Earnings summaries and quarterly performance for TAPESTRY.

Executive leadership at TAPESTRY.

Board of directors at TAPESTRY.

Research analysts who have asked questions during TAPESTRY earnings calls.

Michael Binetti

Evercore ISI

8 questions for TPR

Brooke Roach

Goldman Sachs Group, Inc.

6 questions for TPR

Mark Altschwager

Robert W. Baird & Co.

5 questions for TPR

Matthew Boss

JPMorgan Chase & Co.

5 questions for TPR

Ike Boruchow

Wells Fargo

4 questions for TPR

Lorraine Hutchinson

Bank of America

4 questions for TPR

Aneesha Sherman

AllianceBernstein

3 questions for TPR

Bob Drbul

Guggenheim Securities

3 questions for TPR

Irwin Boruchow

Wells Fargo Securities

3 questions for TPR

Matt Boss

JPMorgan Chase & Co.

3 questions for TPR

Rick Patel

Raymond James Financial

3 questions for TPR

Adrian Yee

Barclays PLC

2 questions for TPR

Adrienne Yih-Tennant

Barclays

2 questions for TPR

Alex Straton

Morgan Stanley

2 questions for TPR

Robert Drbul

Guggenheim Securities

2 questions for TPR

Adrianne Yih

Barclays PLC

1 question for TPR

Dana Telsey

Telsey Advisory Group

1 question for TPR

Paul Lejuez

Citigroup

1 question for TPR

Rakesh Patel

Raymond James

1 question for TPR

Tracy Kogan

Citigroup

1 question for TPR

Recent press releases and 8-K filings for TPR.

