Thermon Group Holdings (THR)·Q3 2026 Earnings Summary

Thermon Delivers Record Q3 as Revenue and Bookings Hit All-Time Highs

February 5, 2026 · by Fintool AI Agent

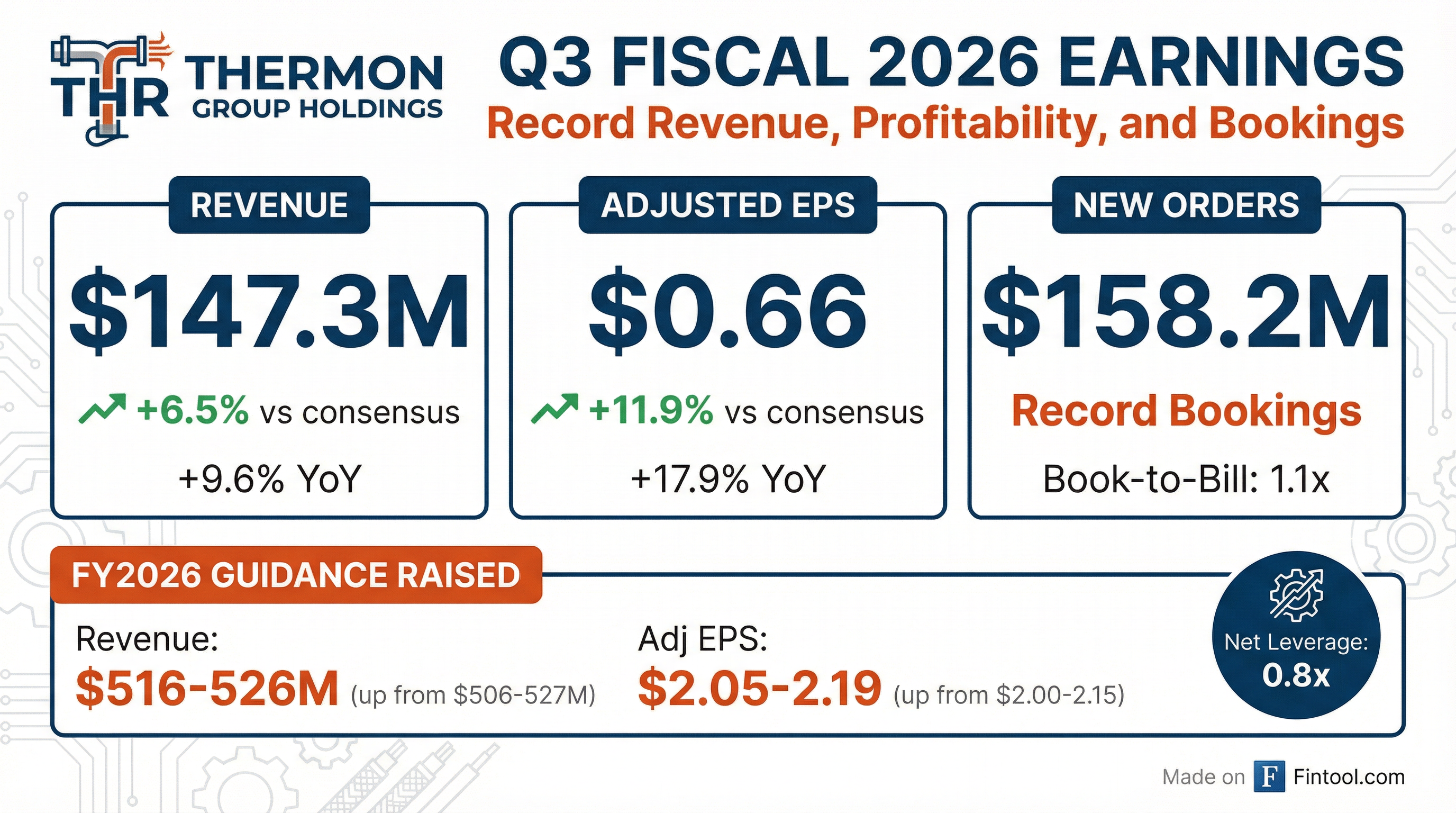

Thermon Group Holdings (THR) reported Q3 fiscal 2026 results that exceeded expectations across all key metrics, delivering record revenue, profitability, and bookings. Revenue of $147.3 million beat consensus by 6.5%, while adjusted EPS of $0.66 topped estimates by nearly 12%. The company raised full-year guidance, citing strong momentum in large project activity and secular growth tailwinds across data center, power generation, and LNG markets.

Did Thermon Beat Earnings?

