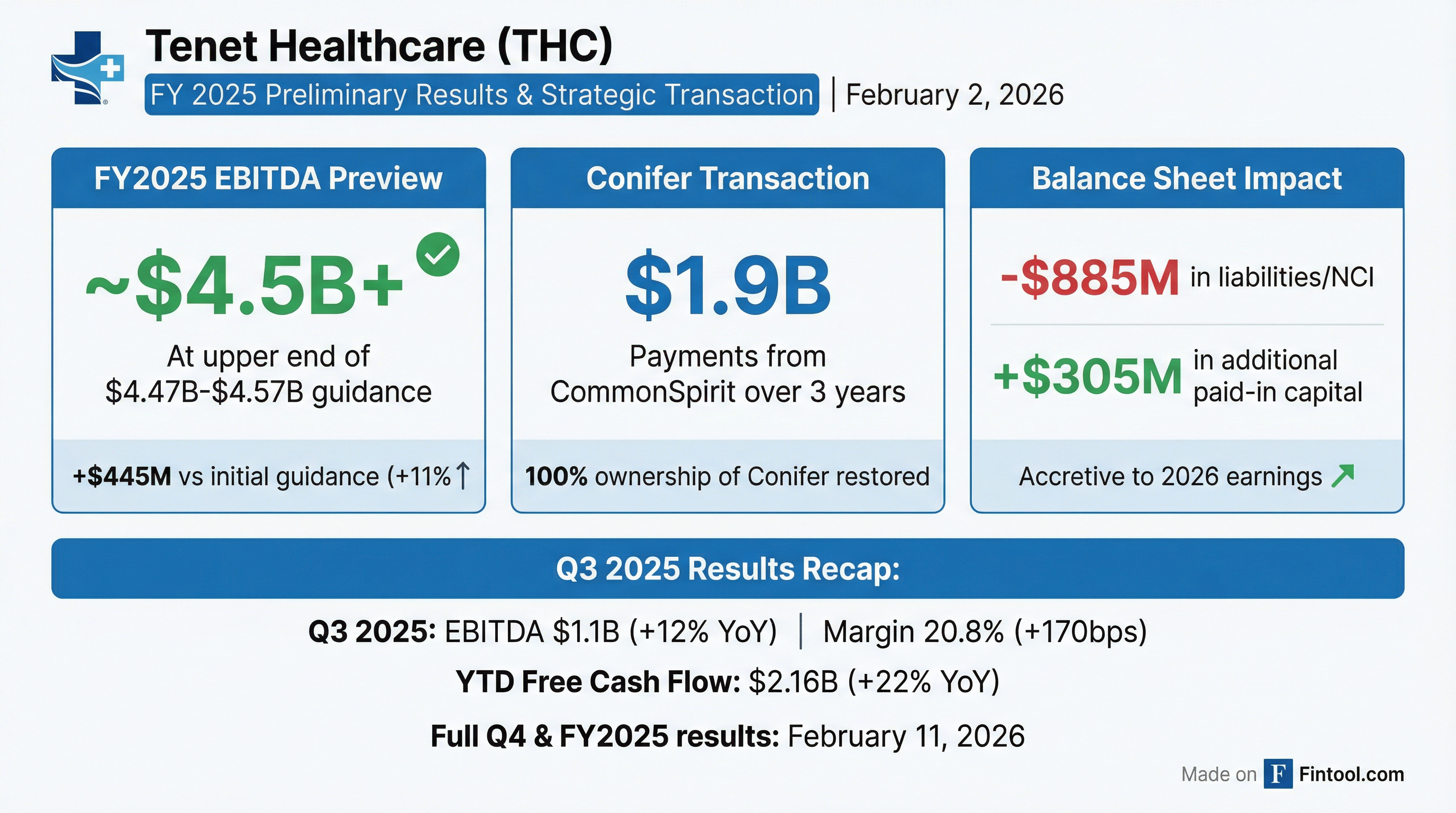

- Tenet Healthcare reported 2025 net operating revenues of $21.3 billion and consolidated Adjusted EBITDA of $4.566 billion, marking a 14% growth over 2024. The full-year Adjusted EBITDA margin improved by 210 basis points to 21.4%.

- For 2026, the company provided guidance for consolidated Adjusted EBITDA in the range of $4.485 billion-$4.785 billion and consolidated net operating revenues between $21.5 billion-$22.3 billion. Adjusted free cash flows are projected to be $2.5 billion-$2.8 billion.

