TAPESTRY (TPR)·Q2 2026 Earnings Summary

Tapestry Smashes Q2 Estimates as Coach Powers Record Quarter, Stock Surges 7%

February 5, 2026 · by Fintool AI Agent

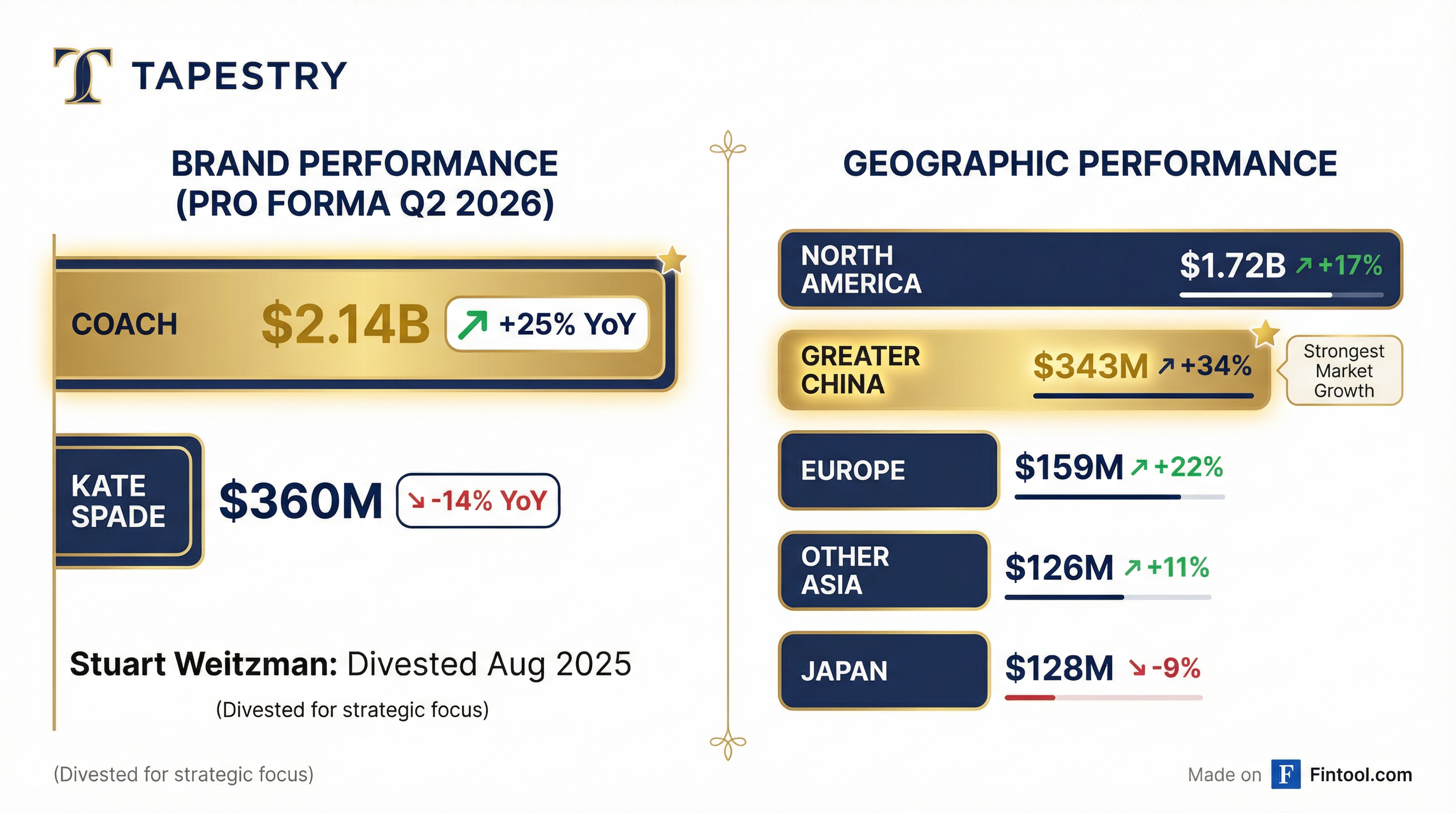

Tapestry delivered a blowout Q2 FY2026 with record quarterly revenue, operating profit, and EPS, smashing analyst expectations across all key metrics. The Coach brand was the star performer, surging 25% to drive pro forma revenue growth of 18%. Management responded by materially raising full-year guidance and increasing planned shareholder returns to $1.5 billion.

Did Tapestry Beat Earnings?