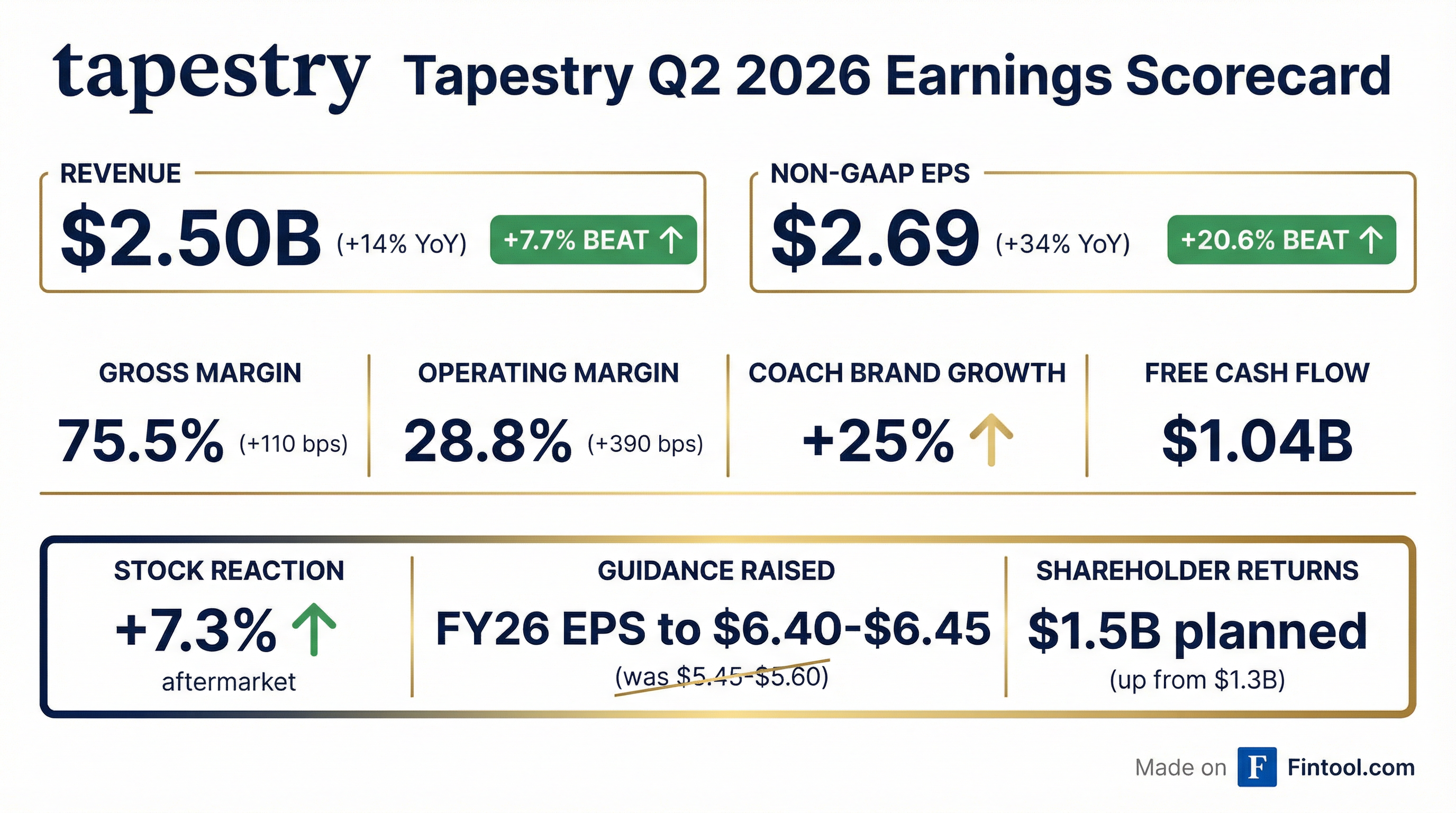

- Tapestry delivered pro forma revenue growth of 18%, adjusted operating margin expansion of 390 bps, and EPS of $2.69, up 34% YoY in Q2 2026.

- Strong regional performance: North America sales +17%, Europe +22%, and Greater China +34% in the quarter.

- Raised full-year FY 2026 guidance to > $7.75 B revenue (≈15% nominal, 14% constant currency) and EPS of $6.40–$6.45 (>25% growth).

- Returned capital with a $0.40/share Q2 dividend and $400 M of share repurchases; now targeting $1.5 B of total shareholder returns in fiscal 2026, including $1.2 B in buybacks.

- Delivered pro forma revenue growth of 18%, adjusted operating margin expansion of 390 bps, and EPS of $2.69 (+34%) in Q2 2026 versus prior year.

- Regional sales outperformed: North America +17%, Europe +22%, Greater China +34% year-over-year.

- Achieved a gross margin of 75.5% (+110 bps) and SG&A leverage of 270 bps on an 8% rise in expenses.

- Raised full-year guidance to > $7.75 billion revenue (+15% nominal), EPS of $6.40–$6.45 (+25%), and adjusted free cash flow of ~$1.5 billion.

- Declared a $0.40/share dividend, repurchased $400 million of shares in Q2, and now expect to return 100% of FCF ($1.5 billion) to shareholders in FY 2026.

- In Q2, pro forma revenue grew 18%, adjusted operating margin expanded 390 bps, and EPS rose 34% to $2.69.

- By region, North America sales rose 17%, Europe 22%, Greater China 34%, Other Asia 12%, while Japan declined 6%.

- Declared a quarterly dividend of $0.40 per share and repurchased $400 million of stock in Q2, bringing YTD buybacks to $900 million; full-year returns expected at $1.5 billion (100% of free cash flow).

- Raised FY 2026 guidance to revenue >$7.75 billion (≈15% pro forma growth) and EPS of $6.40–$6.45, with free cash flow expected at $1.5 billion.

- Tapestry delivered pro forma net sales of $2.50 B (+18% vs LY), with a 75.5% gross margin, 28.8% operating margin, and EPS of $2.69 (+34% vs LY).

- Coach net sales grew 25% to $2.14 B, generating $847 M operating income (39.5% margin), driven by regional gains: North America +27%, Greater China +37%, Europe +26%.

- Kate Spade net sales declined 14% to $360 M, with $17 M operating income (4.6% margin), reflecting a strategic brand reset including a 40% reduction in handbag styles and lower promotional activity.

- The company raised its Fiscal 2026 revenue, margin, EPS, and cash flow outlook.

- Tapestry delivered Q2 FY2026 revenue of $2.50 billion, up 14% year-over-year, with GAAP operating margin expanding 620 bps to 28.6% and GAAP EPS of $2.68.

