Earnings summaries and quarterly performance for TRIMBLE.

Executive leadership at TRIMBLE.

Robert G. Painter

President and Chief Executive Officer

Jim Palermo

Chief Information Officer

Kenny Bement

Chief Accounting Officer

Mark Schwartz

Senior Vice President, AECO Sector

Peter Large

Senior Vice President, Strategy, Corporate Development, Corporate Partnerships and Alliances, and Office of Technology Innovation

Phillip Sawarynski

Senior Vice President and Chief Financial Officer

Ronald J. Bisio

Senior Vice President, Field Systems

Board of directors at TRIMBLE.

Börje Ekholm

Chairperson of the Board

James C. Dalton

Director

Johan Wibergh

Director

Kaigham (Ken) Gabriel

Director

Kara Sprague

Director

Mark S. Peek

Director

Meaghan Lloyd

Director

Ronald S. Nersesian

Director

Thomas Sweet

Director

Research analysts who have asked questions during TRIMBLE earnings calls.

Kristen Owen

Oppenheimer & Co. Inc.

10 questions for TRMB

Tami Zakaria

JPMorgan Chase & Co.

10 questions for TRMB

Jonathan Ho

William Blair & Company

8 questions for TRMB

Charles Albert Dillard

Bernstein

7 questions for TRMB

Jason Celino

KeyBanc Capital Markets

7 questions for TRMB

Jerry Revich

Goldman Sachs Group Inc.

7 questions for TRMB

Arsenije Matovic

Wolfe Research, LLC

5 questions for TRMB

Robert Mason

Robert W. Baird & Co.

5 questions for TRMB

Robert Wertheimer

Melius Research

5 questions for TRMB

Guy Hardwick

Freedom Capital Markets

4 questions for TRMB

Nay Soe Naing

Berenberg Capital Markets LLC

4 questions for TRMB

Clarke Jeffries

Piper Sandler & Co.

3 questions for TRMB

Devin Au

KeyBanc Capital Markets Inc.

3 questions for TRMB

Joshua Tilton

Wolfe Research

3 questions for TRMB

Chad Dillard

AllianceBernstein

2 questions for TRMB

Rob Mason

Baird

2 questions for TRMB

Rob Wertheimer

Melius Research LLC

1 question for TRMB

Recent press releases and 8-K filings for TRMB.