Revenue: $2.50B actual vs $2.32B consensus = +7.7% beat

Non-GAAP EPS: $2.69 actual vs $2.23 consensus = +20.6% beat

This marks Tapestry's eighth consecutive earnings beat. The company has consistently outperformed analyst expectations since Q2 FY2024, demonstrating the effectiveness of its "Amplify" growth strategy.

What Did Management Guide?

Tapestry significantly raised its FY2026 outlook across all key metrics:

The new EPS guidance of $6.40-$6.45 represents over 25% growth versus prior year and exceeds the prior FY2026 consensus of approximately $5.68.*

Guidance assumptions include:

- U.S. trade and tax policies as of February 1, 2026, including OECD Pillar Two

- No material worsening of inflationary pressures or consumer confidence

- FX expected to be a 70 bps tailwind to revenue

- Tax rate of ~17% (down from prior 18% guidance)

- Weighted average diluted shares of ~211 million

How Did the Stock React?

TPR shares surged +7.3% in aftermarket trading to $136.25 following the earnings release, approaching the 52-week high of $136.04.

The strong reaction reflects the magnitude of the beat and guidance raise. The stock has more than doubled from its 52-week low of $58.39 set in early 2025, driven by consistent execution on the Amplify strategy and the successful divestiture of Stuart Weitzman.

What Changed From Last Quarter?

Key changes vs Q1 FY2026:

-

Coach acceleration: Coach brand growth accelerated to +25% from +22% in Q1, with handbag AUR and units both up mid-teens

-

Kate Spade stabilization remains elusive: Kate Spade declined 14% (vs -11% in Q1 YTD), though management continues to focus on brand repositioning

-

China momentum building: Greater China surged 34%, up from +20% in Q1, as holiday demand exceeded expectations

-

Gross margin expansion despite tariffs: Gross margin expanded 110 bps despite a 190 bps tariff/duty headwind, offset by 250 bps of operational improvements

-

Shareholder return acceleration: Buyback plan increased by $200M to $1.2B for FY2026, with $900M already executed YTD at ~$109/share average

Brand Performance Deep Dive

Coach: The Growth Engine

Coach delivered its strongest quarterly growth in years, with revenue of $2.14B (+25% YoY):

Key drivers:

- Handbag AUR and units both increased at mid-teens rates

- 3.7 million new customers acquired globally

- Gen Z represented ~1/3 of new customers

- Digital sales grew ~20%

- Brick and mortar up mid-teens

Kate Spade: Turnaround Work Continues

Kate Spade remains challenged, with revenue of $360M (-14% YoY):

While Kate Spade continues to face headwinds, the brand remains a focus for management's turnaround efforts. The impact on consolidated results is mitigated by Coach's strength and the Stuart Weitzman divestiture.

Regional Performance

All major regions except Japan delivered strong pro forma constant currency growth:

Greater China's 34% growth was a standout, reflecting strong holiday demand and successful consumer engagement strategies. The weakness in Japan was partially attributable to yen depreciation.

Balance Sheet and Cash Flow

Tapestry's financial position remains robust:

Capital Allocation

Tapestry is returning nearly 100% of adjusted free cash flow to shareholders:

Q2 execution: Repurchased 3.6 million shares for $400M at ~$112/share average

YTD execution: Repurchased 8.3 million shares for $900M at ~$109/share average

Key Risks and Considerations

Tariff impact: Management noted a 190 bps gross margin headwind from tariffs and duties, which was more than offset by operational improvements. The outlook embeds current trade policies as of February 1, 2026.

Kate Spade weakness: The brand's continued decline (-14%) remains a drag on overall performance, though it's increasingly less material given Coach's dominance.

Macroeconomic sensitivity: Guidance assumes no material worsening of inflationary pressures or consumer confidence.

FX exposure: While currently a tailwind (~70 bps expected for FY26), currency volatility could impact results.

Forward Catalysts

- Q3 FY2026 earnings expected May 7, 2026

- Kate Spade turnaround progress - any signs of stabilization would be positively received

- China consumer trends - continued strength could drive further estimate revisions

- Dividend declaration - next quarterly dividend of $0.40/share payable March 23, 2026

Q&A Highlights

On Coach's sustainability in North America (Brooke Roach, Goldman Sachs):

Coach CEO Todd Kahn outlined his "Confidence Performance Indicators" (CPIs) framework:

"My confidence is grounded in facts and experience... Not only did we comp the comp in the most critical holiday period, we did it the right and sustainable way, with lower promotions, exceptional margins, and a 40% increase in marketing."

