Earnings summaries and quarterly performance for Thermon Group Holdings.

Executive leadership at Thermon Group Holdings.

Bruce Thames

President and Chief Executive Officer

Greg Lucas

Vice President, Chief Accounting Officer

Jan Schott

Senior Vice President, Chief Financial Officer

Roberto Kuahara

Senior Vice President, Global Operations

Ryan Tarkington

Senior Vice President, General Counsel & Corporate Secretary

Thomas Cerovski

Senior Vice President and Chief Operating Officer

Board of directors at Thermon Group Holdings.

Research analysts who have asked questions during Thermon Group Holdings earnings calls.

Brian Drab

William Blair & Company

9 questions for THR

Justin Ages

CJS Securities

8 questions for THR

Jonathan Braatz

Oppenheimer & Co. Inc.

5 questions for THR

Chip Moore

EF Hutton

4 questions for THR

Aaron Spychalla

Craig-Hallum Capital Group

2 questions for THR

Alfred Moore

C.L. King & Associates

2 questions for THR

John Braatz

Kansas City Capital

2 questions for THR

Jon Braatz

KCCA

2 questions for THR

Recent press releases and 8-K filings for THR.

- CECO Environmental reported record financial results for full year 2025, with revenue of $774.4 million, up 39%, and orders exceeding $1 billion at $1,064.3 million, up 59%.

- The company finished 2025 strong, with Q4 revenue of $214.7 million, up 35%, and Adjusted EBITDA of $29.8 million, up 57%.

- CECO announced a strategic transaction to combine with Thermon Group Holdings, Inc..

- The company raised its 2026 full-year outlook (excluding Thermon), projecting revenue between $925 million and $975 million and Adjusted EBITDA between $115 million and $135 million.

- Thermon Group Holdings and CECO Environmental have entered a definitive cash-and-stock agreement to combine, valued at approximately $2.2 billion including debt.

- Thermon shareholders can choose between a mixed consideration, an all-cash option, or an all-stock option, with the default mixed package valued at approximately $63.13 per share, representing a 26.8% premium to Thermon's pre-deal price as of February 23, 2026.

- Upon closing, expected mid-2026, CECO shareholders will own approximately 62.5% and Thermon shareholders 37.5% of the combined company, which will continue as CECO Environmental under current CECO CEO Todd Gleason.

- The transaction is expected to generate approximately $40 million in annual cost synergies over three years and has been unanimously approved by both companies' boards.

