TOMPKINS FINANCIAL (TMP)·Q4 2025 Earnings Summary

Tompkins Financial Posts Record Operating EPS, Sells Insurance Unit for $223M

January 30, 2026 · by Fintool AI Agent

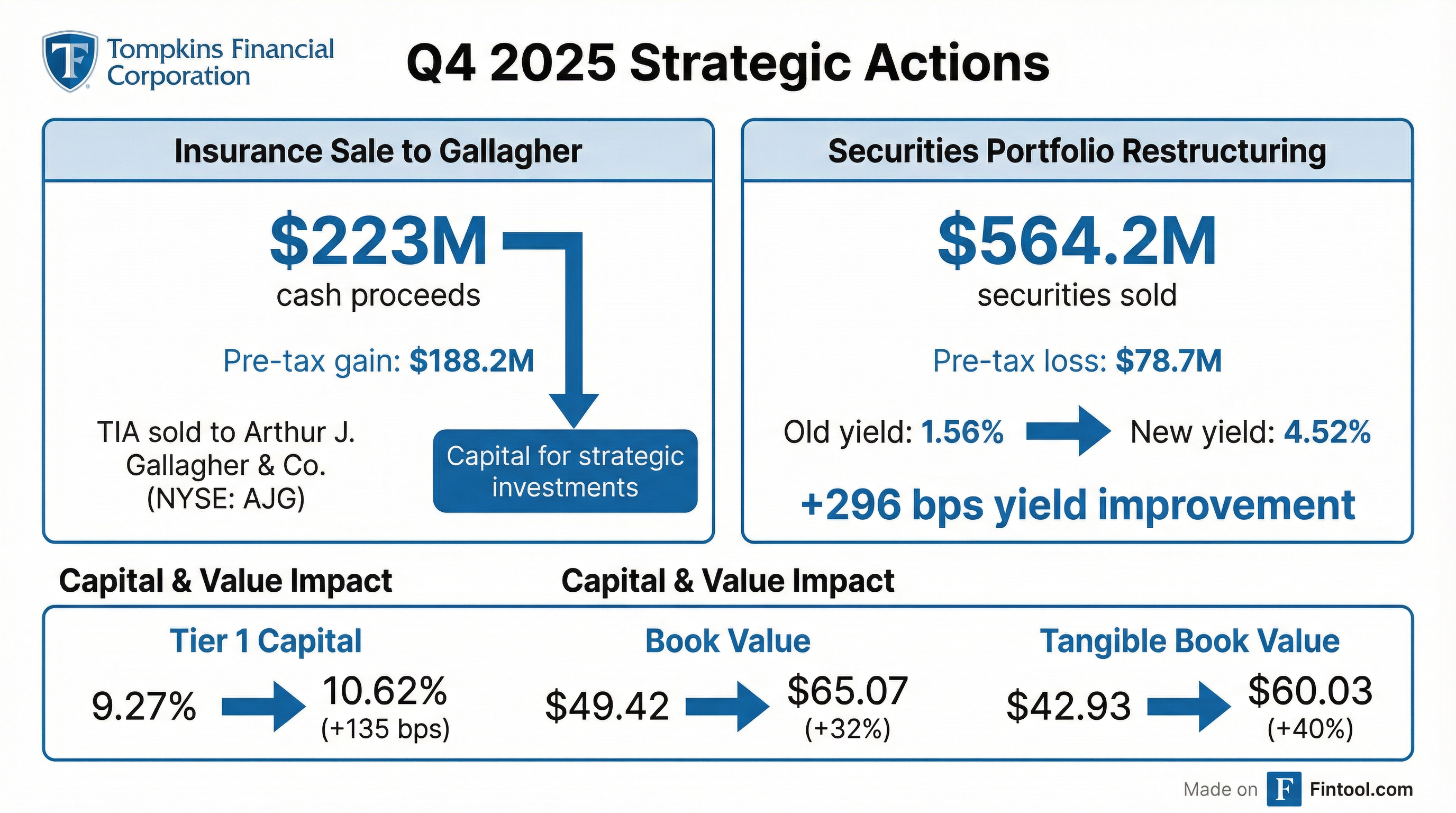

Tompkins Financial Corporation (NYSE American: TMP) delivered record operating earnings for Q4 2025, beating EPS consensus by 4.7% while executing a transformational strategic pivot. The regional bank sold its insurance subsidiary for $223M and restructured its securities portfolio, setting the stage for improved profitability in 2026.

Did Tompkins Financial Beat Earnings?

Yes — beat on both operating EPS and revenue.