Key CPIs cited:

- North America market share still in single digits, global share below 1%

- Gen Z acquisition driving heat halo effect across all age groups

- Growth balanced across product families (no single family >10% of sales)

- AUR and units equally contributing (AUR still 5-10x below European luxury)

- Unit count still 20% below pre-pandemic globally, 25% in North America

On China and Europe momentum (Ike Boruchow, Wells Fargo):

Todd Kahn on China's 34% growth:

"We've been there for over two decades. We have hundreds of stores. We are very close to the Chinese consumer... Our value and values cut through."

On Europe's 20% growth defying peer weakness:

"France is going to be our next big push... We love the approach of going into youthful neighborhoods where the stores can make money and/or wholesale and digital."

On product innovation and icons (Bob Drbul, BTIG):

On whether signature styles are slowing, Todd quipped:

"When we honed in on Tabby, the New York family, and Teri, I looked at the team a little mischievously, and I said, 'TNT equals explosive growth.' That's where we are."

On AI and technology investments (Adrienne Yih, Barclays):

CEO Joanne Crevoiserat on AI implementation:

"We're already applying AI tools across the value chain, from product development to inventory management, to pricing, to marketing... We have a patented data fabric. This is not new to Tapestry."

Designers are leveraging AI to iterate on sketches faster, test colorways, and accelerate the design-to-sample process, driving both efficiency and creativity.

On the outlook and long-term model (Matthew Boss, JPM; Michael Binetti, Evercore):

CFO Scott Roe on the significance of the beat:

"This is a moment we've prepared for... We've been known for operational discipline for quite a while, but what you see in the results is a new gear of growth. When you add growth on top of this operational discipline, what you have is a really powerful machine."

"Think of this new guide, fiscal 2026, as the base, the re-baseline for growth going forward. We've established mid-single-digit revenue and double-digit earnings, EPS, as our baseline. That's our floor."

Kate Spade Turnaround Details

While Kate Spade remains challenged (-14% revenue), management highlighted early progress on leading KPIs:

Strategic actions underway:

- Reduced handbag styles by 40% for holiday to focus on blockbusters

- Testing updated store experience in 10 locations with lift in conversion and ADT

- Blockbuster handbags (Duo, Kayla, Margot, 454) outperforming with higher AUR and strong Gen Z acquisition

- Pullback in promotional activity to reset brand health

CEO Joanne Crevoiserat:

"This is a unique brand with heritage, distinctive positioning, and meaningful long-term opportunities. With disciplined execution, the benefit of continued learnings from Coach's success and Tapestry's brand-building capabilities, we're acting with focus to realize the brand's full and significant potential."

Additional Product & Marketing Details

Coach product families driving growth:

- Tabby franchise accelerating with Gen Z customer recruitment

- New York family (Brooklyn, Empire) outperforming

- Teri, Juliet, and Laurel expanding through new colorways, materials (crystals), and sizes

- Kiss Lock back in stock with new sizes coming

Marketing investment:

- Marketing spend increased ~40% YoY, now at 11% of sales heading to 12%

- Continued shift toward top-of-funnel brand building

- Holiday campaign "Gift for New Adventures" featured Elle Fanning, Charles Melton, Kōki, and K-pop rapper Soyeon

- China collaboration with CLOT streetwear brand

Retail innovation:

- Coach Coffee concepts at Jersey Gardens and Woodbury Commons outperforming expectations

- New store formats in Ginza, Yorkdale, Macau, and The Dubai Mall elevating brand experience

Q3 FY2026 Guidance

Management provided detailed Q3 shaping:

Gross margin expected to decline in Q3 due to tariff timing (tariffed inventory selling through), but SG&A leverage more than offsets for net margin expansion.

Key Takeaways

- Record quarter across all metrics - revenue, operating profit, and EPS all hit new highs

- Coach is firing on all cylinders - 25% growth with balanced AUR and volume gains, strong Gen Z acquisition

- Significant guidance raise - EPS outlook increased by ~$0.90 at midpoint, reflecting confidence in momentum

- Shareholder-friendly capital allocation - returning nearly 100% of adjusted FCF, with buyback accelerated

- Tariff headwinds being absorbed - operational improvements more than offsetting trade policy impacts

- Stock approaching 52-week highs - +7.3% aftermarket reaction reflects quality of results

- Management confidence high - CFO calling this "a new gear of growth" with mid-single-digit revenue and double-digit EPS as "the floor"

*Values retrieved from S&P Global where citations not provided.