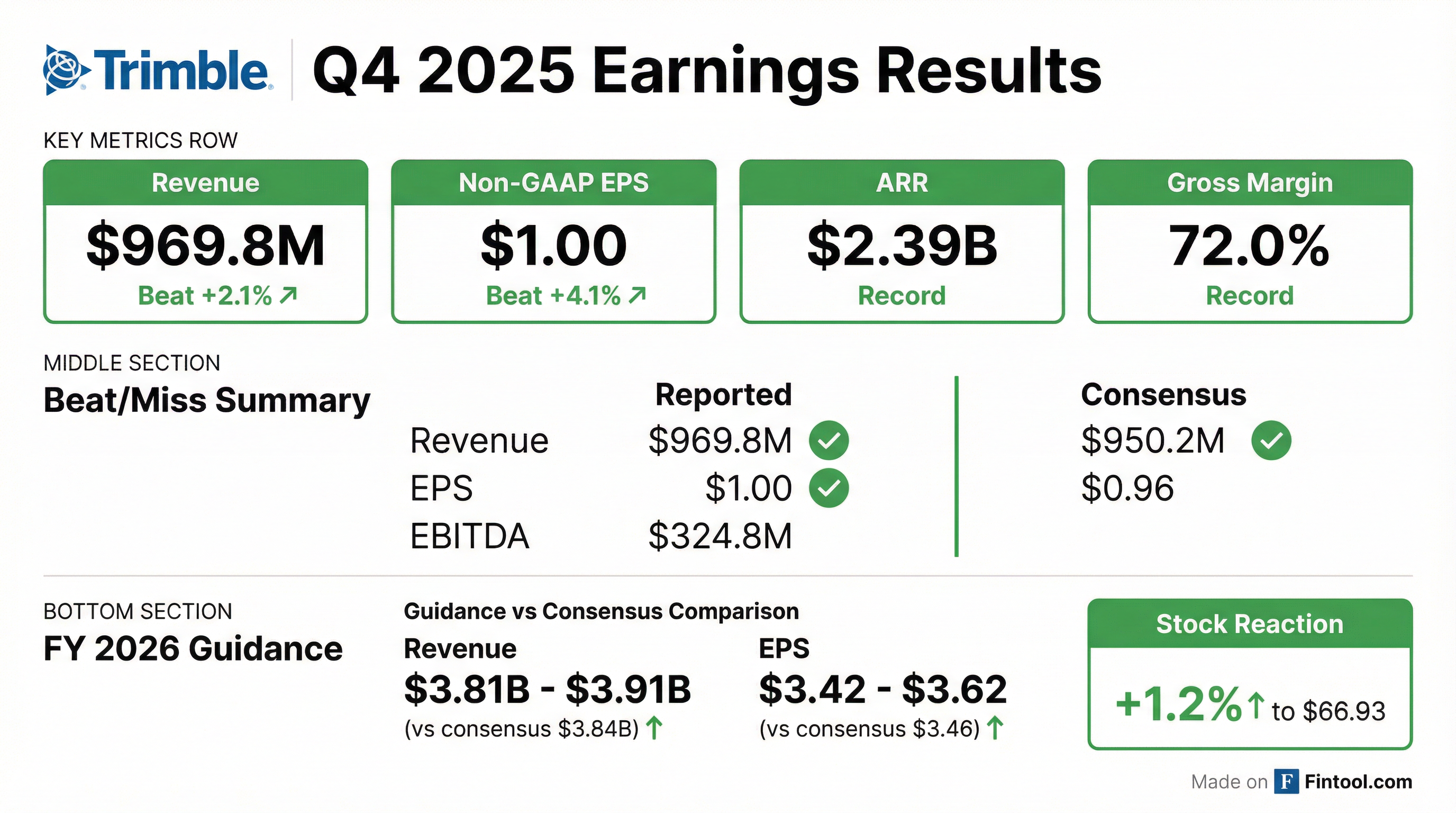

- Q4’25 revenue of $970M (+16% organic, +9% ex–Jan 1 renewals) and ARR of $2.392B (+14% organic); delivered $1.00 non-GAAP EPS and 33.5% adjusted EBITDA margin.

- FY’25 revenue reached $3.565B (+10% organic), ARR $2.392B (+14% organic), with non-GAAP EPS of $3.13 and 29.3% adjusted EBITDA margin.

- AECO segment drove robust Q4 growth: revenue of $454M (+32% organic, +15% ex–Jan 1) at 44.1% operating margin; Field Systems posted $379M (+4% organic) at 30.0% margin.

- FY’26 guidance targets organic ARR growth of 12–14%, revenue of $3.81–3.91B, non-GAAP EPS of $3.42–3.62, and adjusted EBITDA margin of 29.4–30.2%.

- Trimble delivered Q4 revenue of $970 million (+9% YoY) and full-year revenue of $3.57 billion (+10%), with ARR of $2.39 billion (+14%), Q4 EPS of $1.00, and FY EPS of $3.13.

- Q4 gross margin expanded to 74.6% and EBITDA margin to 33.5%, while full-year gross margin was 71.7% and EBITDA margin 29.3%.

- Segment performance in Q4: AECO ARR $1.48 billion (+16%) and revenue $454 million (+15%); Field Systems ARR $409 million (+20%) and revenue $379 million (+4%); Transportation & Logistics ARR $508 million (+7%) and revenue $136 million (+4%).

- The company repurchased $148 million of shares in Q4 (with $925 million remaining authorization) and generated full-year free cash flow of $361 million.

- For 2026, Trimble guides revenue of $3.86 billion (+7.5%), EPS of $3.52, ARR growth of 13%, and EBITDA margin expansion to 29.8%.

- Q4 revenue of $970 M (+9%) and FY 2025 revenue of $3.57 B (+10%); ARR grew 14% to $2.39 B; Q4 EPS $1.00 (+12%) and FY 2025 EPS $3.13 (+10%)

- AECO segment Q4 revenue $454 M (+15%) with ARR up 16% to $1.48 B (operating margin 44%); Field Systems Q4 revenue $379 M (+4%) with ARR up 20% to $409 M (operating margin 30%)

- Q4 gross margin expanded to 74.6% and EBITDA margin to 33.5%; FY 2025 gross margin 71.7% and EBITDA margin 29.3%

- Repurchased $148 M of shares in Q4 with $925 M remaining under authorization; FY 2025 free cash flow was $361 M and net leverage 1.1×

- 2026 outlook: revenue $3.86 B (+7.5%), ARR growth 13%, EPS $3.52, and EBITDA margin 29.8%

- In Q4, revenue was $970 M (+9% YoY); full-year revenue reached $3.57 B (+10%); ARR grew 14% to $2.39 B, led by AECO (+16%) and Field Systems (+20%).

- Q4 non-GAAP EPS was $1.00 (+12% YoY); FY EPS was $3.13 (+10%).

- Segment Q4 highlights: AECO revenue $454 M (+15%); Field Systems revenue +4% with ARR +20%; Transportation & Logistics revenue +4%, ARR +7%.