- USPI's Adjusted EBITDA grew 12% to $2.026 billion in 2025 and is anticipated to be $2.13 billion-$2.23 billion in 2026. The hospital segment's Adjusted EBITDA grew 16% to $2.54 billion in 2025 and is projected to be $2.355 billion-$2.555 billion in 2026.

- The company repurchased 8.8 million shares for $1.386 billion in 2025 and plans to continue share repurchases, having retired approximately 22% of outstanding shares for around $2.5 billion since Q4 2022.

- Management is focusing on structural expense management and technology deployment for future efficiencies , while anticipating a $250 million impact to 2026 Adjusted EBITDA due to the expiration of enhanced premium tax credits.

- Full-year 2025 net operating revenues reached $21.3 billion and consolidated adjusted EBITDA was $4.57 billion, marking a 14% increase over 2024 with an adjusted EBITDA margin of 21.4%.

- For full-year 2026, Adjusted EBITDA is projected to be between $4.485 billion and $4.785 billion, with USPI contributing $2.13 billion to $2.23 billion and the hospital segment $2.355 billion to $2.555 billion.

- The company generated $2.53 billion in free cash flow in 2025 and repurchased 8.8 million shares for $1.386 billion during the year, contributing to approximately 22% of outstanding shares retired since Q4 2022 for $2.5 billion.

- The expiration of enhanced premium tax credits is expected to create a $250 million headwind to 2026 Adjusted EBITDA, primarily in the hospital segment, based on an assumed 20% reduction in overall enrollment.

- A Conifer transaction was completed, involving the retirement of $885 million in obligations and the receipt of $1.9 billion in accelerated cash flow, yielding an after-tax net present value of approximately $1.1 billion.

- Tenet Healthcare reported strong Q4 2025 results, with Consolidated Adjusted EBITDA growing 13% to $1.183 billion and Adjusted Diluted EPS growing 37%.

- Both the Ambulatory and Hospitals segments demonstrated significant growth in Q4 2025, with Ambulatory Adjusted EBITDA growing 9.4% and Hospitals Adjusted EBITDA growing 16.4%.

- For FY 2026, the company projects net operating revenues of $21.5 to $22.3 billion and Consolidated Adjusted EBITDA of $4.485 to $4.785 billion.

- The FY 2026 outlook also includes Adjusted Diluted EPS of $16.19 to $18.47 and Adjusted Free Cash Flow less NCI distributions of $1.60 to $1.83 billion.

- The company expanded its network by adding 8 facilities in Q4 2025, bringing the total number of facilities to 559 as of December 31, 2025.

- Tenet Healthcare reported strong financial performance for Q4 and full-year 2025, with Q4 2025 net operating revenues of $5.5 billion and consolidated adjusted EBITDA of $1.183 billion, a 13% increase over Q4 2024. For the full year 2025, net operating revenues reached $21.3 billion and consolidated adjusted EBITDA was $4.566 billion, representing a 14% increase over 2024, with an adjusted EBITDA margin of 21.4%.

- For 2026, the company projects consolidated net operating revenues between $21.5 billion and $22.3 billion, and consolidated Adjusted EBITDA in the range of $4.485 billion to $4.785 billion. This guidance includes an estimated $250 million headwind to Adjusted EBITDA due to the expiration of enhanced premium tax credits.

- The company generated $2.53 billion in free cash flow for full year 2025 and expects adjusted free cash flow for 2026 to be between $2.5 billion and $2.8 billion. Tenet repurchased 8.8 million shares for $1.386 billion in 2025 and has retired approximately 22% of outstanding shares for around $2.5 billion since the share repurchase program began in Q4 2022.

- USPI's adjusted EBITDA grew 12% to $2.026 billion in 2025, with a 2026 Adjusted EBITDA projection of $2.13 billion-$2.23 billion. The Conifer transaction is estimated to have an after-tax net present value of approximately $1 billion-$1.1 billion.

- Tenet Healthcare reported net income available to common shareholders of $371 million and Adjusted diluted earnings per share of $4.70 for Q4 2025, marking a 36.6% increase in Adjusted diluted EPS compared to Q4 2024.

- For the full year 2025, the company achieved net operating revenues of $21.310 billion, Adjusted EBITDA of $4.566 billion, and free cash flow of $2.53 billion.

- Tenet provided a FY 2026 Adjusted EBITDA Outlook in the range of $4.485 billion to $4.785 billion and an Adjusted diluted earnings per share outlook of $16.19 to $18.47.

- In 2025, the company repurchased 8.8 million shares of common stock for $1.386 billion and reduced its net debt to Adjusted EBITDA ratio to 2.25x at December 31, 2025.