- Pro forma net sales (ex-Stuart Weitzman) grew 18% on a constant-currency basis, led by 25% growth at Coach.

- The Board declared a quarterly dividend of $0.40 per share (annualized $1.60) and executed $400 million of share repurchases in Q2, bringing year-to-date buybacks to $900 million.

- Tapestry raised its FY2026 non-GAAP guidance to > $7.75 billion in revenue (+11%), EPS of $6.40–$6.45, and $1.5 billion in adjusted free cash flow.

- Record Q2 revenue of $2.50 B, up 14% year-over-year, with pro forma net sales growth of 18%.

- GAAP diluted EPS of $2.68 (up 94% vs. prior year) and non-GAAP EPS of $2.69 (up 34%); GAAP operating margin expanded 620 bps, non-GAAP by 390 bps.

- Raises FY 2026 outlook: revenue > $7.75 B (≈11% growth; ~15% pro forma), EPS of $6.40–$6.45, and adjusted free cash flow ≈ $1.5 B.

- Shareholder return program: plans $1.5 B return including a $1.60 annual dividend ($0.40 per quarter) and $1.2 B stock repurchase (Q2 repurchases of $400 M).

- AM Best affirmed Tune Protect Re’s Financial Strength Rating at B++ (Good) and its Long-Term Issuer Credit Rating at bbb+ (Good) with a stable outlook.

- The company’s balance sheet is rated strong, supported by robust risk-adjusted capitalisation and a conservative investment portfolio; however, its modest absolute capital base of USD 33 million at year-end 2024 may increase volatility under stress scenarios.

- In 2024, Tune Protect Re delivered strong operating performance with a combined ratio of 81.9% and a return on equity of 14.1%, driven by favourable loss experience in its travel insurance business and positive investment income.

- AM Best classifies the reinsurer’s business profile as limited, noting its niche focus on travel-related products and its use of Tune Protect Group’s technology platform; moderate underwriting growth is expected over the medium term.

- Tapestry’s Q1 FY2026 revenue reached $1.7 billion, up 12–13% YoY, led by Coach’s 21–22% sales increase among Gen Z shoppers

- The company raised its FY2026 revenue outlook to ~$7.3 billion, targeting 4–5% growth on a reported basis and 7–8% ex-Stuart Weitzman

- Gross margin expanded to 76.3% and adjusted operating margin improved by 200 bps despite a 230 bps tariff headwind; profits grew 35%

- Strategic initiatives include Coach Tabby handbags (85% of Coach revenue), a 30% reduction in Kate Spade’s bag lineup, and the Amplify plan, which added 2.2 million new customers (35% Gen Z)

- Tapestry delivered 16% pro forma revenue growth in Q1 2026, led by 21% growth at Coach, with a 76.5% gross margin (+120 bps YoY) and 200 bps operating margin expansion.

- Adjusted EPS was $1.38, up 35% YoY and ahead of guidance; the board declared a $0.40 quarterly dividend (≈ $83 million).

- Full-year outlook updated: EPS of $5.45–$5.60 (7–10% growth), $1.3 billion in free cash flow, and $1 billion planned share repurchases.

- Coach’s momentum driven by mid-teens AUR growth, unit growth inflection, and strong Gen Z acquisition, while Kate Spade focuses on turnaround via brand investments and reduced discounting.

- Tapestry’s Q1 pro forma revenue rose 16% YoY, led by a 21% gain at Coach, and adjusted EPS reached $1.38 (+35%).

- First-quarter gross margin was 76.5% (+120 bps) and adjusted operating margin expanded 200 bps, aided by the Stuart Weitzman divestiture and operational improvements.

- Declared a quarterly dividend of $0.40 per share and repurchased 4.7 million shares for $500 million, bringing FY 2026 capital return guidance to $1.3 billion.

- Raised fiscal 2026 outlook to $7.3 billion in revenue (7–8% growth) and EPS of $5.45–$5.60, incorporating $170 million of tariff headwinds and targeting 100 bps of SG&A leverage.

Quarterly earnings call transcripts for TAPESTRY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more