- 2026 guidance: revenue of $3.86 B (~7.5% growth), ARR growth 13%, non-GAAP EPS of $3.52, and EBITDA margin expansion to 29.8%.

- Capital allocation: repurchased $148 M of shares in Q4 ($925 M remaining authorization), generated $361 M YTD free cash flow, and ended with a 1.1x leverage ratio.

- In Q4 2025, Trimble reported $969.8 million in revenue, down 1% year-over-year but up 4% organically; annualized recurring revenue (ARR) reached $2.39 billion, up 6% year-over-year (14% organically).

- GAAP operating income was $216.2 million (22.3% margin) and non-GAAP operating income was $313.1 million (32.3% margin); diluted GAAP EPS was $0.65 and non-GAAP EPS was $1.00.

- For fiscal 2025, revenue totaled $3.587 billion (down 3% YoY, up 6% organically); GAAP EPS was $1.76 and non-GAAP EPS was $3.13.

- Full-year 2026 guidance projects revenue of $3.81–3.91 billion, GAAP EPS of $2.04–2.23, and non-GAAP EPS of $3.42–3.62.

- Q4 revenue of $969.8 million (-1% y/y, +4% organic) and ARR of $2.39 billion (+6% y/y, +14% organic).

- Record Q4 gross margin of 72.0%, GAAP operating margin of 22.3% and non-GAAP operating margin of 32.3%; Q4 diluted EPS of $0.65 GAAP and $1.00 non-GAAP.

- FY 2025 revenue of $3,587.3 million (-3% y/y, +6% organic), GAAP EPS $1.76, non-GAAP EPS $3.13, and 12.2 million shares repurchased for $875.4 million.

- 2026 guidance: FY revenue $3,810–3,910 million, GAAP EPS $2.04–2.23, non-GAAP EPS $3.42–3.62; Q1 revenue $893–918 million, GAAP EPS $0.32–0.36, non-GAAP EPS $0.69–0.74.

- On December 4, 2025, Trimble entered into an unsecured revolving credit facility of $1.25 billion maturing December 4, 2030, replacing its prior 2022 agreement; the facility can be upsized by $500 million and had no outstanding borrowings at signing.

- Undrawn commitments incur fees of 0.075%–0.275% per annum; borrowings bear interest at either the alternate base rate plus 0.00%–0.75% or at term SOFR/SONIA/EURIBOR rates plus 0.875%–1.75%, with quarterly or periodic payment schedules.

- The Board approved a new, indefinite share repurchase program of up to $1.0 billion, replacing its prior $1.0 billion authorization (of which $273 million remained).

- Trimble’s “Connect and Scale” model now spans three segments—Transportation & Logistics, Field Systems and AECO—driving the business to 65% recurring revenue and >70% gross margin in 2025.

- The company targets significant growth in under-penetrated markets, with a $72 billion total addressable market (25% penetrated) and a $49 billion AECO TAM (20% penetrated), supporting a low- to mid-teens EPS growth outlook.

- AI is positioned as an extension of existing solutions, using Trimble’s industry domain knowledge and customers’ private and public data to deliver tailored insights and process automation.

- Capital allocation focuses on high-ROI organic ARR expansion, tuck-in M&A and returning ~1/3 of free cash flow to shareholders via share buybacks, while evaluating larger construction-software acquisitions as opportunities arise.

- Trimble delivered $901 million revenue (+11% y/y), ARR of $2.31 billion (+15%) and EPS of $0.81 (+16%) in Q3 2025.

- Full-year 2025 guidance was raised: revenue midpoint increased by $45 million to $3.565 billion, EPS midpoint to $3.08, and organic ARR growth midpoint maintained at 14%.

- AECO segment ARR reached $1.42 billion (+17%) with revenue of $358 million (+17%); Field Systems posted $409 million revenue (+8%) and ARR of $386 million (+18%).

- Repurchased $50 million of shares in Q3 2025, with $273 million remaining under authorization and a long-term plan to use ≥ 33% of free cash flow for buybacks.

- Q3 revenue of $901 million, up 11%, with ARR of $2.31 billion (+15%) and EPS of $0.81 (+16%)

- AECO segment: ARR $1.42 billion and revenue $358 million, both +17%; Field Systems: revenue $409 million (+8%) and ARR $386 million (+18%)

- Margins improved: gross margin 71.2% (+90 bps) and EBITDA margin 29.9% (+160 bps)

- Capital return: $50 million share repurchase in Q3, $273 million remaining authorization; YTD free cash flow $206 million; leverage ratio 1.2×

- Raised FY25 revenue guidance by $45 million to $3.565 billion, increased EPS midpoint to $3.08, and maintained organic ARR growth midpoint at 14%

Quarterly earnings call transcripts for TRIMBLE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more