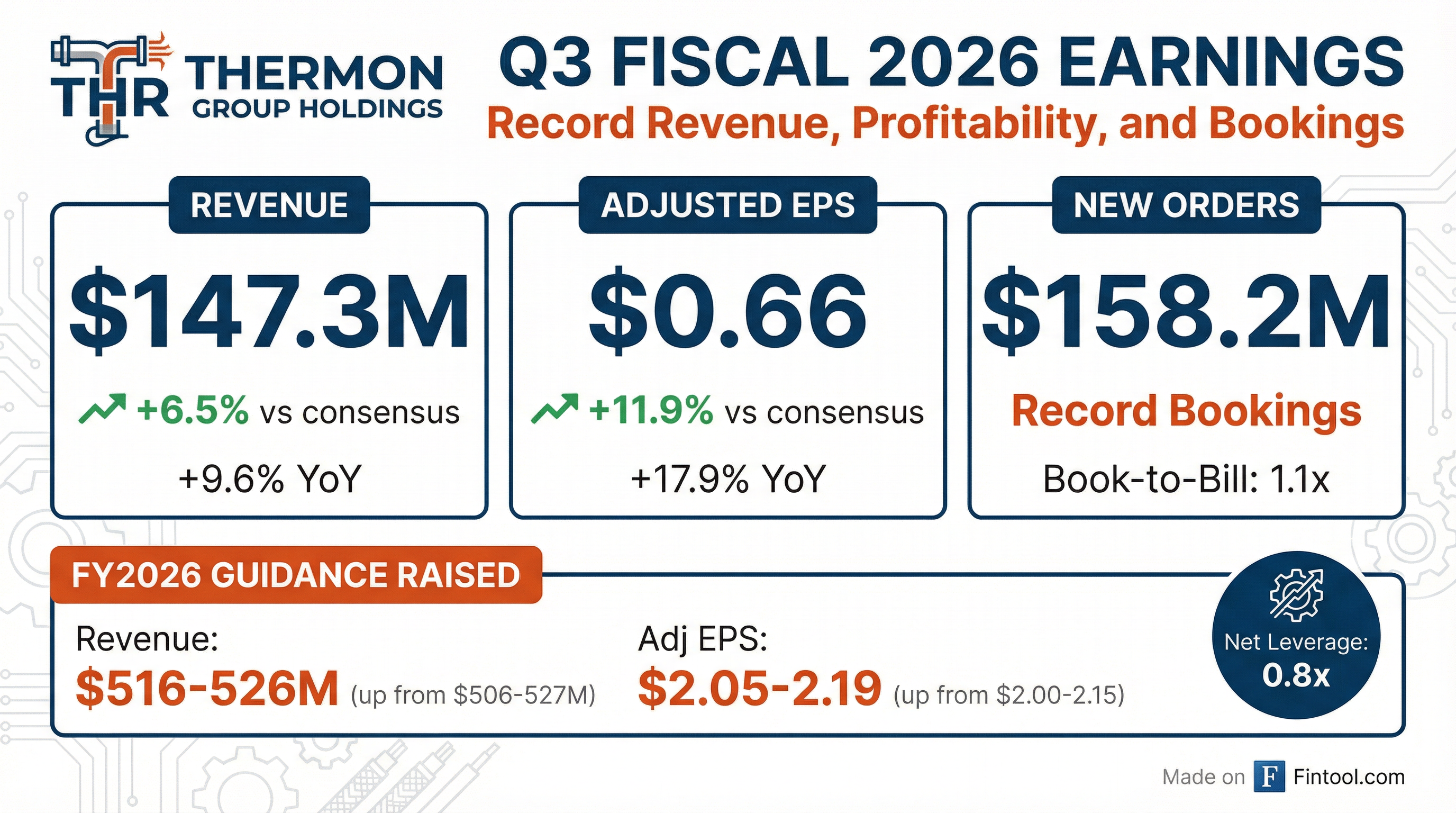

- Thermon Group Holdings achieved record-breaking results in Q3 fiscal 2026, with revenue up 10% to $147.3 million, adjusted EBITDA up 12% to $35.6 million, and adjusted EPS up 18% to $0.66.

- The company reported strong order trends, with orders increasing 14% to $158.2 million and a book-to-bill ratio of 1.1 times, leading to a 10% increase in backlog.

- Significant growth opportunities are emerging from the data center market, with liquid load bank quoting activity doubling sequentially to $60 million, and medium voltage heaters, which have a pipeline of over $150 million and a backlog of over $11 million.

- Management raised its full-year fiscal 2026 guidance, forecasting revenue between $516 million and $526 million and Adjusted EBITDA between $114 million and $120 million.

- Thermon Group Holdings achieved record-breaking Q3 fiscal 2026 results, with revenue up 10% year-over-year to $147.3 million, adjusted EBITDA up 12% to $35.6 million, and adjusted EPS up 18% to $0.66.

- The company raised its full-year fiscal 2026 financial guidance, now projecting revenue in the range of $516 million-$526 million and adjusted EBITDA between $114 million-$120 million.

- Orders for the quarter increased 14% year-over-year to $158.2 million, resulting in a book-to-bill ratio of 1.1 times, driven by strong activity in LNG, midstream gas processing, and a large sustainable aviation fuels project in Asia.

- Momentum continues in key growth areas, with the liquid load bank quote log for data centers doubling sequentially to $60 million and the medium voltage heater pipeline expanding to over $150 million.

- Thermon Group Holdings achieved record-breaking results in Q3 fiscal 2026, with revenue up 10% year-over-year to $147.3 million and adjusted EBITDA increasing 12% to $35.6 million.

- The company reported strong order trends, with orders growing 14% to $158.2 million and a book-to-bill ratio of 1.1x, contributing to a 10% increase in backlog.

- Strategic growth initiatives are gaining traction, including liquid load bank quoting activity for data centers doubling to $60 million and the medium voltage heater pipeline expanding to over $150 million.

- Gross margins improved to 46.6% in Q3 2026, driven by operating leverage, pricing, and a favorable project mix.