Thermon delivered a decisive double beat in Q3 FY2026:

Revenue increased 9.6% year-over-year, driven by accelerating large project (CAPEX) activity, which surged 36.6% compared to the prior year period. Gross margin expanded 40 basis points to 46.6%, while adjusted EBITDA margin reached 24.2%, up from 23.7% a year ago.

This marks Thermon's eighth consecutive earnings beat in the last nine quarters, with only a minor miss in Q1 FY2026:

What Did Management Guide?

Management raised guidance across all metrics, narrowing the revenue range while lifting the floor:

CFO Jan Schott cited "strong visibility into the remainder of the year" based on disciplined pricing execution, favorable book-to-bill, and sustained large-project strength.

What Changed From Last Quarter?

Several developments marked an acceleration from Q2 FY2026:

Bookings surge: Orders reached a record $158.2 million, up 14% year-over-year, resulting in a book-to-bill ratio of approximately 1.1x. Large project orders increased approximately 60% year-over-year, driven by LNG project activity, midstream gas processing, and a large sustainable aviation fuels (SAF) project in Asia. Total bid pipeline grew 8% at quarter end, with nearly 80% of opportunities coming from diversified end markets.

Data center momentum: Quoting activity for data center solutions nearly doubled sequentially. The company shipped its first liquid load bank testing units during the quarter—just six months after initiating development—demonstrating rapid product velocity.

CAPEX mix shift: Large project (CAPEX) sales represented 17.2% of revenue, up from 13.8% a year ago, a 340 basis point increase. This reflects growing momentum in energy transition and infrastructure investments.

Deleveraging continues: Net debt declined to $96.3 million from $110.0 million at quarter-end, with net leverage dropping to 0.8x from 1.0x.

Strategic Growth Platforms: Data Centers and Electrification

The earnings presentation highlighted significant traction on two key growth platforms:

Liquid Load Banks (Data Center Testing):

- Quote log expanded from ~$30M to ~$60M (2x growth sequentially)

- 20 units shipped, marking Thermon's entry into the market

- 40 units ordered, with active engagement across owners/operators, commissioning firms, and rental partners

- Dedicated production line being established to support scaling

Medium Voltage Heaters (Electrification):

- Pipeline expanded to over $150M

- Secured 3rd order, bringing backlog to $11M

- Leveraging global footprint to scale manufacturing

- Cross-selling into existing chemical, industrial, O&G, and food & beverage relationships

- High barriers to entry: difficult to engineer, harder to manufacture, requires exhaustive international certifications

Power Sector Pipeline:

- Opportunity pipeline has grown to $180M, up 58% year-over-year

- Over 60% of opportunities in the US market

- Products include emissions monitoring (tubing bundles), temperature management (Genesis control systems), and auxiliary boilers for conventional and nuclear power generation

Revenue Mix and Diversification

Thermon's trailing twelve-month results show continued end market diversification:

Geographic Mix: USLAM 49%, Canada 31%, EMEA 13%, APAC 7%

The company's "3D Initiatives" (Decarbonization, Digitization, Diversification) generated $100 million in trailing twelve-month revenue, demonstrating progress on strategic priorities.

Key Management Quotes

CEO Bruce Thames on the record performance:

"Thermon delivered a record third quarter, achieving the highest revenue, profitability, and bookings in our company's history—an exceptional milestone that reflects both strong end-market demand and outstanding execution across our global organization."

On data center and electrification opportunities:

"Development of our liquid load bank testing solutions is progressing exceptionally well. We shipped our first units during the quarter, just six months after initiating development, demonstrating the ingenuity and agility of our team. Quoting activity for our data center solutions remains extremely robust, with our quote log nearly doubling sequentially."

CFO Jan Schott on capital allocation:

"We ended the third quarter with net leverage of just 0.8x and total cash and available liquidity of $141.2 million, providing us with the capacity to invest in growth while maintaining a strong financial foundation."

Financial Trends: 8-Quarter View

Q3 is seasonally the strongest quarter for Thermon, and this quarter's 24.2% adjusted EBITDA margin represents the highest in company history. The margin trajectory shows consistent improvement, supported by Thermon Business System initiatives and favorable pricing.

Capital Allocation and Balance Sheet

Thermon continued to strengthen its balance sheet while returning capital to shareholders:

The company repurchased $15.8 million in shares during FY2026 YTD, bringing total repurchases since program inception to $36 million. $38.5 million remains available under current authorization.

How Did the Stock React?

Despite the record results and raised guidance, THR shares traded lower in after-hours trading:

- Prior close (Feb 4): $46.19

- After-hours: $44.53 (down ~3.6%)

- 52-week range: $23.05 - $49.61

The muted reaction likely reflects elevated expectations heading into the print—THR shares had rallied over 95% from their 52-week low and were trading near all-time highs. The guidance raise, while positive, was modest (~2% at the midpoint) and may have disappointed investors expecting a larger upward revision given the strength of Q3 results.