The headline GAAP EPS of $6.70 is distorted by two major one-time items: a $188.2M pre-tax gain from selling the insurance subsidiary offset by a $78.7M pre-tax loss on securities sales. Operating EPS of $1.78 strips out these items and represents the best-ever quarterly operating result for the company.

What Changed From Last Quarter?

This was a transformational quarter. Two strategic actions reshaped the balance sheet:

1. Insurance Subsidiary Sale ($223M)

Tompkins sold all shares of Tompkins Insurance Agencies (TIA) to Arthur J. Gallagher & Co. (NYSE: AJG) for approximately $223M in cash.

- Pre-tax gain: $188.2M

- Strategic rationale: "Provides capital to support strategic investments for the future" — CEO Stephen Romaine

- Insurance revenue impact: Q4 insurance revenue down 63.7% YoY due to sale timing

2. Securities Portfolio Restructuring

The company sold $564.2M of available-for-sale debt securities at a pre-tax loss of $78.7M, then reinvested proceeds at significantly higher yields:

Management expects this restructuring to "favorably impact securities revenue in future periods." The weighted average life of both purchased and sold securities was approximately 5.5 years.

How Did the Core Business Perform?

Strip away the one-time items, and the underlying banking franchise showed strong momentum:

Net Interest Margin Expansion

The NIM expansion was driven by:

- Growth in average loan balances

- Improved yields on earning assets

- Lower funding costs from rate cuts and improved funding mix

- Securities portfolio yield up 45 bps QoQ and 68 bps YoY from reinvestment at higher rates

Loan and Deposit Growth

Loan growth was mainly in commercial real estate and C&I portfolios.

How Did the Stock React?

TMP rose 2.2% on earnings day, closing at $76.73.

The stock has rallied approximately 42% from its 52-week low, reflecting improving fundamentals and the strategic repositioning.

What Does This Mean for Capital and Book Value?

The TIA sale proceeds significantly strengthened the capital position:

Book value jumped 19.1% quarter-over-quarter, driven by the TIA sale gain and improved securities portfolio valuations.

What About Credit Quality?

Asset quality metrics improved, though the quarter included some elevated charge-offs:

Nonperforming assets declined to $48.2M from $65.2M a year ago, largely due to resolution of a $14.2M commercial real estate loan.

Net charge-offs were $3.3M in Q4, up from $1.1M in Q3, driven by a $2.4M charge-off on a $7.4M commercial real estate relationship.

Did Tompkins Raise the Dividend?

Yes. The Board declared a quarterly dividend of $0.67 per share, up $0.05 or 8.1% from Q1 2025.

- Payable: February 22, 2026

- Record Date: February 13, 2026

The company also repurchased 22,339 shares at $1.6M during Q4 under its 2025 Stock Repurchase Plan.

What Did Management Say?

CEO Stephen Romaine highlighted the strategic positioning:

"We are pleased to report record quarterly net income and operating earnings for the fourth quarter of 2025. Our improved results were driven by strong loan and deposit growth, both of which were up over 7% for the year, and by an expanding net interest margin which was up 49 basis points over the fourth quarter of 2024. During the fourth quarter of 2025, we announced the sale of Tompkins Insurance Agencies, Inc. and restructured our balance sheet, which we believe leaves us with continued momentum heading into 2026 and provides us with capital to support strategic investments for the future."

Key Risks and Considerations

-

Insurance revenue lost: TIA contributed ~$35.6M in full-year 2025 insurance revenue. This recurring fee income stream is now gone.

-

Securities loss realization: The $78.7M loss on securities sales reduced GAAP earnings and AOCI. While economically neutral (reinvested at higher yields), this is a sunk cost.

-

CRE concentration: The company has experienced elevated charge-offs from commercial real estate in 2025. Special Mention loans rose to $100.7M from $36.9M a year ago.

-

Rate sensitivity: NIM expansion depends on continued favorable rate environment and funding mix.

Looking Forward

Key catalysts to watch:

- NIM trajectory: Will the securities restructuring and loan growth sustain NIM above 3.40%?

- Capital deployment: How will management deploy the $223M TIA proceeds? M&A? Buybacks? Organic growth?

- Credit normalization: Will CRE-related charge-offs subside in 2026?

- Operating expense efficiency: Salaries and benefits grew 8.9% YoY — can this moderate post-TIA sale?

Historical Earnings Trend

Operating EPS has grown 30% from Q4 2024 to Q4 2025, driven by NIM expansion and loan growth.

Tompkins Financial Corporation is a regional bank headquartered in Ithaca, NY, serving Central, Western, and Hudson Valley regions of New York and Southeastern Pennsylvania through Tompkins Community Bank. The company provides commercial and consumer banking, and wealth management services under the Tompkins Financial Advisors brand.