- Tenet Healthcare reported fourth quarter 2025 Adjusted diluted earnings per share of $4.70, a 36.6% increase over the prior year, and Consolidated Adjusted EBITDA of $1.183 billion, up 12.9%. For full year 2025, the company achieved $4.566 billion in Adjusted EBITDA and $16.78 in Adjusted diluted earnings per share on $21.310 billion in net operating revenues.

- The company provided a 2026 financial outlook, expecting Adjusted EBITDA to be in the range of $4.485 billion to $4.785 billion and Adjusted diluted earnings per share between $16.19 and $18.47. Additionally, free cash flow for 2026 is projected to be $2.94 billion to $3.29 billion.

- Tenet entered into an agreement with CommonSpirit Health regarding Conifer Health Solutions, which includes $1.9 billion in payments from CommonSpirit to Tenet over three years and a $540 million payment from Conifer for CommonSpirit's equity stake, effective January 1, 2026. This transaction is anticipated to generate approximately $1.65 billion of revenue from contract termination for Tenet in 2026.

- In 2025, the company repurchased 8.8 million shares of common stock for $1.386 billion. The net debt to Adjusted EBITDA ratio improved to 2.25x at December 31, 2025, down from 2.54x at December 31, 2024.

- Tenet Healthcare announced the closing of an accretive asset sale regarding Conifer's revenue cycle management services contract with CommonSpirit, with a total value to Tenet of $2.65 billion.

- The transaction includes $1.9 billion in cash payments from CommonSpirit to Tenet over three years, starting with $540 million in the first quarter of 2026, offset by a $540 million payment from Tenet to CommonSpirit in Q1 2026 to redeem CommonSpirit's 23.8% equity stake in Conifer.

- The estimated annual Adjusted EBITDA less NCI from this contract in 2025 was approximately $190 million, and the transaction is valued at an approximate 14x multiple on this figure.

- This deal returns full strategic control of Conifer to Tenet, enabling continued investments in automation, AI, and offshoring, and is expected to lower NCI expense by approximately $100 million in 2026.

- Tenet plans to actively deploy capital to generate shareholder value, with share repurchase being an important priority, in addition to continued M&A in the ambulatory space and capital expenditures for organic growth.

- Tenet Healthcare (THC) announced the closing of an accretive asset sale regarding Conifer's Revenue Cycle Management Services contract with CommonSpirit, valuing the transaction at $2.65 billion.

- The deal involves $1.9 billion in cash payments to Tenet over three years, with $540 million due in Q1 2026, and is based on an approximate 14x multiple of the impacted $190 million estimated 2025 Adjusted EBITDA less NCI from the contract.

- The transaction returns full strategic control of Conifer to Tenet, resulting in a $100 million reduction in NCI expense in 2026 and enabling increased investments in automation and AI.

- Tenet plans to actively deploy capital to generate shareholder value, prioritizing share repurchases, M&A in the ambulatory space, and capital expenditures for organic growth.

- Tenet Healthcare (THC) announced the closing of an accretive asset sale regarding Conifer's Revenue Cycle Management Services contract with CommonSpirit, generating a total value to Tenet of $2.65 billion.

- This transaction involves $1.9 billion in cash payments from CommonSpirit to Tenet over three years, beginning with $540 million in Q1 2026, and the acquisition of CommonSpirit's 23.8% equity stake in Conifer.

- The deal is based on an approximate 14x multiple on the impacted 2025 Adjusted EBITDA less NCI of $190 million from the contract.

- For 2026, Tenet expects to recognize consistent adjusted EBITDA from the services and anticipates a reduction in NCI expense by approximately $100 million due to the retroactive equity transfer.

- The company plans to actively deploy capital for shareholder value, with share repurchase being an important priority, alongside M&A in the ambulatory space and capital expenditures for organic growth.

- Tenet Healthcare Corporation completed a strategic transaction with CommonSpirit Health, regaining full ownership of its Conifer Health Solutions subsidiary.

- Key financial terms of the transaction include payments totaling approximately $1.9 billion from CommonSpirit to Tenet over three years, a $540 million redemption payment from Conifer to CommonSpirit, and a reduction of Tenet’s redeemable non-controlling interest and other liabilities by approximately $885 million.

- The company expects its Adjusted EBITDA for the year ended December 31, 2025, to be at the upper end of its guidance range of $4.47 billion to $4.57 billion.

Fintool News

In-depth analysis and coverage of TENET HEALTHCARE.

Quarterly earnings call transcripts for TENET HEALTHCARE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more