Risks and Considerations

Management highlighted several risk factors in the filing:

- Tariff exposure: Guidance assumes tariff headwinds will be fully offset by price and productivity in H2, with current tariff regime remaining in place with no notable improvement or escalation

- Cyclicality: General economic conditions affect capital investment timing across key end markets

- Project timing: Ability to timely deliver backlog and convert bid pipeline to orders

- Currency risk: Revenue mix across geographies creates FX exposure

Forward Catalysts

Near-term (1-2 quarters):

- Q4 FY2026 earnings (May 2026) with full-year results

- Continued ramp of data center liquid load bank solutions

- Conversion of elevated bid pipeline to bookings

Medium-term:

- Energy transition and electrification demand in Europe (medium voltage heaters)

- LNG infrastructure buildout

- Data center power infrastructure expansion

- Strategic M&A with 0.8x leverage providing significant capacity

Multi-Year Track Record

Thermon's Q3 results extend a strong multi-year performance trajectory:

- +14% Revenue CAGR from FY2021 to FY2026E

- +26% Adjusted EBITDA CAGR over the same period

The company positions itself as a "compelling investment opportunity" with leading market position in mission-critical heat tracing technology, large installed base with recurring aftermarket revenue, and exposure to secular growth in energy transition, data centers, and onshoring.

Q&A Highlights

On gross margin sustainability (Brian Drab, William Blair):

CEO Bruce Thames addressed whether 46%+ gross margins are sustainable given the higher CapEx mix:

"The Thermon Business System, we've been able to systematically drive productivity and efficiency gains that are translating into bottom-line results. I think that's something that's in place and will continue to drive going forward. Price has been another area where we've certainly gained some incremental margin in the marketplace."

He noted the current project mix is "largely design and supply with much less... turnkey or additional content around field labor, around installation, or third-party materials," which improves margin profile. Q3 is seasonally the highest gross margin quarter, with margins expected to normalize in Q4/Q1 before rebuilding.

On data center customer channels (Brian Drab, William Blair):

COO Tom Cerovski detailed the diverse customer relationships:

"We've formed relationships with rental companies out there that specifically rent equipment into this market. There's also a burgeoning group of companies that do nothing but commissioning of data centers... And then we've also worked directly with end users. In some cases, they're installing these units permanently."

On medium voltage heater competitive moat (Aaron Spicala, Craig-Hallam):

Tom Cerovski emphasized barriers to entry:

"This has a very large competitive moat around it in terms of the capabilities to build these heaters... These heaters come with international certifications and approvals that require exhaustive testing and compliance reviews. Quite frankly, these medium voltage heaters are difficult to engineer and even harder to manufacture."

The company is currently quoting and selling manufacturing slots into FY27 and FY28 fiscal years.

On LNG and midstream applications (Aaron Spicala, Craig-Hallum):

Bruce Thames outlined the product breadth for LNG markets:

"Medium voltage heaters are used for natural gas regeneration... our heat tracing products are used extensively just due to the colder temperatures... We also have immersion heater opportunities in various applications there, and then our tubing bundles are sold in there."

On FATI acquisition outlook (John Bratt, Kansas City Capital):

Bruce Thames highlighted exceptional performance:

"In less than 18 months, we've essentially doubled that business. We expect... to double that business over the next 2-3 years. That would be really serving the increased demand for electrification as well as the market opportunity represented by medium voltage heaters."

The company is investing to build capacity for medium voltage heaters in Milan for Europe and the Eastern Hemisphere.

On CapEx outlook for FY27:

Management indicated CapEx will increase from the historical ~2.5% average to closer to 3% of revenue next year, reflecting investments in liquid load bank and medium voltage heater production capacity in both Western and Eastern Hemispheres.

The Bottom Line

Thermon delivered a record quarter that exceeded expectations on revenue (+6.5%), adjusted EPS (+11.9%), and bookings (+14.1%). The company raised full-year guidance while continuing to deleverage and return capital to shareholders. Secular growth tailwinds in data centers, power generation, and LNG position Thermon well for sustained momentum, though the stock's muted after-hours reaction suggests the strong results may have been priced in following the recent rally. The 0.8x net leverage and $141M liquidity position provide strategic flexibility for both organic investment and M&A.

Key callouts from the earnings call: gross margin sustainability is supported by structural factors (Thermon Business System, design/supply mix), the FATI acquisition is expected to double again over the next 2-3 years, and medium voltage heaters represent a multi-year opportunity with significant barriers to entry.

View the full earnings call transcript, earnings press release, and investor presentation.