- Management raised its fiscal 2026 financial guidance, now expecting revenue between $516 million and $526 million and adjusted EBITDA between $114 million and $120 million.

- Thermon (THR) reported strong Q3 2026 financial performance, with revenue increasing 9.6% to $147.3 million, Adjusted EBITDA growing 11.9% to $35.6 million, and Adjusted EPS rising 17.9% to $0.66 compared to Q3 2025.

- The company experienced robust demand, with orders increasing 14.1% year-over-year to $158.2 million, leading to a book-to-bill ratio of 1.1x and a 10.1% increase in backlog to $259.4 million.

- Free Cash Flow grew 56.0% to $13.1 million, and Net Debt to Adjusted EBITDA leverage improved to 0.8x from 1.1x in the prior year, reflecting strong financial health.

- Thermon updated its full-year 2026 guidance, projecting revenue between $516 million and $526 million, Adjusted EPS between $2.05 and $2.19, and Adjusted EBITDA between $114 million and $120 million.

- Strategic growth platforms, Liquid Load Banks and Medium Voltage Heaters, showed significant traction, with the Liquid Load Banks quote log expanding to ~$60 million and the Medium Voltage Heaters pipeline growing to over +$150 million.

- Thermon Group Holdings, Inc. reported record third quarter Fiscal 2026 results, with revenue of $147.3 million, an increase of 9.6% year-over-year, and Adjusted EBITDA of $35.6 million, up 11.9% with a 24.2% margin.

- Net income for Q3 2026 was $18.3 million, or $0.55 earnings per diluted share, while Adjusted Net Income reached $21.9 million, or $0.66 Adjusted EPS.

- The company achieved record new orders of $158.2 million, representing a 14.1% increase year-over-year, resulting in a book-to-bill ratio of 1.1x and a 10.1% increase in backlog to $259.4 million as of December 31, 2025.

- Thermon maintained a strong financial position with a net leverage ratio of 0.8x and total cash and available liquidity of $141.2 million as of December 31, 2025, and repurchased $15.8 million in common shares during Fiscal 2026.

- Management raised its full-year Fiscal 2026 guidance, now expecting revenue between $516 and $526 million, Adjusted EBITDA between $114 and $120 million, and Adjusted EPS between $2.05 and $2.19.

- For Q1 Fiscal 2025, revenue increased to $115.1 million, a 7.7% year-over-year growth, primarily driven by the Vapor Power acquisition and OPEX growth, despite a 5.3% organic revenue decline due to large project delays.

- Adjusted EBITDA grew 5.0% to $23.2 million in Q1 Fiscal 2025, while Adjusted EPS decreased 5.0% to $0.38.

- The company generated $8.8 million in Free Cash Flow and reduced its net leverage to 1.1x during Q1 Fiscal 2025.

- For Fiscal Year 2025, THR anticipates revenue between $527 million and $553 million (representing 7%-12% growth) and Adjusted EPS between $1.90 and $2.06.

- THR reported strong Q2 2026 results, with revenue increasing 15% to $131.7 million and Adjusted EBITDA growing 29% to $30.6 million, resulting in an Adjusted EPS of $0.55.

- The company updated its full-year 2026 guidance, raising the expected revenue range to $506 - $527 million and Adjusted EPS to $2.00 - $2.15.

- THR maintained a net leverage of 1.0x and returned $6 million in capital through share repurchases during Q2 2026, with a refreshed $50 million share repurchase authorization in place.

- The company secured its first order for the new Poseidon Liquid Load Bank datacenter testing solution, with a quote log expanding to nearly $30 million.

- Thermon (THR) reported strong Q2 2026 results, with revenue up 15% year-over-year to $131.7 million and adjusted EBITDA increasing 29% to $30.6 million.

- The company raised its full-year 2026 financial guidance, projecting revenue between $506 million-$527 million and adjusted EBITDA between $112 million-$119 million.

- Strategic growth initiatives are advancing, including securing the first order for the Poseidon Liquid Load Bank for data centers and two initial orders totaling nearly $10 million for Quantum medium voltage heaters.

- Thermon ended the quarter with a strong financial position, including net leverage at 1.0 times and $129 million in total liquidity.

Quarterly earnings call transcripts for Thermon Group Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more